Rare earth elements (REEs) have been in the geopolitical spotlight for much of the year. Many, myself included, are surprised that the combination of severe trade tensions between the U.S. and China, strong growth in wind farm installations (wind farms use lots of REE magnets) and emerging growth in electric vehicles over the next decade has not driven REE prices higher.

However, if one scans the green energy/tech/battery metals landscape, one might notice something strange. Not only have REE prices not moved higher, vanadium, cobalt and lithium prices have all fallen precipitously over the past 15–18 months. My point is that commodity prices can and sometimes do remain weaker for much longer than people imagine possible.

However, when the prices of these critical metals rebound, they can move really fast. Three times over the past 15 years the uranium price has increased by hundreds of percentage points within a 12-month period. Cobalt, lithium and vanadium had spectacular runs from 2015 to 2017, only to fall out of bed in 2018 and 2019.

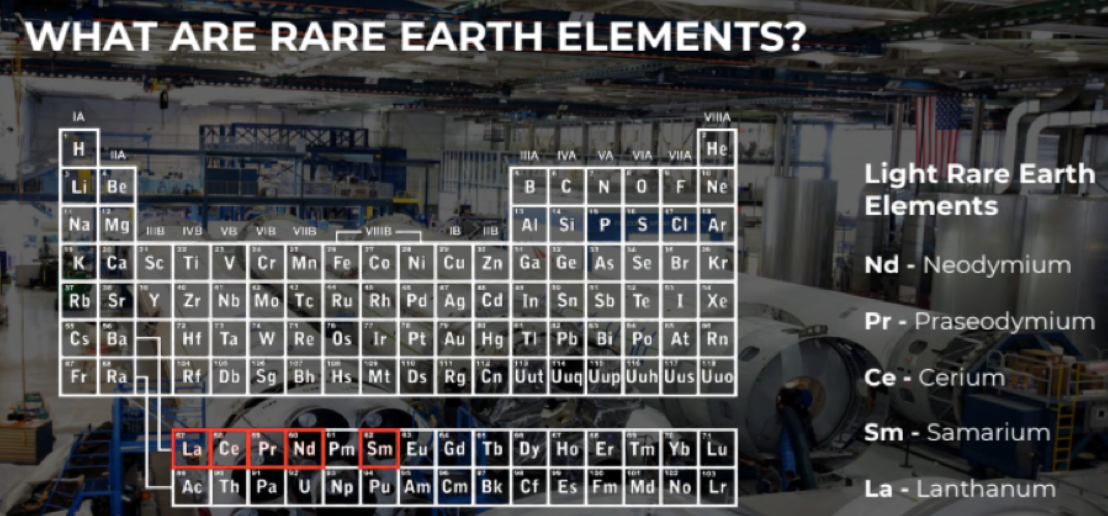

In many ways, rare earth metals are even more crucial to modern society than the green energy/tech/battery metals. Most important, they're used heavily in every First World country's military programs. I won't list all of the offensive and defensive military capabilities that rely on REEs; those can be found with a quick Google search. The U.S. cannot allow China to continue dominating all aspects of the REE industry.

Nothing I've said so far is new, but this is new: In August, the U.S. Department of Defense (DoD) commenced a wide-ranging assessment of North American REE supply chains, including barriers to the market experienced by aspiring producers. The DoD will use information from industry participants to propose recommendations to promote the North American commercial, industrial, high-tech manufacturing, green energy and defense industries.

The DoD indicated that help could include government investment into select REE companies or projects in the U.S., Canada and Australia.

Canadian-based Defense Metals Corp. could serve North American LREE markets

Tiny Defense Metals Corp. (DEFN:TSX.V; DFMTF:OTC; 35D:FSEQB) responded to the DoD's request for information. I have no idea if that will lead to funding or something like a loan guaranty, but it's highly encouraging that China's dominance in REE processing and supply is finally being addressed.

With that in mind, I was able to track down the CEO of Defense Metals, Craig Taylor, to ask him about his company, his flagship project and, of course, the need for critical rare earth metals to be sourced from multiple places around the globe, not just China.

Peter Epstein: How did the U.S. get itself into a dangerous over-reliance on China for REEs (and other things)?

