Investors in Kincora Copper Ltd. (KCC:TSX.V) have had to be patient in allowing management to explore for really big prizes in Mongolia and New South Wales, Australia. This week we learned that it was well worth the wait. On July 6, the company announced an excellent drill result intersecting multiple mineralized skarn zones at its Trundle Park target in Australia's foremost porphyry region [see July corporate presentation].

The results are noteworthy for at least three reasons: there's considerable near-surface, high-grade mineralization; as the first of six holes, even better assays could follow (leveraging knowledge gained from this result); and further evidence of an adjacent porphyry system was found.

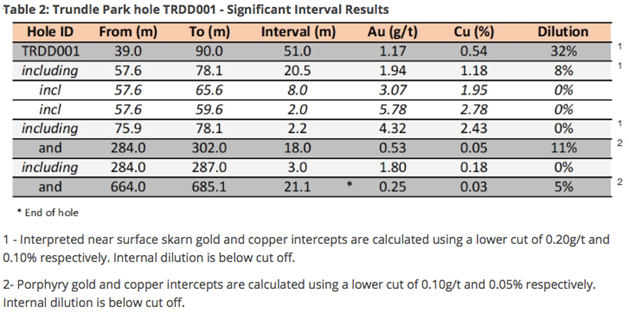

By far the best mineralization is from 39 meters (39m) to 90m depth. This 51m interval hit 1.17 g/t Au + 0.54% Cu. Included in the 51m is one meter, from 57.6m, of 10.4 g/t gold (Au) + 4.4% copper (Cu). See image below.

51m, less than 90m deep: Very good grades + a porphyry teaser at depth

At current gold and copper prices of US$1,793/ounce and US$2.78/lb., this is an in-situ rock value of ~US$100 = ~CA$135.5/tonne. In gold terms, it's 1.75 g/t Au equivalent (equiv.). In copper terms, 1.64% Cu equiv. Note: these strong grades will not be indicative of the overall deposit. However, this hole suggests the potential for a nearer-term, standalone open pit.

That's the sexy part of the assay, the hole also intersected a targeted adjacent "porphyry intrusion system" with broad anomalous mineralization. This assay delivered the most significant intervals to date. Management notes that Trundle is the only brownfield project held by a listed junior in Australia's foremost porphyry district, the Lachlan Fold Belt (LFB).

John Holliday, technical committee chair, and Peter Leaman, senior VP of Exploration commented: "We are extremely pleased and excited by the results of this first hole. It's not often one sees such high grades near surface within a porphyry environment. Assay results prove previously announced visual interpretations of multiple zones of significant gold and copper mineralization. This supports the skarn being a standalone target at depths and intervals often mined by open cut and underground methods. . .

". . .These results from this first hole at the Trundle target, plus visual indications from the second hole 8.5 km north at the Mordialloc target, are very encouraging. The Trundle project appears to sit within the interpreted Northparkes Intrusive Complex, placing Kincora in a unique global setting as the only listed junior exploring a large system in a brownfield field setting."

Breaking: Dr. Copper says "reports of my death are greatly exaggerated"

The timing of the press release could hardly be better. Copper has bounced back strongly from US$2.10/lb. in mid-March to US$2.78/lb., +32%. Dr. Copper has spoken loud and clear. He/she believes that, even if temporarily slowed, the global electric transportation and green energy revolutions are alive and well.

Dr. Copper is leaning toward a V-shaped recovery. Others seem to agree, look no further then Tesla's >CA$300 billion valuation for evidence of market sentiment on electric vehicles!

In addition to copper's irreplaceable role in electric transportation and renewables, copper demand will increase if/when the world's major economies embark on infrastructure massive spending sprees. Giant infrastructure builds/rebuilds(bridges, tunnels, airports, stadiums, etc.) are highly copper-intensive.

Even if copper demand is tepid, the supply response to the pandemic has been dramatic. Reduced production from countries such as Chile, (where per capita COVID-19 cases are among the worst in the world), Peru, the Democratic Republic of Congo and others, will last several more quarters. Chile is by far the largest producer, larger than the next three copper-producing countries combined in 2019.

It took three paragraphs to sound off on copper, but just one on gold. For years, gold bugs have pointed to fiat currencies, deficit spending, debt issuance, money printing, imminent inflation, etc., pushing gold to US$5,000 or US$10,000/oz. "next year!!" Next year has finally arrived. I'm not predicting US$5,000+/oz. anytime soon, but gold fundamentals are as strong as ever. Bull markets in precious metals last years, not months. Gold is up 31% from its US$1,368/oz. low of March.

A single hole, but a tonne of de-risking as exploration models validated

Turning back to this hole at Trundle, it is the first of two each at three targets in an ongoing 3,800m program. This single assay delivered meaningful de-risking of the Kincora story. Positive visual inspection of the core was verified by strong results that largely confirmed the team's targeted geological model and exploration strategy. This is critical, because a fear investors have with junior miners is that even talented management teams will run out of money before finding anything promising.

