In an April 15 research note, ROTH Capital Partners analyst Yasmeen Rahimi reviewed the reasons why Galmed Pharmaceuticals Ltd. (GLMD:NASDAQ) is "high on the mergers and acquisitions candidate list."

ROTH Capital Partners, she added, believes "all the ducks are in a row for large pharma suitors [and] the clock is now ticking until a deal strikes."

There isn't much time left for big pharma to make a move, Rahimi indicated. Last week, at Galmed's post Phase 2 meeting with the FDA, the agency gave the company the greenlight to proceed with its Phase 3 ARMOR trial of Aramchol in nonalcoholic steatohepatitis (NASH) patients with fibrosis. During the meeting, the two parties agreed on key trial design components, including patient population, endpoints, treatment duration and dose.

Second, Rahimi pointed out, Galmed is trading eight to 16 times lower than other biopharma companies on the brink of a Phase 3 trial, the valuation making the company attractive from a suitor's standpoint.

Third, Galmed's drug candidate is "highly safe and globally tested," as about 200 centers, in the U.S. and around the world, were involved in the previous ARMOR study.

Last, because the company's Phase 3 Aramchol study in NASH would be global, the cost to conduct it would be about five times less than what it would be in the U.S. alone.

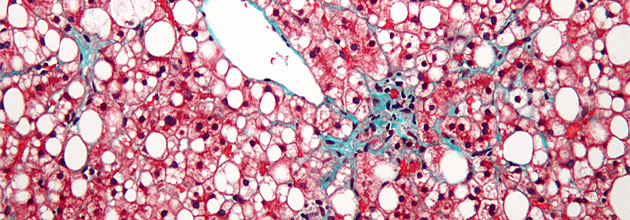

In other news, Rahimi reported, Galmed had a poster presentation at the recent annual meeting of the European Association for the Study of the Liver. It contained preclinical data that show Aramchol improved liver glucose homeostasis in a NASH mice model.

Specifically, mice fed the MCD diet, containing 0.1% methionine, and administered Aramchol demonstrated statistically significant reductions, or about 1.5 to four times the control, in key markers. They also showed dose-dependent improvements in glycolysis and gluconeogenesis. "The poster noted that the reduction in FBP (first irreversible step in glycolysis) could be responsible for the regulation of the adenosine monophosphate-activated protein kinase activity, signifying altered control of energy homeostasis," Rahimi noted.

ROTH has a Buy rating and a $32 per share price target on Galmed, whose stock is trading today at around $8.02 per share.

[NLINSERT]Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Disclosures from ROTH Capital Partners, Galmed Pharmaceuticals Ltd., Flash Note, April 15, 2019

Regulation Analyst Certification ("Reg AC"): The research analyst primarily responsible for the content of this report certifies the following under Reg AC: I hereby certify that all views expressed in this report accurately reflect my personal views about the subject company or companies and its or their securities. I also certify that no part of my compensation was, is or will be, directly or indirectly, related to the specific recommendations or views expressed in this report.

Within the last twelve months, ROTH has received compensation for investment banking services from Galmed Pharmaceuticals Ltd.

ROTH makes a market in shares of Galmed Pharmaceuticals Ltd. and as such, buys and sells from customers on a principal basis.

Within the last twelve months, ROTH has managed or co-managed a public offering for Galmed Pharmaceuticals Ltd.

ROTH Capital Partners, LLC expects to receive or intends to seek compensation for investment banking or other business relationships with the covered companies mentioned in this report in the next three months.