Maurice Jackson: Joining us for a conversation are Gregory Beischer, the president, director and CEO, along with special guest, senior project geologist, Chris van Treek, of Millrock Resources Inc. (MRO:TSX.V; MLRKF:OTCQB), a premier project generator.

Pleasure to have you here to discuss the latest developments from Millrock Resources' successes in the Goodpaster District of Alaska, which is becoming one of the most highly contested mining districts in the world.

Mr. Beischer, before we delve in today's interview, please introduce us to Millrock Resources and share the investment opportunity that the company presents to the market.

Gregory B.: We are a project generator company, Alaska-based and focused. We come up with lots of early-stage exploration projects and then invite other companies to come in and earn their way into our projects.

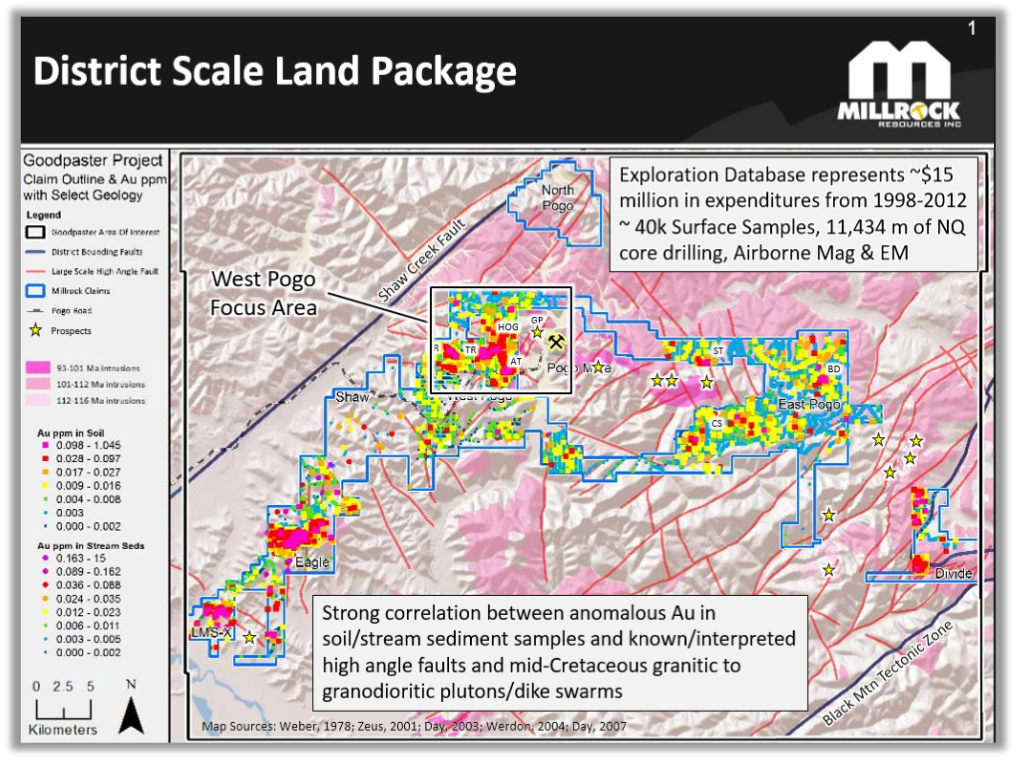

We've stuck to this business model since our inception. The Goodpaster Project is our latest one, and one we're particularly proud of to have in our property bank. Millrock has been pulling it together for almost five years now, and we have successfully made some really big moves the past spring to stake up the entire district. Now we're really making some advancements on the project.

Maurice Jackson: Mr. Beischer, for first-time listeners who may not be familiar with the Goodpaster District of Alaska, please provide us with some background on the district and why Millrock Resources has been strategically positioning itself within the district.

Gregory B.: The Goodpaster District has been mined on a small scale by placer miners or alluvial gold miners. Around 1994, a big discovery was made that became the Pogo gold mine, operated for many years by Sumitomo Metal Mining Co. Ltd. (STMNF:OTCPK).

But more recently—just a about a year ago now—Australian midtier producer, Northern Star Resources Ltd. (NST:ASX), bought up the mine from Sumitomo and it'll be making continuous improvements in the mine's operation.

