Lithium and cobalt companies are a hidden gem in the mining sector. Lithium and cobalt, along with nickel, are the primary metals used in most modern batteries.

42% of the world's cobalt production goes toward the creation of lithium-ion cell batteries.

According to the Cobalt Institute, lithium-ion batteries have higher energy density than other battery types and are used in laptops, smartphones, medical devices and electric vehicles, in addition to having a number of other industrial applications. Needless to say, the need for lithium and cobalt won't be diminishing anytime soon.

While an initial spike in prices led to investor euphoria in 2017, that euphoria quickly faded as prices corrected sharply in 2018 and into 2019. But there is evidence to suggest that a huge boom in the battery metals may still be just around the corner. If so, this could be an excellent opportunity for contrarian investors to start accumulating shares on the cheap.

Before getting into two of the best lithium and cobalt stocks in 2019, let's briefly examine the case for an imminent increase in demand for lithium and cobalt.

Lithium and Cobalt Demand Set to Surge

With the proliferation of smartphones and electric vehicles, demand for lithium and cobalt has become entrenched in the global economy. And over the next five years, it seems almost certain that increasing amounts of lithium and cobalt will be needed for producing batteries.

Benchmark Mineral Intelligence Managing Director Simon Moores told the U.S. Senate in February 2019 that he sees global cobalt demand rising fourfold by 2023 and higher still by 2028. This estimate factors in the potential decrease in demand resulting from companies like Tesla seeking to reduce reliance on cobalt in their batteries in order to reduce supply-side risks.

Moores' report puts into perspective the dramatic increase in production of lithium-ion batteries:

"The advent of electric vehicles (EVs) and the emergence of battery energy storage has sparked a wave of lithium ion battery mega factories being built. Benchmark Mineral Intelligence is now tracking 70 lithium ion battery mega factories under construction across four continents… in October 2017, the global total was at 17."

That one little factoid is all anyone really needs to know in order to get the picture of increasing demand for lithium and cobalt. The question for investors then becomes: what small cap lithium and cobalt companies are in a position to capitalize on and profit from this trend?

Two Lithium and Cobalt Companies with Promising Futures

Lithium Americas Corp. (LAC:TSX; LAC:NYSE) has a lithium project in Argentina and another in Nevada. It has seen increased investor interest lately and the share price has started to move higher. Someone has been buying shares of LAC as if they know something the rest of the world doesn't.

First Cobalt Corp. (FCC:TSX.V; FTSSF:OTCQX; FCC:ASX) is among the few leaders in the cobalt sector seeking to establish a North American cobalt supply chain. The company recently closed a $1.6 million private placement and the share price is showing signs of bottoming.

While there are plenty of lithium and cobalt companies to choose from, we believe these two provide excellent chances for profit as the sector expands.

Lithium Americas

Lithium Americas has two big projects under its belt: the Cauchari-Olaroz project in Argentina and the Thacker Pass project in Nevada.

Cauchari-Olaroz Project

The Cauchari-Olaroz project is one of the largest known brine lithium resources in the world. The company recently increased the resource by 53% to 17.9m measured and indicated tonnes of lithium carbonate equivalent (LCE). It is a high-grade resource, with few impurities and low costs.

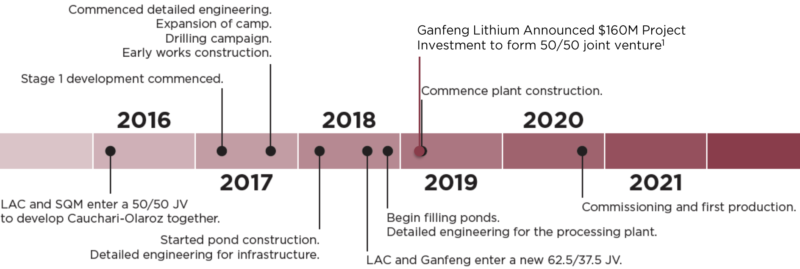

Lithium Americas owns 50% of the project with Gangfeng Lithium owning the other half. Gangfeng recently made a new investment of $160 million into the project to increase its stake to 50%. It is targeting initial production in the back half of 2020, as shown in the timeline below.

