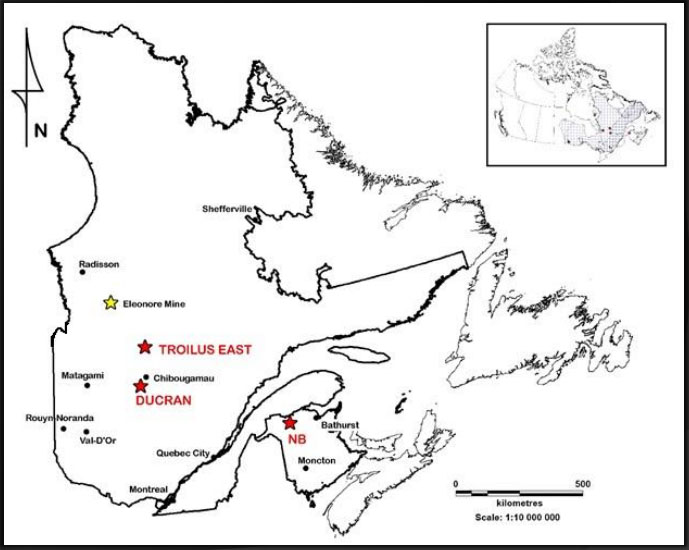

X-Terra Resources Inc.'s (XTT:TSX; XTR:FSE) gold exploration properties are in Canada, the Grog and Northwest project in New Brunswick and Troilus East in Quebec.

The company recently completed an inaugural, 1,904-meter drill program at the Grog and Northwest properties, where it has an option to earn a 70% interest.

New Brunswick is an especially good place to be exploring right now, as the provincial government has placed all mineral claims under protection status, "to ensure continuity of mineral claims during this time" of extreme uncertainty. This means that work requirements for the 2020 exploration season are waived for active claims and all active claims are extended for one year. X-Terra is one of only a handful of companies exploring specifically for gold in New Brunswick.

"This is a bold step and demonstrates the outstanding leadership and support the government has taken to ensure stability for individuals and companies like X-Terra, that have been working and will continue exploring in the province, once the Covid-19 pandemic situation begins to improve," Michael Ferreira, president and CEO of X-Terra, stated.

In addition, "New Brunswick, with its vast network of forestry roads, provides so much access that it allows the company to put almost all of the money into the ground. The chances of success are higher because there are more funds being spent on actual exploration versus camp costs, logistics costs, helicopter costs, etc. That's one on the reasons we're really fond of New Brunswick, the infrastructure there, and, of course, its gold potential," Ferreira told Streetwise Reports.

Having drilled 16 holes in five targets at Grog and Northwest, the company is awaiting assay results for 11 of the holes, all of which come from the Grog property. X-Terra noted that the program has already exceeded its expectations, "as all geological targets have revealed very encouraging visual indicators of significant alteration and mineralization in different contexts related with the MacKenzie Gulch Fault."

The first drill results published were from the Northwest property, which is actually located south of Grog. "In an area of the property 2 km west of Rim and 3 km north of Dome and Bonanza, trenching revealed grades up to 4.5 g/t gold. We noticed in the trenches there were more parallel veins, confirming a stockwork existed, and there was more alteration than we had observed elsewhere. So the decision was made to drill under our trenches," Ferreira said.

Assay results for the first two holes at the Northwest property were released on February 18. "The numerous anomalous results in gold, including 6.93 g/t Au over 0.5 meter in NWST-20-003 and 1.2 g/t Au over 1 meter in NWST-20-002 prove that the system is gold bearing," the company stated.

"Hitting gold values in these first holes is big step and really encouraging considering that the initial gold discovery was generated by fortuitous roadside prospecting and pre-existing till samples completed by X-Terra. The extension of the till survey in that direction warrants additional sampling, which will ultimately reduce the initial 500 meters spacing between samples, and will without a doubt, define more accurate exploration targets that will eventually be followed up with additional drilling," Ferreira noted.

As for the Grog property, Ferreira said that "when our senior geologist went out to the property for the first round of due diligence and verification, he observed some important key alteration components, which are very closely associated with epithermal and porphyry deposits. All the work that we've been doing and the discoveries that we've made on Grog have enabled us to design an intelligent drill program to carry out tests over four different targets spanning 3.7 km within a gold-bearing corridor. More importantly, the 11 drill holes pending all originate within a 1.6 km gold bearing corridor that is extremely favorable, from Grog to Bellevue South. Our primary objective is to see if we can connect that entire system all together."

