In a news release, Vancouver-based Irving Resources Inc. (IRV:CSE; IRVRF:OTCBB) reported that it has "signed a binding option agreement with Shimadzu Ltd. to acquire the 5.2 sq km Yamagano mining license, site of extensive historic high-grade gold vein mining, in southern Kyushu approximately 11 km southwest of the large, high-grade Hishikari gold mine."

The firm explained that the Yamagano mining district is host to numerous historical gold mining operations dating back to the year 1640. Irving Resources advised that Yamagano has not seen any modern exploration or drilling and is the nearest past producer neighbor to the Hishikari mine.

The company stated that gold veins at Yamagano appear to be associated with a particular geophysical feature identified as an area of anomalously high gravity. The firm emphasized that this characteristic was recognized very early at other Kyushu properties including the Kushikino gold mine where 1.80 million ounces (Moz) of gold was produced and the Hishikari deposits where 7.98 Moz of gold have been produced.

The company advised that the option agreement is binding and is exercisable for a period of 10 years from the signing date. The option terms call for Irving Resources to issue a total of 350,000 common shares over four years. The initial 87,500 common shares are issuable now at an established price of CA$2.90 per share. The remaining balance of shares will be split into equal amounts of 87,500 common shares due at the beginning of the second, third and fourth years. As part of the arrangement, Irving Resources is also required to commit aggregate property expenditures of US$250,000 on properties it controls within 10 km of the property.

Irving is responsible for paying the annual government fees required to maintain the property in good standing and is additionally required to pay the reasonable costs of required water testing and other costs related to maintaining safe operations at the property.

The firm stated that if the option is exercised and the transaction is approved by the Japanese regulating agency it will issue 350,000 additional common shares to Shimadzu and Shimadzu will be entitled to receive a 1% NSR royalty.

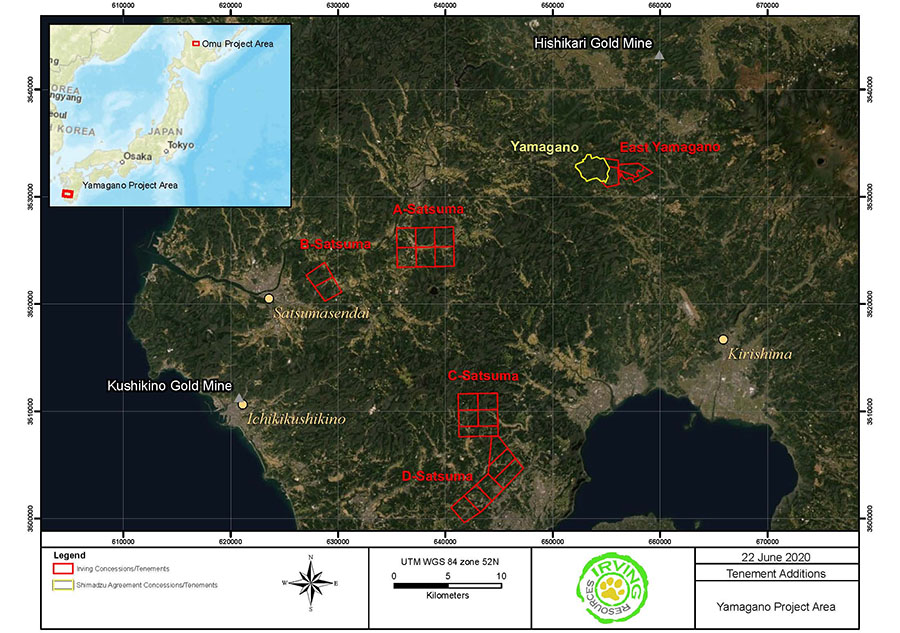

The company noted that it now has control over five key property positions in Kyushu including Yamagano, and the four Satsuma (A, B,C, and D) projects. The firm pointed out that each of these land holdings are subject to exploration alliances with Newmont Corp. and Sumitomo Corp. and that it is currently in talks with both companies to discuss strategy for advancing exploration at each project.

Irving Resources' CEO and Director Akiko Levinson remarked, "We are honored to have completed this agreement with Shimadzu...This is one of the great historic gold districts in Japan, but has seen no modern exploration. We look forward to beginning the search for further high-grade gold veins on the Yamagano mining tenement and adjacent lands we have staked."

Read what other experts are saying about:

Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Irving Resources. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.