After Standard Lithium Ltd. (SLL:TSX.V; STLHF:OTCQX) managed to close an almost two-times oversubscribed CA$12.1 million capital raise on Feb. 21, 2020, the company is financed at least into the "proof of concept" completion of its demonstration plant, and the subsequent consummation of the formal joint venture (JV) with Lanxess AG (LXS:DE).

The timing couldn't have been better, as the COVID-19 pandemic gathered speed at the same moment, severely dampening sentiment at, for example, the mining industry's premier event, PDAC, in the first week of March.

With the funding secured, Standard Lithium proceeded as quickly as possible, abiding by COVID-19 measures at the Lanxess location, resulting in the announcement on May 19, 2020, of the successful commissioning and commencement of continuous 24/7 operation of the demonstration plant, first of its kind at this scale, this month.

In the meantime, lithium product prices kept on falling, so as these are interesting times, it certainly is time for an update, further illustrated by input from CEO Robert Mintak.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. dollars (USD), unless stated otherwise.

Standard Lithium recently announced the successful start-up of the industrial-scale direct lithium extraction demonstration plant at Lanxess' South Plant facility in southern Arkansas (the site) on May 19, 2020. This plant, using LiSTR direct lithium extraction technology, had been successfully commissioned on May 15, 2020 and is now operating on a 24/7 basis, extracting lithium directly from the tail brine of Lanxess' bromine operations.

Standard Lithium is now involved in systematic optimization to fine-tune the plant, which is a highly automated, three-story demonstration plant including an integrated office, control room and laboratory, and investigate how performance can be improved further. The most important features of the technology, per the news release, are that it:

- Produces lithium chloride (LiCl) directly from unconcentrated raw brine;

- Reduces recovery time from months to less than a day;

- Eliminates the massive environmental footprint of evaporation ponds;

- Returns virtually all water to the source aquifer;

- Is not affected by weather conditions;

- Vastly increases recovery efficiencies to as much as 90%; and,

- Unlocks large-scale unconventional brine resources.

The demonstration plant is capable of an annual production of between 100-150 tonnes per annum of lithium carbonate equivalent (LCE). To be clear, the LiSTR demonstration plant extracts lithium from the Lanxess tail brine stream and produces a high purity lithium chloride solution (LiCl), similar to the output of the evaporation ponds process but much faster, done in hours instead of many months. The LiCl will be sent off-site and converted via a third party to battery-quality, 99.5%-purity lithium carbonate (Li2CO3).

The commercial operation would incorporate an onsite Li2CO3 conversion plant. Standard Lithium is working on its own Li2CO3 technology called "SiFT". The SiFT technology utilizes processes from the pharma industry and includes artificial intelligence and robotics to self-optimize the crystallization process. A news release in March announced that a prototype pilot plant produced a better than 99.9% purity Li2CO3. Depending on the success of testing, either the SiFT plant or a standard plant will be constructed after the construction decision has been made.

In the meantime, the company is actively monitoring the COVID-19 pandemic and working closely with Lanxess to implement preventative measures at the site to safeguard the health of its employees and contractors. This results, for example, in funny site visit pictures like this:

Site visit at demonstration plant site

Some of the measures being put into place include:

- Continuing operations at the site with the minimum staff present onsite as required;

- Screening all contractors and external visitors to site for risk factors, as well as employees returning on shift change;

- Requiring employees who show symptoms or are in close contact with someone with symptoms to stay home from work;

- Suspension of all international travel and requiring employees returning from travel outside of the USA or Canada to self-isolate for the government recommended 14-day self-quarantine period;

- Implementing work-from-home practices where possible, including ongoing process engineering and optimization work at the company's LiSTR demonstration plant;

- Reducing in-person meetings and transitioning to videoconferencing where possible, as well as restricting any large gatherings;

- Enhanced cleaning and disinfecting protocols at the site on hard surfaces and especially at touch-points; and,

- Promoting personal preventative measures, such as frequent handwashing, and increasing awareness of social distancing practices.

According to CEO Robert Mintak, the impact of COVID-19 on the project has been managed exceptionally well, with the technical team in Canada working virtually with the operations team in Arkansas. The impact to the timeline has been about eight weeks, but compared to peers that have been largely stalled or halted during the pandemic, Standard was able to push further ahead. A preliminary feasibility study that has been planned has been impacted by the travel ban. A release date will not be certain until international travel returns to somewhat normal.

