GoldMining Inc.'s (GOLD:TSX; GLDLF:OTCQX) strategy is disciplined: buy resource-stage projects—projects that have had millions of dollars of prior drilling and a 43-101 resource from a qualified geologist—at prices well below their discovery costs.

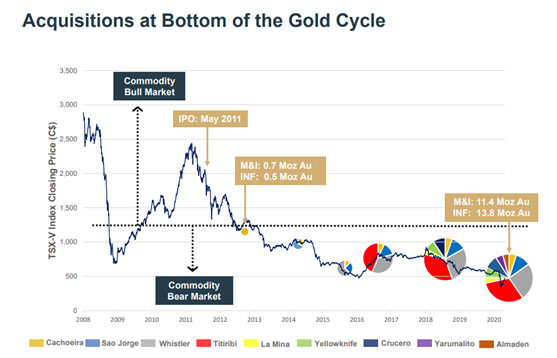

The company, which went public in Canada in 2011, made its first purchase in 2012, in Brazil. Partnering with BrasilInvest, the largest merchant bank in Brazil, it picked up several projects in that country before branching out in 2015 with the acquisition of the Whistler project in Alaska. It has since acquired projects in Canada, Peru and Colombia.

"After gold topped in 2011, from 2013 onwards we got really deep into a bear market for gold," Amir Adnani told Streetwise Reports. "You could basically buy projects for below their discovery cost, that being the amount of money that goes into the ground."

GoldMining has spent about $81 million to acquire its 14 projects located in five countries in the Americas: Canada, Colombia, Peru, Brazil and the United States. "We have been able to create a very large and diversified portfolio. We've assembled the portfolio that we have today—11.4 million ounces Measured and Indicated and 13.8 million ounces Inferred. We paid about $3.21 per ounce, which is a very attractive number. You couldn't go out today and replicate what we did over the last decade in today's gold market," Adnani said.

"It is massive to have 11.4 million ounces Measured and Indicated and 13.8 million ounces Inferred; the gold resource is as large as certain intermediate gold producers'. But what is so important about these ounces is that they are diversified. This is not a single resource in one large deposit where you have concentration of risk in one asset or one country. It's extremely diversified in five countries. And I think what truly sets it apart is both the size and diversification," Adnani explained.

"If you create critical mass, you become more interesting to shareholders because when you enter a bull market, size matters. That's how you create a high beta to gold with low risk because you have low maintenance assets. The assets already have been drilled, they have resource estimates, and that can really provide and deliver excellent torque to the movements in the gold price," Adnani said.

Adnani points to the looming shortage in precious metal resources. "At low gold prices, the major gold producers were underinvesting in exploration and development, focusing instead on leveraging their balance sheets and paying down their debt. There was hardly any investment going into the ground or to build up their resource pipeline, the pipeline for future growth, so that total resources today for the industry are at a decade low; reserves for gold producers have declined by over 40% from 2012."

With gold hitting record highs, Adnani sees the perfect storm developing for the gold price. "Economic conditions, lower interest rates, and all the challenges with extractions, especially given all the mine destruction, are leading to a multiyear bull market set up, and we're in the early innings of it. There's a shortage of gold resources in the ground; that's the pipeline for future growth."

"We have a number of options that are at our disposal to best maximize value," Adnani said. "One option is to develop and derisk these assets toward production. Another option is recognizing that because there's a shortage of gold resources, larger companies are very aggressively looking for growth through mergers and acquisitions. We could potentially look at getting bigger or we could potentially be acquired either as a whole or in bits and pieces because we're in five different countries; different parts of the portfolio may appeal to different larger suitors."

GoldMining also recently created a subsidiary royalty company, Gold Royalty Corp., that has been seeded with 14 newly formed royalties from the existing project portfolio. "This initiative was designed to give our shareholders a very distinct form of value in terms of the royalty exposure on the same assets that you can have versus just 100% ownership of the asset and it is designed so that we can look longer term at potentially a spin off or IPO of Gold Royalty Corp. and maximize the value," Adnani said.

On August 5, GoldMining announced that David Garofalo has signed on as chairman, CEO and director of Gold Royalty Corp. and as an advisory board member of GoldMining. Garofalo was president and CEO of Goldcorp until it was sold to Newmont Corp. in 2019. Prior to that, he served as president and CEO of Hudbay Minerals.

H.C. Wainwright, Haywood Securities and ROTH Capital Partners all cover GoldMining and all three have Buy recommendations on the firm.

