We are in the best time of the year to be invested in resource stocks. That is from late December into perhaps March. Add to that a quite insane U.S. President eager to accelerate the start of World War III for Israel and you have what at least will be an interesting environment until the U.S. either regains its sanity or becomes a pile of ashes.

I was in a war. I didn't like it. I'm dead set against more American kids dying for Israel. We cannot prevent the bankruptcy of the U.S.: all the stupid and pointless wars of the last two decades have baked bankruptcy into the cake. When you start whacking leading figures in other countries, it is only natural that they start thinking doing the same to you is a great idea. Trump just painted a bull's eye on the back of every American soldier in the Middle East.

I've been doing this for so long that everything is coming full circle. I visited the Dominican Republic to see a gold project immediately next to the massive Pueblo Viejo Gold Mine ten years ago. It was possible to stand on the Pueblo Grande project now owned by Precipitate Gold Corp. (PRG:TSX.V; PREIF:OTCBB) and throw a rock and hit an open pit at Pueblo Viejo.

Pueblo Viejo is jointly owned by Barrick Gold and Newmont/Goldcorp and produces 550,000 to 600,000 ounces of gold a year. It has an interesting history. The mine was the first gold mine in the new world put into production by the Spanish. It is the 5th largest gold mine in the world. Low prices forced the operator Rosario Dominicana into bankruptcy in 1999. It was put back into production by new operators in 2012 as gold prices improved.

An interesting project called the Pueblo Grande property surrounds the Pueblo Viejo Gold Mine on three sides. I visited the project a long time ago. It's quite common for even the best of projects to go through multiple owners before someone actually moves it to production.

Linear Gold run by Wade Dawe first owned it. I went to see one of his projects in Mexico and wrote it up. Dawe demanded the right to edit the article before I posted it. That demand left a bad taste in my mouth. Then he insisted I totally rewrite it so it was all about him rather than the people doing all the valuable work on the Mexican project.

Nobody pays me to write about egomaniacs so I did something I have only done twice out of five hundred site visits. I let him know I wasn't going to either rewrite or post the piece and I wouldn't be charging him for my expenses. I've followed his career since; he seems to be one of those guys who look at mining company as if they are baseball trading cards. He hasn't accomplished much, as least not for shareholders in the last ten years.

When I was looking at Linear, the project that I really wanted to see was the property surrounding the Pueblo Viejo mine because of nearly five hundred years of recorded history of mining there.

Linear traded the project to another company named Everton. Ten years ago I got my chance to see Pueblo Grande on a site visit with Everton. Barrick was knee deep into rehabilitation at Pueblo Viejo with plans to be back in production in 2012. On the Everton visit we were allowed to visit Barrick's mine. It was impressive and remains one of the key gold mines in the world. It also is a major factor in the economy of the Dominican Republic because of the taxes they pay and employment they provide.

Everton got caught out at the very top of the market in 2011 with no cash on hand and declined by 99.5% from $2.25 in 2011 to a low of $0.005 in 2015. The stock was halted a couple of years ago. They still did, however, own the Pueblo Grande project. A year ago exactly Everton did a deal with Precipitate Gold (PRG-V) and sold their three remaining DR projects to Precipitate for 7 million shares, $25,000 in cash and a tiny 1-2% NSR.

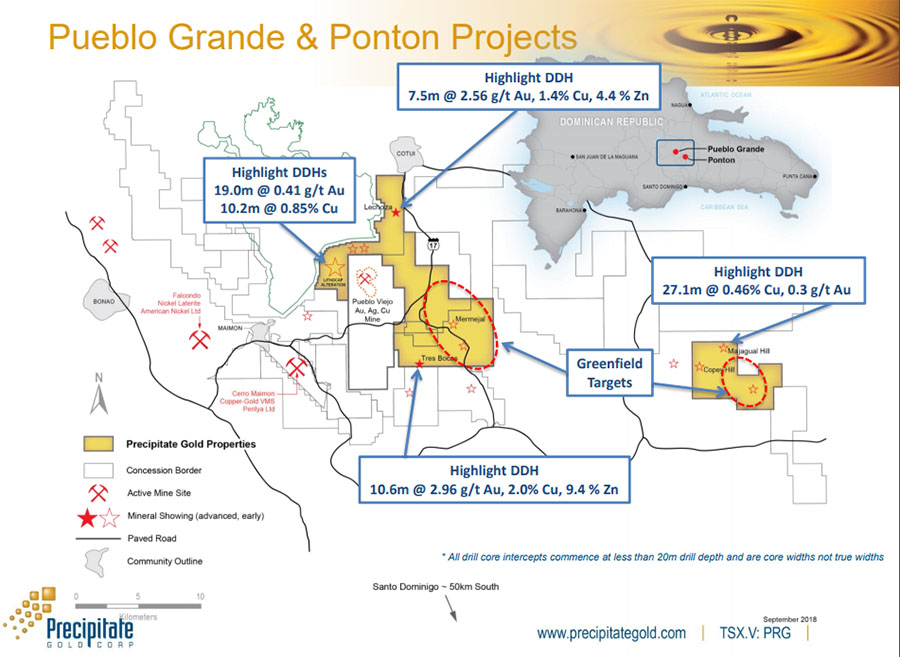

The Pueblo Grande project is the main focus out of three different properties for Precipitate Gold. Data from over 29,500 meters in 220 drill holes has been compiled into a data set. While Everton owned the project they had results of 23.4 meters of 4.76 g/t Au, 10.6 meters of 2.96 g/t Au with 101.9 g/t Ag as well as 27.0 meters of 2.46 g/t gold and 26.7 g/t Ag. The project surrounds Pueblo Viejo on the west, north and east. It holds 9,863 square Ha.

3D magnetics reveal five mag low anomalies likely associated with magnetite destruction similar to the characteristics of Pueblo Viejo high sulfidation alteration. The company has generated eight distinct drill targets and received their drill permits in September for as many as thirty drill platforms.

In early November PRG completed a non-brokered private placement for just over ten million shares at $0.13 including a half warrant at $0.20 until November of 2021. As of now the company is well cashed up for the planned drill program and is in final preparation of access roads and drill pads.

As of now PRG has a market cap of about $23 million CAD. The share price has more than doubled in the last six weeks in anticipation of good results coming from the drill program. The five million warrants from the November 2019 private placement are in the money and would provide an additional $1 million for exploration. So for now the company can count on about $2 million for exploration and a couple of kicks at the can.

My close friend Quinton Hennigh is a director and an advisor to the company. Anyone who follows 321gold knows exactly how highly I regard Quinton. His projects mostly get it right and he hits homers out of the park on a regular basis.

There is more to the story but the company does an excellent job of communication in their presentation. I highly encourage any interested investor to go to see the presentation.

Precipitate Gold is an advertiser. I have participated in the last private placement and I eagerly look forward to their upcoming drill program. Do your own due diligence.

Precipitate Gold Corp

PRG-V $0.255 (Jan 06, 2020)

PREIF-OTCBB 92.9 million shares

Precipitate Gold website.

Bob Moriarty founded 321gold.com, with his late wife, Barbara Moriarty, more than 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

[NLINSERT]Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Precipitate Gold. Precipitate Gold is an advertiser on 321gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp, a company mentioned in this article.