I feel this is very reasonable, and even in line with normal project/study delays across the board of junior mining companies. The real outbreak of COVID-19 in March didn't leave the Standard Lithium chart unharmed, as can be seen here:

Share price; 3-year timeframe

Looking in hindsight, the mid-March panic was a perfect buying opportunity. But many were probably expecting much more bad news, or a limited dead cat bounce at best, as the U.S., as the leading economic power, was gearing up to become the epicenter of the pandemic, with a president who initially denied a crisis and compared COVID-19 with the flu. The difference is there is a vaccine against influenza, and not against COVID-19.

However, the virtually unlimited financial support programs from the central banks and governments seemed to provide sufficient oxygen for the markets, resulting in strong and lasting recoveries of indices and almost all individual stocks. For now, Standard Lithium has fully recovered and more, reaching highs not seen since Q4/2018, and is working toward the all-important technology proof of concept, the consummation of the JV with Lanxess and a final investment decision.

As a reminder: This demonstration plant is roughly designed at 1/60 scale of the target production capacity of the first phase of commercial production, and should provide sufficient testing data this quarter for a planned, upcoming prefeasibility study (PFS). If the testing is successful and the JV formed, it should be a straight path for the contemplated phased commercial production development, after the investment decision would have been made by Lanxess.

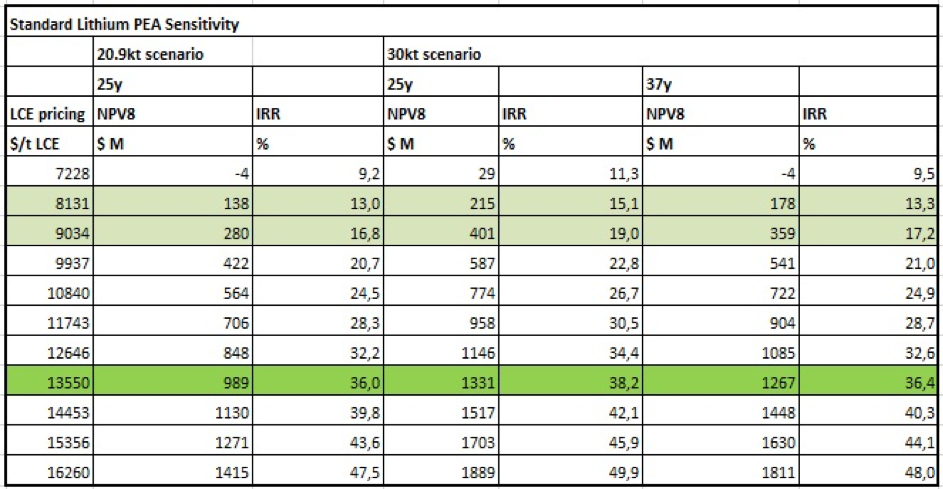

The base-case economics used indicate a pretty robust lithium project. At a capex of US$437 million, an operation can be constructed with an after-tax net present value 8 (NPV8) of US$989 million, and an after-tax internal rate of return (IRR) of 36%, based on an average, long-term LCE price of US$13,550/ton (US$13,550/t).