Haywood analyst Colin Healey wrote on August 5, "Mr. Garofalo brings significant experience to the company's recently formed Gold Royalty Corp. and the GoldMining Advisory Board with an impressive resumé which includes oversight of the development of over a dozen projects into producing mines. GoldMining management continues to impress us with their execution and ability to attract top-tier talent."

"The addition of a highly successful, high-visibility CEO to run the newly established Gold Royalty Corp. will no doubt bring more eyes to the story and accelerate the build-out of the royalty portfolio," Healey stated. "Mr. Garofalo's reputation and credibility is a major asset to GOLD. We recommend continuing to add to positions in GOLD-T at the current significant discount to peers, to gain significant leverage to gold as the environment for precious metals remains very bullish."

On August 10, H.C. Wainwright analyst Heiko Ihle raised his firm's target price to CA$7.50 per share and highlighted David Garofalo's appointment, noting that he brings "a wealth of experience with major gold producers. . .Having served in multiple leadership capacities in the natural resources sector over the last 30 years, Mr. Garofalo brings vast experience to both Gold Royalty Corp. and GoldMining, which given the current market conditions, we think positions both companies for success."

Ihle also stated, "Following the recent creation of its new gold streaming and royalty subsidiary, GoldMining could benefit from a re-rating as royalty companies tend to trade at a premium to producing or exploration firms. This is especially pertinent given the recent hiring of Mr. Garofalo given his wealth of experience in the industry."

ROTH analyst Jake Sekelsky reiterated his firm's target price of CA$5.75 on June 24 when he wrote, "In our view, the creation of Gold Royalty Company represents an opportunity for long-term value creation. . .We are supportive of management's proactive approach to unlocking value from its portfolio of gold assets and expect GRC to provide GoldMining shareholders with optionality going forward. . . In our view, GoldMining is well-funded to execute on its stated objectives for 2020 and believe the company should continue to provide investors with leverage to rising gold prices."

GoldMining has 145 million shares issued and outstanding, and around 157 million fully diluted. It counts among its shareholders KCR Fund, Sprott Global, BrasilInvest, Extract Capital, IAMGold Corp. and Ruffer Gold.

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: GoldMining Inc. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of GoldMining Inc., a company mentioned in this article.

Additional disclosures:

Disclosures from Haywood Securities, GoldMining Inc, August 10, 2020

Analyst Certification: I, Colin Healey, hereby certify that the views expressed in this report (which includes the rating assigned to the issuer’s shares as well as the analytical substance and tone of the report) accurately reflect my/our personal views about the subject securities and the issuer. No part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendations.

Important Disclosures

The following Important Disclosures apply for GoldMining Inc.: N/A

Research policy available here.

Disclosures from H.C. Wainwright & Co., GoldMining Inc., Company Update, July 13, 2020

I, Heiko F. Ihle, CFA, Tyler Bisset and Marcus Giannini, certify that 1) all of the views expressed in this report accurately reflect my personal views about any and all subject securities or issuers discussed; and 2) no part of my compensation was, is, or will be directly or indirectly related to the specific recommendation or views expressed in this research report; and 3) neither myself nor any members of my household is an officer, director or advisory board member of these companies.

None of the research analysts or the research analyst’s household has a financial interest in the securities of GoldMining, Inc. (including, without limitation, any option, right, warrant, future, long or short position).

As of June 30, 2020, neither the Firm nor its affiliates beneficially own 1% or more of any class of common equity securities of GoldMining, Inc.

Neither the research analyst nor the Firm has any material conflict of interest in of which the research analyst knows or has reason to know at the time of publication of this research report.

The research analyst principally responsible for preparation of the report does not receive compensation that is based upon any specific investment banking services or transaction but is compensated based on factors including total revenue and profitability of the Firm, a substantial portion of which is derived from investment banking services.

The firm or its affiliates received compensation from GoldMining, Inc. for non-investment banking services in the previous 12 months.The Firm or its affiliates did not receive compensation from GoldMining, Inc. for investment banking services within twelve months before, but will seek compensation from the companies mentioned in this report for investment banking services within three months following publication of the research report.

The Firm does not make a market in GoldMining, Inc. as of the date of this research report.

H.C. Wainwright & Co., LLC and its affiliates, officers, directors, and employees, excluding its analysts, will from time to time have long or short positions in, act as principal in, and buy or sell, the securities or derivatives (including options and warrants) thereof of covered companies referred to in this research report.

Disclosures from ROTH Capital Partners, GoldMining Inc, Company Note, June 24, 2020

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Shares of Goldmining, Inc. may be subject to the Securities and Exchange Commission's Penny Stock Rules, which may set forth sales practice requirements for certain low-priced securities.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months.