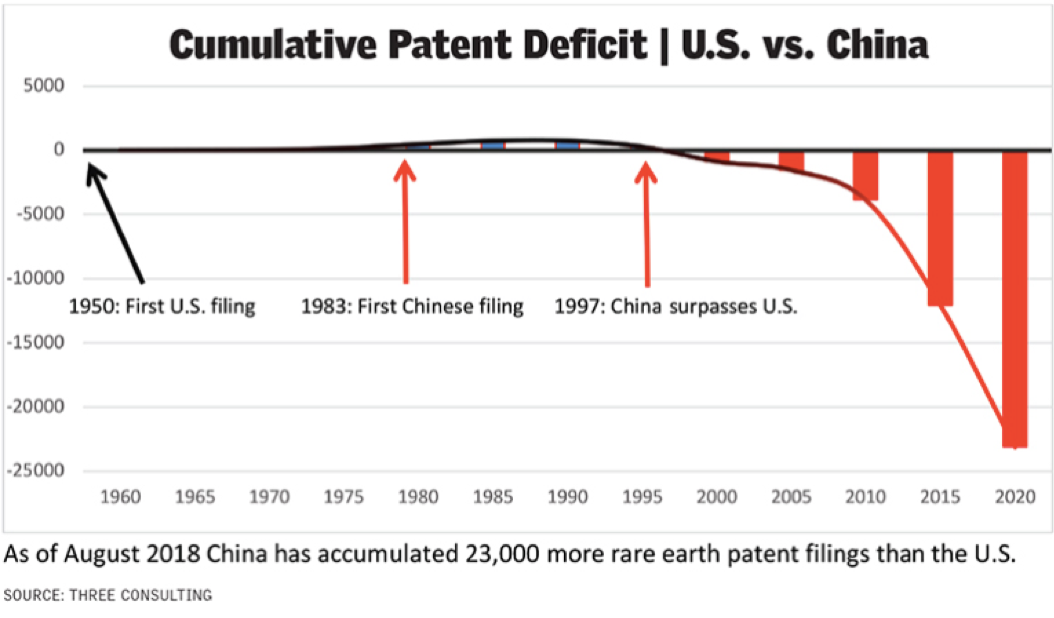

Craig Taylor: In the 1980s and '90s, the U.S. moved substantially all of the mining, production and refining of REEs to China to lower costs. A primary reason costs were lower in China was because of weak environmental oversight. Things may have improved on the environmental front in the past 20–30 years, but the damage has been done to the north American REE industry.

There have been large moves in the prices of gold, silver, palladium and platinum over the past year. Some of the activity is presumably due to Chinese/U.S. trade tensions. Why haven't rare earth metals prices participated in the rally?

That's a good question. A lot of people are wondering why prices for rare earth metals like neodymium (Nd), praseodymium (Pr), dysprosium (Dy), and others have remained relatively steady after a meaningful move higher in May/June. By now, most readers know that China dominates the global supply of REEs. They control more than 80% of the market. China can heavily influence prices. If China wanted prices to be higher, prices would probably be higher.

So far, China has not restricted the flow of REEs to the west. But, we think Chinese officials are keeping that option on the table to use for maximum effect if/when they deem the time is right. Still, no matter what China does, we think pricing for crucial REEs is headed higher purely on supply-and-demand fundamentals. It's been reported that without presidential action, U.S. industry cannot reasonably be expected to provide the production capability for samarium cobalt rare earth permanent magnets adequately and in a timely manner.

Peter Epstein: Can you please give readers the latest snapshot of your flagship Wicheeda REE project?

