In a June 19 research note, analyst Pavel Molchanov reported that Raymond James downgraded its recommendation on SunPower Corp. (SPWR:NASDAQ) to Market Perform from Outperform following the stock's year-to-date 104% jump. The previous target price was $9 per share, and the share price currently is around $10.34. Raymond James does not have a current target price on SunPower.

Also noteworthy is that, looking forward, SunPower will likely face some macroeconomic tailwinds, Molchanov highlighted. They include the upcoming incremental decrease in the federal Investment Tax Credit (ITC) that will likely cause demand pullback as it plays out, affecting distributed, or commercial and residential, deployments the most. Starting in 2020, the ITC will drop from 30% to 10% for commercial and to 0% for residential.

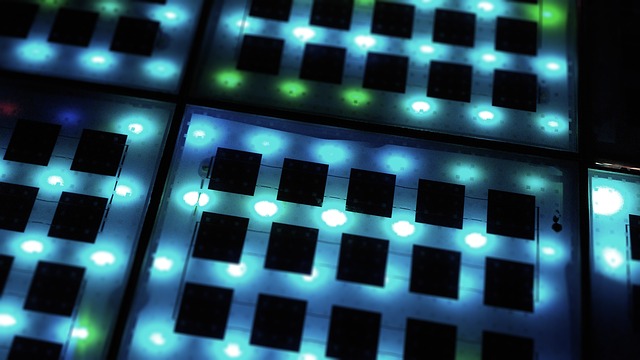

There also is the probability of renewed price pressure on photovoltaic (PV) modules, Molchanov pointed out, as Chinese competitors continue to capture market share and the Section 201 tariff phases out, from 25% today to 20% in 2020, 15% in 2021 and zero subsequently. The latter will diminish the pricing advantage that SunPower and other tariff-exempt companies had.

However, SunPower "has a solid position due to its status as an integrated player, including leverage to distributed PV and battery storage, both being themes that we like," Molchanov noted. It also has the "added bankability advantage of having the energy giant Total as a 'big brother.'"

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from Raymond James, SunPower Corp., June 19, 2019

ANALYST INFORMATION

Analysts Holdings and Compensation: Equity analysts and their staffs at Raymond James are compensated based on a salary and bonus system. Several factors enter into the bonus determination, including quality and performance of research product, the analyst's success in rating stocks versus an industry index, and support effectiveness to trading and the retail and institutional sales forces. Other factors may include but are not limited to: overall ratings from internal (other than investment banking) or external parties and the general productivity and revenue generated in covered stocks.

The analyst Pavel Molchanov, primarily responsible for the preparation of this research report, attests to the following: (1) that the views and opinions rendered in this research report reflect his or her personal views about the subject companies or issuers and (2) that no part of the research analyst's compensation was, is, or will be directly or indirectly related to the specific recommendations or views in this research report. In addition, said analyst(s) has not received compensation from any subject company in the last 12 months.

RAYMOND JAMES RELATIONSHIP DISCLOSURES

Certain affiliates of the RJ Group expect to receive or intend to seek compensation for investment banking services from all companies under research coverage within the next three months.

Raymond James & Associates, Inc. makes a market in the shares of SunPower Corporation, Enphase Energy, Inc. and TPI Composites, Inc.

Raymond James & Associates or one of its affiliates owns more than 1% of the outstanding shares of TPI Composites, Inc.

Additional Risk and Disclosure information, as well as more information on the Raymond James rating system and suitability categories, is available here.