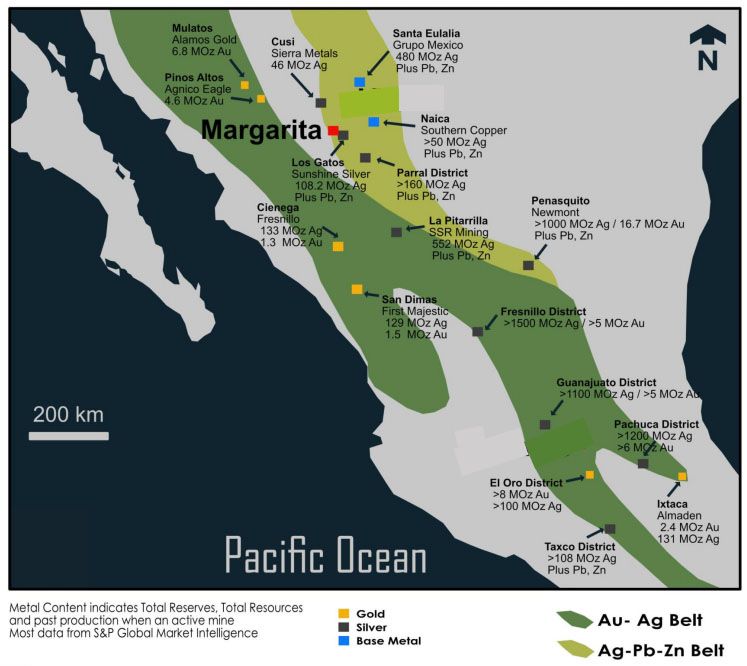

FenixOro Gold Corp. (FENX:CSE; FDVXF:OTCQB) announced exciting findings on its final data set from its recent ground magnetics and soil geochemistry program. The work has generated another new target area at its Abriaqui project in Colombia. Abriaqui is directly on trend, about 15 km to the west, of Zijin Mining's 12M+ ounce, high-grade Buriticá mine.

Abriaqui is in the Middle Cauca geologic trend, where since 2007 >90 million ounces of gold has been discovered in epic deposits like AngloGold's Nuevo Chaquiro and La Colosa, and Gran Colombia's Marmato and Zijin's Buriticá deposits.

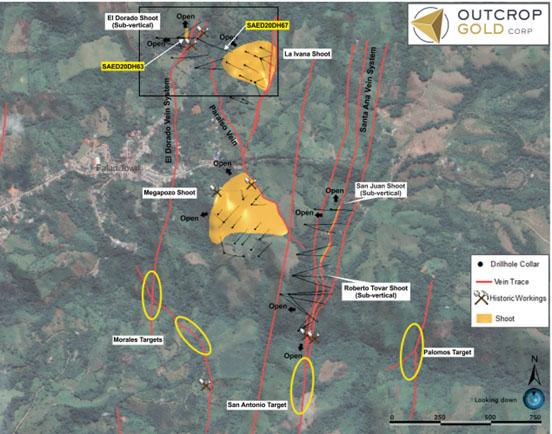

FenixOro's main vein systems and porphyry target are in the northwestern portion of Abriaqui. This newly defined target is in the southeastern part of the project.

The soil anomaly, open to the south, consists of a 100 meter line of samples, all in excess of 0.4 g/t gold. Since July, numerous other gold-in-soils anomalies have been reported across the property, but those have been associated with known families of high-grade gold veins.

Additional unexplained soil anomalies including several samples over 1 g/t gold, along with the new magnetics/soil gold anomaly, add to the extensive target list in the southeast block and help assure a continuous pipeline of fresh drill targets.

The plan over coming months will consist of an expansion of the soil grid to the south/southeast and additional detailed surface mapping and sampling. Given the lack of any other explanation for the anomalies, a second porphyry gold target has been postulated for this new area.

The new target, 1,200 meters from where drilling is currently underway extends known mineralization to 2.5 x 1.0 km. The new target is 500 meters above area being drilled, supporting the thesis that the mesothermal veins have >900-meter vertical continuity.