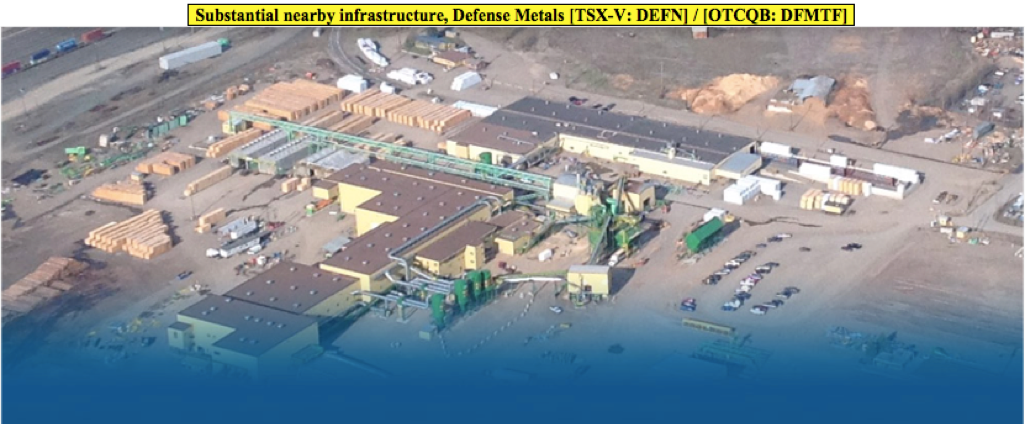

Craig Taylor: Yes, of course. The Wicheeda property consists of 6 mineral claims covering about 1,700 hectares (~4,200 acres). It's ~80 kilometers northeast of Prince George in central British Columbia. Favorable mineralogy and an attractive lanthanide distribution makes Wicheeda a very prospective light rare earth metal (LREE) deposit. We have a trained workforce in one of the most mining-friendly jurisdictions in the world. A hydroelectric power line, gas pipeline and the Canadian National Railway are all nearby.

The Wicheeda deposit's mineral resource contains 11.37 million tonnes (Inferred) averaging 1.96% LREE, at a cutoff grade of 1.0% LREE (sum of cerium, lanthanum, neodymium and samarium percentages). The technical report describing the project and the Inferred resources can be found on SEDAR under the date July 9, 2019.

Peter Epstein: Very interesting. Can you continue by telling us about the ongoing drill program?

Craig Taylor: Yes. As many readers may know, we are in the middle of a diamond drill program designed to test the northern, southern and western extent of the Wicheeda deposit, further delineate the relatively higher-grade, near-surface, dolomite-carbonatite unit, and address select internal drilling gaps in the deposit.

Core drilling started at the location of our prior 30-tonne bulk sample—which, by the way, returned composite head assays of 1.77% lanthanum-oxide, 2.34% cerium-oxide, 0.52% neodymium-oxide and 0.18% praseodymium-oxide. That's a total of 4.81% light rare earth oxide (LREO).

We are off to a great start; eight of a planned 13 drill holes totaling 1,165 meters have been completed. All holes intersected significant widths of visible REE mineralization. A detailed review of historic and current drill cores indicates the presence of multiple phases of REE-mineralized dolomite-carbonatite, one of which visually appears to contain a higher percentage of REE-bearing minerals.

We have intersected REE mineralization in all eight drill holes to date. Resource definition drilling will allow for an updated and enhanced geological model that management believes should substantially increase the confidence level in the contained mineral resources of the Wicheeda deposit.

Peter Epstein: What are the next steps after delivering an updated mineral resource estimate? A preliminary economic assessment (PEA)?

Craig Taylor: We engaged an experienced consulting group to give us a roadmap of the extensive environmental requirements for our project. We will start with baseline studies that have to be conducted for at least a year. So, no PEA in the next 12 months, but we expect to complete a third-party PEA in the first half of 2021.

Peter Epstein: What are your latest thoughts on the need for a pilot plant? Approximately how much might it cost?

Craig Taylor: We are looking very closely at building a pilot plant. SGS is finishing up work that will help us in our thinking about that. I can say that we're leaning toward doing one. We think it would cost about $550,000. The pilot plant would be up and running before a PEA is delivered.

Peter Epstein: So, to reiterate, Defense Metals is well positioned to benefit from demand for non-Chinese REEs and has near-term catalysts to watch for?

Craig Taylor: Yes, exactly. Let me add, it's not just the U.S. that wants increased security of supply and a more diversified supply base—everyone does! We have a number of near-term catalysts, most notably drill results, an important update on ongoing metallurgy work being done by SGS, and a new mineral resource estimate—all within the next few months.

And, we hope to have a pilot plant and a PEA several months after that. We have a pristine capital structure, with just 30 million shares outstanding and no debt, and we are funded to the end of the year.

Peter Epstein: Thank you, Craig, for the informative update. Continued good luck on the Wicheeda project.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Read what other experts are saying about:

Disclosures/disclaimers: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Defense Metals Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Defense Metals Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned stock in Defense Metals Corp. and the Company was an advertiser on [ER].

While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover any specific events or news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Defense Metals. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Defense Metals, a company mentioned in this article.

Graphics provided by author.