Bill Powers: For about three years you've been the CEO of Silver One Resources Inc. (SVE:TSX.V; BRK1:FSE; SLVRF:OTC). You're focused in Nevada. I didn't really pay attention to this until you alerted me to the fact that Nevada is not the Gold State, it's actually the Silver State. Talk to us a little about how Nevada is a good silver mining state.

Greg Crowe: Well, essentially, it's a silver mining state because California stole the name the Golden State. But I must admit that in the early days, back in the mid-1800s, silver was the dominant mineral being mined in Nevada. And one of the reasons that Nevada entered the Union was because silver was used to pay down the Civil War debt. And it became known as the Silver State, [with] lots of silver production, big mines like Comstock. The one that we are about to finish acquiring, called Candelaria, which was the richest producing silver mine in Nevada. That changed in the 1980s actually, which was interesting, with the discovery of gold and Barrick Gold Corp.'s (ABX:TSX; GOLD:NYSE) big discovery up in northern Nevada. And since then everybody's been looking for gold, gold, gold.

But we like silver. And we took that to our advantage. And we found a very good prospect, in addition to our Candelaria project, that we actually staked. And I can tell you a bit about that down the road too.

Bill Powers: Give us an overview of the Candelaria project and what is the upside here for investors?

Greg Crowe: Yeah, Candelaria is an interesting project. As I said, [it was] the richest producer from the mid-1800s up until mid-1900s and produced, on average, 1,250 grams per ton silver, from near surface high-grade veins. Then essentially it turned into an open-pit situation, mined up until 1997–1998. The last producer was Kinross Gold Corp. (K:TSX; KGC:NYSE). And the reason they shut the mine down was not because they exhausted the mine or the heaps. They only shut down because of the collapse of silver prices.

Silver prices touched, I think, $2.50 per ounce, and stayed under $5 per ounce until 2003 and thereafter. So in the meantime they shuttered the mine. Started reclamation and sold it off to Silver Standard Resources Inc. in 2001. Silver Standard did a big drill program, outlined a very sizeable resource, and moved forward with the idea of bringing it back in production. They couldn't think about it in the $3 to $4 per ounce silver range, so they put it on the shelf. We came along in 2016 and structured a deal with Silver Standard (now SSR Mining Inc. [SSRM:NASDAQ]) to purchase a 100% interest with no royalties.

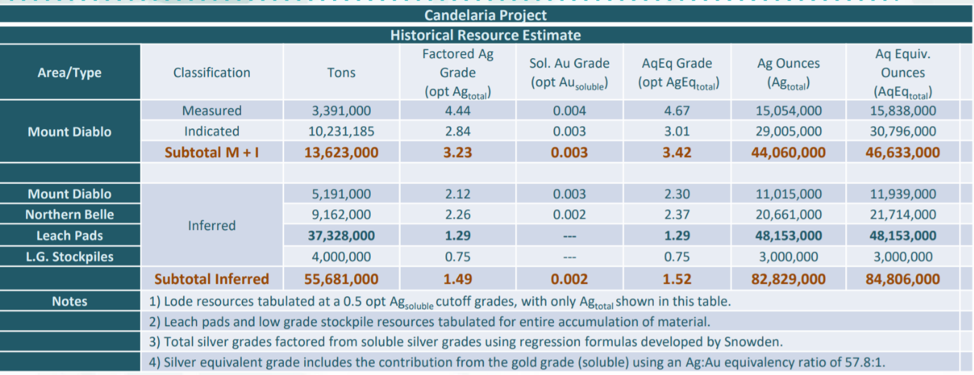

Bill Powers: So there's a large historical resource there. What exactly is that historical resource, and also talk to us about the exploration upside at this project.

Greg Crowe: The historical resource, which we're aiming to drill and become current, is Measured and Indicated resources of about 46 million ounces of silver, and additional Inferred resources of about 83 million ounces of silver. In the Inferred category, of that 83 million ounces, 48 million ounces still sits on the old leach pads. And we've done some good metallurgical testing. We're continuing with that metallurgical testing with the [question]: Can we bring those heaps back into production? Our metallurgical testing will take another few months, but everything is looking very, very optimistic, particularly in this current upticking silver market.

Bill Powers: So you'd be looking at potentially a lower capex because there is a resource right there at surface. Best case scenario, when could that possibly come into production?

Greg Crowe: Best case scenario, it would be two years, and it all depends on what are the results of this metallurgical testing, which are going to take another few months, and then the permitting process. But one of the good things is because it was a disturbed site, and not completely 100% reclaimed, then it would, with a solid plan, of course, be much easier to facilitate permitting.

Bill Powers: And you have some solid financiers that have backed the project, including, most notably recently, Eric Sprott. How did that investment by Eric Sprott come about?

Greg Crowe: Well, in essence, the original investors in the company were affiliated with First Mining Finance, First Majestic Silver Corp. (FR:TSX; AG:NYSE; FMV:FSE) and Keith Neumeyer. Eric and Keith work together, and Eric became aware of Silver One. Interesting enough, when I met with Eric in Toronto, he showed me that Silver One was actually on his list for acquisition, and we announced a financing in June prior to the uptick in the silver markets. We put it out there that we would do a financing and try to raise about $2 million. Within three weeks, we had $5 million, with Eric Sprott coming in as our largest single shareholder.

Bill Powers: So there's a lot of fundamental value in the company in the historical resource of silver ounces in the ground. There's exploration upside at the Candelaria project. And you're also working at your Cherokee project. Talked to us about the exploration upside at the Cherokee project.

