Prior to the market open this morning Biogen Inc. (BIIB:NASDAQ) and Eisai Co. Ltd. (4523:JP) announced that, "after consulting with the U.S. Food and Drug Administration (FDA), Biogen plans to pursue regulatory approval for aducanumab, an investigational treatment for early Alzheimer's disease."

The company outlined in the report that "the decision to file is based on a new analysis, conducted by Biogen in consultation with the FDA, of a larger dataset from the Phase 3 clinical studies that were discontinued in March 2019 following a futility analysis." The company further noted that it plans to file a Biologics License Application (BLA) in early 2020 and that submission will include data from the Phase 1/1b and Phase 3 EMERGE and ENGAGE studies.

The company explains in the report that "aducanumab (BIIB037) is an investigational human monoclonal antibody studied for the treatment of early Alzheimer's disease. Biogen licensed aducanumab from Neurimmune under a collaborative development and license agreement and since October 2017 Biogen and Eisai have collaborated on the development and commercialization of aducanumab globally."

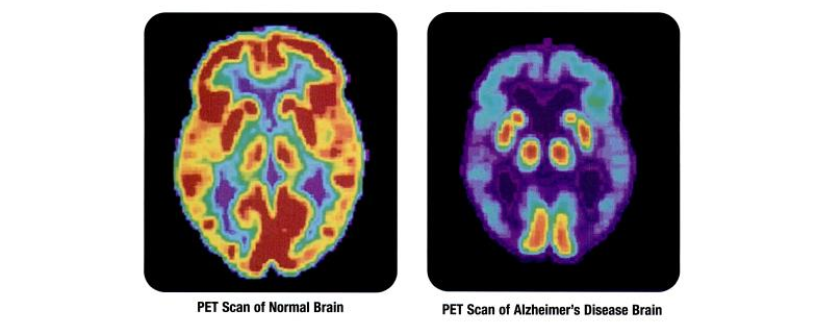

Biogen's CEO Michel Vounatsos commented, "With such a devastating disease that affects tens of millions worldwide, today's announcement is truly heartening in the fight against Alzheimer's. This is the result of groundbreaking research and is a testament to Biogen's steadfast determination to follow the science and do the right thing for patients...We are hopeful about the prospect of offering patients the first therapy to reduce the clinical decline of Alzheimer's disease and the potential implication of these results for similar approaches targeting amyloid beta."

In a joint statement, Dr. Anton Porsteinsson, William B. and Sheila Konar Professor of Psychiatry, Neurology and Neuroscience, director of the University of Rochester Alzheimer's Disease Care, Research and Education Program (AD-CARE), and principal investigator, added, "This large dataset represents the first time a Phase 3 study has demonstrated that clearance of aggregated amyloid beta can reduce the clinical decline of Alzheimer's disease, providing new hope for the medical community, the patients, and their families...There is tremendous unmet medical need, and the Alzheimer's disease community has been waiting for this moment. I commend Biogen, the FDA, the medical community, and the patients and their study partners for their persistence in working to make today's announcement a reality."

On a very busy day for Biogen, the firm also announced positive Q3/19 earnings in a separate release today. In that report the company indicated that Q3/19 revenue increased by 5% to $3.60 billion compared to $3.44 billion in Q3/18. Over the same period GAAP diluted EPS increased 17% to $8.39, up from $7.15 and Non-GAAP diluted EPS increased 24% to $9.17, up from $7.40.

CEO Michel Vounatsos commented on the earnings, "Biogen delivered solid performance in the Q3/19 driven by continued resilience from our MS core business and growth from SPINRAZA and biosimilars...SPINRAZA continued on a strong trajectory, particularly outside the U.S., and we are preparing for the expected launch of VUMERITY, which we believe will be an important addition to our market-leading multiple sclerosis portfolio...we made strong progress in our pipeline as we initiated new clinical programs targeting Parkinson's disease and brain contusion, and we look forward to nine important data readouts by the end of next year."

Biogen is a biopharmaceutical company based in Cambridge, Mass., which specializes in discovering, developing and delivering innovative therapies for people living with serious neurological and neurodegenerative diseases. The company states that it "has the leading portfolio of medicines to treat multiple sclerosis, has introduced the first approved treatment for spinal muscular atrophy, commercializes biosimilars of advanced biologics, and is focused on advancing research programs in multiple sclerosis and neuroimmunology, neuromuscular disorders, movement disorders, Alzheimer's disease and dementia, ophthalmology, immunology, neurocognitive disorders, acute neurology, and pain".

Eisai Co. Ltd. is a global research and development-based pharmaceutical company headquartered in Tokyo, Japan. The company employs approximately 10,000 people globally and indicates that it strategically focuses on the areas neurology and oncology. The firm has a market capitalization of around $14.61 billion (1585.94 billion yen) and trades on the Tokyo Stock Exchange.

Biogen began the day with a market capitalization of about $41.2 billion with approximately 184.4 million shares outstanding. BIIB shares opened nearly 39% higher today at $310.00 (+$86.49, +38.70%) compared to yesterday's closing price of $223.51. The stock has traded today between $279.42 and $318.00/share and currently is trading at $287.64 (+$64.13, +28.69%).

[NLINSERT]Disclosure:

1) Stephen Hytha compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

6) This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.