International Montoro Resources (IMT:TSX.V) is trading at a very cheap valuation, an enterprise value (EV) of ~CA$4.5 million (CA$4.5M). This is absurd given the company's existing assets, near-term prospects and expert deal-making team. In addition to two promising gold properties, IMT has two nickel–copper (Cu)–platinum group element (PGE)–cobalt (Co) projects (all in Ontario), and a rare earth element (REE) project in British Columbia (BC).

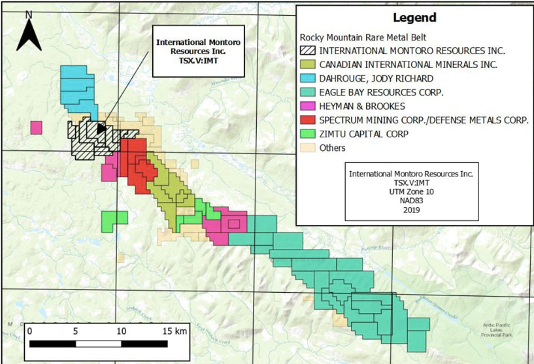

The company's Wicheeda North REE project alone is arguably worth as much or more than IMT's entire EV. Adjoining this 1,444-hectare property is Defense Metals Corp.'s (DEFN:TSX.V; DFMTF:OTCQB; 35D:FSE) 1,708-hectare Wicheeda REE project. Defense Metals is a single-project company with a market cap of $8M. I believe IMT's smaller and less developed REE property is, nonetheless, worth at least $4.5M.

The following four properties are the primary assets being advanced at this time. Those projects are: Wicheeda North, BC (REE); Blackfly, Atikokan, Ontario (gold); Serpent River/Pecors, Elliot Lake, Ontario (Ni-Cu-PGE + uranium + REEs); Camping Lake, Red Lake, Ontario (gold).

Note: Another acquisition was just announced—two high-grade gold properties in central Newfoundland. I will follow up these properties in my next article.

Blackfly Gold Property near Atikokan, Ontario

IMT recently entered into an option agreement to acquire the Blackfly Gold property (BGP) near Atikokan, Ontario. The BGP claims cover 1,296 hectares. The project is west of Falcon Gold Corp.'s (FG:TSX.V) Central Canada project, which recently reported 10.2 g/t gold over 3.0 meters (3.0m), and has a non-complaint historic resource of 230,000 ounces at 9.9 g/t gold.

Note: Karim Rayani is CEO of both IMT and Falcon Gold, and an active buyer of shares in both companies.

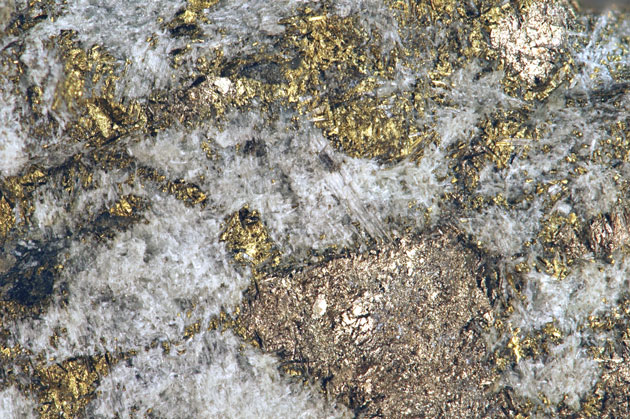

On Sept. 22, IMT announced the mobilization of an exploration team for follow-up geological mapping and sampling on the Blackfly vein. There's significant mineralization, with values upward of 15 g/t gold over a 1.1m drill hole interval, and up to 167 g/t in grab samples.

The Northwest zone at Blackfly returned drill hole intercepts of 8.3m at 0.94 g/t gold and 11.0 g/t over 2.0m.

Blackfly is ~14 kilometers (14 km) southwest along strike of Agnico Eagle Mines Ltd.'s (AEM:TSX; AEM:NYSE) Hammond Reef deposit, which has 4.5 million ounces (4.5 Moz gold. A resurgence of interest in the Atikokan camp is due to development of Hammond Reef and Agnico staking and acquiring surrounding land. On top of Agnico, IMT, Falcon Gold, Abitibi Royalties Inc. (RZZ:TSX.V) and Portofino Resources Inc. (POR:TSX.V; POT:FSE) have also secured properties.

Work from 1941 described two gold vein shoots at Blackfly. The southern shoot averaged 11.9 g/t gold over a thickness of 0.33m on a strike length of 21.6m. The northern shoot averaged 13.4 g/t over 0.27m on a strike of 32.0m. Work conducted by TerraX in 2010–2012 included compilation of historical reports and data, drilling and surface geochemistry.

