San Miguel open pit; Pirquitas Mine

1. Introduction

Although silver does not get much love lately, there are silver plays around that could move significantly as soon as the price of the metal recovers in more positive precious metals sentiment. One of these plays is Golden Arrow Resources Corp. (GRG:TSX.V; G6A:FSE; GARWF:OTCQB). Despite the name, this junior doesn't own one NI-43-101 compliant ounce of gold in the ground yet. Its flagship project is called Chinchillas, located in the Jujuy province in Argentina, and is a large, open pit silver/lead/zinc project. At the moment it is on the brink of production, as part of the Puna Operation, a joint venture (JV) with much larger gold/silver producer SSR Mining (SSRM.TO, market cap of C$1.6B, formerly known as Silver Standard).

The Chinchillas deposit has been turned into an open pit mine recently, and production is ramping up towards nameplate capacity. The ore is being delivered to the nearby Pirquitas processing plant, as the Pirquitas silver mine, previously owned by SSR Mining itself, was depleted this year.

SSR Mining has financed this whole operation, and Golden Arrow can sit back front row after paying back its 25% share of capex, and watch the show unfolding while being paid. As Golden Arrow gets 25% of after-tax net cash flow generated by Pirquitas, this is not much at this stage and silver price, but as soon as full production is reached by the end of this year and especially as the silver price starts rising again, the share price will probably see a strong re-rating. To get an indication of the upside potential, and other ins and outs of Golden Arrow, let us take a closer look.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

2. Company

Golden Arrow Resources is an exploration and development company operating in Argentina, and member of the mining investment firm called Grosso Group, founded by Joe Grosso, who already pioneered successfully in mining for over two decades in Argentina. The Grosso Group made four major discoveries during that period: Gualcamayo, Navidad, Chinchillas and Amarillo Grande. The flagship project of Golden Arrow is the 25/75% Puna JV with operator SSR Mining, based on the Chinchillas deposit and the Pirquitas Mine, 45 kilometers away, which until very recently was one of the largest primary silver mines in the world, in the Jujuy province.

Both companies have a long history in this area, which probably has been beneficial for operations. Besides the Puna project, Golden Arrow also owns several gold/silver/copper exploration projects in Argentina and recently acquired the advanced Atlantida and Indiana copper-gold projects in Chile. These advanced exploration projects are united in a subsidiary called New Golden Explorations, and the plan is to acquire more projects, and spin this out from Golden Arrow in the early part of next year.

Chinchillas deposit; Argentina

Golden Arrow Resources has C$5 million in cash at the moment according to management/financial statements, and no long-term (LT) debt. The company recently (July 6, 2018 per MD&A) arranged a US$10 million credit facility with JV partner SSR Mining, confined to Puna capex obligations, with an interest rate of US Base rate plus 10% and a final maturity date of December 31, 2020. This short period explains the relatively high interest rate, but raising it through equity would have caused a lot of dilution anyway, so this way it can proceed with funding its part of capex. The loan is secured by the 25% ownership of Golden Arrow in Puna Operations.

Management, Board, insiders, friends and family control about 50% of shares, which is good to see, and JV partner SSR Mining holds about 5% of outstanding shares. There are 4.5 million warrants, with an average exercise price of C$0.70, and 9 million options with an average exercise price of C$0.53.

As of November 7, 2018, Golden Arrow Resources has a share price of C$0.25 and a market cap of C$25.4 million, with 101.97 million shares outstanding, and fully diluted 115.48 million. All options and warrants are out of the money at the moment. The average volume is a pretty liquid 294,195 shares.

Share price GRG.V, 3 year period (Source: tmxmoney.com)

Overall sentiment on the Venture isn't positive at the moment, but Golden Arrow has been hit particularly hard lately, most likely in my opinion because of the last financing round it initiated.

The company tried to raise C$2.625 million @ C$0.35 including a full 2-year warrant @ C$0.55 for general working capital, but failed unfortunately due to "current adverse mining market conditions," according to the news release of October 22, 2018. Golden Arrow had in fact raised most of the money, but did not want to lower the financing price as requested by several parties, so it decided to not pursue this further at this moment. Fortunately, it has the financial resources in place to fulfill the capex funding obligations for Puna Operations, and other, not further disclosed, near-term objectives.

