Once in a while I run into countrymen in the mining business, and as a Dutchman this doesn't happen too often. Notwithstanding this, I was connected to a gentleman named Kees Dekker through a mutual contact, and it appeared soon enough that Kees shared a preference for critical analysis with me. Having worked a long career in the mining business when located predominantly in South Africa and Namibia after graduating in the Netherlands but doing projects all over the world, he now aims to work as a freelance mining analyst. I am more than happy to provide him with a platform to introduce himself, as examples of his analysis indicated to me that he could be of great value for anybody who's interested in thorough research on a mining company. Some of these sometimes very extensive examples will be published, starting shortly after this interview, to give a good idea of the level of Kees' analyzing capabilities. For now, it is time to introduce Kees Dekker, so here we go. - The Critical Investor

The Critical Investor: Thank you, Kees, for participating in this interview. It is a pleasure to get to know a countryman who knows his way around the mining industry and who also likes to analyze mining companies. For starters, can you tell us your background and experience?

Kees Dekker: Let me first begin with some basics. I am 64 years of age, and currently reside with my wife in Namibia, the country where I started my career after obtaining BSc and MSc degrees in Geochemistry (BSc, MSc) in Utrecht, Netherlands. I subsequently got BCom and MBA degrees from South African universities. We returned to Namibia after our two adult sons left for Germany to pursue careers there.

My career started back in 1979 as an exploration geologist for a subsidiary company of Gold Fields of South Africa (GFSA), which was at the time the third largest global gold producer, but also controlling a number of major base metal and coal companies. In 1983 I was appointed senior geologist at a large base metal mine, the Black Mountain Minerals mine in South Africa.

After completing an MBA in Cape Town, sponsored by GFSA, I joined head office in 1986 as a senior mineral economist at Gold Fields in the Coal and Base Metals Evaluation Section. There I was involved in the annual valuation of Group Companies, coordinating feasibility studies and carrying out project evaluations.

In 1988, I was appointed Section Head of the Coal and Base Metal Valuation Department, managing and mentoring five analysts. In 1990 I was appointed to Group Economist when I managed economists involved in macro-economic analysis, monitoring commodity market development and producing metal price forecasts, as well as advising the pension fund trustees on equity investments and supervising a country risk analyst.

In 1992, I was appointed as Assistant Manager of the GFSA Group, when I had reporting to me an Architectural Section, a Quantity Surveying Section, a Project Management Section and a Property Administration Section, which also looked after the assets of Gold Fields Property Company, listed on the Johannesburg Stock Exchange. The position was often used by GFSA to provide commercial exposure before moving to a more senior position elsewhere in the Group.

In July 1995, I was appointed Regional Manager in Quito, Ecuador for Latin America, except for Brazil. Unfortunately, following the severe downturn in 1999 in the mineral industry and with Gold Fields doing particularly poorly, new management decided to retrench many people including myself.

In 2002, I was appointed as New Business Manager by Oryx Natural Resources, focused on finding diamond projects in Africa. Oryx offered me a job in 2003 as President of its operating diamond mine in the DRC. I left this job after I concluded that the operation did not have the chance to ever be feasible, and I joined another diamond-focused company called Matikara Limitada in Angola, as Chief Operating Officer. Matikara was a JV company between the second largest diamond producer in South Africa, Transhex, and Lev Leviev, who had the monopoly for marketing Angolan diamonds for a long time.

After this, in 2006 I joined RSG Global, a reputable mining consultancy, which got acquired by Coffey Mining in 2007, as Manager for southern Africa. Because of a very different corporate culture I decided to follow my former Manager - Audits at RSG, Mick McMullen, and joined Lachlan Star, one of his companies, in May 2008.

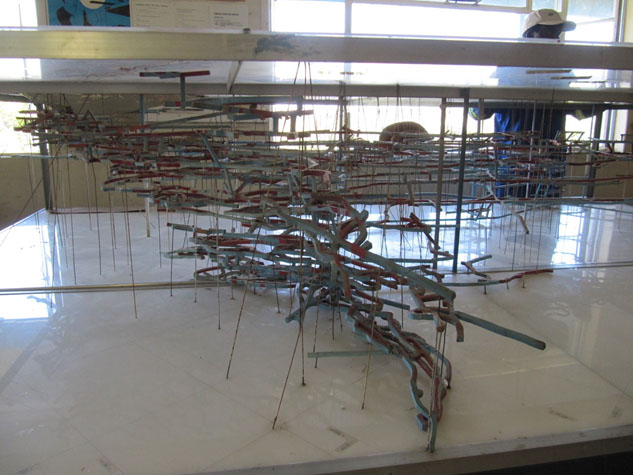

CMD gold mine, Chile (credits: Kees Dekker)

At Lachlan Star I was coordinator of a pre-feasibility study of a gold project in Zambia, followed by the review, acquisition and resource expansion of a gold mine in Chile until the summer of 2012.

