"Destroyers seize gold and leave to its owners a counterfeit pile of paper."– Ayn Rand

Twelve days ago, we were forced by gale force winds to seek safe harbor in the lovely northern Ontario town of Britt, located on the north shore of the Magnetawan River, approximately fifty miles south of Sudbury. As I was growing increasingly less patient with Mother Nature's petulance, I found myself drawing an intuitive parallel between the good fortune in avoiding the ravages of the Georgian Bay rollers (big waves) and the pecuniary good fortune of having taken a very large physical and paper position in silver.

Riding out a dangerous and violent midsummer Great Lakes tempest in the sanctuary of Wright's Marina alongside dozens of equally thankful-yet-exasperated mariners was analogous to watching your incompetent boss drive your new Porsche off a cliff: You are filled with mixed emotions, angry that your voyage has been delayed yet ecstatic that you are safe from harm.

Similarly, being overweight silver in today's confused and catatonic financial world has been at once both a blessing and a damnation: Purchases at the lows in early July have been countermanded by the many earlier attempts, since December 2015, that had to be aborted due to the criminal interference and intervention covered countless times in this publication (and, invariably, to the point of launching quote monitors out the ninth-floor window in search of a bullion bank skull).

Since the tops in 2011, it has not been a pleasant voyage for those aboard the silver ship, but nothing quite as painful as the period of December 2015 until June 2019, as the precious metals nadir that I nailed on December 4, 2015 gave us a brief nine-month rally. Maddeningly, after August 2016, the bullion bank behemoths mercilessly punished all technical traders by selling all breakouts, flooding the Crimex with counterfeit paper "gold" and paper "silver." I came out in late 2016 with the "Sell breakouts, buy breakdowns" strategy, which was precisely the correct chart to follow, gingerly avoiding the treacherous rocks and shoals of drawdowns as I successfully navigated around the perhaps $400 per gold ounce and $5 per silver ounce of systemic "shipwreck" brought about "regulatory undersight," giving way to total bullion bank control. And all I could do was sit back and watch.

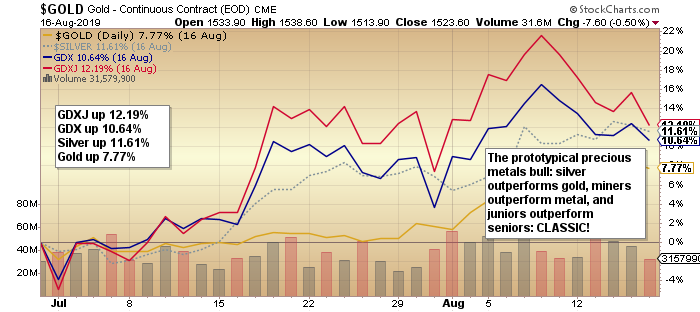

The landscape all changed in June, not so much by the advance through the six-year cap at $1,375 per ounce but more so by the content and quality of the advance. How many times have you read my thoughts on the importance of the prototypical sequence required by true precious metal bull markets? Silver outperforms gold; miners outperform physical; and junior miners outperform senior miners. As the chart below would suggest, we have a classic "phoenix-style" bull market, arising majestically from the ashes of neglect and criminal collusion to assume its well-deserved resplendence in its role the market leader for the balance of 2019.

The Invasive Species missive, penned just after we arrived into the Byng Inlet in full flight from the 50 kilometer per hour northwest gales, brought about a plethora of responses, the bulk of which were favorable, with the only dissenters being the staunchest of bulls in the precious metals arena. I advised the sale of 50% in the GDX and GDXJ positions exactly one week ago, and I did so, averaging over $42 (paid $30.13) for GDXJ and $29.60 (paid $21.11).

Despite the fact that they are marginally lower this week, the bulls were outraged by my decision to take profits on half-positions in the miners. The old adage that "one never goes broke by taking a profit" is offset by Jessie Livermore's "the hardest thing to do in a bull market is to hold on," but it is important for the outraged bulls to understand that the GYM portfolio remains 25% long physical gold, 25% long physical silver, 12.5% long GDX, 12.5% long GDXJ, and holds 25% cash. I am attempting to capture "alpha" by trading 25% of the portfolio into what has been a mind-blowing run from the lows in June—and also, I might add, from the start of the year, as shown in the chart below.

On a less-favorable note, the best performer of the bunch was the Gold Junior Miner ETF (GDXJ), which one might think would include more than a handful of the junior explorers. But investors are still reeling from the horror of the 2011–2015 bear market in gold, which resulted in catastrophic losses in the junior explorers. Gold corrected 45% from the 2011 highs, but many explorers, once darlings of the average speculator, are still down over 90% in some cases.

The best example of exactly why the GGMA portfolio kept the explorco exposure to a minimum is shown below. I cite, as an example from 2011, where ATAC Resources Ltd. (ATC:TSX.V) was heralded as the "next big Carlin-type deposit." Some of the smartest investors in the world believed the hype as the control block wound up being sold to a billionaire investor at or near the top in 2011. This is a stark contrast to Great Bear Resources Ltd. (GBR:TSX.V; GTBDF:OTC) ($5.26) recommended at $2.30 in January, it is now the largest position in the GGMA portfolio.

