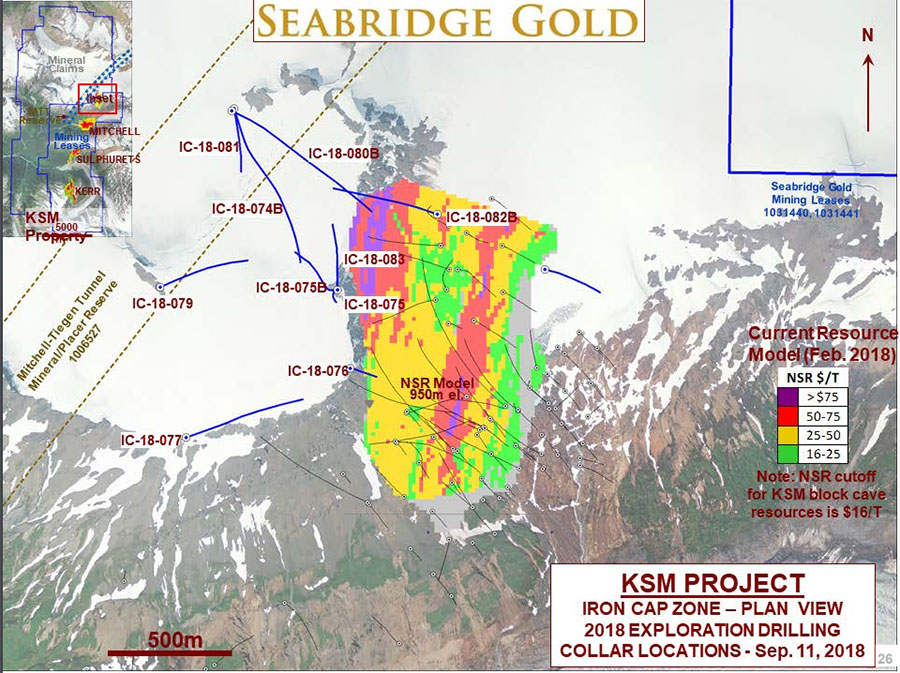

Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) announced in a news release that the March 7 updated resource estimate for Iron Cap contains shows a size increase and confirmed the high-grade zones in the overall resource.

The independent study, prepared by RMI, for this northwest British Columbia deposit encompasses all previous drill results along with findings from 18 holes and 20,341 meters of diamond core drilling done last year.

The current total resources are 423 million tons (423 Mt) in the Indicated category and 1,899 Mt in the Inferred, which compare to 370 Mt and 1,297 Mt, respectively, on the previous estimate of February 2018.

The update reflects an increase in Indicated resources by 0.46 million ounces (0.46 Moz) of gold and 177 million pounds of copper. Inferred resources also grew, by 7.45 Moz gold.

As for grades, the Indicated category contains 0.41 grams per ton (0.41 g/t) gold, 4.6 g/t silver, 0.22% copper and 41 parts per million (41 ppm) molybdenum. The Inferred category encompasses 0.45 g/t gold, 2.6 g/t silver, 0.30% copper and 30 ppm molybdenum.

The size and grade of Iron Cap's resource, as reflected in the update, are such that Seabridge could move this deposit ahead of the Kerr and Sulphurets deposits in the mine plan's sequence. Also, Iron Cap is closer to existing infrastructure and could be developed more quickly and at less cost, the company noted.

Read what other experts are saying about:

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise Reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Seabridge Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases.