On August 25, Standard Lithium Ltd. (SLL:TSX.V; STLHF:OTCQX) announced another important milestone on its way to first commercial production, with giant German specialty chemicals company Lanxess AG (LXS:DE), of battery-grade lithium chemicals.

Fabrication of phases one and two of Standard Lithium's LiSTR direct lithium extraction demonstration plant (DP) are complete. All site construction works are on schedule, the concrete slab and foundations required to house the DP are in place. Nine modules are in transit and expected to arrive at the Lanxess South Plant facility in southern Arkansas before month's end.

When fully commissioned, the DP will continuously process an input "tail brine" flow of 50 gallons per minute, an annualized production rate of 100–150 tonnes of lithium carbonate equivalent (LCE). Lanxess "tail brine" is a heated, mineralized flow of water (brine) exiting the Lanxess South Plant facility, stripped of bromine, containing significant concentrations of lithium.

The DP showcases Standard's proprietary LiSTR technology, which uses a solid sorbent material to selectively extract lithium. The environmentally friendly process eliminates the need for evaporation ponds and reduces processing time from 9–18 months to a matter of hours while, at the same time, greatly increasing lithium recovery rates.

Dr. Andy Robinson, president and COO, commented, "The Standard Lithium team and our partners continue to execute on our strategic plan to timely advance our project in Southern Arkansas. Over two years of disciplined process design and engineering work has brought us to this point, and we look forward to announcing the completion of additional key milestones in the near-future."

There's a massive disconnect in the lithium world. For years, demand forecasts have been going up. The demand side of the equation—driven by both energy storage and the electrification of passenger and commercial vehicles—is likely to increase at a compound annual growth rate (CAGR) of at least 16%, perhaps 20% or more. Albemarle Corp. (ALB:NYSE) has a particularly good graphic depicting this unmistakable trend.

However, that hardly matters if global supply can't keep up, which I highly doubt that it can. In the chart above I show thousands of tonnes of LCE potentially consumed each year based on a range of CAGRs. For example, at a 20% CAGR from Albemarle's 270,000-tonne figure in 2018, demand could reach 967,000 tonnes in 2025.

A source I trust even more is Benchmark Mineral Intelligence, which has 2018 consumption at ~285K tonnes LCE, growing by 22.8% this year to ~350K tonnes. Since I'm using a chart from Albemarle [see below], I use their 270,000 tonne figure in my CAGR scenarios.

In a July 30 blog post by Benchmark Minerals Intelligence, they say that "lithium supply has to increase at a 19% CAGR over the next six years [from 2019] to meet 2025 demand. Even at the height of the market, the industry only managed to grow by 11% per year, on average, from 2015¬–2018."

In my opinion, it's not necessary to try to assess global supply scenarios over the next 10 years. Why? No scenario can meet true demand. The point of the last several paragraphs is that the market will take every battery-grade tonne of lithium chemicals produced by Standard Lithium and Lanxess for decades to come. And, the price in 2.5 years, when Standard starts commercial production, will likely be higher than it is today.

I think it's important to remind readers that Lanxess is one of the premier specialty chemicals players in the world. Standard Lithium and Lanxess are expected to form a joint venture (JV) next year, at which point Standard Lithium's burn rate will be greatly reduced to its JV share of 30% and, more importantly, Lanxess has committed to provide 100% of project financing to the JV, operate the plants and take 100% of the lithium off-take.

PEA economics

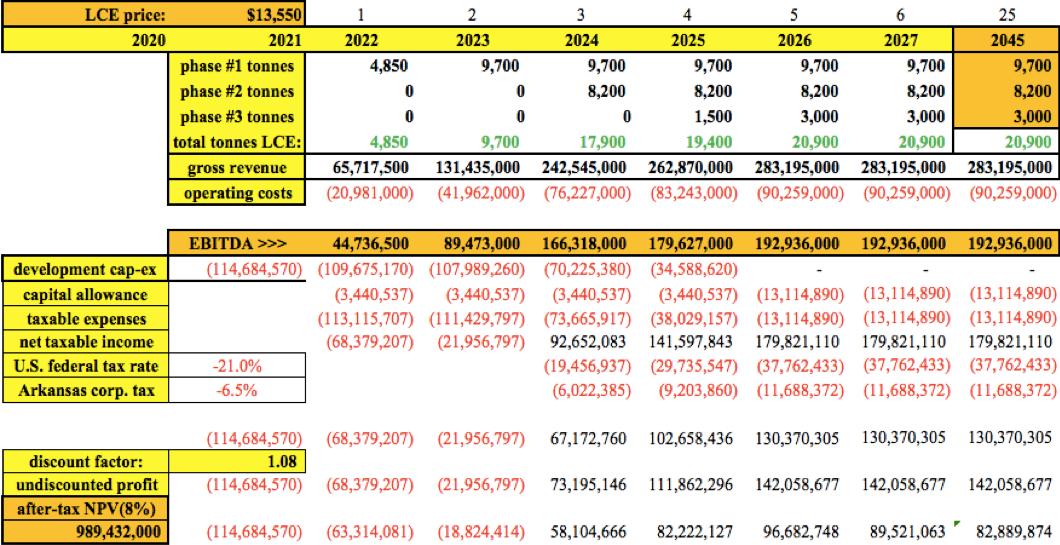

Earlier this month, Standard Lithium's preliminary economic assessment (PEA) was filed on SEDAR. In it, the after-tax net present value (NPV), discounted at 8%, is US$989.4 million = CA$1.316 billion. If 30% of that amount is attributable to Standard's project interest, that's CA$395 million, equal to $4.51 per share (assuming 87.6 million shares outstanding).

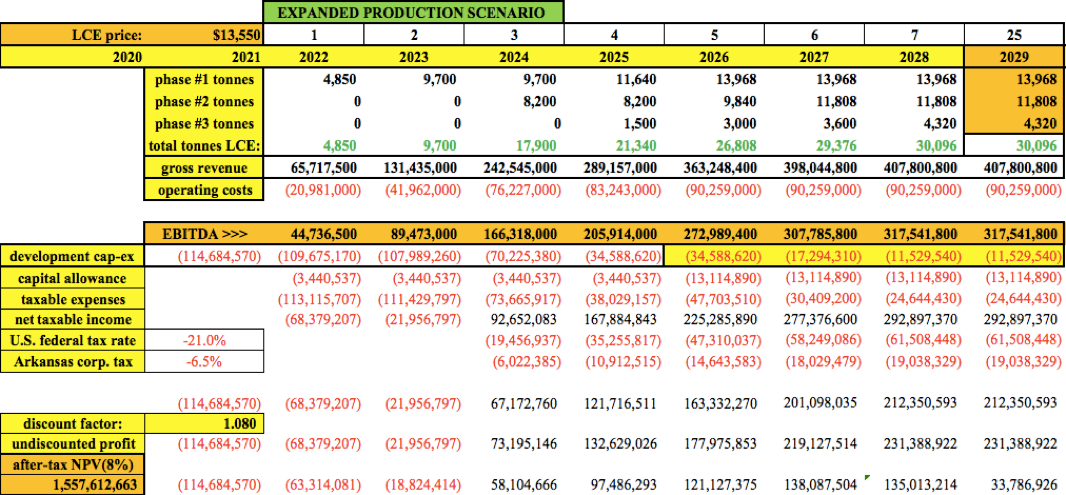

Given that management has discussed the potential of operating at 30,000 tonnes LCE/year versus the more conservative 20,900 tonnes/year in the PEA, I adjusted the cash flow figures found on page 202 of the technical report to increase production (plus incremental development capex) to see what it would do to the NPV.

With two annual increases of 20% for each phase, total output rises to 30,096/year from 2028 on. I added US$75 million in development capex spread over four years to pay for that increased capacity.

In that scenario, all else equal, the NPV increases by 57% to CA$2.1 billion, 30% of which is CA$621.5 million, or $7.10 per share. Most readers recognize that pre-revenue metals and mining juniors never trade at 100% of their estimated after-tax NPVs. Depending on how advanced a company's project(s) are, they often trade between 15% to 65% of NPV. Reasons for the discount are 1) time until cash flow begins; 2) project risks; and 3) future capital raises (equity dilution).

In the base-case PEA scenario, Standard Lithium is trading at 23.5% of its share of project NPV. In the expanded production scenario, Standard is trading at 11.2% of its share of NPV—an 88.2% discount. Is this valuation discount warranted? In looking at the factors that dictate a company's discount to NPV, I think Standard stands out favorably on all three. For example, time to cash flow is 24–30 months; many PEA-stage companies are 48–72 months from first cash flow.

Regarding project-level risks, Standard's Arkansas project, bolted onto Lanxess' existing brine processing facilities, is low risk compared to projects in countries with significant geopolitical, permitting, environmental, community relations, climate and exploration risks, or projects lacking in infrastructure, labor, mining services, etc.

Best of all, Standard will have a world-class specialty chemical company as a strategic and financial partner. In my opinion, Lanxess is in the same league as Albemarle or SQM SQM (SQM:NYSE). It's entirely possible that the lithium chemicals produced by Standard Lithium and Lanxess could be customized and sold into niche markets at a premium to prevailing battery-grade lithium prices.

Finally, equity dilution risk is greater for peer PEA-stage companies than for Standard Lithium. Once Lanxess and Standard formalize their JV early next year, Standard will be virtually free-carried through commercial production. That means the company might only need another CA$20 million in equity capital between now and year-end 2020.

Adjusting my earlier calculations for 110 million shares outstanding instead of 87.6 million, the NPV/share would be $3.59, or $5.65 per share in the expanded production scenario. Therefore, pro forma for 110 million shares, Standard is valued at 24% (its share of) the after-tax NPV value in the PEA, and 15.2% of NPV in the expanded production scenario.

Standard Lithium compared to producing lithium companies

Trading at 24% or 15.2% of after-tax NPV is one way of looking at valuation compared to non-producing peers. Another way to consider valuation is by comparing anticipated revenue or EBITDA (earnings before interest, taxes, depreciation and amortization) to that of current producers like Albemarle, SQM and Orocobre Ltd. (ORL:TSX; ORE:ASX). Those three trade at an average EV (enterprise value) to revenue multiple of 3.2x.

Standard Lithium's 30% share of project revenue equates to CA$113 million in 2026, the first year of 20,900 tonnes LCE/year. Discounting that future revenue back six years at a 10% discount factor equals $63.8 million; $63.8 million in revenue times a 3.2 multiple = $204.1 million. Dividing that figure by a pro forma 110 million shares outstanding = $1.86 per share in today's dollars. Under the expanded production scenario (30,096 tonnes/year), a 3.2x revenue multiple equates to $2.67/share.

Looking quickly at EBITDA multiples, lithium brine majors Albemarle, SQM and Livent Corp. (LTHM:NYSE)trade at an average EV/EBITDA multiple of ~8.5 times. Applying an 8.5x multiple to Standard's 30% interest in the PEA-derived EBITDA, and discounting that value by 10% for six years, generates a share price of $3.16. In the expanded production case, the share price is $5.20.

One last example: I took a closer look at Orocobre. It produced 12.6K tonnes of lithium in the 12 months ended June 30, 2019, of which it owns 66.5% of the economics. So that's 8.4K tonnes attributable to Orocobre. It has an EV of CA$434 million, it's trading at $51.6K per tonne of attributable production.

Standard Lithium could be producing 7,000–10,000 tonnes LCE/year, (net to them), by the mid- to late 2020s. Taking the midpoint of 8,500 tonnes x $51,600 = $438 million. That's $4 per share (based on 110 million pro forma shares). Discounting the share price back at 10% for six years equates to a share price of $2.26.

Conclusion

The above commentary is for illustrative purposes only. Calculated prices per share are not price targets, especially since they range from $1.86 to $5.86 on an estimated pro forma share count of 110 million. In the first half of next year, Standard Lithium's cash burn will decline as Lanxess picks up 70% of the burden and arranges 100% of the JV funding through commercialization.

I believe that the global lithium market will be better in 2020 than in 2019, better again in 2021 versus 2020, and better still in 2022. As I have mentioned in other articles, when the market turns for lithium juniors there will be far fewer viable companies around to absorb the wave of investment dollars. By 2022, the Standard Lithium/Lanxess JV might be able to lock in medium or long-term contracts at high prices.

Most of the U.S. western states' brine projects are dead. Argentina looks very challenging lately, on a number of fronts, except for the more advanced projects. Standard Lithium will clearly be one of the primary beneficiaries of an improved market as it approaches commercial production largely on time and on budget.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Standard Lithium, including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is not to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Standard Lithuim are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed or registered financial advisors before making any investment decisions.

At the time this interview was posted, Peter Epstein owned shares of Standard Lithium, and the Company was an advertiser on [ER].

Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.