I have chosen to discuss the junior explorcos only because of the relatively poor performance of the juniors within the GGMA portfolio, and that includes Getchell Gold Corp. (GTCH:CSE) (down 55% from the January purchase price at $0.18). The problem with exploration juniors here in 2019, versus 2009, is that the new generation of speculators have a) more (non-mining) to choose from; b) limited history of joy in discoveries; and c) no regard for precious metals.

Because of these reasons, if I invest in GTCH at $0.15 pre-drilling, I do not get the advantage of speculators moving the price higher in expectation of a lottery-style win. In the 1990s, stocks commanded $30 million market caps during the pre-discovery phase. That lasted until 1997, when Bre-X snuffed the lights out.

Again, in contrast, I recently added Aftermath Silver Ltd. (AAG:TSX.V) to the GGMA portfolio, to secure exposure to a physical silver resource for a company capped at under CA$3 million. When silver exploded higher in late July, AAG was able to catch a bid because they did not need to find a resource; they already had one.

Stakeholder Gold Corp. (SRC:TSX.V) was added in January at $0.05 per share, with gold under $1,300 per ounce, and there it remains with gold at $1,500. Why? It is because they have no precious metals resource and no active project to attract investor interest (but that is a topic for another time and day).

As I stated when I added Aftermath, the deals I will own going forward are the ones that have a resource to backstop exploration. From an investor's viewpoint, it is preferable to be drilling to define a discovered ore body than to be trying to find a brand-new one. There may be less leverage in paying up for that resource, but until retail speculators begin to buy into exploration plays pre-discovery, I am better off waiting for that discovery and then buying, because I have deflected the risk away from reliance on those two unforgiving ladies of the exploration fates—Mother Nature and Lady Luck. Between Aftermath and Great Bear, the portfolio has over CA$50,000 in profits; the rest are down a cumulative CA$15,600. Two explorcos and one uranium/vanadium play (Western Uranium & Vanadium Corp. [WUC:CSE; WSTRF:OTCQX]) are underwater, with one gold discovery and one silver resource constituting the wins. As we move forward, I want to add to what is working and reduce what is not. (Note: I will have a missive out early next week specifically addressing the juniors, with special attention to GTCH and WUC.)

As we move forward though the second half of 2019, the goal is to continue to avoid the rocks, drastic drawdowns that have plagued most precious metals investors since 2016. Investing can be a wonderfully calm experience with flat seas and shining sun and just enough wind to keep us cool. But as I have found in my years as a mariner, "ideal conditions" on a body of water such as Georgian Bay can become "hazardous conditions" at the drop of a barometric hat. Just as a plummeting barometer warns of an impending change in conditions (usually for the worst), a rising barometer is the reverse.

For the precious metals, until the late 1980s and the advent of the Working Group on Capital Markets, precious metals were the singular best barometers (in reverse) of looming trouble on the economic or financial horizon. The shift we encountered in June has served to challenge the status quo, whereby prices are managed to facilitate an aura of calm, but since the bond market and the inversion of the yield curve represents a market that not even the powerful Fed can control, the metals now appear to be in the Fed's rear-view mirror, instead of its crosshairs. Despite numerous albeit feeble attempts, the bullion banks have offered what I would brand as "futile attempts" to control prices, as if they are being distracted by a larger menace. Furthermore, since the bond market is many times larger in size than stocks, and since Forex is an equal amplitude larger than bonds, the central bankers have not only the tip of a tiny crag (gold) off their port bow to contend with, they also now have three Titanic-style icebergs and Cape Horn in their binoculars.

Finally, as a punctuative rationale to explain this change, the explosion in the amount of bonds paying a negative interest rate is not only an iceberg, it is a nuclear torpedo targeting the broad side of the global financial starboard bow.

Capital preservation is now the numero uno of objectives, and it is no surprise that just as running to an inland town called Britt vaporized any and all chance of quiet anchorages and serene relaxation, it also allowed us to let the tempest pass. Physical gold and silver are a "safe harbour" counterparty to nothing and no one. They have no nationality and no liens of any sort. Physical ownership and possession are akin to being "a lee of the wind," and that is exactly where I will be in the days, weeks and months ahead.

Carpe Sanctum: Seize sanctuary.

Originally trained during the inflationary 1970s, Michael Ballanger is a graduate of Saint Louis University where he earned a Bachelor of Science in finance and a Bachelor of Art in marketing before completing post-graduate work at the Wharton School of Finance. With more than 30 years of experience as a junior mining and exploration specialist, as well as a solid background in corporate finance, Ballanger's adherence to the concept of "Hard Assets" allows him to focus the practice on selecting opportunities in the global resource sector with emphasis on the precious metals exploration and development sector. Ballanger takes great pleasure in visiting mineral properties around the globe in the never-ending hunt for early-stage opportunities.

Read what other experts are saying about:

Disclosure:

1) Michael J. Ballanger: I, or members of my immediate household or family, own securities of the following companies mentioned in this article: Great Bear Resources, Aftermath Silver, Stakeholder Gold, Western Uranium & Vanadium, Getchell Gold. My company has a financial relationship with the following companies referred to in this article: Western Uranium & Vanadium, Getchell Gold. My firm no longer does consulting work for Stakeholder Gold. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Western Uranium and Vanadium and Aftermath. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aftermath Silver, Stakeholder Gold, Western Uranium & Vanadium, Getchell Gold, companies mentioned in this article.

Charts provided by the author.

Michael Ballanger Disclaimer:

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.