Some of the key points in Cauchari-Olaroz part of the press release include:

Production wells: Currently there are seven wells in production and three more are under construction. By the end of April, the project is scheduled to have seven drilling rigs mobilized at site for drilling of additional production wells.

Civil: Work associated with roads and platforms continues as planned. Contracts have been awarded for earthworks (plant and operations camp), concrete supply and other key items.

Procurement: Minera Exar is in the process of reviewing proposals for long lead items and expects to finalize such awards in due course.

Cauchari-Olaroz will have 40,000 tpa lithium carbonate capacity. I also like the fact that management's interests are highly aligned with shareholders. Management and directors own 12.1% of the company.

The Stage 1 Feasibility study returned results that include: 25,000 tpa battery grade lithium, a 40 year project life, operating costs of $2,495/t, an after-tax NPV of $803 million at a 10% discount rate, a 28.4% after-tax IRR and 3.4 year payback.

Thacker Pass Project

The Thacker Pass project is a Nevada-based lithium mining operation taking place in the largest known lithium deposit in America. The project is 100% owned by Lithium Americas and is not part of any joint venture. This puts LAC in a unique position to profit from the rising demand for lithium.

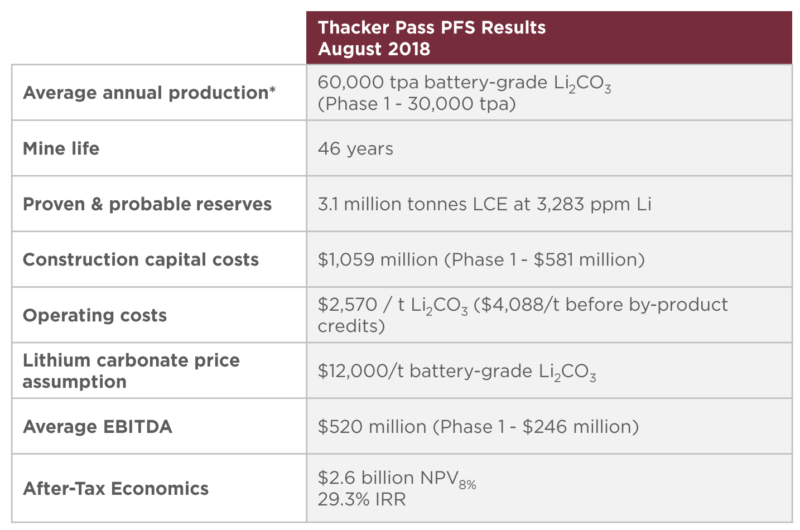

The Thacker Pass project is economic, scalable, and the company intends to use a cutting-edge method of extracting lithium directly from claystone deposits. It is making steady progress with commissioning of the pilot plant well underway. Environmental baseline data has been collected, permit applications are advancing, and a Preliminary Feasibility Study was released back in August of 2018.

The PFS called for 60,000 tpa battery-grade lithium, a mine life of 46 years, operating costs of $2,570/t, an after-ax NPV of $2.6 billion and IRR of 29.3%.

The technical chart shows that the recent spike took out key resistance at the red downtrend line and did it on exceptionally high volume. This also pushed the price through both the 100-day and 200-day moving averages. Adding to the bullish move, the recent advance pushed the price for LAC above resistance at $4.50, which held twice over the past six months.

Lithium

Lithium

Lithium Americas (LAC) Chart

Higher highs and higher lows since bottoming late last year is another bullish technical sign for LAC. The relative strength index (RSI) was overbought in early March, dipped to 40 during the pullback and is currently at 60 with room to run higher. There is plenty of upside potential for LAC, as it would need to more than double just to return to 2018 highs.

First Cobalt

First Cobalt is a Canada-based pure-play cobalt company and owner of the only permitted primary cobalt refinery in North America. The company is exploring a restart of the First Cobalt refinery in Ontario, Canada, which could produce 2,000 tonnes of cobalt sulfate or metallic cobalt per year.

First Cobalt's flagship asset is the Iron Creek Cobalt Project in Idaho, U.S., which has Inferred mineral resources of 26.9 million tonnes grading 0.11% cobalt equivalent. The company's other assets include 50 past-producing mines in the Canadian Cobalt Camp and the only permitted cobalt refinery in North America capable of producing battery materials.

