Like most projects around the world, Treasury Metals Inc. (TML:TSX; TSRMF:OTCBB) is temporarily slowing down and shutting down drilling at its Goliath Gold project in Ontario, caused by the omnipresent COVID-19 pandemic, but as it has been completing over half of its drilling program before the virus broke out, it has been reporting several sets of drill results so far this year, and still has a few batches to come. Most of the intercepts are solid, nothing spectacular, but in line with the existing resource.

The goal has predominantly been to prove up the Measured and Indicated resource to Proven and Probable for the upcoming Pre-Feasibility Study (PFS), and this is proceeding well. The company is also looking to add ounces to expand the resource, but these will not be eligible for the PFS reserves, but will indicate future potential for production. I asked management several questions regarding exploration, advancements and adjustments because of the pandemic, and it seems despite the inevitable delays, Treasury Metals is still firmly on track.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Treasury Metals reported two sets of drill results in the first quarter, and a last one on April 2, 2020, all of which will be discussed in this update. In between, the company also sold several claims and royalties on the Shining Tree Gold property to Platinex (PTX.CSE) for equity on March 11, 2020.

Treasury Metals is excited to work with Platinex on Shining Tree. Platinex Chairman and CEO James Trusler is arguably one of the most experienced geological engineers in the sector with five discoveries throughout his career, primarily in Canada. He spent many years at Teck and Inco and therefore has seen most projects at some point in his career. According to CEO Greg Ferron, Jim has a strong technical team and they are very excited about the opportunity at Shining Tree. Investors will most likely see the adjacent Juby Gold project change hands in the short term, which will see a mid-tier gold produce immediately next door.

It has been a long time since, but I do hope Trusler will handle his corporate communications with the First Nations a bit differently compared to the 1999–2009 case. I ran into a pretty entertaining article about the issue. After a decade of disagreements and court cases, Platinex tried to force the issue in 2009 after Ontario took too much time, at least in its view, to make a decision on the matter. Trusler, already being the Platinex CEO at the time, was on the floatplane that tried to land at the lake nearby the project, however it was unable to as First Nations Chief Donny Morris was blocking the landing trajectory of the plane by dragging debris through the water with a small boat.

Morris did this since Platinex didn't consult with his tribe about the visit, as Platinex repeatedly failed to consult them over the years, troubling relations to an absolute low. Since then, Platinex received $5 million and a 2.5% royalty for returning the Crown Land claims to Ontario in 2009, thus emerging victorious in the end, after it was allowed to do small scale exploration by the Supreme Court in 2007. This case received widespread attention, and formed the cornerstone of updating many mining acts nationwide with regards to timely and effective communication with Indigenous people like the First Nations. According to Trusler, the royalty is on one of the best greenfield platinum projects in the world, and he is actively working with all level of governments to encourage development of the project located near the Ring of Fire area in Ontario. Treasury will assist as it has a strong permitting track record.

So that's a bit of entertaining history on the side. Let's have a look at the actual transaction between Treasury and Platinex, which was announced on March 11, 2020. Both companies entered into a non-binding heads of agreement between the two companies to create a substantial gold focused property package in the Shining Tree District in northern Ontario.

The highlights are:

- Treasury will transfer a 100% interest in its 280 claim unit, 5,045-hectare Shining Tree Fawcett East property to Platinex, to create a significant gold focused property package in northern Ontario

- Treasury will transfer to Platinex several royalties comprising four Ontario and Chile based exploration projects covering gold, PGMs and base metal opportunities

- In consideration for acquiring the Shining Tree East Property and the royalties, Platinex will issue to Treasury 12,500,000 common shares of Platinex and 5,000,000 non-transferable warrants of Platinex. Each warrant will be exercisable at a price of $0.05 per share for a period of three years from the date of issuance, provided that if the closing price of the Platinex shares is equal to or greater than $0.30 for a period of 20 consecutive trading days, Platinex will have the right to increase the exercise price of the warrants by giving a written notice to Treasury that the exercise price shall be increased to $0.15 per share on the date that is 10 days from the date of such notice. In addition, Treasury shall not exercise the warrants if such exercise would result in Treasury owning 20% or more of the issued and outstanding Platinex shares.

