Back in the Dark Ages, before cellular phones and the Internet, I was studying to complete the Ontario Securities course one afternoon when I came across the part discussing "asset allocation" and "portfolio construction." This section covered the recommended mix of bonds and stocks, and everything revolved around the word "risk." When the customer was in early adulthood, they advised being overweight stocks and underweight bonds, and as the customer matured toward middle age and retirement, the weightings slowly reversed, resulting in an entirely fixed income portfolio generating returns of around 10%.

In other words, a $1,000,000 pool of retirement capital threw off $100,000 of annual income upon which to comfortably retire. With that kind of return, there was little need for the risk associated with stocks, and proof of that was the firm for which I toiled, McLeod Young Weir Ltd., known primarily as a "bond house" with the vast majority of their operations and research geared to fixed income.

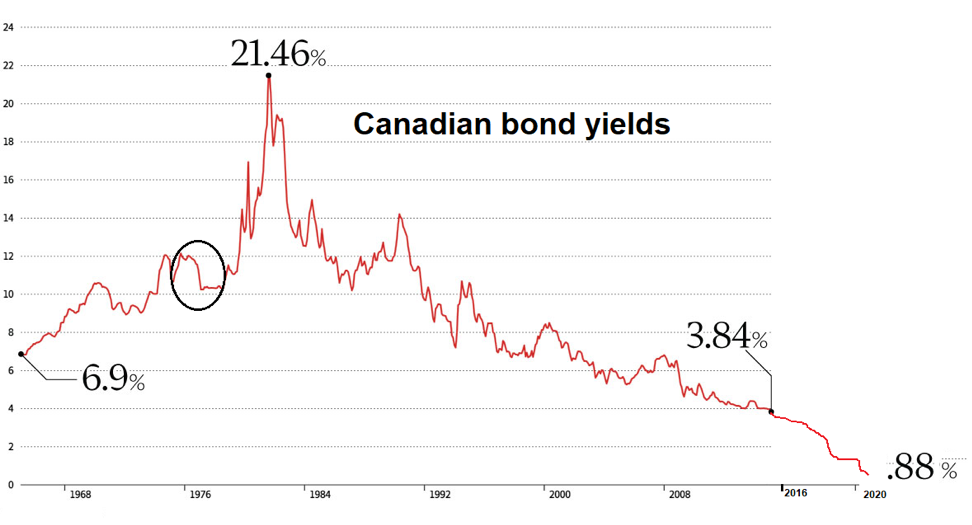

However, over the years, as central bankers gained more and more sway over policy and as bond yields began to sink, the importance of the risk-free return as a benchmark for performance was replaced by more aggressive styles of portfolio construction. Though "financial engineering," new products driven by derivatives and leverage were designed to augment these diminishing yields, and instead of investing their $1,000,000 of retirement capital with the "lender of last resort," the Bank of Canada, retirees today are forced to follow the advice of the financial wizards of Wall and Bay Streets. They invest in alternative products or outright stocks and, in doing so, move from "risk-free" to "risk-fraught" and very uncertain returns. As you can see from the chart shown above, $1,000,000 invested today generates a 0.88% return, or a paltry $8,800 of annual income, which is pathetic.

More importantly, after the shellacking taken by stocks in the last quarter, coupled with the 2008 financial crisis, the new mantra for retirees is no longer return on capital, but rather the certainty of a return of capital as the paramount consideration.

I did an ad hoc Google search of "asset allocations," and arrived at the following example of a few different types of allocations. You can see that all of these include stocks, with the most outrageous being the Rempel Maximum, which has a person leveraged to the gills to own stocks. Imagine the poor retiree that must generate income by moving to stocks, who is today down 17.1% year to date (TSX Composite), which amounts to a loss of $171,000 on his million-dollar nest egg. Now that's "real money."

Where I am going with this train of thought is simple. Nowhere in any of these "models" is there an option for precious metals. It is either Door #1 to Hades, or Door #2 to Purgatory. I can go "overweight" risky assets and "underweight" riskier assets, or vice-versa, but at the end of the day, I have a retirement fund made up of risky paper.

Thanks to the wizardry of central banking and financial engineering, prices for things that used to be the domain of the natural flows of capital, driven purely by the forces of demand and supply, have become pre-set, orchestrated prices that are either suppressed (as in gold and interest rates) or inflated (as in stocks and real estate and anything else vaguely resembling banker collateral). This unnatural interference in the flows of capital is diabolically dangerous, and it the reason why we are seeing these grotesque moves by the ever-merging life forms called the U.S. Treasury and the Federal Reserve. What I saw last week was beyond surreal, and it is not going to end well.

