Nevada's Carlin Trend is a behemoth, having produced more than 84 million ounces of gold since the 1960s. To get an idea of what is still in the ground, the Carlin Complex, operated by Nevada Gold Mines, the Barrick Gold and Newmont joint venture, sports a resource of 30 million ounces gold in the Measured and Indicated category.

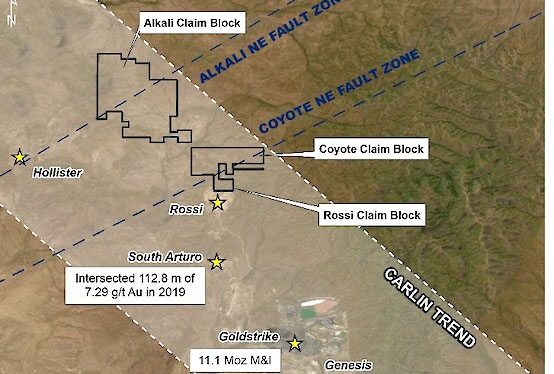

Fremont Gold Ltd. (FRE:TSX.V; FRERF:OTCQB; FR2:FSE) aims to add to the Carlin Trend gold tally through exploration on its 100%-owned North Carlin project. North Carlin is surrounded by some high-grade neighbors. It is 6 kilometers from Nevada Gold Mines and Premier Gold Mines' South Arturo mine, where recent drilling returned 39.6 meters of 17.11 grams per tonne (g/t) gold, 12 kilometers from the Goldstrike Mine, operated by Nevada Gold Mines, which hosts 11.1 million ounces of gold in the Measured and Indicated category, and Hecla Mining Company's Hollister Mine lies just 6 kilometers west.

The North Carlin project is large—more than 42 square kilometers—and largely underexplored. That is about to change because Fremont just announced a drill program there. "Permitting is well underway at North Carlin and drilling should be underway later this month. We are excited to get started as we have developed a number of untested drill targets," Fremont CEO Blaine Monaghan said.

"North Carlin is situated in the right geological setting for the discovery of a major gold deposit," Monaghan added. "Fremont has developed several drill targets based on soil geochemistry, gravity and geomagnetic surveys, and the projection of key faults that control gold mineralization in the Carlin Trend."

Fremont is permitting 10 drill sites and plans to begin with three holes of up to 500 meters each. "We are starting off with a relatively small first phase drill program of three holes and may add an additional hole or two. We hope to complete the drill program by mid-December but we are prepared to drill it into the winter months," Monaghan stated.

With the backlog at the labs this season as a result of COVID restrictions along with increased exploration, Fremont expects to receive assays in February or March, depending on when the drilling ends.

Fremont also plans to begin exploration work on its Cobb Creek project, situated in Nevada's Independence Trend, that it has optioned from Contact Gold. Cobb Creek hosts a historical resource of 54,864 ounces of gold in oxides and 118,134 ounces of gold in sulphides, but the property has not been drilled in almost 30 years.

"We want to get in there this spring; it hosts that historical resource, but the resource is hosted in a different deposit style," Monaghan said. "We think it has good potential for a Carlin-type deposit. We want to do some early-stage exploration work, using the Carlin model to identify what targets we think have the best potential for a Carlin-type discovery, and then start the permitting process."

Earlier this year, Fremont drilled a nine-hole program at its Griffon project, also in Nevada, in the Cortez Trend. "While the first three holes returned pretty good results, such as 50.3 meters of 1.05 gram per tonne gold starting near surface, we weren't able to return another interval that looked like that in the remainder of the holes," Monaghan said. "We're interpreting all of the new data to help us vector in on new targets."

Fremont recently closed a non-brokered private placement for gross proceeds of CA$2 million. The initial offering was doubled when Palisades Goldcorp Ltd. came in with the lead order. Proceeds are going to be used for drilling at North Carlin, the exploration program at Cobb Creek and for general working capital.

Analyst Thibaut Lepouttre wrote in Caesars Report on November 6, "Fremont Gold Ltd. has now closed the CA$0.05 financing, and the company ended up raising CA$2M after upsizing the original CA$1M placement. . .the CA$2M cash injection will fund the upcoming North Carlin drill program where the company is planning to drill three holes for a total of 1,500m. . .Fremont should be able to end the year with a strong treasury while waiting for the North Carlin assay results."

James Kwantes noted in Resource Opportunities on October 11, "Fremont Gold Ltd. is pivoting to its 42 sq km North Carlin project. The company is permitting 10 drill sites and plans to drill about 1,500m at North Carlin, a deeper target, in the next couple of months."

Fremont has 122.9 million shares outstanding, 201.4 million fully diluted.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Fremont Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Additional disclosures:

Caesars Report:

Disclosure: The author has a long position in Fremont Gold and has participated in the recent financing. Fremont Gold is a sponsor of the website.

Disclosures from Resource Opportunities

Disclosure: James Kwantes owns shares of Fremont Gold.

Companies are selected for presentation in this publication strictly on their merits, and Resource Opportunities sponsors are selected on their merits as well. No fee is charged to non-sponsor companies for inclusion. The author may from time to time have a position in the securities of the

companies mentioned herein, and may change his positions without notice. Any positions will be disclosed explicitly.