As Platinex was trading at 2.5c at the time of announcement, the Platinex share consideration had a value of $312,500. Considering the early stage of the properties, it has only seen mapping, sampling and very limited near surface drilling, it is hard to assign any value to the package. The remotely interesting thing about this claim package is that the Shining Tree Gold Camp is located in the southwest portion of the Abitibi Greenstone belt along the projected extension of the Larder Lake-Cadillac Break, next to the Juby Gold Project owned by Pan American Silver, and in between the operating Young-Davidson Mine owned by Alamos Gold and the advanced development Côté Lake project owned by IAMGold:

Of course these last two deposits aren't at the doorstep of the Shining Tree project, but the trend is a very, very prolific one. I view the equity holding of Treasury in Platinex as a wild card at these times of rising gold prices. I am not sure if Platinex can raise sufficient funds to adequately drill out its project, but at least it is a risk-free option for Treasury on any hits. However, the stock is starting to see more volume since the transaction was announced.

After Treasury announced this deal, the company followed with some pretty nice drill results on April 2, 2020. The Main Zone drilling produced the following interesting highlights:

- TL20-523 intersected 6.3 g/t Au over 19.5 m including 9.7 g/t Au over 12.0 m in the Main Zone Central Shoot

- TL20-525 intersected 4.8 g/t Au over 9.0 m including 10.1 g/t Au over 4.0 m in the Main Zone East Shoot

- TL20-522 intersected 2.9 g/t Au over 4.9 m in the Main Zone Central Shoot

Holes 523 and 525 are located close to hole 522 and 524, which can be seen in the map below (see light green box), which indicated only a few of the drilled holes, unfortunately:

As far as the highlights of the drill results of the current campaign go, I put them together in a table, with the green marked intercepts being the most interesting as far as economic intercepts go:

Intervals do not indicate true widths, with inclinations ranging -65 to -80°, meaning most intercept lengths are about 60–80% of reported lengths. A number of holes were left out that generated larger intervals with a lower grade at depth, being hardly economic at grades ranging between 0.5 g/t and 1.5 g/t Au below 200m. TL20-522 had two different results as the assays were divided over two batches. What to make of these results? It seems compared to earlier resource drilling, the infill results show solid continuity of the mineralized zone in the proposed mining areas, and show very good potential for the upgrade of mineral resources into the Measured category, without meaningful loss of grade and/or tonnage. Management added this statement in one of their news releases:

"A portion of the program has been focused on upgrading specific areas of the Main Zone shoots to the 'Measured' classification for inclusion as potential estimate ounces for the initial mine life years and for grade control purposes. Each of the reported holes have shown very good continuity of the mineralized areas with high grade."

This sounds good, but I also wondered why they are after a higher degree of confidence for the resource just for the initial mine life years, as I (and certainly financiers of capex) would like to see equal confidence for at least the first 8 (repayment of debt usually is on 7–10 year schedules) of the 13 2017 PEA life of mine (LOM) years, if not simply all 13 years. CEO Greg Ferron answered in fact, as noted, primarily for the project financiers that require this level of spacing in those early years to ensure their capital is repaid on a quick repayment schedule if desired. The early years are extremely important at the Goliath as the cash flow from the open pit and first few years of the underground continue to fund required sustaining capital for continued underground development. Once the debt is repaid and first few years of the underground is developed the free cash flow will kick in. On a side note, if the C Zone underground exploration continues to show promising results, Treasury may have a more robust second UG production center.

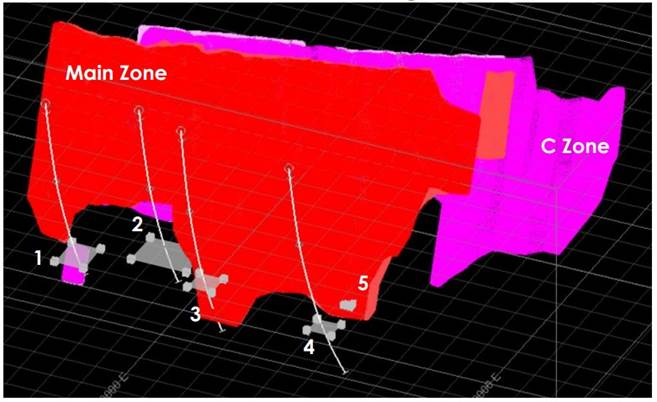

The ongoing proving up of continuity is quite an achievement, given the fact that Goliath is a pretty complex deposit. As a reminder, it is basically two lenses, which are build up around high grade pods. A basic 3D visualization of the lenses looks like this:

The high grade pod structure surrounded by lower grade mineralization can be seen here in conceptual long sections of both lenses, called the Main Zone and the C-Zone.

