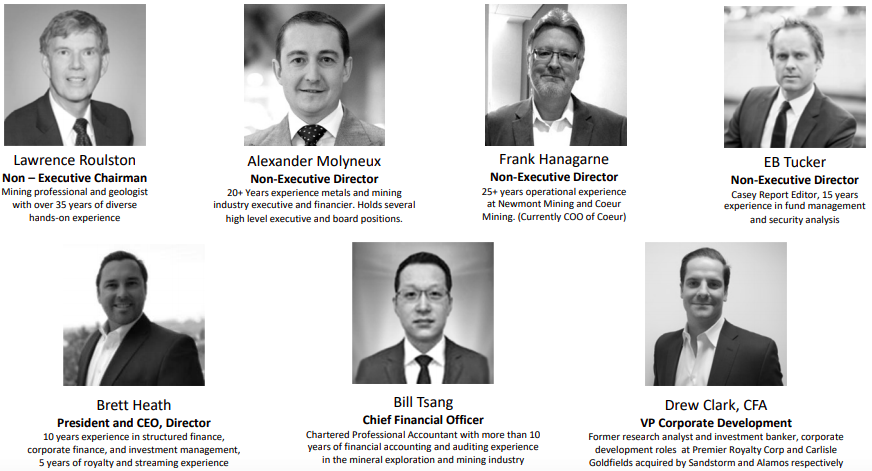

This interview with Brett Heath, CEO of Metalla Royalty & Streaming Ltd. (MTA:TSX.V; EXCFF:OTCQB), took place by phone and email over the past 10 days. Brett and his expert team have achieved quite a lot over the past year. In this interview I asked Brett for an update as I am especially interested in Metalla's latest transaction, (a 2% NSR) on the Santa Gertrudis Royalty. Please take a few minutes to review Metalla's new corporate presentation at the bottom of the interview.

Peter Epstein: Please describe the importance of your most recent acquisition, the Santa Gertrudis Royalty (a 2% NSR).

Brett Heath: The Santa Gertrudis royalty has the potential to be a company-maker for Metalla. The expansive 42,000-hectare property in Sonora Mexico hosts Carlin-type deposits, similar in nature to what has created some of the largest hydrothermal gold deposits in the world. This, combined with a world-class major gold producer in Agnico Eagle Mines Ltd. (AEM:TSX; AEM:NYSE) as the operator, which has invested upward of $100 million ($100M) into the asset, shows the confidence and potential of further upside surprises like the new high-grade discovery of the Centauro Zone. With an overall strike length of 18 km on the Santa Gertrudis property, which has already been identified, Metalla is positioned to benefit from additional exploration success from the balance of Agnico's 2018 drilling campaign and beyond.

PE: Can we get an update on your two or three most important assets?

BH: The Endeavor mine, operated by CBH Resources (a subsidiary of Toho Zinc Co. Ltd. [TYO: 5707]), where we have a silver stream that contributes the most significant portion of Metalla's cash flow, continues to show signs of further exploration success of the Deep Zinc Lode discovery that was made earlier this year. We hope to have an update in 2019 that outlines a mine plan extension past December 2020.

Also, we are expecting a resource update in January 2019 from Osisko Mining Inc. (OSK:TSX) on the Garrison gold property, where Metalla has a 2% NSR royalty. Osisko has drilled an additional 90,000 meters since the latest PEA (the PEA has just under 2 million ounces of gold resources). We are expecting a significant improvement in total ounces, but also an improvement in the categories of Measured and Indicated.

Finally, the Joaquin project, which is being developed by Pan American Silver Corp. (PAAS:TSX; PAAS:NASDAQ), where Metalla owns a 2% NSR, continues to show progress. Pan American has stated it now expects production in Q1/2020.

PE: The Santa Gertrudis deal puts your market cap above CA$80M. At what stage might a mid-tier precious metals royalty and streaming company like Sandstorm Gold (SSL:TSX; SAND:NYSE.MKT; ~CA$1 billion market cap), or Maverix Metals (MMX:TSX.V; MACIF:NASDAQ; ~CA$515M market cap) show interest in acquiring Metalla?

BH: The bigger royalty companies historically look to take over smaller royalty companies when gold and silver enter into a bull market. This is because mining company equity often becomes overvalued, making it less costly to acquire a company like Metalla outright, rather than take on a royalty or stream. Bigger royalty companies that trade at much higher valuations can provide big premiums to smaller royalty companies while still being accretive.

One of the biggest problems the big royalty companies have in a bull market in precious metals is growth. That's because providing project capital to mining companies usually gives them a two to three year window for those projects to come online. They are forced to look at buying companies like Metalla or price royalties or streams at a much higher cost. Historically that hasn't worked out so well.

A crucial part of our portfolio is royalties on development projects with major mining companies. We think these assets will command a large premium in the future, potentially even more than our royalties that are already producing.