As you see often, when a company wants to raise money, the word gets out among interested parties, and especially when these parties can get a full warrant they tend to sell lots of shares in advance, in order to walk the share price down to lower levels as much as possible, so most likely the upcoming placement gets priced not only at a discount but also at a discount to these lower levels, plus they get a free and most likely low priced warrant. It looked like this is exactly what happened, in addition to a sell recommendation of a U.S. based newsletter when there was a peak volume. The company was looking at re-pricing the financing, but decided not to proceed with it after all, which I actually consider to be not a very bad thing as almost 10% dilution at, for example, C$0.25 (which is a 2.5 year low) isn't very good for existing shareholders. A negative is that Golden Arrow can't use proceeds to acquire/fund exploration projects and needs to wait for another opportunity.

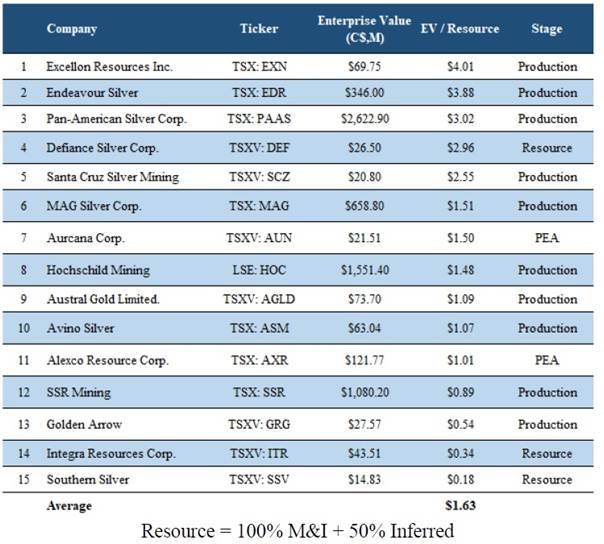

On the other hand I view this failed financing as a blessing in disguise, as the share price probably got walked down to lower levels than otherwise achievable in the market, as fundamentals didn't change in the last two months. As an indication of relative low valuation of Golden Arrow there is a nice table provided by Fundamental Research (report available through Golden Arrow), showing that the company is positioned at the bottom for EV/oz ratios for producers:

Of course an EV/oz ratio doesn't say much for producers as it doesn't take into account all sorts of things like profitability of ounces, jurisdiction, permitting, etc., and large resources usually are valued lower per ounce anyway, but in my view this table represents a nice overview and gives a first, very global indication of silver producer valuations.

3. Puna operation

As mentioned, the Puna operation consists of a JV between Golden Arrow and SSR Mining, formerly called Silver Standard. The JV assets are the Chinchillas deposit of Golden Arrow, and the depleted Pirquitas Mine of Silver Standard. There is a bit of history behind the Pirquitas Mine, as it didn't get depleted completely according to plan. This was the result of a massive and not intended scaling back of reserves, reducing them by 52% in 2011 compared to the 2008 resource estimate.

Just one year before that, CEO Robert Quartermain, after 15 years with Silver Standard (old name of SSR Mining), left the company in 2010 and started heading a certain spin-out called Pretium Resources, which has had its fair shares of controversies as well (and might be in for more, as this resource model isn't free of discussion either). But that is another story. Right now SSR Mining has earned itself a strong reputation as a great operator in the mining industry, and that is what counts here in my view.

The 25/75% JV between Golden Arrow and SSR Mining (the operator and majority owner of Chinchillas and Pirquitas) revolves predominantly around the following terms:

- Golden Arrow received an upfront US$15 million payment from SSR Mining representing 25% of Pirquitas mine earnings (less certain expenditures) in 2017. Golden Arrow has to pay its part of capex, which is about US20 million in total, and has to pay 25% of any future capex requirements.

- Golden Arrow benefits from net earnings (25%) generated by the still producing Pirquitas Mine, but for this year this will be marginal, as only 1 Moz Ag per quarter from remaining stockpiles is being processed at the moment, at cash costs being above the current silver price.

- Golden Arrow had paid about US$3–4 million of capex until Q3 2018, US$14 million up to now, and has to pay the majority of its US$20 million capex share (about US$19 million) before year end of 2018. This is probably where the recent US$10 million loan comes in. Golden Arrow is probably looking to repay most of the eventually drawn amount by future revenues coming from the Puna Operation.