The C-Zone can be seen here:

The Main Zone can be seen here:

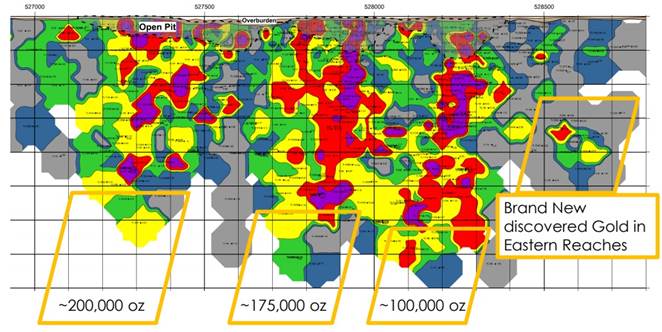

To me this is the most interesting picture of the entire data set available by the company, as it indicates 475,000 oz gold potential at depth, hypothetically substantially adding to the already NI 43-101 defined 1.46Moz AuEq resource. I asked Exploration Manager Adam Larsen why they think exactly there could be this kind of potential. He answered this:

"The lithological units which host the Goliath deposit are consistent down dip and drilling to date has given evidence that this host rock and the mineralized zones should continue at depth. The main issue is that adding resources at depth is pretty costly, as drilling at this time would need to be performed from surface and these expansion holes range from 600 to 1000m in length."

As costs of drilling is estimated by the company at about $200–250/m, just one hole could easily cost a few hundred grand. What is often done in these situations is proving up Inferred potential, and leave up further resource delineation to the party that brings the deposit into production. During production there could be drilling from platforms at depth, which would obviously be much cheaper and faster. See below for a schematic overview alongside strike regarding potential at depth for the various targets and resource zones:

Following the most recent exploration updates (news releases dated April 2, March 10, March 5 and January 13, 2020), Treasury has now completed approximately 10,000 meters of the 15,000 meter program.

Treasury also worked on the second phase of the Soil Gas Hydrocarbon program, involving surface sampling exploration. Company geologists have collected 1,700 samples covering approximately 5 kilometers of strike length east of the Goliath Gold Deposit.

Here is a map showing the sampling targets:

Below is a 3D visualization of the SGH program results, analogous to the results found across the current resource area, and given a confidence rating of 4.0 out of 6.0 (as a comparison, the resource area survey scored 5.0 out of 6.0), the target areas Fold Nose and East Limb appear to resemble the current resource for mineralized potential quite well:

Of course this is only surface sampling, but considering the established close relation between the current resource and this sampling method, management has hopes of finding economic mineralization in the target areas. I consider this method not to be more accurate than other surface methods, like gravity/magnetic surveys or metal sampling. According to Larsen, the team has been testing regional exploration techniques that pick up gold mineralization similar to the deposit at depth. Soil Gas Hydrocarbon sampling was first tested on the resource area and showed promising results. The main reason to use this technique is that it helps the geologists vector in on a potentially prospective area to focus with more detailed field work. Conventional soil samples were also collected during the program and will be interpreted and compiled with the SGH results where they can be incorporated into future exploration programs. The results so far bode well for more expansion drilling at these target areas. According to Larsen, the next steps for regional exploration include an expanded field program to continue soil sampling across the remainder of the property, infill sample and map the anomalous areas identified in the recent program, and potentially plan a regional drill program for Q3/Q4 2020 if warranted by favorable results.

Regarding current drilling activities, everything has come to a halt unfortunately, caused by the ongoing COVID-19 pandemic, as can be read in the news release:

"The company's main priority during the ongoing COVID-19 pandemic is the safety of employees, contractors and communities. As such, we have implemented precautionary measures and adapted operations to aid in the containment of the virus. Drilling operations have been deferred for the time being, all non-essential travel has been suspended, and employees in both the project office in Dryden, Ontario and corporate head office in Toronto work remotely wherever possible and actively ensure physical distancing while our Company follows official health and safety guidance from the World Health Organization, Health Canada, Government of Ontario and local health regions. As a Company, we are committed to working together and assisting local communities where possible to stay informed and safe."

As several countries across the globe are already talking about relaxing measurements, I asked management if they have any clues about returning to action. Ferron stated that they can't do anything else but follow guidance as stated above, but they are ready to scale up activities as soon as the situation allows it. At this point, the company has sufficient funds, and currently has about C$2 million in the treasury, and a convertible debt of C$4.5 million, carrying an 8% interest. The debenture is held by two of the largest equity holders in the company, Extract Capital and DSC, which are supportive.