There was a revealing interview on CNBC last week in which the guest, a money manager named Chamath Palihapitiya, tells the anchor (Scott Wapner) that there should be no bailout of the airline industry. The anchor asks, with a pained expression verging on abject horror, "But you would let all these people lose their jobs?" The gentleman then proceeds to lay to waste any and all shreds of credibility in the CNBC clown by explaining to him what happens when a company goes bankrupt, and how the employees actually benefit in some cases, and how the only losers are the speculators and the unsecured debt holders that gambled in the first place! It was priceless, and it was exactly what I wrote about in 2009 when all the billions of bailout dollars rescued the speculators and riverboat gamblers in the U.S. banking business and threw homeowners under the bus.

The numerous tweets I sent off late last week were an effort to wake more than a few people up to what is turning out to be the Second Major Financial Heist of the New Millennium. The banco-politico alliance is once again remembering to "never let a good crisis go to waste," and are lining up at the trough again to gorge themselves on taxpayer slop. It drives me to absolutely madness.

Moving on to the markets once again, it is imperative to understand one thing before I proceed. The stock market is, for the current U.S. president, not only "of interest;" it is an obsession. Because of this, and because of the current panic gripping the Fed and the Treasury, aided and abetted by the mainstream media, I have zero confidence in the effectiveness of either technical or fundamental analysis of the financial markets here in April 2020. The lines dividing the executive and legislative branches of governments around the world have become blurred, and the fallacy of Fed "independence" has been shown for what it is – fallacy.

The specter of a prolonged bear market brought on by the government lockdown is the logical projection based upon the initial economic feedback and history, but as these are not normal times. As this is an American election year, with a global pandemic surrounding them, these are, in fact, extremely abnormal times. The $6 trillion Fed balance sheet and the Congressional act granting $2.3 trillion in stimulus funding is testimony to the urgency of rescuing the stock market (and voters), so betting heavily on a resumption of the downturn in stocks is unwise at the best, and a fool's folly at worst.

Similarly, expecting that gold and silver are going to be allowed to move to unfathomable heights unimpeded by the invisible hand of the banco-politico alliance is equally naïve. While conditions supporting such a move are ideal, covert operations designed to nullify such a move have been used in the past.

That said, the Dow Jones had the best week since 1938 last week, and CNBC must have flashed it fifty times Thursday afternoon before I turned off the set. Of course, that 1938 rally was a classic bear market rally, with the ultimate lows coming in 1942. The Fibonacci study I did back in late March suggested that the 2,655–2,797 range was the most logical distribution zone for the rebound to end, but it doesn't rule out an extension move toward 2,940.

The rebound itself comes as no surprise to my subscribers; the CNN Fear-Greed Index hit an unheard-of reading of "1" around mid-March and has now risen from "Extreme Fear" to just "Fear" and a "43." Give me a few more Trump tweets and Mnuchin messages; throw in a pinch of Powell pressers, and we will be north of 50 and back in the "Greed" mode, with all systems "go" and stocks a-chargin'.

I am very modestly short the SPY, from $272 and a 50% position in May put options, but it is an outright "punt" on a retest and taken from the "Crash 101" textbook. I "should" get a retest, but with the New York Fed putting in triple overtime, it might get "bypassed" as it did in 2019.

The big news on the week was the new eight-year high registered in gold, and despite the $10 pullback after the close of the pit session, the technical picture looks impressive, verging upon exciting. The HUI had an equally impressive move to 232, going out near the highs of the day and week. However, interestingly, the HUI:Gold ratio remains 20.9%, below the level it hit in late December when gold was priced $120 lower at $1,530/ounce and 59.8% lower than in August 2016, with gold at $1,371/ounce. If gold miners were valued relative to gold prices at the 2016 levels, the HUI would be 371, which is 55% higher then we are today.

That is the reason that I added to positions taken three weeks ago after I posted the two "Generational Buying Opportunity" charts of the Senior Gold (GDX:US) and Junior Gold (GDXJ:US) Miner exchange-traded funds (ETFs). If you assign 2016 valuations to GDX and GDXJ, you get $45.12 GDX and $55.25 GDXJ. In fact, although I took a few trading account shekels off the table into the advance, I still hold August calls in GDX from that Monday morning when it gapped down to $16.18, and I still have 133 days until expiry, which is cool.

They say that entry points are the key to successful speculation, whether it is real estate or stocks, so whenever you get panic as thick as it was in mid-March, you have to ignore CNBC and BNN and your "wealth advisor," and close your eyes, pinch your nose, and buy.

Silver remains an enigma, although it has advanced over 37% off the lows. It has also cleared the first two Fibonacci levels, with only USD $16.64 remaining as a hurdle.

Much as I love silver, I also hate silver, because it is the most easily tampered-with pricing mechanism in the history of commerce. While we all like to think of silver as the "poor man's gold," it is still suffers from 57% industrial demand versus only 8% for gold, so when the world goes into a viral lockdown, silver demand plunges off a cliff, and price with it.