As Golden Arrow sees itself as a minefinder next to a developer (of Chinchillas), it burned through quite a bit of cash in 2017, after the US$15 million was received. At that point the company had about C$24 million in its treasury (July 2017). At the end of 2017, this was brought down to C$16.2 million, most of it spent on exploration, but also significant spending on marketing and management compensation (considerable performance bonuses because of the JV deal).

Fortunately, marketing and compensations have normalized quite a bit, and the company is focusing on exploration again. At the moment, Golden Arrow has enough cash to fulfill its obligations towards the construction and ramping up of Chinchillas, to do some exploration, and do some acquisitions, while SSR Mining is doing the hard work. When Chinchillas is fully operational, I expect cash costs to go down considerably, with Golden Arrow to reap the benefits of this strategy.

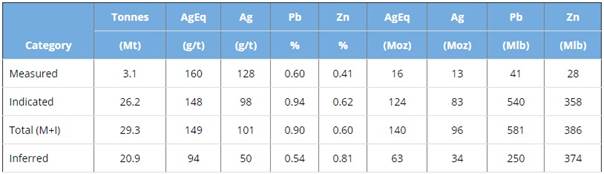

Golden Arrow already drilled an N-I43-101 resource estimate on Chinchillas of 203 Moz (M&I and Inferred) silver equivalent at a decent average grade of 140 g/t AgEq, which is large and decent grade for open pit, and completed a Prefeasibility Study (PFS) in March 2017, with solid economics of an after-tax NPV5 of US$178 million and IRR of 29% at a silver price of $19.50/oz Ag. This is the 2016 resource estimate:

And this is how the orebody looks, pit constrained:

In my view it seems realistic to assume that the higher grade Measured and Indicated part is fairly continuous and not spread out irregularly, hereby limiting future potential to convert Inferred resources into the same kind of higher grade M&I resource (and eventually into Reserves). I don't see this as a problem as there is enough M&I resource already to increase the life of mine and production, as I will discuss later on.

As the price of silver has been trading at US$14.60/oz Ag lately, the resulting NPV5 would be close to zero and the project wouldn't stand a chance of getting capex funding, but the good news is of course that SSR Mining already provided the necessary capital (about US$81 million) to build the mine at Chinchillas, which is already producing and ramping up right now.

According to the PFS, the average operating margins based on cash costs are US$7.40/oz Ag net of by-products, with average all in sustaining costs (AISC) at US$9.75/oz net of by-products, which are very low numbers. The by-products lead and zinc are priced at US$0.95/lb lead and US$1.00/lb zinc in the PFS, whereas the current spot prices are US$0.85/lb lead and US$1.17/lb zinc. As lead revenues are about triple the zinc revenues, current metal prices result in slightly lower by-product revenues than planned, increasing AISC to an estimated US$10.50, which is still robust.

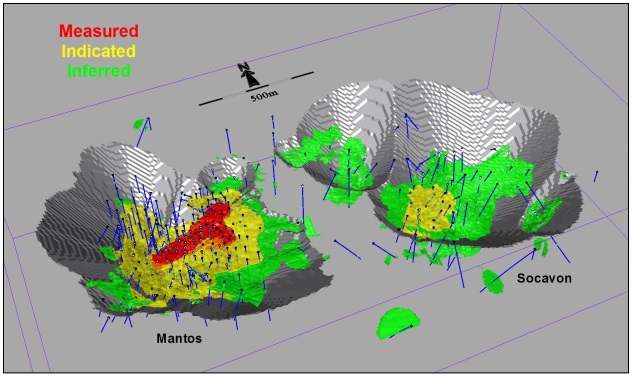

The average cash costs are higher in the beginning, as is presented by SSR Mining in their presentation (in US$):