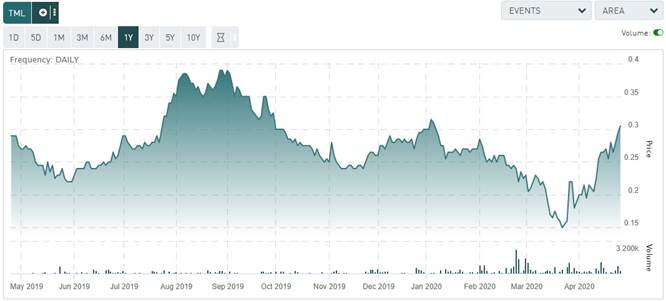

The share price of Treasury Metals looks like this:

Share price; 1 year time frame

The big COVID-19 sell-off around March 20, 2020, left scars on the chart for Treasury Metals as it did for almost any actively traded company worldwide. However it completely recovered at impressive volumes, as did almost all other companies, on the back of massive, global central bank stimulus programs to the tune of trillions, in turn triggering gold reaching almost US$1,800/oz recently. Personally I view this as a potential dead cat bounce for the markets with further downside potential, as I see the pandemic setting off a recession earlier than expected, with the financial figures forecasting mayhem for the coming 3–6 months. For now the recovery and especially the large volumes accompanying this for Treasury show strong support, and the recently hit 15c seems to be the low point here, probably caused by panic selling.

That low was a no-brainer for investors, as Treasury Metals is already severely undervalued at C$0.31. To establish this, let's first rehash a few numbers of Goliath.

The current Goliath resource stands at 1.46 Moz AuEq, consisting of 83 koz Au Measured, 1.14 Moz Au Indicated and 220 koz Au Inferred, with an average grade of 1.40 g/t Au M&I for the open pit component, and 5.39 g/t Au for the underground component. The operation will be a combination of open pit and underground mining, with a low capex of C$133 million (plus a C$20 million reclamation bond, so in fact C$153 million). At a gold price of US$1650/oz, the estimated after-tax NPV5 is no less than C$600 million; the estimated after-tax internal rate of return (IRR) is 41%. Keep in mind the current market cap of Treasury is just C$51.7 million, which is just about 1/12th of the current NPV5. Usually, a PEA stage company with an economic project is valued at 10–20% of NPV5, with the environmental approvement in hand it is probably more adequately valued to the high side of this range. This is the PEA sensitivity for Goliath:

As the company is very close to completing a Pre-Feasibility Study (PFS), the reliability of Goliath Gold numbers will increase a great deal compared to the 2017 PEA. As a consequence, the intrinsic value of the project increases substantially as well. According to management, they expect the PFS to deliver PEA comparable figures, which would be impressive, as a PEA routinely errs to the upside. As the current annual production profile of Goliath Gold involves 87,850 oz Au and 160,000 oz Ag, I would like to see the company increase gold production for the PFS to the magical threshold (for mid tier producers) of 100,000 oz Au annually on average. This would, for example, need an adjustment of the life of mine from 13 years to 11 years, to get to an average of 103,823 oz Au per annum (pa). Maybe drilling could include more ounces as a second option, but these need to be converted into reserves as well, and this would need an additional resource update and lots of drilling, which I deem highly unlikely in the short term. If the PFS indeed delivers according to these ideas, Treasury Metals would become pretty interesting as a takeover target, as 100 koz pa / 1 Moz+ Au deposits with good PFS/FS economics, environmental permit granted and exploration upside have become very rare.

For further comparison, I updated my peer comparison with various companies, all having at least a PEA, all of them in Canada or the USA, gold-focused, and with different mining methods, as Treasury has a fairly unique combination of a small part open pit and largely underground:

And:

On an EV/oz and P/NAV basis, the company seems to be valued in the same range as companies with projects sporting very high capex and low IRR (Falco and Midas) aka leveraged plays, or companies with a fairly good project but failing management (Eastmain, however a turnaround is happening, results of this need to be seen). None of this is happening with Treasury, so I consider it solid value, flying under the radar of many investors.

5. Conclusion

Despite the COVID-19 pandemic being responsible for halting current exploration programs at Goliath Gold, Treasury managed to get out various sets of solid drill results, on both infill and expansion levels, and positive sampling. As a consequence, the Pre-Feasibility Study (PFS), expected this quarter, could likely contain the same economics as present in the 2017 PEA, making Treasury even more undervalued than it already is, based on various metrics, and the environmental approval in hand. Adjusting the life of mine in favor of annual production figures would be something well-liked by various interested parties for sure, likely also improving economics, btw. I like the upside resource potential of almost a half million ounces of gold a lot, as Goliath could go to 2 Moz AuEq that way. With gold rising to multi-year highs in the last weeks, the case for Treasury Metals becomes stronger and stronger.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website, http://www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

[NLINSERT]Disclaimer: The author is not a registered investment advisor, and currently has a long position in this stock. Treasury Metals is a sponsoring company. All facts are to be checked by the reader. For more information go to www.treasurymetals.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions. Streetwise Reports Disclosure: Charts and graphics provided by the author.

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.