This continuity (of significant Au grade-in-soils) suggests the potential for new discoveries is not limited to only existing visible vein structures. Further, a coincident magnetic high indicates potential for second porphyry target.

While phase 1 drilling at Abriaqui remains focused in the northwestern block, the relatively underexplored southeastern block contains "a number of equally interesting targets."

The southeastern area hosts >30 small past-producing mines developed on high-grade gold veins worked intermittently over 80 years by FenixOro's local partner, a legal small miner's cooperative.

The ongoing drill program is testing for the first time, six or more families of stacked, high-grade vein systems. Each target is distinct, drilling is targeting showings at different depths, angles and orientations, across multiple types of mineralization.

Importantly, last week's news effectively extends the pipeline of new drill targets well into next year. Readers may recall that the main target at Abriaqui is a series of >80 "Buritica style," high-grade gold vein families present in corridors up to 1,200 meters long by 400 meters wide. Over 20 vein samples assayed 20+ g/t gold (up to 146 g/t).

Many new veins are expected to be identified. Management will soon gain valuable insights on grades, depths, continuity, vein spacing and widths. If enough higher-grade vein material exists, interspersed with wider zones of 2+ g/t material, there could be one or more compelling deposit(s).

Buriticá is not just a blockbuster mine for Colombia or even for South America—it's one of the largest and highest grade mine start-ups in the world, forecast to have a lowest quintile cost profile, [estimated US$600/oz. AISC]. This is Colombia's first (but not last) large-scale, underground gold mine.

I had been wondering if the planned start of the Buriticá mine would be delayed due to COVID-19, but late last week it opened, marked by a ceremony attended by Colombia's President. This has not been widely reported…. hopefully it will be good news for FenixOro, a true vote of confidence—ground-breaking in the midst of a global pandemic!

Colombia is a hot gold mining jurisdiction these days. Late last month, Newmont Corp. announced the formation of an exploration JV with Agnico Eagle Mines. The JV will explore prospective gold targets of district-scale potential, with a focus in the Mid-Cauca belt. The initial project is 60 km south of Zijin's operations.

Stu Moller, FenixOro's VP of Exploration, and a key player in the discovery and initial development of Buriticá, commented,

"Zijin Mining broke ground on its Buriticá mine — and in a way it broke ground on the rest of the gold mining industry in Colombia — showcasing the geological potential of the Middle Cauca Trend and highlighting the economic impact of a giant, high-grade gold deposit. It helped focus and refine the permitting process, demonstrating that a large mine doesn't have to carry large environmental challenges. It showed that foreign companies are not in Colombia to take the gold and run, but are making long-term commitments to responsible mining, ethical treatment of employees / stakeholders, and regional development outside of immediate mining areas."

Circling back to the ongoing 4,500-meter drill program in the northwestern portion of Abriaqui, nine road-accessible drill holes are underway (currently on hole #3). Each inclined hole is targeting multiple steeply dipping (near-vertical) veins and lower grade interstitial stock-work type mineralization. A tenth hole will test the porphyry to a depth of 300 meters.

CONCLUSION

I believe that FenixOro Gold Corp. (CSE: FENX) / (OTCQB: FDVXF) has the potential to experience a re-rating in valuation upon the release of assays, (if they're strong), expected to begin arriving in about a month. Good drill results would tie Abriaqui ever closer to Buriticá, a mine worth close to C$2.0 billion vs. the C$1.4 billion Zijin paid when the gold price was US$500/oz. lower.

By comparison, FenixOro's market cap is ~C$36 million. Near-term drill results, multiple high-grade gold targets, a world-class (very nearby) analog mine, a top mining jurisdiction—US$1,900/oz gold—there are lots of reasons to want to dig deeper into this story ahead of drill results next month.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures/disclaimers:

The content of the above article is for information only. Readers fully understand & agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about FENIXORO GOLD CORP., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, professional trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of FENIXORO GOLD CORP. are highly speculative, not suitable for all investors. Readers understand & agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed & agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, FENIXORO GOLD CORP. was an advertiser on [ER] & Peter Epstein owned shares in the Company.

Readers understand & agree that they must conduct their own due diligence above & beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.