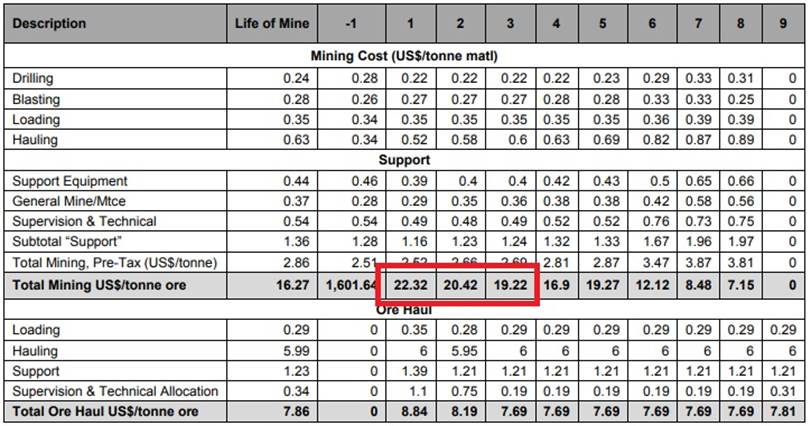

The PFS shows that this is no coincidence, as the total mining costs per tonne of ore are much higher in the beginning as well:

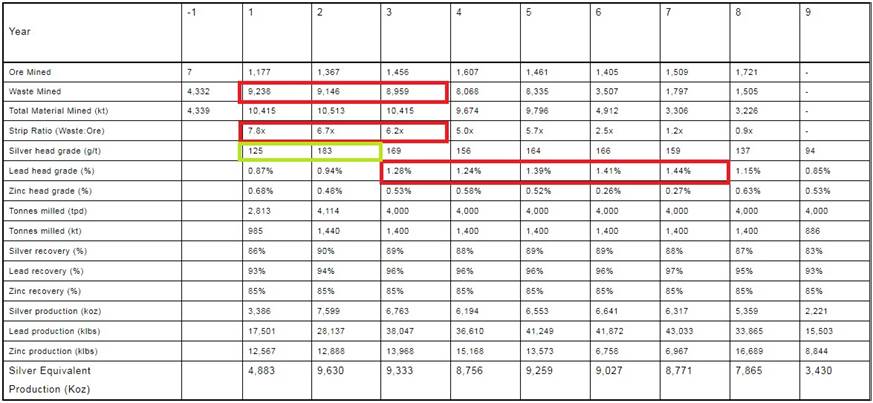

According to the mining schedule, they don't have the possibility to front load the mine with much higher grade in the beginning, as year 1 sees about 20% lower silver grade than average and lead even more for the first two years, at the same time having a higher strip ratio in the first three years:

Pirquitas Mine; SSR Mining

The Pirquitas Mine is producing marginal amounts of silver from the last remaining low grade stockpiles at the moment, achieving 0.95 Moz silver @ 110 g/t Ag in Q2 2018, at high cash cost of US$14.73/oz Ag, causing the mine to operate barely break even. This is all expected to change during the fourth quarter of this year, and ore is already being trucked from Chinchillas to the mine since July, with the processing of this ore expected to commence this month. The first test mining results are coming in according to plan, with the strip ratio (7-8:1) also close to PFS figures:

"Pre-stripping activities at the Chinchillas site continued to advance during the quarter. Approximately 2.1 million tonnes of waste and 0.3 million tonnes of ore were mined, with ore grades reconciling well to the geological model. Approximately 73,000 tonnes of ore from the Chinchillas pit were delivered to the Pirquitas site, of which approximately 39,000 tonnes were processed in two separate test runs as part of the project execution. The tests successfully validated metallurgical performance of the ore and produced saleable lead-silver and zinc concentrates."

SSR Mining has a forecast of 3–4.4 Moz Ag for 2018, so this means it doesn't expect to add much from Chinchillas for this year. The PFS outlines an average annual production during an eight year life of mine (LOM) at a 4,000 tpd throughput of 6.1 Moz Ag, 35 million lb Pb and 12.3 million lb Zn, which is 8.4 Moz AgEq. This is based on 81 Moz AgEq reserves. As the total resource stands at 203 Moz AgEq, and nameplate capacity of the Pirquitas plant is 5,000 tpd, there are options to increase the life of mine and revenues/cash flow, more on this in the next paragraph.

