What is the significance of surpassing $1400 USD per ounce of gold?

Personally, I view the price of gold as a bellwether for the global economy, essentially signalling the health of markets. Without a doubt in my mind, the complexity of the global marketplace is only increasing, and because of this I can't help but think that any of these attempts to control it will fail and only add to the damage that has already been done.

Ultimately, I believe, we are headed to some sort of reset of the global monetary system and breaking $1400 USD per ounce, a price we haven't seen since 2013, signals we are getting closer.

So what does this mean for the junior gold companies? Great question.

I think a bullish outlook for a metal price is a poor reason to invest within the junior resource sector, however, while this is my view, it seems that the vast majority of investors think differently.

Therefore, I suspect, given the rise in the gold price, we may be entering a new bull market in gold stocks.

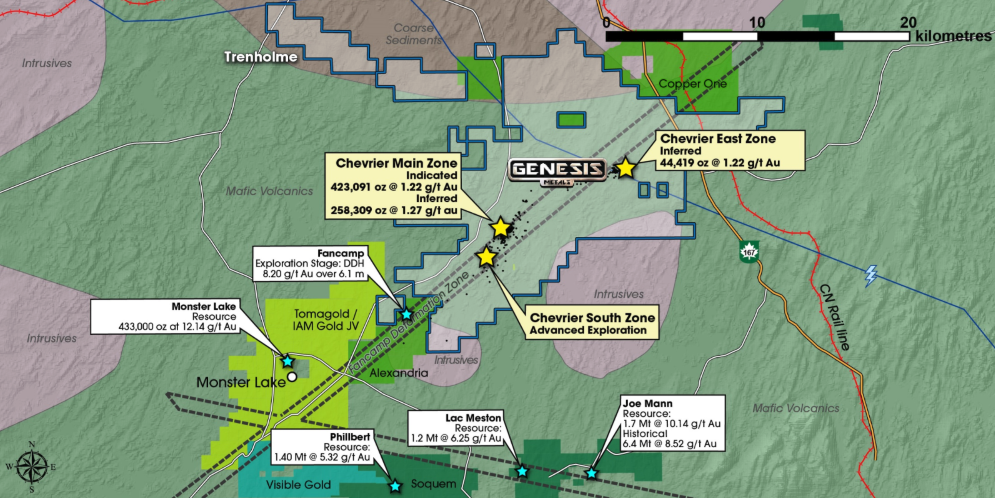

Today, I have an update on Genesis Metals Corp. (GIS:TSX.V; GGISF:OTC), a junior gold company that is exploring and developing its flagship Chevrier Gold Project, in the world famous Abitibi Greenstone Belt in Quebec.

Let's take a look.

Genesis Metals Corporation

Market Cap – $7.4 million (at the time of writing)

Shares – 109.2 million

FD – 132.1 million

Management and Advisors – 16%

Other Major Shareholders – Osisko Mining, Eric Sprott, Gold 2000, Delbrook Capital, U.S. Global Investors, SIDEX/SDBJ and Medalist Capital – 34%

Retail – 50%

Chevrier Gold Project – 2019 Exploration

2019 marks a reboot in Genesis' approach to developing its flagship Chevrier Gold Project.

What do I mean by this? Well, the last few years, much of the exploration and development dollars have been spent on expanding and delineating the project's Main Zone.

In all, the money has been well spent, as the updated resource estimate, released earlier this year, reveals the Main Zone has an indicated resource of 395,000 ounces at 1.45 g/t and an inferred resource of 297,000 ounces att 1.33 g/t, using a 0.5 g/t cut-off.

This field season at Chevrier will be different, as the company looks to generate new high-grade gold targets, as it has expanded its land package along the Fancamp Deformation Corridor and, more importantly, has enlisted Dr. Rob Carpenter and the highly accomplished team at Vector Geological Solutions to lead a modern exploration program across the entire property.

The Vector team is made up of Dan MacNeil and Dr. Alan Wainwright, each which has had extensive exploration experience and successes within the sector.

Exploration will begin with property-wide till sampling. For those who aren't familiar, till sampling is used to identify target metals, such as gold, in areas that have been glaciated.

In these regions, glaciers have eroded the target metals from the underlying rock and transported them away from their source. Therefore, today, by digging down to the till layer, which sits right above the bedrock, exploration teams can better sample for gold.

Till sampling is a highly effective tool in an exploration company's arsenal and will reveal where they should focus its attention with localized geological mapping, trenching and geophysics.