PE: Silver and gold prices (in U.S. dollars) have been weak this year, down 16% and 6%, respectively, how much is that likely to impact your FY 2019 earnings (for the year ending May 2019)?

BH: We take metal price risk along with the mining companies, specifically on silver, where 100% of our cash flow comes from currently. What is important to remember is that royalty and streaming contracts offer guaranteed margins. So where a mining company may be break even or lose money at a slightly lower gold or silver price, Metalla will always have cash flow, as long as the asset is in production. More importantly, when precious metals prices rise, there is a tremendous amount of leverage built in that translates directly to the shareholders of Metalla.

PE: On the other hand, lower precious metals prices might enable Metalla to strike better deal terms. Do you see more attractive transaction opportunities?

BH: We are looking to lock up as much gold and silver in royalty and streaming contracts as we can at current prices. These are the times when incredible deals can be struck, and, as an investor of Metalla, we pay you to wait through our monthly dividend program.

PE: What can you tell readers about new deals you're actively working on, deals that could be announced within the next six months?

BH: I can tell readers that the hardest part of building a royalty company is getting to a place of critical mass. I believe we have achieved this in the first two years at Metalla, and I think it will be easier to scale this company from CA$80M to CA$500M than it was to go from CA$0 to CA$80M. Now is the time to position for the next cycle before the institutions take notice of what we have built.

PE: Your current annualized distribution yield is 2.25% (based on CA$0.80 stock price), the highest of any precious metals-focused royalty/streamer I know of. As the company grows, what are the implications for monthly distributions over the next 6-12 months?

BH: We hope to bring on some royalties that are currently producing over the next six months. If we do, the development pipeline could allow us to enhance our dividend program. We have stated a 50% dividend payout goal, but we are prudently working our way toward that goal.

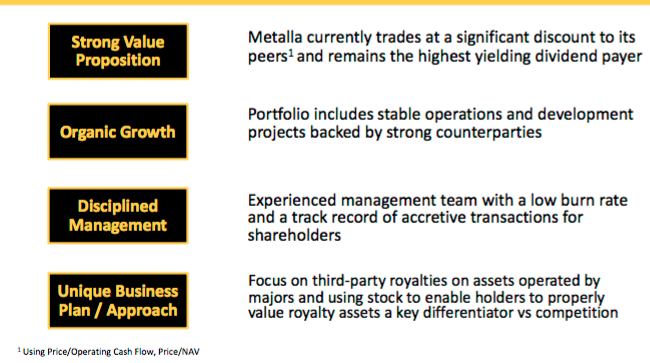

PE: In terms of company valuation, how does Metalla compare to peers? What metrics do you use in your comparisons?

BH: We still trade at a steep discount to peers based on a net asset value (NAV) perspective. As we grow Metalla to CA$100M+ in market cap, we expect investment banks to pick up research coverage of us, showing the deep value Metalla has to offer. This could be a big potential catalyst for shareholders over the coming year.

PE: Why should readers consider buying shares of Metalla Royalty & Streaming Ltd. instead of other precious metals companies?

BH: We have a strategy, focusing on the preexisting royalty market, that has allowed us to excel in what is a very competitive industry. As a first mover, this should continue to translate into outperformance among our peers.

PE: Thank you again, Brett, for your time and thoughtful responses to my questions. Your company is growing nicely, keep up the good work.

{Metalla's November Corp. Presentation}

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis. He holds an MBA degree in financial analysis from New York University's Stern School of Business.

[NLINSERT]Disclosures: The content of this interview is for illustrative and information purposes only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research, [ER] including but not limited to, commentary, opinions, views, assumptions, reported facts, estimates, calculations, etc. is to be considered implicit or explicit, investment advice. Further, nothing contained herein is a recommendation or solicitation to buy or sell any security. Mr. Epstein and [ER] are not responsible for investment actions taken by the reader. Mr. Epstein and [ER] have never been, and are not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and they do not perform market making activities. Mr. Epstein and [ER] are not directly employed by any company, group, organization, party or person. Shares of Metalla Royalty & Streaming are speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they consult with their own licensed or registered financial advisors before making investment decisions.

At the time this article was posted, Peter Epstein owned shares in Metalla Royalty & Streaming, and the Company was an advertiser on [ER].By virtue of ownership of the Company's shares and it being an advertiser on [ER], Peter Epstein is biased in his views on the Company. Readers understand and agree that they must conduct their own research, above and beyond reading this article. While the author believes he’s diligent in screening out companies that are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. Mr. Epstein & [ER] are not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article. Mr. Epstein & [ER] are not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. Mr. Epstein and [ER] are not experts in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article until three business days after the publication of the interview or article. The foregoing prohibition does not apply to articles that in substance only restate previously published company releases. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Metalla Royalty and Streaming, a company mentioned in this article.

Charts and graphics provided by author.