The company itself also mentions exploration upside for both Chinchillas and Pirquitas, and the possibility of a limited high-grade underground operation at Pirquitas, which ore can be blended at the mill according to management. A 2015 drill program completed at the Chocaya, Oploca and Cortaderas veins returned interesting highlights of 3.16m @ 1,436 g/t silver, 1.93m @ 1,890 g/t silver, and 0.83m @ 2,670 g/t silver, and an evaluation study of this potential will be completed by SSR Mining before the end of 2018. SSR Mining sports a 18.6 Moz @ 292 g/t Ag and 4.46% Zn M&I underground resource, which could probably be economic with the plant and infrastructure already in place, and this potential could be enhanced further by the high-grade vein mineralization.

4. Expansion scenario

In order to review full future economic potentialof Chinchillas for the Puna operation, some assumptions have to be made. First of all there is the aforementioned throughput increase to the nameplate 5,000 tpd, which doesn't cost anything, and could bring annual production to 10.0–10.5 Moz AgEq.

The second assumption is converting more resources into reserves. As we have seen, the Inferred part of resources is much lower grade, probably not containing higher-grade ore and therefore likely less profitable. Therefore, I would like to include another 40 Moz AgEq from 62 Moz AgEq M&I resources into the current reserves, bringing these to 121 Moz AgEq. Taking into account the underground Pirquitas resource being developed and kicking in after, let's say, one year, this could add another 10 Moz AgEq. This high grade could balance the potentially lower grade coming from Chinchillas or even increase it, increasing annual production and profitability, but I'll take a somewhat conservative approach here.

When using 120 Moz AgEq of total production at 10.0 Moz AgEq per annum, the new life of mine would be 12 years.

Another item we have to take into consideration is the proposal of Argentina to impose temporary new taxes on exports, to the tune of 12%, on top of the current corporate tax of 30% (which has just been lowered from the long-lasting 35% this year). This is quite a swing from revoking the 5% mining export tax two years earlier. This isn't a done deal yet as Yamana has expressed great difficulties with it, and would have serious impact on foreign mining investments again. It also has a serious impact on NPV.

As none of the warrants and options are even close to being in the money, I use the outstanding number of shares of 102 million.

I am using a 5% discount despite the Puna Operation being located in the Jujuy Province in Argentina. The Pirquitas Mine has been operating for eight years without interference from the government or strikes, and the Chinchillas open pit mine is constructed and commencing production without issues so far. For currency exchange rates I use today's USD:CAD of 1:1.31.

