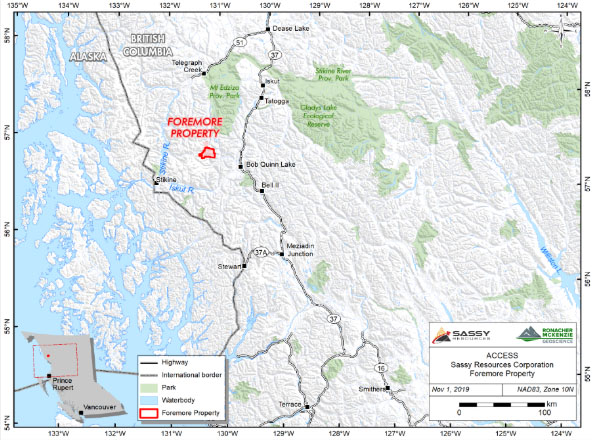

Sassy Resources Corp. (SASY:CSE) is a newly listed, high-grade, gold-silver play with two Canadian projects. The crown jewel is in the world famous Eskay Camp of British Columbia's Golden Triangle (GT). Its 100%-controlled Foremore project is 45 km north of the legendary Eskay Creek Mine. Sassy has just 29.1 million shares outstanding, (49 million fully diluted), with 15.1 million shares currently free trading.

Foremore covers 146 sq. km (14,585 ha) and contains a number of high-grade, gold-silver targets with select, strong showings of zinc, lead and copper. Regional neighbors are Newmont's/Teck's Galore Creek to the northwest, Copper Fox's/Teck's Schaft Creek to the north, Enduro Metals' Newmont Lake to the southwest and Skeena Resources (Eskay Creek, Snip), Garibaldi (E&L, Casper), Metallis and Eskay Mining ~30 km to the south.

Sassy initiated its first drill program on July 20th. The first of two phases was recently completed. Management will release results as received and analyzed.

Sassy Resources is a spinout from Crystal Lake Mining (now Enduro Metals). Crystal Lake negotiated the option on the Foremore project 15–16 months ago in an entirely different market. As such, management is benefitting from attractive terms (1.25 million shares of Sassy + $300k in cash over four years). The property is subject to a 3% NSR of which 2.5% can be clawed-back by Sassy for a total of $3 million.

Critical takeaways from my initial review of Sassy: 1) flagship asset is an attractive, sizable property in the heart of the Eskay Camp, (and center of the GT), with ample historical exploration including 71 drill holes, 2) management, board and advisors are outstanding, especially for a company with an Enterprise Value (EV) {market cap + (0) debt – (~$2 million) cash} of just $14 million, and 3) valuation + airtight capital structure is quite compelling.

I'm tracking 475 gold-heavy juniors with market caps between $3 million and $999 million, including Sassy, 34 have significant properties in the GT. The average gain of the top 20 GT juniors is +511% (from 52-week lows). The top five are up an average of +966%, the top 10, +792%. Compare that to Sassy at $0.47, up +57% from its last capital raise at $0.30.

Of course, this comparison is not apples to apples because Sassy did not suffer through the COVID-19-induced March selloff. On the other hand, it hasn't benefited from the precious metal frenzy that has driven peers to all-time highs. Few know this story, it started trading two days ago!

The chart above depicts the top 20 pre-construction GT companies. Sixteen are pre-maiden resource. Notice that the average # of outstanding shares = 149.6 million. Sassy has 34.1 million. (Note: I add deep in-the-money options + warrants to company share counts, Sassy has 5 million warrants struck at $0.10).

I don't mean to suggest that Sassy's stock will necessarily move a lot higher, but I see plenty of room to grow without running into peer valuation concerns. There are relatively few precious metal juniors, with great management teams and projects, in safe, prolific high-grade jurisdictions—with substantial near-term discovery potential and ultra-low share counts—that haven't already soared.

The GT is one of the best performing gold districts on the planet. Yet, giant returns in gold-silver juniors are widespread. Of my 480 names, 236 (49.2%) have been (at least) four-baggers (+300%) off their lows. Ok, enough about how hot the market is. What makes Sassy so interesting?

Sassy Resources, high-grade project, high-grade team

First, as mentioned, a tremendous mgmt. team, board and technical advisors. President, CEO and Director Mark Scott is a mining rock star with 20 years' experience at Noranda, Inco Ltd. and Vale.

He has run large operations, overseeing everything from exploration to reclamation for three underground mines and fully integrated processing, including mill, smelter and refinery. Mr. Scott brings a wealth of experience in mining, processing and exploration operations, strategic planning, business and organizational development.