It is key that while the existence of gold within the till samples is obviously paramount, the Vector team isn't necessarily as concerned with the grade of gold, but more on the gold grain morphology.

MacNeil explained to me that the grain morphology is vital in understanding the source of gold, as the shape and surface texture of the gold grain is an indicator of how far away the gold may have travelled from its source.

Source: Research Gate – Grain Morphology Example

Chevrier has been expanded to 275 square kilometers along one of the most famous gold corridors within the Abitibi. With this methodical approach to exploration, I think that there is a high probability that they will identify a few great high-grade gold targets for the next drill program.

Secondly, we have to keep in mind that the Main Zone is still open at depth, which, in my mind, shows great promise for further expansion of the deposit. The Abitibi is famous for its deep, steeply dipping high-grade gold deposits and, therefore, the next drill program should be chock full of high potential targets.

Changes in Leadership

On June 24, Genesis announced the resignation of Chairman and CEO Brian Groves and the appointments of Adrian Fleming as chairman of the Board and Jeff Sundar as interim CEO.

To refresh your memory, Fleming is a geologist by trade with over 40 years of experience in both technical and executive roles. Some highlights include being a founding director at Northern Empire and Underworld Resources, both of which were acquired by majors.

Additionally, Sundar has been a driving force behind Genesis as its president over the last few years and, I think, will do well in his new role. Sundar has over 20 years of experience in the mining industry, and is a former director of Northern Empire, which was sold to Coeur Mining for $117 million in October of 2018. Also, he was a VP/director of Underworld Resources, which was acquired by Kinross for $140 million in the last cycle.

The Genesis team is rounded out by exploration manager Andre Liboiron; director John Florek; independent directors Keenan Hohol, Robert Scott and Steve Williams.

A Discovery Group Company

Genesis Metals Corp. is a part of the Discovery Group of Companies, which is led by John Robins and Jim Paterson. Discovery Group has churned out some of the best stories the sector has seen over the last few years.

A few of the M&A successes have been Kaminak Gold Corp., which was sold to Goldcorp for $520 million, and Northern Empire Resources Corp. Which was sold this past summer to Coeur Mining for $117 million.

Additionally, you have other high-quality resource projects, such as Bluestone Resources Inc., Fireweed Zinc Ltd. and Great Bear Resources, all of which have had success over the last year, as they move their projects forward.

In short, Genesis' entry into Discovery Group speaks to the potential of the company and to its management team, a group in which Robins and Paterson must have confidence, as their reputations are now linked.

Strategic Advisors

While not being a part of the company's main team, strategic advisors can play key roles in the development of a project. In particular, Genesis has done a great job assembling a cast of advisors that have resumes filled with success, particularly in exploration, resource expansion, capital markets and, arguably most important to the Genesis story, M&A.

Being a Discovery Group Company comes with not only the notoriety of being a part of the group, but also means, in this case, that both Robins and Paterson will play strategic advisor roles for the company.

John Robins is a professional geologist by trade with a wide variety of experience over the course of his more than 30 years within the industry. Robins was both a founder and chairman of Kaminak and, in 2008, was recognized for his achievements in mining exploration by the Association for Mineral Exploration British Columbia with the H.H. "Spud" Huestis Award.

Jim Paterson has more than 22 years within the mining industry with experience in raising capital, M&A, joint-ventures, spin-outs, RTOs and IPOs. Currently, he is chairman and CEO of Valore Metals Corp and was a founding director of Northern Empire Resources Corp.

Genesis will benefit greatly from having these two men as strategic advisors, as it moves its flagship Chevrier Gold Project forward.

New Additions

In November of 2018, Genesis announced that Dr. Rob Carpenter, Dr. Andrew Ramcharan and Garrett Ainsworth would be joining its list of strategic advisors.

Dr. Carpenter is a professional geoscientist with over 25 years of experience in the resource sector. He is best known as co-founder, president and CEO of Kaminak Gold Corporation (2005 to 2013) and its multi-million ounce Coffee Gold Project, where he is credited with the initial discovery and leading the company to it maiden resource estimate. Kaminak was sold to Goldcorp in 2016 for $520 million.

Dr. Ramcharan is a professional engineer with over 18 years of experience in operations, project evaluation, M&A, finance and investor relations. Most recently, he was a managing director of project evaluation for both debt and equity financings at Sprott Inc.

Last but not least, Garrett Ainsworth is a geologist by trade and former VP exploration for NexGen Energy, which discovered the world-class Arrow Uranium Deposit in Canada's Athabasca Basin.

