A quick update since FansUnite Entertainment Inc. (FANS:CSE) went live on Tuesday, May 5, because big things are happening in the industry, thus showing there is an enormous appetite for this kind of technology especially now, as we (very slowly) emerge out of this COVID pandemic.

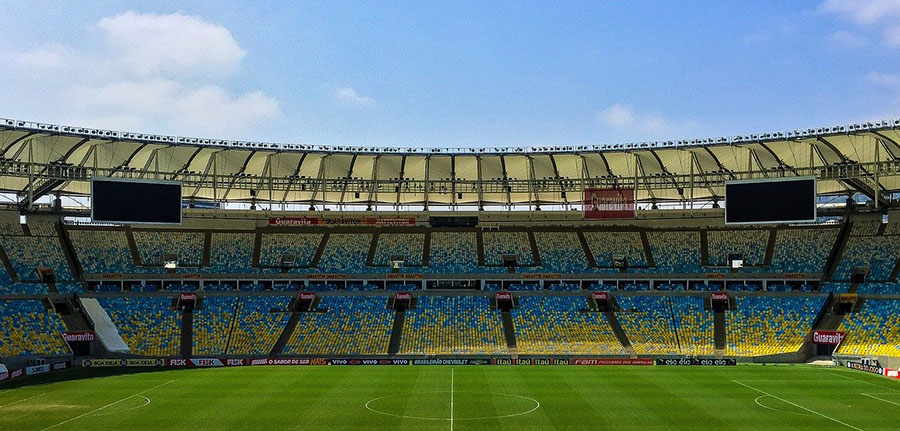

On the sports front, Germany announced that its Bundesliga soccer will resume games in May, yet with tight restrictions and no fans. This is followed by the Turkish soccer league, which plans to resume playing on June 12. The Ultimate Fighting Championship (UFC), with a huge draw to the masses—the UFC 246 prelims averaged 1.767 million viewers on ESPN—will return at VyStar Veterans Memorial Arena in Jacksonville, Fla., on May 9, again featuring no live fans. So as more sports emerge in our "new reality," where will those fans be? Online, of course! In a fanless sports environment we're going to see a lot of online engagement no matter what sport or activity that may be. That's going to spawn even more online attention, which will likely hold firm even after we emerge from our home quarantine.

The industry is rapidly consolidating. On Tuesday we alluded to The Stars Group Inc. (formerly Amaya), which, according to Bloomberg, "saw record revenue in its first quarter as COVID-19 led to an increase in online activity starting in March. Indeed TSGI.T has had a great run from $18 mid-March to a high of $40 on May 1 after it confirmed shareholder approval of a friendly takeover by UK based Flutter Entertainment plc. (LSE:FLTR.L - News). The two create a Ł10 billion (US$12 billion) giant, according to Racing Post, and combine for more than 13 million customers, US$4.6 billion in revenue and US$1.7 billion in EBITDA.

Investors are getting on board

In our previous note we referred to DraftKings (NASDAQ:DKNG), which launched as recently as April 23, in the thick of this stay-at-home pandemic. After completing a merger with Diamond Eagle, a special purpose acquisition company, and back-end technology provider SBTech, its stock soared. DraftKings' stock jumped 14% in its first day of trading before closing up 10.38% at $19.35. The company was also able to add another half a billion dollars on the balance sheet at a time when it's not easy to raise money. That company currently has a $17 billion market capitalization.

Meanwhile there's been a noticeable correlation of trading activity in the industry from mid-March to the end of April:

- Prior to the merger with Canadian The Stars Group, Dublin, Ireland-based Flutter, trading as OTC:PDYPY in the U.S., had a good run of its own. Since mid-March it doubled from $31 to $64 by the end of April, despite any global sport-killing pandemic.

- UK-based GVC Holdings PLC (LSE:GVC) gained 23% in the last month, from $611 to $750, reaching a US$4.3 billion market capitalization.

- After falling from February highs of $30, Scientific Games (NASDAQ:SGMS) more than tripled from a $4 low mid-march to $13 by the end of April to again reach a $1 billion market valuation.

- Penn National Gaming (NASDAQ:PENN), now at a US$1.8 billion market capitalization, has a chart that mirrors SGMS. After February highs of $38, PENN rebounded through the COVID crisis. It also more than tripled from a low of $4.50 mid-March to a $17.80 high by the end of April.

- Score Media and Gaming (SCR.V,) with a market capitalization of $185 million, during that same period, ran from $0.32 to $0.42 mid-march to April 29, gaining 31%

- (are you starting to a pattern here?)

On the regulatory front, Colorado, became the next state to legalize sports bargaining following New Jersey, Nevada, Delaware and Pennsylvania. The state is poised to generate $6 billion in annual wagers and an estimated $400 million in revenue once the industry matures, according to Dustin Gouker, chief analyst for PlayColorado.com. According to the Denver Post, Colorado fans will have their pick of 17 digital sportsbooks currently licensed to operate in the state.

FansUnite Is at a Small-Cap Entry Point with Tremendous Upside.

It is in this environment that FansUnite launched on the Canadian Securities Exchange on May 5. "We are just getting started," said CEO Darius Eghdami. "We've bought a great asset in McBookie and will be continuing to focus on M&A." McBookie, the company's first acquisition, is a white-label sportsbook in the UK, focusing on the Scottish market. It offers 200,000 members active in sports and virtual games, and boasts over $100 million turnover cumulatively the last three years. "We want to be active in finding that next 'McBookie' operating in a niche market, looking at Esports assets and also creative ways to get into the U.S. market. "

After a financing at $0.35, the now-trading company rests slightly above that as a relatively new and unknown entity—so far—which is why now is great opportunity participate in a smaller scale, yet leveraged, consolidation play. "We have a great opportunity to use our stock as currency, and then grow and scale companies through our team and resources," says Eghdami.

"We also have great investors and support, a very experienced board and management team and a clear vision of how we want to be that next gaming giant. The path has been shown by other Canadian gaming companies such as Amaya, and we want to follow that path and execute on our vision."

It's an ambitious plan: a CA$25 million market-cap company, $2 million in the bank, with a consolidation plan to attack a $1 trillion online industry. Yet FansUnite comes out of the gate with strong financial backing led by board member Shafin Diamond, CEO of Victory Square since 2015, a venture builder that builds start-ups in web, mobile, gaming, AI and AR/VR. Diamond has launched 40 start-ups in 24 countries, employed more than 350 people, and has generated over $100 million in annual revenues.

Eghdami says the immediate plan is to strengthen its UK presence with McBookie and focus on M&A activity, while continuing to develop its software platform.

The games are just beginning.

Knox Henderson is a journalist and capital markets communications consultant. He has advised for a broad range of small cap companies in the resource, life sciences and technology sectors for more than 25 years.

[NLINSERT]Disclosure:

1) 1) Knox Henderson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: FansUnite Entertainment Inc. My company has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with FansUnite. Please click here for more information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of FansUnite, a company mentioned in this article.