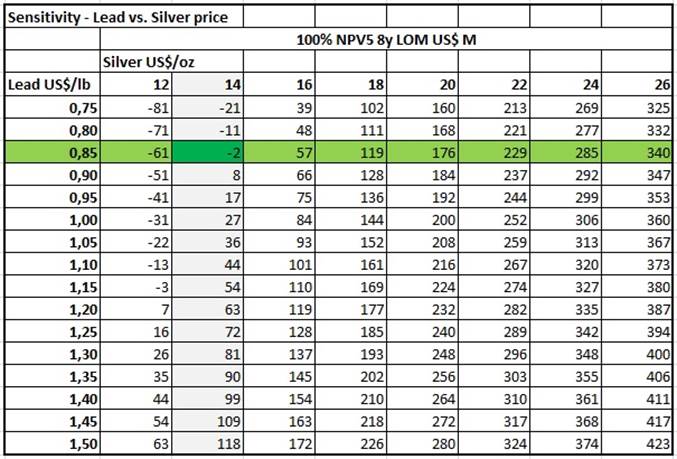

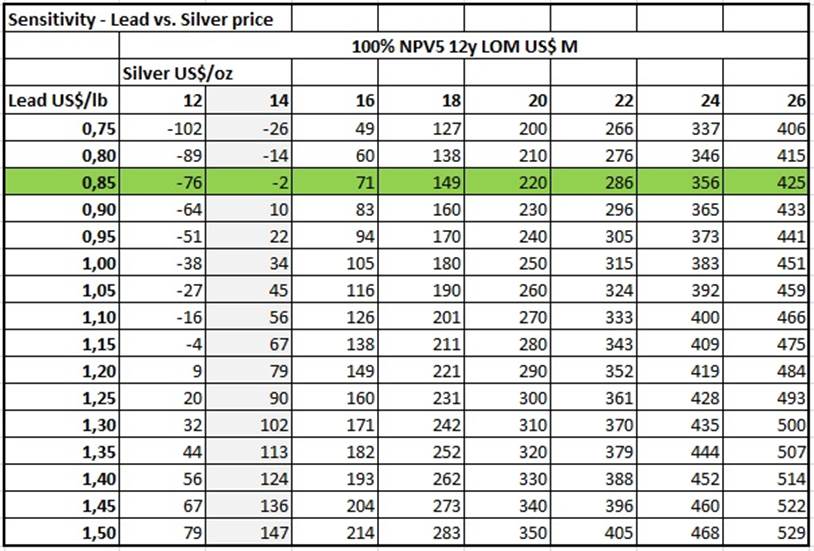

This results, as a reference, for the current eight year life of mine plan, assuming no export taxes or expansions, in the following sensitivity for NPV5:

Clearly at current metal prices the NPV5 is close to zero. However, this doesn't mean that the assets of Golden Arrow are worth nothing either. The Pirquitas plant, etc., in itself has a breakup value in this condition of at least 25–30% of replacement value, I estimate this at US$30–40 million for a 5,000 tpd operation, and Golden Arrow owns 25% of this which means US$7.5–10 million, which is C$9.75-13 million. The company has about C$5 million in cash, and it has several exploration projects, two of them with historic resource estimates. I estimate all of these projects at C$5 million combined.

Chinchillas, although with zero NPV, should be worth at least C$5 million as all leveraged plays are worth something (sometimes quite a lot, see Seabridge). Total asset value would come in this way at an estimated C$25–28 million, which would come very close to the current market cap. As long as Golden Arrow can repay its credit facility from Puna cash flows, and keep the lights on, I would estimate a structural bottom of C$0.15–0.20 per share no matter what happens with metal prices, which is a nice cushion in my view for the somewhat defensive mining investor.

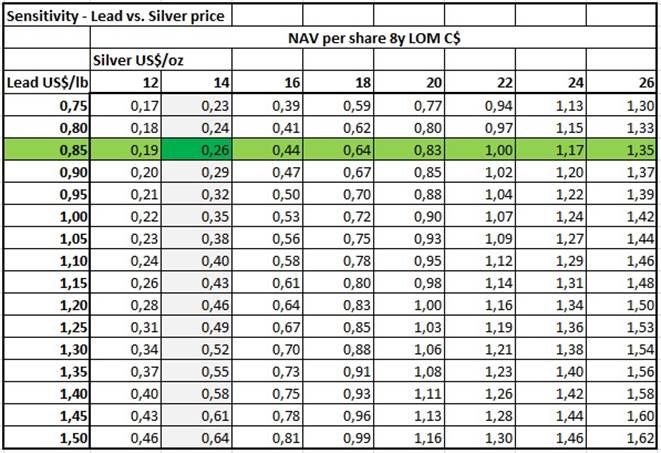

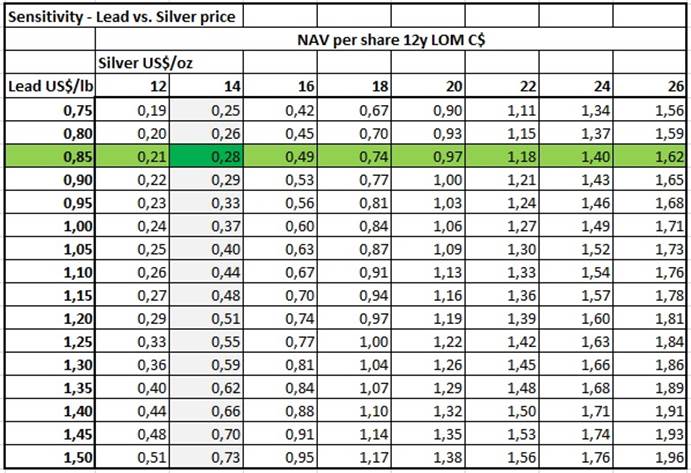

The calculated NPV5 numbers are used to generate NAV per share, based on cumulative discounted cash flows. The capex of US$81 million is subtracted from NPV5 as the mine has been built and there is hardly any debt (up to US$10 million per the credit facility). The result is adjusted for ownership, currency exchange rate and divided by 102 million outstanding shares. The resulting table looks like this:

One could think that based on NPV the stock is slightly undervalued at the moment, but this is not exact science, of course. The leverage on a rising silver price becomes quite obvious, and is in my view the main strength of Golden Arrow as an investment. However, if we take into account the 12-year scenario, bigger capacity and new taxes, there is more upside to be expected:

A lot of upside is taken away by the increased taxes, so if this desperate move by Macri can be changed or discarded it would add half the 8y NPV5. The NAV per share looks like this:

Without the extra export tax you could add roughly 20–25% to these numbers, which explains why, for example, Yamana is not too pleased about this new tax.