4th Best Jurisdiction for Mining Investment in the World

From a jurisdictional standpoint, it doesn't get much better than Quebec when it comes to mining investment attractiveness. The Fraser Institute (FI) gives Quebec an index score of 88.38, ranking it second in Canada and fourth in the world. FI's mining investment attractiveness index score is reflective of both the mineral potential and the government policy perception of the region.

Quebec's Mineral Potential

Quebec is home to 25 producing mines and over 350 surface mineral mining operations, putting the value of Quebec's mineral shipments at $8.7 billion in 2014 (Investissement Quebec). Quebec is Canada's second largest producer of gold, largest producer of iron and zinc, and the only North American producer of niobium. The mineral wealth is evident and is a big reason why FI ranks Quebec among the world's top ten in mining investment attractiveness.

Highlighting Quebec's world-class mineralization is the Abitibi Greenstone Belt (AGB), which is 150 km wide and stretches 650 km from roughly Wawa, Ontario, to Val d'Or, Quebec. The belt has produced millions of ounces of gold over its history, with the Cadillac Gold Camp, Virginiatown, Rouyn-Noranda Gold Camp, and Val d'Or Gold Camp being just a few of its largest contributors.

Quebec Politics and Infrastructure

The government of Quebec supports mineral exploration within its borders with a tax credit system that refunds 25% of eligible exploration expenses for non-operating corporations, and 10% of eligible exploration expenses for operating corporations (Financial Incentives). So, roughly, for every $1 of non-flow-through raised capital spent by a Quebec based mineral explorer, 25 cents will come back to the company, which can effectively be rolled right back into further exploration work. This is not only a huge plus for the company and its shareholders, but an ingenious way for the province to promote mineral exploration.

The long history of mining in the AGB means that most regions of the belt are accessible or near infrastructure such as highways, rail, power, and deep water ports along the St. Lawrence Seaway. Also, Quebec boasts some of the most competitive electricity rates in Canada, as its hydroelectric dams constitute a major portion of its electricity production.

Finally, Quebec takes great pride in a transparent mining system, which is built around three key pillars:

"Open access to resources is ensured on the largest possible portion of territory, Mineral rights are granted on a first-come, first-served basis and if a discovery is made, the title holder can be reasonably sure of obtaining the right to develop the resource." ~ Investissement Quebec

NOTE: Quebec provincial funds, SIDEX, SDBJ and FTQ, have participated in past private placements in Genesis and now own a good portion of stock. In my mind, it's a great indication of the potential value that the Chevrier Gold Project may have moving forward.

Favorable politics and world-class geology—for me, it doesn't get much better than Quebec, as far as your investment buck goes!

Chevrier Gold Project

Genesis' 100%-owned Chevrier Gold Project encompasses 275 square km and is located 35 km south of Chibougamau, Quebec, in the heart of the Abitibi Greenstone Belt. Chevrier straddles 15 km of the Fancamp Deformation Zone, and is 15 km northeast of IAMGOLD's high-grade Monster Lake gold deposit.

NOTE: The IAMGOLD and Toma Gold Monster Lake JV released their maiden inferred resource of 433,300 ounces of gold at 12.14 g/t at a 3.5 g/t cut-off.

Chevrier Gold Project History

Prior to Genesis, the area in which the Chevrier deposit is located was owned and explored by Inmet Mining Inc. (Minnova), which, in 1989, was the first to drill the now Main Zone of Chevrier, where it intersected gold grading 5.4 g/t. The property was then purchased by Geonova Explorations, which outlined Chevrier's Main Zone.

In 2007, the property changed owners once again, with Tawsho taking the reins. That company went on to complete a 2,792 km aeromagnetic survey, a ground EM Time Domain survey, 24 diamond drill holes, an independent NI 43-101 resource estimate (by Met-Chem Canada Inc.), and a 5,000 ton bulk sample.

Since Genesis acquired Chevrier in Q2 of 2016, it has completed a long list of work that includes the inventory of more than 70,000 meters of drill core, the re-sampling and re-assaying of selected mineralized intervals, re-sampling of four trenches, 3D modelling of Main, South and East Zones, 50+ km of IP surveying, and executed a 10,000 meter drill program, which focused on confirming historical Geonova drill holes, exploration stepout holes on the Main Zone Deposit and the exploration of other IP and geological targets. Results from this program can be found on Sedar.