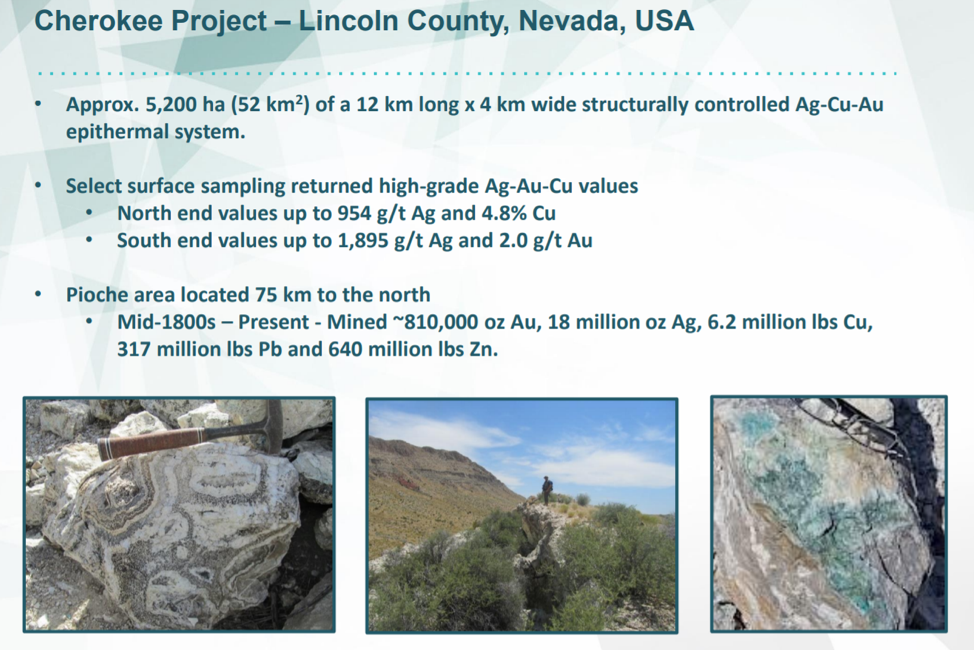

Greg Crowe: Yeah. Cherokee's interesting. And it goes back to the premise that Nevada's the Silver State. But most of the exploration has been focused on gold. There has been some silver exploration, but we saw a reference to an old historic mine that, in the 1800s, produced in the thousands of grams per ton silver. So we said we better go look at this. And we went and looked at it. And low and behold, [we found] beautiful, what are referred to as epithermal-style boiling point textures. Good indications of copper mineralization on surface, affiliated with some very sizable veins. [We] started walking the veins and we traced them for 12 kilometers, or nine miles, along strike and the ground was completely open.

So we staked the whole thing. And then we bought five of the patents. We now have 100% interest. [When we] started detailed sampling at the north end, where the old Cherokee mine is, we started getting values as high as a thousand grams per ton silver and 4.8% copper. In the south end, where the veins kind of come together, copper seems to disappear, but we're starting to see two grams of gold creep in, and we're still getting strong silver values. This time up to 1,800 grams per ton silver. This is on surface, select grabbed samples. The veins to our knowledge have never had a drill on them.

So our plan is to. . .we're out there right now sampling and mapping, finding more and more veins, and then we're going to be doing a property-wide airborne geophysical survey. With that information, we hope to be able to identify drill targets for the new year.

Bill Powers: What does the treasury and the burn rate of the company look like right now?

Greg Crowe: The treasury is about CA$4.2 to $4.5 million, in that range there. We do have these ongoing exploration programs, which will probably amount to about CA$2 million in total, but outside those, the average burn rate of the company is about CA$1.2 million per year.

Bill Powers: As we conclude, what final thoughts would you like to leave with the investors listening to us?

Greg Crowe: Well, [for] those of you who really do believe, shall we say, that we live in a somewhat unstable world, and in uncertainty economically, and you're a believer in solid assets like gold and silver—then look at not only gold and silver, but gold and silver companies; especially those that have some something behind them and good financial backers behind them.

Bill Powers is the host of the Mining Stock Education podcast that interviews many of the top names in the natural resource sector and profiles quality mining investment opportunities. Powers is an avid resource investor with an entrepreneurial background in sales, management and small business development. His latest interviews can be found at MiningStockEducation.com.

[NLINSERT]Disclosure:

1) Bill Powers: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Silver One Resources is a Mining Stock Education advertiser.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

The content produced by Bill Powers and Mining Stock Education LLC is for informational purposes only and is not to be considered personal, legal or investment advice or a recommendation to buy or sell securities or any other product. It is based on opinions, public filings, current events, press releases and interviews but is not infallible. It may contain errors and we offer no inferred or explicit warranty as to the accuracy of the information presented. If personal advice is needed, consult a qualified legal, tax or investment professional. Do not base any investment decision on the information contained on MiningStockEducation.com, our podcast or our videos. We usually hold equity positions in and are compensated by the companies we feature and are therefore biased and hold an obvious conflict of interest. MiningStockEducation.com may provide website addresses or links to websites and we disclaim any responsibility for the content of any such other websites. The information you find on MiningStockEducation.com is to be used at your own risk. By reading MiningStockEducation.com, you agree to hold MiningStockEducation.com, its owner, associates, sponsors, affiliates, and partners harmless and to completely release them from any and all liabilities due to any and all losses, damages, or injuries (financial or otherwise) that may be incurred.