An updated mineral resource estimate is expected in the near term and the resource contains no arsenic, which means simpler processing & permitting.

FCC is among a small handful companies around taking advantage of what's known as the Idaho Cobalt Belt. This area in Lemhi County, Idaho, is thought to be one of the most cobalt-rich regions in America. The Iron Creek Cobalt Project consists of 1,700 acres worth of exploration claims and mining patents in the Idaho Cobalt Belt.

The company just announced it has successfully produced a battery grade cobalt sulfate using the First Cobalt refinery flowsheet. This significant milestone brings the company closer to recommissioning the only permitted primary cobalt refinery in North America. It also owns 45% of the cobalt camp surrounding the mine, including 50 past producing mines.

On March 29, 2019, FCC announced a non-brokered private placement that raised $1.6 million by issuing 8.9 million shares of the company at $0.18. The proceeds are being used for ongoing work at the First Cobalt refinery and other general purposes.

The technical chart shows the price putting in a double bottom this year and breaking out above the long-term downtrend lines. We also see a series of higher highs on the chart, coupled with increasing volume. This all suggests a bottoming in the share price for First Cobalt.

First Cobalt (FTSSF) Chart

The RSI is at 55, with plenty of room to continue higher without hitting overbought levels. As with Lithium Americas, the upside potential with First Cobalt is massive. The share price would need to go up roughly nine times in order to return to 2018 highs. The first half of 2019 appears to be an excellent time to start edging into a position in First Cobalt Corp.

Best Lithium and Cobalt Stocks: Lithium Americas and First Cobalt

It's not hard to make the case for Lithium Americas and First Cobalt being two of the top battery metals companies to invest in during 2019.

Lithium Americas is preparing to mine the largest deposit of lithium in America and just secured $160 million in funding from their JV partner Gangfeng Lithium.

First Cobalt owns the only permitted cobalt refinery on the continent, a highly prospective cobalt project in Idaho and a camp with multiple projects near their refinery in Ontario.

Both companies have seen significant insider buying in recent months and both companies are starting to show bottoming patterns in their technical charts. This makes the current entry points attractive for long-term investors wanting to bet on increased prices for battery metals.

The absolute bottom may have yet to be hit for either stock, but this could be a good time to start accumulating shares via buying in tranches.

Both the fundamentals and technicals suggest that higher prices are in store for the lithium and cobalt sectors. This may not be the most popular time to buy, but contrarian investors know that the precise time to buy is when others are selling and there is blood in the streets. Prices for lithium, cobalt and the companies that mine these metals look very oversold and undervalued in our view.

If you are interested in getting free updates with our investment research and trading ideas, click here.

Jason Hamlin

Founder - Gold Stock Bull

Jason Hamlin is the founder of goldstockbull.com and publishes a highly rated investment newsletter focused on precious metals and cryptocurrencies. Hamlin has a background analyzing charts and trends for the world's largest market research company, is versed in fundamental and technical analysis and has consulted to Fortune 500 companies around the globe. Hamlin is a cycles investor, student of Austrian economics and speaks regularly at investment conferences. The Gold Stock Bull newsletter is focused on finding junior mining companies that are undervalued relative to their peers and early-stage cryptocurrencies and ICOs that can provide investors with high levels of returns.

[NLINSERT]Disclosure:

1) Jason Hamlin: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Lithium Americas Corp. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. Gold Stock Bull disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.

Graphics provided by the author.

Gold Stock Bull is not an investment advisory service, nor a registered investment advisor or broker-dealer and does not purport to tell or suggest which securities or currencies customers should buy or sell for themselves. All ideas, opinions, and/or forecasts, expressed or implied herein, are for informational purposes only and should not be construed as a recommendation to invest, trade, and/or speculate in the markets. Any investments, trades, and/or speculations made in light of the ideas, opinions, and/or forecasts, expressed or implied herein, are committed at your own risk, financial or otherwise. The information on this site has been prepared without regard to any particular investor's investment objectives, financial situation, and needs. Accordingly, investors should not act on any information on this site without obtaining specific advice from their financial advisor. Past performance is no guarantee of future results. Full disclaimer.