Imagin Medical Inc. (IME:CSE; IMEXF:OTCQB) recapped in a news release its fiscal year 2019 (FY19) corporate and financial results. It will hold a conference call to discuss them at 5 p.m. EST on Jan. 7, 2020.

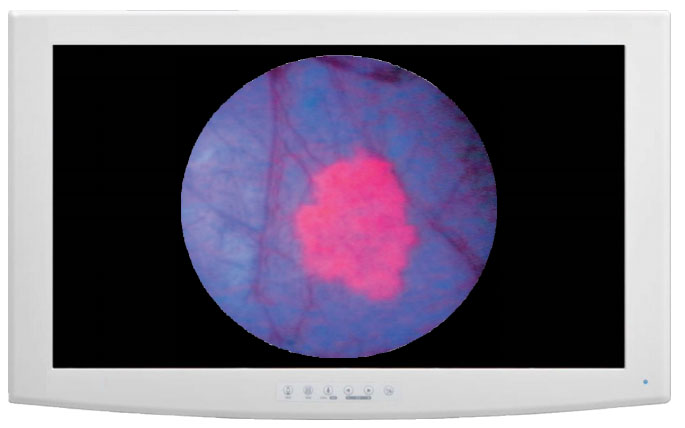

Regarding corporate successes in FY19, specifically with respect to development of its i/Blue Imaging System, Imagin completed in February the proof of concept phase of its redesigned control unit and validated the performance of the light source and imaging modules. In April, the company finished the i/Blue system's initial functional unit. In July, Imagin moved into the design verification stage, which remains underway.

Also earlier in the year, the company met with the U.S. Food and Drug Administration (FDA) to discuss the premarket approval regulatory pathway for its product. It also obtained feedback on its prototype at the American Urology Association's annual meeting.

"With the design verification stage nearing completion, we are preparing for pilot production runs in Q1/20," President and CEO Jim Hutchens said in the release. "We are excited to build on our momentum in the new year and continue moving the i/Blue system toward commercialization."

During FY19, Chris Bleck joined Imagin as a director and bladder cancer expert Dr. Ashish M. Kamat became a member of its scientific board of advisors.

As for the year's financial results, the biotech firm posted a net loss of CA$4,457,322, or CA$0.03 per common share. This is roughly CA$3 million less than its net loss in 2018 of CA$7,958,086, or CA$0.07 per common share.

Imagin spent CA$4,499,927 on operating expenses, slightly less than in 2018, when they totaled CA$4,998,339. FY19's expenses were mainly for research and development (R&D) and general administration.

Of the total, R&D expenses accounted for CA$3,188,202, significantly higher than the total in 2018 of CA$806,849. This was due to required development, design, engineering, FDA and regulatory costs.

General administrative expenses in FY19 were CA$1,311,725, much less than the CA$3,823,486 spent in 2018. A decrease in consulting fees drove this trend.

As of Sept. 30, 2019, Imagin had CA$2,272,770 in cash.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Imagin Medical. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Imagin Medical. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Imagin Medical, a company mentioned in this article.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.