That risk has been moderately reduced (but not eliminated). If results from hole #2 at the Mordialloc target, 8.5 kilometers north of hole #1, are as good or better, Kincora's valuation might look undervalued compared to peers such as Magmatic Resources (MAG:ASX), Sky Metals (SKY:ASX) and Stavely Minerals (SVY:ASX) that have an average market cap of ~CA$80 million (CA$80M) versus ~CA $25M for Kincora.

To be clear, none of these companies measure up to Alkane Resources Ltd.'s (ALK:ASX; ANLKY:OTCQX) CA$700M market cap, but one cannot rule anything out at this early stage. So far there are just two winners of six holes, but we now know there's smoke at Trundle. Will any of the next four holes find fire?

Let's take a step back to revisit the bigger picture. High-grade, near-surface skarn mineralization is exciting, but the pot of gold/copper at the end of the rainbow is one or more porphyry deposits. Results from the first hole, and anticipated results from hole #2, represent a meaningful step closer to the pot of gold/copper.

Director John Holliday has said on the record that he thinks after Alkane's Boda project, Kincora has the best porphyry play in the district. Likewise, CEO Sam Spring believes Kincora is the leading pure-play porphyry explorer in Australia's LFB. Make no mistake, they're biased!

Still, unlike many junior gold/copper districts around the world, there are relatively few juniors active in the area. I mentioned three, there are about a dozen with meaningful flagship projects in the region. By contrast, Canada's Golden Triangle has three dozen, or more.

Readers are invited to view Kincora's July corporate presentation. On pages 29 and 30, management places their drill result into context. While the first drill hole at Trundle did not contain the highest grades or widest intercepts, its high-grade mineralized zones are closer to surface than some peers. And, this is just the first hole!

The skarn and porphyry intrusion system setting intersected is common among large porphyry systems. For example, in the Macquarie Arc, the Big and Little Cadia skarns at Cadia were important to the discovery of multiple adjacent "causative intrusions and deposits" that make up the largest porphyry system in Australia. Kincora's strategy is to drill to depths at which porphyries at Cadia, Northparkes, Cowal and Boda are situated.

Management, Board and Technical Team: Now the hard part

The management, board, technical team and advisers share in this initial exploration success. But, where does this leave the company? I think the considerable strength of Kincora's team will be amplified in coming months as it leverages the valuable knowledge gained from the first six holes. Kincora found smoke at Trundle, it's now trying to locate the porphyry fire.

CEO Spring provided me with this exclusive quote: "What we intersected near-surface in hole #1 is a skarn. What we're testing for in hole #2, and at the bottom of hole #1, is a porphyry (the presumed source of mineralization in the skarn). At the Mordialloc target, hole #2, we don't see a skarn—we knew that only a porphyry was the target. What we intersected in hole #2 suggests that we're closer to the core of a porphyry system (which, if you hit, can easily be a company maker) than in hole #1, without yet hitting it."

While some investors are rightfully congratulating the team, I suggest that their jobs have only just begun. Now that we know there's probably something meaningful (although not necessarily economic) at Trundle, the pressure is on to advance the project efficiently and cost effectively. This is where tremendous experience and skill sets come into play.

In looking at the bios, we have Mr. McRae, with nearly 30 years' at Rio Tinto Plc (RIO:NYSE; RIO:ASX; RIO:LSE; RTPPF:OTCPK), president and CEO of three of Rio's segments. Mr. Lehman has >40 years' experience, mostly with BHP Billiton Ltd. (BHP:NYSE; BHPLF:OTCPK), including Tier 1 discoveries under his belt. He's a world-renown expert in copper and gold deposits. Mr. Holliday, based in New South Wales (NSW), has >30 years' with BHP and Newcrest Mining Ltd. (NCM:ASX)—a principal discoverer of the world-class Cadia copper-gold porphyry in NSW. Very few, if any, are better suited to lead Kincora's technical team.

CEO Sam Spring has been a senior exec at Kincora for eight years. Prior he held a number of positions including lead mining/metals analyst at Goldman Sachs and various roles evaluating, advising or negotiating merger and acquisition (M&A) activities in multiple jurisdictions. Readers are encouraged to also review the bios of other highly talented contributors above and below. This is a group who have done this before; discovered, developed, permitted, constructed, funded and commissioned mines.

I doubt Kincora is going to ride this horse across the finish line, but the experts working on Trundle, and Kincora's other high-profile targets in NSW, understand exactly what potential acquirers are looking for. They've created vast shareholder wealth in past endeavors. With continued successes they're on track to potentially deliver another exciting outcome for Kincora Copper stakeholders.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Epstein Research Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Kincora Copper, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Kincora Copper are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this article was posted, Kincora Copper was an advertiser on [ER] and Peter Epstein owned shares in the Company.

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts and financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events and news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.