After expressing optimism about Newrange Gold Corp.'s (NRG:TSX.V; CMBPF:OTCMKTS) early metallurgical testing, I said that I hope to provide an update on the latest exploration plans of the company in my next weekly message.

The company's CEO, Robert Archer, saw my comment and reached out to me with a phone conversation on April 11. Regarding exploration plans, they are still being discussed internally, but what I can tell you is that there are a few hugely positive developments that have management rethinking how they approach exploration on this project. As reported in the company's March 26 press release, management is now talking about the following three types of gold mineralization on the project:

- High-grade (over 10 grams per tonne) gold mineralization.

- Local fracture-controlled mineralization with coarse visible gold that exists in discontinuous vein-like structures that cut mid-grade (one gram per tonne to 10 grams per tonne gold).

- Surrounding local fracture-controlled mineralization is surrounded by a large cloud of lower-grade (under 1.0 gram per tonne gold) mineralization.

So, regarding the positive discoveries recently announced by the company, the first major positive in my mind may be the third type of mineralization noted above. While investors tend to get most excited by splashy high-grade intercepts like those at Great Bear's Dixie Project, the third type of mineralization on Newrange's Pamlico Project may be the most important in terms of the economic potential at Pamlico. It suggests the possibility of a larger-scale bulk mining project, especially given indications of very positive metallurgy as well as the fact that the Pamlico oxide material that leaches very well extends to an unusually deep 300 meters from surface. In other words, it seems to me there is clearly the potential for a very-large-scale bulk mineable gold deposit, which, given high-grade sweeteners could make this a high margin project. Obviously it is way too early to take that to the bank. But early indications are very positive.

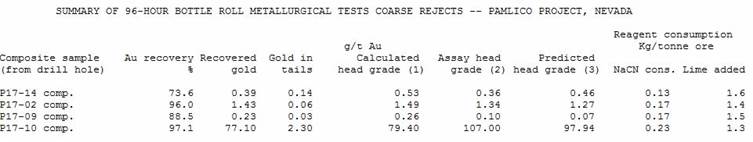

Second, metallurgy so far is looking stellar. For example, on February 5, management reported that bottle roll leach tests recovered up to 97.1% on the highest-grade sample of four that were tested. The lowest recovery was 73.6%, which is still a respectable leach recovery.

Recoveries of the other two were 88.5% and 96%. But that's not all the good news to come out of these early leach recovery tests. Management reports a very rapid leach time (96 hours) for those results, and the reagent required was extremely low. In addition, it appears likely that an extended leach time would improve recoveries even beyond the 97.1% recovery for the high-grade sample because it was still yielding gold when the leach was terminated. But there is one more point regarding the February 5 report and that is that as you can see from the table below for the three lowest-grade composite samples, the average grade of the gold actually recovered by leaching (from calculated head grades) was 27 per cent higher than the predicted or assay head grades, suggesting both better grades, larger volumes and therefore more gold may be present in the large clouds of stock work or disseminated mineralization surrounding the structurally controlled high-grade gold at Pamlico.

The third point that has me excited is results from the company's ongoing metallurgical studies that show the potential to create a high-grade concentrate from the Pamlico Project where a preliminary screen test has successfully produced a concentrate assaying 26.53 grams gold per tonne gold from sampled mineralization with a head grade of 4.291 grams per tonne gold. The original sample was dry screened, with no crushing, into two size fractions—a coarse fraction (plus-95 millimeters) and a fine fraction (minus-95 millimeters). The two fractions were then submitted to American Assay Labs in Sparks, Nev., for analysis. The coarse fraction assayed 1.02 grams per tonne gold and contained only 20.72 per cent of the gold in 87.18 per cent of the sample volume, while the fine fraction assayed 26.53 grams per tonne gold, representing 79.28 per cent of the gold, in 12.82 per cent of the original sample weight. The results are set out in the chart below. Additional samples from multiple areas on the property have been collected and submitted for further screen testing to examine optimal sizes, and to evaluate wet and dry screening and other techniques to further increase the gold reporting to the fine fraction and reduce the gold content of the coarse fraction.

If these results hold up over the entire project or a large portion of it, they may have a very significant positive impact on the economics of the project. As Bob Archer noted in the April 4 press release, "By implementing simple, low-cost screening and concentrating approximately 80 per cent of the gold in less than 13 per cent of the sample weight, it may be possible to eliminate a crushing circuit altogether, to mine large volumes of low-grade mineralization, and substantially reduce the volume of material to be processed. This, in turn, would result in a smaller processing facility, materially reducing permitting requirements, capex and opex costs. Furthermore, it indicates the potential to deliver higher-grade feed to a processing facility, thereby allowing more intense treatment of higher-grade material, which could result in higher extraction and recovery rates."

One last positive I would like to mention is that with ongoing mapping and sampling, new unknown adits and stopes were discovered beyond the known old workings, expanding the known footprint of this mineralized system by 1 to 1.5 kilometers to the south.

Based on the growing list of positive aspects to the Pamlico Project, Newrange is an excellent example of a highly prospective gold exploration project that is getting very little interest from the market. Given his past success, Bob Archer has the ability to find investors of significance that can generate interest in this story. In advance of his success in that regard, you may want to consider picking up a few shares before they become dearer.

As he followed the demolition of the U.S. gold standard and the rapid rise in the national debt, Jay Taylor's interest in U.S. monetary and fiscal policy grew, particularly as it related to gold. He began publishing North American Gold Mining Stocks in 1981. In 1997, he decided to pursue his avocation as a new full-time career—including publication of his weekly J. Taylor's Gold, Energy & Tech Stocks newsletter. He also has a radio program, "Turning Hard Times Into Good Times."

[NLINSERT]Disclosure:

1) Jay Taylor's disclosures are below.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Great Bear Resources. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Charts and graphics provided by the author.

J Taylor's Gold, Energy & Tech Stocks (JTGETS), is published monthly as a copyright publication of Taylor Hard Money Advisors, Inc. (THMA), Tel.: (718) 457-1426. Website: www.miningstocks.com. THMA provides investment ideas solely on a paid subscription basis. Companies are selected for presentation in JTGETS strictly on their merits as perceived by THMA. No fee is charged to the company for inclusion. The currency used in this publication is the U.S. dollar unless otherwise noted. The material contained herein is solely for information purposes. Readers are encouraged to conduct their own research and due diligence, and/or obtain professional advice. The information contained herein is based on sources, which the publisher believes to be reliable, but is not guaranteed to be accurate, and does not purport to be a complete statement or summary of the available information. Any opinions expressed are subject to change without notice. The editor, his family and associates and THMA are not responsible for errors or omissions. They may from time to time have a position in the securities of the companies mentioned herein. No statement or expression of any opinions contained in this report constitutes an offer to buy or sell the shares of the company mentioned above. Under copyright law, and upon their request companies mentioned in JTGETS, from time to time pay THMA a fee of $250 to $500 per page for the right to reprint articles that are otherwise restricted solely for the benefit of paid subscribers to JTGETS.