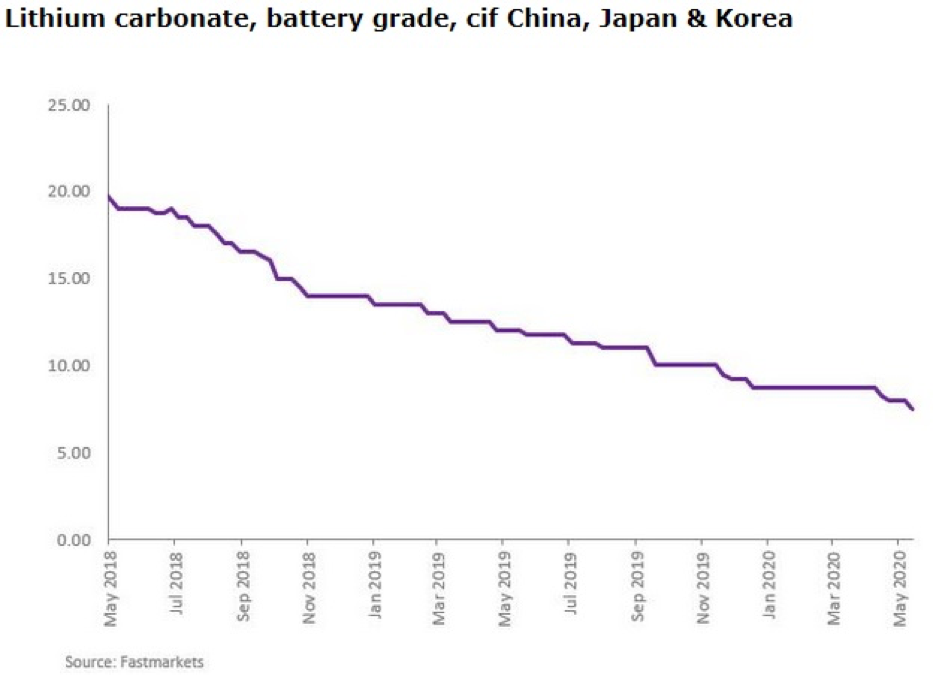

However, we are nowhere near such lofty price levels anymore, unfortunately. In this useful article by Matt Bohlsen on Seeking Alpha, we can find a monthly update on lithium pricing, which I find to be very useful when doing due diligence on lithium companies: Fastmarkets quotes an LCE price of US$7,500/t (coming down from US$8,750/t in February), and lithium hydroxide prices of US$9,750/t . Benchmark Mineral Intelligence (BMI) has April prices at US$6,582/t for Li carbonate (coming down from US$7,922/t in February), US$9,125 for Li hydroxide, and US$420 for spodumene (6%). What I find fascinating is that the hydroxide price gap with carbonate remains constant in absolute terms, resulting in a larger and larger relative difference, potentially indicating higher fees being calculated by converters in Asia.

The trend keeps following a downward path, including a new drop in April/May, probably caused by COVID-19 fallout, as can be seen here in this chart coming from Fastmarkets (paid for link, chart provided by Bohlsen on Seeking Alpha.com):

As the lithium carbonate market seems to be oversupplied, and demand is weakening further due to COVID-19, the short-term outlook isn't particularly healthy. For the long term, I have seen market scenarios contemplating US$9,000–10,000/t LCE, but we aren't there yet.

Therefore I again reworked the lithium sensitivity, where three scenarios are presented, the 20.9kt LCE pa (per annum) base case, and the hypothetical 30kt LCE pa expansion scenarios, as I calculated them in my first article on the company:

A current US$7,228/t LCE price, which is roughly a midpoint of Fastmarkets and BMI estimates, would generate a hypothetical NPV8 of about zero, and a hypothetical post-tax IRR of 9.2%, which would render the project not economic, as lithium projects usually need an IRR of at least 25%.

As the Lanxess project has one of the best economics for lithium projects around, almost no project is economic these days. These figures are based on 100% project-ownership economics. As stated in the past, Lanxess is committed to provide project finance to the JV when testing and the PFS are successful for them, and Standard will probably be an estimated 30% JV partner (according to company documents filed on SEDAR). I asked CEO Robert Mintak this, and other questions, in the following short interview:

The Critical Investor (TCI): Thanks for taking the time to conduct this short interview. First I wanted to ask you for a quick update on several basic items. Could you tell us what your current cash position, after raising CA$17.1 million in Q4/2019-Q1/2020?

Robert Mintak (RM): We closed a non-brokered financing in February for just over CA$12 million, which has allowed us to continue advancing the project. We have a team of roughly a dozen at the plant in El Dorado and a handful working in Canada. At the end of Q3, March 31, 2020, we had roughly CA$7 million, which we are deploying strategically to achieve our immediate milestones while managing the runway.

TCI: Could you explain to us what optimization steps you and your team are undertaking, and to what kind of improvements these could lead, possibly in terms of NPV/IRR increase, or capex/opex decreases?

(RM): Without going into a lengthy description, the ongoing operations, testing and optimization steps are similar to any piloting stage. On the LiSTR process specifically we will be testing for effective lithium recoveries, concentration and purity, residence time in the loading, washing and stripping reactors, water and energy consumption, and adsorbent life cycle performance and reagent recovery and optimization.

TCI: When do you expect to get publishable useful numbers on costs, finally showing commerciality of the proprietary extraction process, maybe not at current LCE prices but, for example, at US$10,000/t levels?