I actually like Golden Arrow as a leveraged play, as the profitability at current metal prices is zero, so the multiplier of cash flows relative to a rising metal prices is largest in this situation. Golden Arrow isn't part of a cash bleeding loss making operation, which would be a negative, even in a rising metal price environment, as investors turn to those companies last. The relative increase of stocks that are already making profits is often less than these neutral leveraged plays, as these stocks often are priced at a premium as most investors turn to those first in difficult times.

After having analyzed the potential of Chinchillas for the company, let's have a brief look at the exploration projects.

5. New Gold Explorations

New Gold Explorations is a newly created, fully owned Canadian subsidiary, and contains all exploration projects, encompassing about 200,000 hectares of prospective ground in Argentina and Chile. The plan behind it is to do a spin-out at some point when the time is right, to avoid further dilution of Golden Arrow shares and create a standalone explorer. Not too long ago this was planned for this quarter, but it has been postponed until the early part of next year, as Golden Arrow decided to wait in order to avoid too much dilution when raising the necessary cash now. Golden Arrow is busy acquiring interesting projects for New Gold, for now most are early stage but management is also looking at more advanced projects, and is seeking JV partners for those.

The latest addition is the Indiana gold-copper project in Chile. Interesting part here is that this project has a historical resource estimate of 600 Koz AuEq (3 Mt @ 2.8g/t Au and 1.6% Cu). It is a near surface deposit of vein type mineralization, with ramps for underground access for exploration. The agreement involves a US$15 million staged payment over four years, with minimal obligations the first year.

Nearby is the also recently acquired Atlantida project, also in Chile, and also with a historical resource estimate, this time 427 Mt @ 0.43% CuEq. The deposit type is porphyry style at depth combined with a higher-grade skarn near surface. Terms include a US$6 million staged payment spread out over four years with minimal first year payments. Management believes that both deposits have significant upside potential, also because sampling returned good values, on average 0.51 g/t gold and 0.49% copper. In my view, an average grade of 1.1–1.2% CuEq is needed for a big UG porphyry deposit in order to be economic, but a higher-grade starter pit could lower this grade considerably.

A project that has been a while longer in the portfolio of Golden Arrow is the Antofalla project, which management believes to have strong similarities with Chinchillas for geology. It has been with the company for quite some time now, and has seen quite a bit of drilling, but it didn't provide the same exploration success as Chinchillas yet.

Antofalla project; Catamarca Province, Argentina

Golden Arrow owns more exploration projects in Argentina, often located on structures that contain existing, large resources (Los Helados, Filo del Sol, Gualcamayo, Famatina, Cerro Casale, etc), but these projects are all early-stage grassroots, which have seen limited drilling only besides rock sampling, trenching, ground magnetics, and time domain IP.

Mogote project; San Juan Province, Argentina

As all exploration projects need a lot of work and payments, it is too early to assign much value to them. Management and geologists are convinced of large upside potential in at least two or three of the projects, and is eager to explore these.

6. Conclusion

In my mind Golden Arrow represents one of the safest leveraged plays on the silver price, as one of the best operators around, SSR Mining, is handling the Puna Operation as part of their JV. Cash flows are around the corner, management has normalized spending, and the share price has hit rock bottom after a sell recommendation by an influential newsletter and a failed attempt by management to raise cash. Call it a blessing in disguise or not, but the upside on higher metal prices is considerable from now on, but the company has also other ways to add value while waiting for silver to start rising. I am an interested shareholder.

Access road Pirquitas Mine

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website http://www.criticalinvestor.eu, and follow me on Seekingalpha.com, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer:

The author is not a registered investment advisor, currently has a long position in this stock, and Golden Arrow Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.goldenarrowresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

[NLINSERT]Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Pretium Resources and Seabridge Gold. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pretium Resources, a company mentioned in this article.

Charts and graphics provided by the author.