I believe that the Goodpaster District will be a gold mining camp of major proportions one day—multiple mines, ultimately, with an endowment measured in many millions of ounces of gold, and Northern Star has made some fantastic successes in the first year of operation.

Recently they have made new discoveries, recalculated the global resource and it's now known that there's 6 million ounces of resource and reserves on top of the approximate 4 million that have already been mined previously by Sumitomo.

So it's a great mine. It's a high-grade mine. Northern Star's already made more discoveries, and they announced even more discovery holes northwest of the mine last week, which we're quite excited about because we own ground to the northwest of the mine.

Maurice Jackson: Chris, how did Northern Star find their Goodpaster deposit?

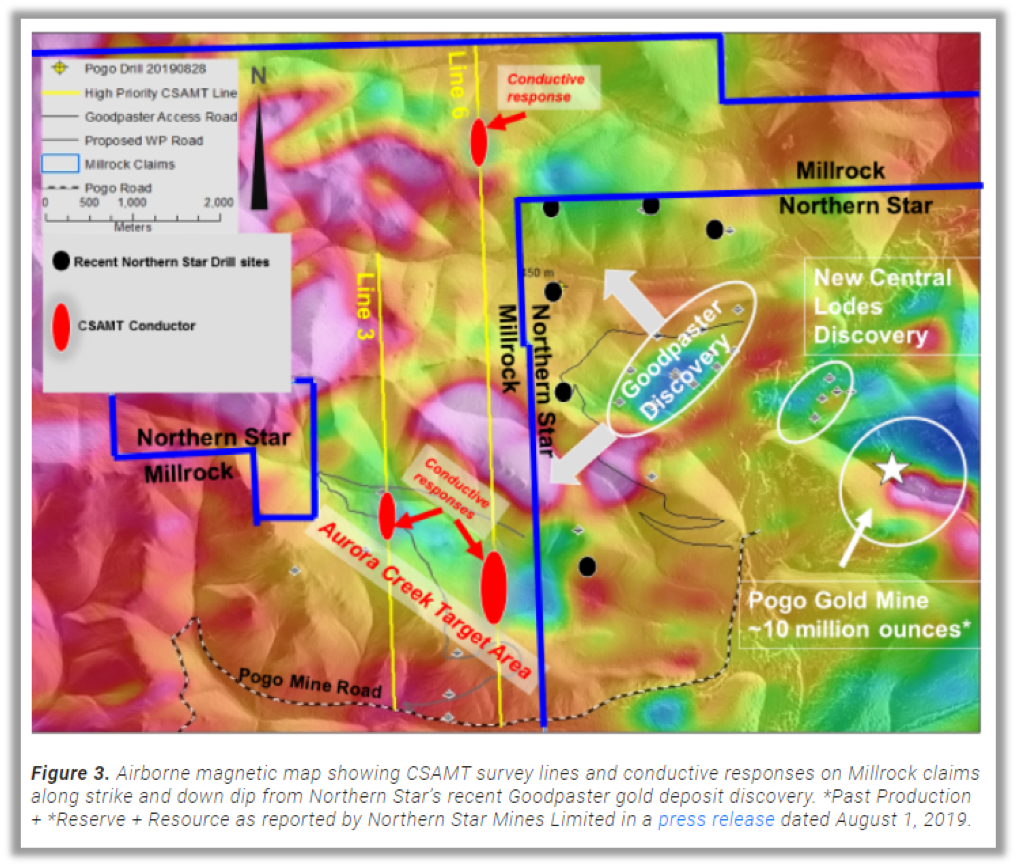

Chris van T.: After acquiring the mine, they took a look back at the historic CSAMT data—and some of this happened under Sumitomo ownership—and realized that there were very nice conductors from a resistivity survey that sat right where the mine workings had been, and put two and two together.

After viewing other area survey results, they targeted the Goodpaster area, because it had similar rock properties to the mine. [They] went in and drilled where they had pulled up a little short before, about 50 meters short, and drilled into this conductor and ended up discovering the Liese Zone, which is the main mine focus area-type vein there. This was a real big technical and geologic success for them at that point.

Maurice Jackson: Let's discuss some of the latest events occurring right now with Northern Star Resources. I was reviewing some of their press releases issued and they just announced a plan to expand their Pogo Mine by 30%, with a capital commitment of US$30 million. What can you share with us regarding the expansion, and how does it fit into the narrative of Millrock's value proposition on the West Pogo?