I am still rethinking my position on silver and how to play it for the rest of the year, but the challenge lies in this: If I opt for added alpha by going for the huge leverage and added volatility of silver, I sacrifice the certainty of being on board gold, whose fundamental and technical set-ups are spectacular. I like the certainty of gold, but I also love the excitement of a rampaging short squeeze in silver. I have been through two of them, in 1980 and in 2011, and came out with my arms, legs and face intact, and only minor damage to my liver. The exhilaration of the silver ride is matched only by the violence of its terminus, and the attendant piles of malodorous body bags at the side of the trading pit. Surviving one of them is tantamount to three tours of duty in an Asian jungle armed with a broken hockey stick and a roll of tape.

I made a prediction on Twitter last week, which is this: "Give me a 2-day close above USD $1,750 in gold and I'll show you a $2,000 price by Queen Victoria's birthday." For those heathens unfamiliar with the Great Queen Victoria, we Canucks celebrate her date of birth every May 24 weekend, usually with great vigor and always with great respect. As it is usually the first chance to get the first real sunburn of the year after a grueling winter, we affectionally nicknamed it the May "Two-Four" weekend. That's because, back in the day, every Friday included a lineup at what was called, a few decades back, "The Brewer's Retail," and the hard-core "players" came out of the store with a case (or several) of twenty-four bottles of Molsons or Labatts beer, affectionately and appropriately called "The Two-Four." You didn't order a "case" or a "dozen" or a "six-pack;" the real players ordered a "Two-Four," and because the first really fine spring weekend of the Canuck year is usually a long weekend spent at some poor lad's parents' cottage, you always arrived (invited or not) with a "Two-Four." More often than not, one left with only a few "empties," so as to not burden the host, but that is the reason most Canucks refer to this holiday as "The May Two-Four Weekend."

So, as is customary of the upcoming festive part of May, I raise a glass both in advance and in salute of the breakout in gold prices and the birth date of the regal Lady from whom the phrase "We are not amused" found its origin.

The last thing to discuss, notwithstanding the Herculean efforts of Bill Murphy and Chris Powell, founders of GATA, is that, at long last, we are finally witnessing the fruits of labor drawn from the hearts and loins of true believers in "free market capitalism," the identity of whom you will be hard-pressed to find in today's banco-politico alliance.

The domination of the mainstream media (MSM) by the owners of digital, literary and monetary printing presses, can only be described with one adjective—vile. The true role of gold has always been to protect wealth and was never meant to be a cognizant threat to the U.S. dollar because the Founding Fathers, who drafted the American Constitution, designed it that way. They knew precisely the outcome of uncontrolled and opportunistic politico-banco alliances, which was why they built currency debasement safeguards within the document.

But, as is always the case, over time the documents gets subverted through Constitutional "amendments" that are argued in defense of "modern conditions." These "modern conditions" are at the very heart of why societies move from "free" to "enslaved," because the elite would have you all believe that moves they are allowed to make and laws they are allowed to break are justification for outcomes rarely intended and never expected.

The indiscriminate trashing of the domestic currency of any country is a crime in over 90% of the globe's sovereign countries. but laws protecting currency debasement are waived when the perpetrators are politicians or bankers. The average citizen goes to jail while the banco-political alliance is applauded. Abominations like this have only one defense; you don't play their game. You have to pay your bills with dollars or euros or yuan or yen, but you don't have to invest in them—and nor should you.

Looking out on the horizon, you must realize that the vast majority of portfolio managers around the world have, for decades, been managing money without any exposure to precious metals. In that context, gold has been an orphan, under-owned and unloved in a relative sense. With the trillions upon trillions of investible assets having ignored the space for so many years, there remains an entire generation of managers only just waking up to its portfolio utility. Having gold up 12.91% year to date has allowed those very few advisors to protect their client assets, but they are so rare that they represent a tiny fraction of the fund flows that move markets.

As soon as the Q1 performance numbers begin to surface, I predict a tsunami of new money flooding into the precious metals space. We are already seeing it, with gigantic volume and percentage moves in the big boys like Newmont Goldcorp Corp. (NEM:NYSE) and Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), but when all of these imitative and herd-mentality fund managers get the memo, trillions of dollars will be chasing a very small and completely underowned sector. When this Hadrian's Wall of demand hits the Lilliputian paucity of supply, precious metals producers, developers and explorers are going to experience exponential price moves that will dwarf the moves seen in 1976–1980 and 2002–2011.

Make sure you have your positions, because you won't recognize these prices by the time summer rolls around.

Originally published on April 10, 2020

Follow Michael Ballanger on Twitter @MiningJunkie.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

[NLINSERT]Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: None. My company has a financial relationship with the following companies referred to in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp, a company mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.