TerraX stated in a report that the lineament containing the Blackfly vein has alteration and mineralization traceable over a 4.4 km strike length on the property. The best gold values were from grab samples that graded 167 and 85.6 g/t gold.

Elliot Lake, Ontario (Serpent River/Pecors Ni-Cu-PGE + Uranium + REEs

X-Terra Resources Inc. (XTT:TSX.V; XTRRF:OTCMKTS; XTR:FSE) has been sitting on REE and uranium assets for over a decade. The Serpent River/Pecors property is a 100%-owned, 1,840-hectare parcel in Ontario. Rio Algom mined >100 million pounds of U308 from similar deposits in the Elliot Lake camp.

A historical, non-NI-43-101-compliant resource estimate of 14.8 million pounds (20 million tonnes at 0.037% U3O8) was done. Significant REE values accompany the uranium mineralization. Elliot Lake was a major producer of yttrium as a byproduct of uranium production.

This is a nice call option on the uranium price, which has failed to move meaningfully despite the best uranium fundamentals in nearly a decade. Even if uranium prices remain stalled around $30/lb., Serpent River also holds considerable promise for nickel, copper and PGEs like palladium.

In 2009, IMT commissioned a geophysical specialist to further interpret the airborne survey data. The resulting 3D representation of the inversion block showed an approximate size of 7 x 3 km, and an estimated depth of nearly 2 km, so approaching 40 cubic km.

Everyone knows that gold has soared lately; it's up +62% since the beginning of 2016. However, few may know that palladium is up +344%! Think about that: Has it been the best performing metal on the planet? Even small amounts of palladium in the metals mix could be valuable credits to production costs.

Nickel, who cares about nickel? Tesla Inc. (TSLA:NASDAQ) does! Elon Musk directed a lot of investors toward nickel juniors in comments he made last month, and nickel received additional bullish commentary in the Battery Day presentation by Tesla. Nickel looks like an ever clearer winner in lithium-ion batteries, while the role other battery metals will pay faces growing uncertainty.

Red Lake, Ontario (Camping Lake—Gold)

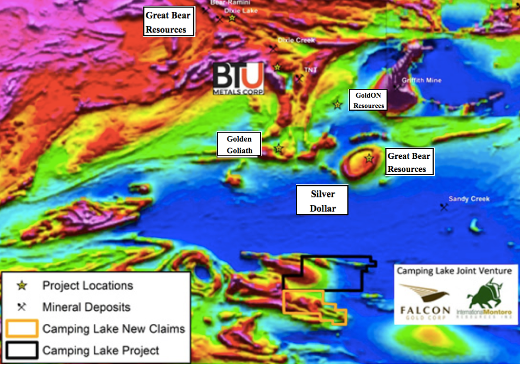

It's hard to believe I'm near the bottom of an article about a company with a CA$4.5M EV, talking about a fourth promising property in a well-known jurisdiction. Camping Lake is in the Red Lake mining district of Ontario. IMT is earning into an initial 51% stake in 3,400 hectares at Camping Lake. Falcon Gold is the vendor.

So far, Camping Lake's main claim to fame is its close proximity to Great Bear Resources Ltd.'s (GBR:TSX.V; GTBDF:OTCQX) Dixie project; it's about 20 km to the south of Dixie. The entire Red Lake district is active with more than a dozen significant drill programs and development activities.

Red Lake's Pure Gold Mining Inc. (PGM:TSX.V; PUR:LSE) has surpassed the $1 billion market cap threshold, up nearly 600% from March. It expects to pour first gold at its high-grade mine in the heart of the district by year's end. Pure Gold is widely considered a prime takeout target.

Conclusion

A sum-of-the-parts valuation would come up with well north of CA$4.5M. In the hands of larger strategic partners, I think the four assets mentioned herein could be worth 3–4 times the current EV.

In his short time as CEO of IMT, Rayani is doing a great job at drawing attention to the company. One way is through his ongoing open market purchases of shares; he's acquired >1.3M since the beginning of August.

Could each of the four properties mentioned possibly be worth $3–5M, on a standalone basis, with more eyeballs on each story? Yes. And, valuations on viable mining projects are only headed in one direction. Gold, palladium, nickel, copper, REEs—I truly believe these are some of the best commodities to bet on.

With International Montoro Resources Inc., investors get exposure to a diversified suite of metals. Four projects means four bites at the big discovery apple.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of the above article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about International Montoro Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc., is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, professional trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of International Montoro Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, International Montoro Resources was an advertiser on [ER] and Peter Epstein owned shares in the company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Defense Metals. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with X-Terra Resources. Please click here for more information. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the decision to publish an article until three business days after the publication of the article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of X-Terra, a company mentioned in this article.