The company also plans to be active at its Troilus East property in north-central Quebec very shortly. The project is adjacent to Troilus Gold Corp.'s (TLG:TSX; CHXMF:OTC) property, which currently has a mineral resource of 4.71 million ounces of gold equivalent Indicated and 1.76 million ounces gold equivalent Inferred. Troilus recently completed at 6,000-meter drill program and raised just over $12 million. X-Terra's Troilus East is located less than 2 km from the former open-pit mine that saw historical production of 2 million ounces of gold and 70,000 tons of copper.

Troilus East, which is 100% owned by X-Terra and is royalty-free, is made up of 182 mining claims covering around 93 sq km.

The area overall has recently been a beehive of activity. "We have seen Troilus Gold and others staking claims in and around the entire Frotet Evans Greenstone Belt and to the south. The area is getting a lot of attention and a lot of money is being spent to acquire land in this area," Ferreira said.

"This summer we have the budget of $400,000 up to $600,000 to go and put some boots on the ground at Troilus East, to complement the work that's already been done in New Brunswick," Ferreira noted.

X-Terra is actively exploring both its Quebec and New Brunswick projects. "As we wait for the remaining New Brunswick drill results to come in, we are completing some additional compilation to better understand the projects to come up with new targets and new exploration approaches in order to increase our chances at a discovery," Ferreira explained.

"Our exploration strategy has remained unchanged and we were lucky to complete our drill program before the Covid-19 outbreak," Ferreira noted.

X-Terra has 61.7 million shares outstanding, 85,783,102 million fully diluted. Current strategic investors include Caisse de Depot, Sidex, SDBJ, FTQ and Desjardins Securities.

The company recently closed a non-brokered private placement of 3 million units at CA$0.08 per unit, for gross proceeds of $240,000. Each unit consists of one common share and a warrant to purchase one additional common share at CA$0.13 until March 25, 2023. The company noted that the funds will be used for exploration at the New Brunswick and Quebec properties and for working capital purposes.

X-Terra has garnered the attention of industry observers. Michael Kryton of Equity IR wrote on October 15, 2019, "X-Terra Resources Inc. is proving to be one of the sector's most persistent gold diggers. The Quebec-based junior gold exploration company just announced results from its stripping and trenching activities at the Grog and Northwest properties in the Restigouche County in New Brunswick. The new discovery, referred to as the 'Bellevue showing,' revealed a gold value of 2.24 g/t Au."

"For a company that has been in the sector for just five years, X-Terra Resources has been consistently producing results and growth. For investors, these are the hallmarks of a good thing. Good as gold," Kryton concluded.

Technical analyst Clive Maund charted X-Terra and on February 24 wrote, "The price and its moving averages are tightly bunched together, a circumstance that frequently precedes the start of a major bull market, and an advance from here will quickly lead to moving averages swinging into bullish alignment." He rated the stock "an immediate strong speculative buy."

Read what other experts are saying about:

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: X-Terra Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with X-Terra Resources. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of X-Terra Resources, a company mentioned in this article.

Additional disclosures:

Disclosures from Equity IR

This web site and our newsletter are services of Equity IR, a media and advertising firm that is from time-to-time compensated by the companies profiled on this web site’s or in our newsletter’s. When compensated in shares, readers should be aware that it is our policy to liquidate all shares immediately. The liquidation of our stock may have a negative impact on the securities of the company liquidated, including decreased market value and/or dilution of the company’s securities All direct and third party compensation received has been disclosed on our newsletter and on this disclaimer in accordance with section 17(b) of the Securities Act of 1933. Equity IR.

www.equityir.com website, and all of its financial websites and the information provided are through its investor relations website www.investedgroup.com. Equity IR. newsletters are electronic publications, and is for informational purposes only. Equity IR. covers both client and non-client issuers. Equity IR. provides information on selected public companies. All companies profiled and featured on this website or on Equity IR. emails pay cash, unrestricted stock or restricted stock to Equity IR as compensation for the electronic dissemination of the company’s information and our comments about the company. Section 17(b) of the Securities Act of 1933 requires that Equity IR. fully discloses the type compensation (i.e. cash, unrestricted stock, restricted stock, and restricted stock with registration rights, stock options, stock warrants, or other type compensation) and the specific amount of the compensation our company receives or will receive, directly or indirectly, from an issuer, underwriter, or dealer. No information contained in our website, e-mail communications or our publications should be considered as a solicitation to purchase or sell the securities of the profiled companies. Equity IR or any of its employees are not registered investment advisers or a registered securities broker dealers in any jurisdictions. We do not undertake or represent to make investment recommendations or to give advice pertaining to the purchase or sale of the securities mentioned in our web site, e-mail communications or publications.

CliveMaund.com

Clive Maund does not own shares of X-Terra Resources, and neither he nor his company has a financial relationship with the company.