RM: The price today of battery-quality lithium carbonate is not the same as what is being reported. Pricing out of Japan and Korea is above $10,000. We will be modeling the project economics based upon well-thought and researched pricing models for battery-quality (BQ) lithium over the next number of years. COVID-19 has had an impact on the sales of electric vehicles (EVs) and other consumer goods, however, the economy coming out the pandemic will be different than the economy prior. EVs and renewable energy, which includes stationary storage, have been prioritized as part of new era of dirigisme that is being displayed by many of the world's largest economies. The lack of investment in the raw material supply chain, new lithium production, along with importance of localizing production and decoupling from China-centric critical supply, will elevate the value of a U.S. producing lithium asset.

TCI: What about the SiFT pilot processing plant? Do you still anticipate delivery to the Arkansas site in mid-Q2, or did COVID-19 slow things down here as well?

RM: The SiFT plant is fully mechanically built and paid for. We will begin commissioning soon. Instead of shipping the plant to Arkansas as originally contemplated, because of the COVID travel restrictions, we will commission the plant in Canada by shipping LiCl from Arkansas to Canada. The same results, but this will save money and time. We will at some point, when travel returns to normal, ship the SiFT plant for installation in Arkansas.

TCI: When is the PFS expected? Try to be as specific as possible.

RM: COVID travel restrictions will determine the PFS timing. The PFS will require site visits by several qualified persons (QPs). With the current pandemic and other elements it would be out of place to provide a specific timeline.

TCI: If possible, could you indicate to the audience your expectations for PFS economics, as compared to PEA economics?

RM: The PEA that was released in Q3/2019 took a very conservative stance. We believe the data from the demonstration plant, combined with some other key cost input efficiencies like reagent recovery, will improve the already attractive project numbers by a healthy percentage.

TCI: As mentioned in the paragraph before this interview, prices for lithium products have dropped off significantly, even rendering the project uneconomic. I know you are optimizing project economics, but a drop from US$10,000 being the minimum of being economic, to US$7,000 nowadays, is probably more than can be restored by optimization. How are you dealing with this, and more importantly maybe, do you know how Lanxess is dealing with this? Do they have a certain higher-price scenario for the long-term future in their heads, and will continue with a construction decision as long as a certain minimum LCE price will result in an economic project?

RM: As I mentioned earlier, I disagree with the sub-$10,000 pricing scenario for battery-quality lithium carbonate. And I state, regardless of the pricing today, the industry is going to be facing a day of reckoning in the near future for the lack of investment in new projects capable of producing battery-quality lithium chemicals—not spodumene concentrate, rather fully integrated lithium chemical production. This will likely result in a spike in pricing much like what we saw from 2015-18.

TCI: I read something in the PEA recommendations about adding a unit, which could use direct raw brine, without using the tail brine of the Lanxess bromine operation. Is this still an option?

RM: The LiSTR process is not affected by bromine being present in the brine. So yes, we are looking at the entire opportunity in south Arkansas, which represents a much larger number than what was considered in the PEA.

TCI: Do you have anything else to add for interested investors?

RM: The project is incredibly exciting, and potentially disruptive for the industry. A number of companies have been promoting direct lithium extraction, black boxes and magic beads, for years, but the approach we have taken has been project-focused and methodically executed. We now have an operating direct-extraction plant while still pre-commercial. This is at a scale no one has ever done before. We are just at the starting line and things are going to get even more exciting as we go into the next phase.

Conclusion

After COVID-19, the world seems to have changed. Fortunately, Standard Lithium managed to raise CA$12.1 million right before things got serious, and commenced their demonstration plant after small delays. On the process side of things, the project is running quite smoothly despite COVID-19. On the lithium product-pricing side, things don't really cooperate.

However, according to CEO Robert Mintak, real contract pricing for lithium products in Japan and South Korea, being major battery producers, is hovering close to US$10,000, which would still render the Lanxess project economic with an after-tax IRR of 25%, as one of very few lithium projects.

After COVID-19 restrictions are no longer necessary, Standard can complete its upcoming PFS, which will likely show improved economics. Directly after this, a Lanxess construction decision awaits.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Standard Lithium is a sponsoring company. All facts are to be checked by the reader. For more information go to www.standardlithium.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.