New Geological Model

Over its 29 year history, Chevrier has seen 213 drill holes, totalling over 87,000 meters. However, the Genesis team is the first to consolidate, re-evaluate and form a comprehensive geological model regarding the Main Zone's gold mineralization.

Below is an image of the mineralization within the Main Zone, using a 0.3 g/t Au grade shell.

Chevrier Gold Project – Plain View of the Main Zone Deposit

Chevrier Gold Project Resource Update

Using the new geological model and the compiled data from the most recent drill program, Genesis has released an updated resource for the Chevrier Gold Project. The updated resource includes the Main and East Zones and, as described in the previous section of the report, envisions a mining scenario in which there is both an open pit and underground workings.

Indicated Gold Resource – 395,000 ounces averaging 1.45 g/t

Inferred Gold Resource – 297,000 ounces averaging 1.33 g/t

NOTE: With a combined indicated and inferred resource of 692,000 ounces of gold, and with Genesis' MCAP sitting below $10 million, this presents an interesting value proposition. Keep in mind, not all ounces are of equal value, but nonetheless, this is a good high-level indicator of value.

This is a great start for the Genesis team as, collectively—indicated and inferred—they sit very close to 1 million ounces of gold in an area of the Abitibi that looks poised for development in the coming years. Clearly, the next move for the Genesis team is to expand this new resource, which will be aided by its newly formed strategic advisors team.

2019 and beyond should be very interesting for investors as they move forward.

Chevrier Resource Expansion

In terms of expanding the deposit, one of the best possibilities comes with drilling deeper, as the Principal Zones remain open at depth.

Chevrier Gold Project – Long Section of the Main Zone Deposit

To date, I believe there have only been a handful of holes drilled below 400m, each of which hit mineralization. Given the nature of many of the Abitibi gold deposits, such as Osisko Mining's Windfall Lake Gold Project, there is certainly the potential for more ounces to be found at depth.

I look forward to the next drill program which will test the extent of the mineralization at depth, and will most certainly tackle the other high priority targets on the property.

Concluding Remarks

The new gold bull market may be upon us, owning undervalued junior gold companies, such as Genesis, could be highly advantageous in the weeks and months ahead.

Investing in junior resource companies is risky and, therefore, in my opinion, you need to seek out companies that are led by strong management teams, who can navigate the risk and propel the company forward.

Genesis Metals is a company that I am invested in and believe has the horsepower, in terms of the management team, to move the Chevrier Gold Project forward. Clearly, the company must focus on expanding the resource by drilling deeper and exploring the property's high priority targets.

As outlined in my report, there is a strong list of advisors who have "been there and done that" within the resource sector, and I am confident will have a great influence on the direction of Genesis moving forward.

Summarizing my thesis for investment, here are what I think are a few of Genesis' most compelling strengths:

- A proven management team: Sundar, Fleming, Florek and Liboiron

- Strategic Advisors: Discovery Group's John Robbins and James Paterson, Dr. Robert Carpenter, Dr. Andrew Ramcharan, and Garrett Ainsworth.

- Strategic Shareholders List Headlined by: Osisko Mining, Eric Sprott, Delbrook Capital, Gold 2000, US Global Investors, SIDEX/SDBJ/FTQ and Medalist Capital

- Located in the 4th best jurisdiction in the world, Quebec

- Systematic 2019 exploration program led by Vector Geological Solutions – high-grade gold targeting

- Expanded land package with high exploration potential, Chevrier Gold Project and October Gold Project

- Great bang for its drilling buck, as its all-in drill costs, thus far, have roughly averaged $220 per meter

Brian Leni is the founder and editor of Junior Stock Review. He is a professional engineer who has over 10 years of experience in heavy industry.

[NLINSERT]Disclaimer: The following is not an investment recommendation, it is an investment idea. I am not a certified investment professional, nor do I know you and your individual investment needs. Please perform your own due diligence to decide whether this is a company and sector that is best suited for your personal investment criteria. Currently, I do not own Genesis Metals Corporation stock. All Genesis Metals Corporation analytics were taken from their website and press release. Genesis Metals Corporation is a Sponsor of Junior Stock Review.

I hope you will find this article interesting and useful, and will have further interest in upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The Critical Investor is not a registered investment advisor, currently has a long position in this stock, and Genesis Metals is a syndication sponsoring company. The Critical Investor is compensated for the syndication of this article by Genesis Metals. All facts are to be checked by the reader. For more information go to www.genesismetalscorp.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Newmont Goldcorp and Coeur Mining, companies mentioned in this article.

Graphics provided by the author.