Gregory B.: Millrock has been very impressed with Northern Star. They're clearly an excellent mining company. They know what they're doing. They've changed the mining methods to be more efficient, to get more gold out of the ground.

I think they're starting to make a lot of money with this mine and I think they're really going to make a fortune with it, especially as the gold price rises even further.

They've made some great new discoveries and they published some of those about 10 days ago. And we know that they've been drilling just on the other side of our mutual claim boundary for almost two years straight, flat out, and they announced finally some of those results. There's some really high-grade intersections in what appears to be multiple stacked zones of quartz-vein gold mineralization.

Maurice Jackson: Chris, you have some very, very intriguing news to share with us on the latest geophysical results. Walk us through their potential significance.

Chris van T.: We decided to employ the same methods that Sumitomo used in order to image their conductor, and that's the controlled source audio magnetotellurics. We chose two areas over our more perspective ground and completed the geophysics during August and September.

The results are showing conductors that have the correct geometry in elevation to be an extension of the same type of big regional fault that hosts the veining over on the Goodpaster prospect. So we're very excited about the potential that we're seeing in the area from the latest geophysical survey.

Maurice Jackson: Mr. Beischer, Millrock has made a lot of progress at the West Pogo, which leads me to ask, what is the next unanswered question from Millrock Resources? When can we expect a response, and what determines success?

Gregory B.: Well, we're kind of faced with a decision right now, Maurice. This is a really, really compelling drill target we've developed on the West Pogo block. Millrock's approach to exploration has been to always make partnerships and let other companies take the initial drilling risk.

This one we feel so strongly about that, honestly, it's quite tempting for us to raise the money and do the first round of drilling.

But having said that, Millrock share price is only $0.09 or $0.10 at the moment; that would be quite diluted if we were to raise enough money to do what needs to be done. The first eight, 10 or 12 holes—that would cost us an excess of $3 million.

So if we get the right offer, we would probably take it. But whatever company earns into this project, I'll tell you we're not going to give it away.

They have to come prepared in the first year to drill 10 or 12 holes and that's going to cost several million. But I feel very strongly that any partnership we make will require the other company to advance the whole project.

There's all kinds of other prospects on the huge claim block that we've staked. More work needs to be done to bring each of those up to drill readiness. But they've got a good one to start with at West Pogo—quite compelling targets. Those would be the parameters of any company making a deal on this project.

Maurice Jackson: Gentlemen, I don't know if you play poker, but based on the geophysical results that we received, could we have received a better outcome? Because I'm looking at your nonverbals and they look quite stoic.

Chris van T.: It was definitely an encouraging result to have a predictive model come in with results that are so far agreeing with what we were hoping to see in a geologic sense in the area. So we're very encouraged.

Maurice Jackson: Mr. Beischer, before we close here, what kind of feedback have you been receiving from shareholders?

Gregory B.: Well, everyone's quite excited, [and] not just shareholders. We've shown the project now to lots of interested mining companies and other explorers. It's an easy story to tell and an easy one to get excited about. Those companies can immediately see the potential that we've been able to prove and it's starting to catch on with our shareholders. I think the message is starting to get out that we really latched onto a terrific project at Goodpaster.

Maurice Jackson: Mr. Beischer, for someone that wants to get more information on Millrock Resources, please share the website address.

Gregory B.: www.MillrockResources.com.

Maurice Jackson: As a reminder, Millrock Resources trades on TSX.V: MRO | OTCQB: MLRKF. Millrock Resources is a sponsor of Proven and Probable and we are proud shareholders for the virtues conveyed in today's message.

As reminder, I'm a licensed representative for Miles Franklin Precious Metals Investments. We are providing a number of options to expand your precious metals portfolio from physical delivery, offshore depositories, precious metal IRAs and private blockchain distributed ledger technology. Call me directly at 855-505-1900 or you may email maurice@milesfranklin.com.

Finally, please subscribe to www.provenandprobable.com. We provide mining insights and bullion sales.

Gregory Beischer and Chris van Treek of Millrock Resources, thank you for joining us today on Proven and Probable.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

[NLINSERT]Disclosure:

1) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Millrock Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Millrock Resources is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own shares of Millrock Resources, a company mentioned in this article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.

Images provided by the author.