Many mining/metals juniors of similar size and exploration stage have 3, 4, maybe 5 senior-level, highly experienced mining professionals (including advisors) involved. Sassy has eight. Instead of me describing each of them, their bios can be seen above and below.

How good is the Foremore prospect? It's of decent size and is vastly underexplored. A big reason why is that 35 years ago snowpack and glaciers covered >90% of the project area. Look below at the very dramatic before and after pictures, 1985 vs. 2019.

The best historical drill intercepts from a total of 71 holes:

Notice that these highlights are from just 2 of 12 named mineral occurrences. In addition to following up on these great historical assays, a lot more work is going to be directed at the Westmore/Toe/SG/Boulder/Zigzag/Sunday and Heather zones. {Note: in a follow up article I will describe exploration results and future plans in greater detail}.

Exploration in the area of the Foremore property dates back >30 years. It includes prospecting, mapping, sampling, airborne and ground geophysical surveys and 71 diamond drill holes. Nearly an estimated $15 million has been invested over the decades, probably >$20 million in today's dollars.

That's well more than the current EV. I believe the considerable value of the historical exploration is increasing along with the price of gold and silver.

The most significant work was completed by Cominco Ltd. from 1987 to 1996, followed by Roca Mines Inc., mostly from 2002 through 2008. No diamond drilling has occurred at Foremore since 2008, because Roca went bankrupt due to an ill-timed molybdenum transaction.

From July 25 to September 20, 2019, a surface prospecting, local geological mapping and geochemical sampling program was undertaken. Sassy collected 573 samples and received some noteworthy results.

At spot prices, the best 16 samples range in gold equivalent grade from ~16 g/t to ~150 g/t and averaged ~44 g/t. Although dominated by impressive gold and silver values, there were some significant contributions from zinc, lead and copper as well.

** Snowpack / glacier cover of Foremore property: 1985 vs. 2019 **

Tight share structures make a big difference in junior mining

Management stated that 15.1 million of 29.1 million shares are currently free-trading. Two private placements done in May (5.7 million shares) and July (6.5 million shares) become free-to-trade on September 22nd and November 29th. There are 17.2 million warrants outstanding at an average strike of ~$0.36 vs. today's share price of $0.47.

Some of the very best junior stock performances come from companies with under 50 million shares outstanding. Perhaps you've heard of Great Bear Resources? 50 million shares outstanding, it's up >7,000% from its low in 2018. How about GT superstar Teuton Resources? Also 50 million shares outstanding, up >4,000%. I could go on….

I realize I might sound promotional with all these peer performance references, but we are smack in the middle of an epic precious metals bull market. Gold is up +70% from its 2018 low. Silver is up +131% from March of this year!

I believe precious metal prices will remain strong, and perhaps even continue climbing. The U.S. presidential election and ongoing uncertainty surrounding Covid-19 will be with us for at least the next nine months.

Management plans high impact, high-grade North American acquisition(s)

Management plans to make meaningful acquisition(s) of high-grade properties/projects in North America. The stated goal is to pursue trending metals such as gold and silver, but also battery metals like nickel and copper. Having multiple projects diversifies exploration risk and allows for year round exploration. A material acquisition seems reasonably likely in the next few months.

Acquisitions of high-grade projects make a lot of sense in both bull and bear markets. Higher grade provides a margin for error and increased mine plan flexibility. Management believes juniors should explore and make discoveries, not spend giant sums (relative to market caps) to drill. Find it, demonstrate blue-sky potential, then step aside and let the deep pockets take over. I wholeheartedly agree! This strategy helps ensure that a tight capital structure remains tight.

Conclusion

Investors in precious metal juniors can chase hot stocks, many up 500%+, or take a closer look at Sassy Resources. If the company reports strong drill results, it might not take much trading volume to send shares a lot higher. Only 15 million free-floating shares until September 22nd, when 5.6 million additional shares hit the market.

As good as this management team is, I'm very interested in seeing the new properties/projects that potentially come into the company. CEO Scott promised to remain vigilant about protecting Sassy's capital structure.

No one can predict the future. I can't tell readers that gold and silver prices will continue to march higher. However, I can say with confidence that high-grade assets are incredibly robust and valuable in bull markets. Sassy Resources (CSE: SASY) is in the right place at the right time with the right project, people and strategy.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures:

The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Sassy Resources, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Sassy Resources are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Sassy Resources was an advertiser on [ER] and Peter Epstein owned zero shares, options and warrants in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont, a company mentioned in this article.