Since 2012 I have acted as a freelance consultant involved in technical reviews of among other, the Stillwater Mining Company operations and projects, Nevada Iron Limited, New Chris Minerals and for private equity funds such as QKR (acquisition of the Navachab mine in Namibia), the Casablanca Capital (Cliffs Natural Resources) and Blackstone Special Opportunity fund (Talvivaara mine in Finland and the Renard diamond project of Stornoway). I have also visited projects in many other exotic places like India, Eritrea and Zimbabwe. Right now I am looking to intensify my work as a consultant as I feel too young to retire yet.

Sandawana Emerald mine, Zimbabwe (credits: Kees Dekker)

TCI: That's an impressive resumé in mining, and you seem to have covered a variety of fields, from doing exploration yourself to managing studies to managing large exploration projects to acquisition of assets. What would you consider your field of knowledge and expertise as a mining professional?

KD: I see myself as a generalist, a bridge between technical and commercial functions, and one of my strengths is having strategic insights. I also belief that I am good at identifying critical success factors and risks. I do not simply accept numbers and information provided to me and will always re-crunch the numbers to verify whether these are correct and credible.

TCI: That makes sense looking at your experience. Tell me, over the years you must have encountered some mining celebrities, or have some nice anecdotes from the industry at least?

KD: As an old hand many of the people I worked with are retired.

- Robin Plumbridge – ex-Chairman of Gold Fields of South Africa

- Alan Wright – ex-Chairman of Gold Fields Limited

- Neil Gregson – ex-colleague now portfolio manager at JP Morgan Asset Management

- Mick McMullen – my ex-manager Audits at RSG Global, entrepreneur and ex MD of Stillwater Mining Company

- Alex Black – came across him when Rio Alto visited our mine in Chile to see whether we could do a deal together. He came across as very astute.

One year after I had joined head office, GFSA decided to list its Namibian subsidiary on the Johannesburg Stock Exchange as Gold Fields Namibia. I was made responsible to value the three mining operations and the Tsumeb smelter to draft the technical report for the listing and in support of the listing price. My superior at the time who accompanied me was called Ian Blackie. You can imagine that we were immediately referred to by the locals as Black and Decker.

In Africa I have seen some stupid deals. The JV company in Angola had a 35% beneficial interest (split between two partners!) for which it had to make all the upfront investments and undertake the work plus pay for a local office staffed with Angolan partners that cost US$50,000 per month and were only obstructive. The diamonds produced during exploration (for an evaluation of a diamond project one needs to mine between 0.5% and 5% of the deposit to arrive at a representative sample in terms of grade and value) were all kept in "trust" by the government, only to be released when a mine was actually developed. Any analyst worth its salt and familiar with these projects would know that this cannot ever give a decent return to the investor unless the project is exceptional. Experience at Transhex has shown that, once a mine was constructed, the Angolan governmental diamond mining company, Endiama, and other Angolan partners took control and (over)staffed the operation with friends and family, absorbing any free cash flow. The subsequent financial performance was just so that operations could finance themselves, but not a cent was earned that could leave the country as dividends.

My experiences in the DRC and Angola have strongly coloured my views about investing in Africa. I would not touch projects in those countries with a barge pole, and avoid other projects in almost all other African countries.

TCI: I can imagine that DRC and Angola are particularly prone to the "African discount," but I have made money on the likes of True Gold and Endeavour, so jurisdiction risk is elevated but I wouldn't discard the continent completely for investments. After such a career, why did you develop an interest in being an analyst?

KD: It plays into my strength of having technical and commercial insight at the same time. I have an analytical mind and the work I do is to review a project/company holistically, not just focused on a particular field. Delving into the business plans of the main assets gives a view of the longer-term prospects for a company, which other analysts usually not provide as being too laborious, or too far outside their scope of knowledge.

Another reason for being a mining analyst is that I love to travel. My freelance work has taken me to such exotic places such as Goa in India (for a due diligence on an iron ore company) and the Danakhil Depression in Ethiopia (potassium project), the Atacama desert in Chile (gold and copper projects), Palm Springs (iron ore project), etc.

TCI: I have seen this delving in examples of your analysis. You have sent me examples of models of producing mines that were quite extensive, many spreadsheet pages, hundreds of rows. I have never seen this level of detail before, and I am convinced you can model entire projects as producing mines. However, when you are dealing with economic studies as source material you don't have quite granular data, which is required. How do you deal with this when analyzing juniors with just economic studies at different stages of detailed engineering, for example just a PEA?

KD: When valuing projects/companies one can only model the available information. It has little to do with PEA, PFS, etc., but with the level of detail provided by the companies. The only difference between PEA and other studies is the level of confidence one can attach to the input parameters. I do not like to tackle valuations where I have to fill in gaps in information, but the NI-43-101 reports must adhere strictly to certain minimum disclosure criteria, which are usually adequate for my purposes. The main reason why I hardly ever look at purely Australian and UK listed companies is the lack of disclosure they can get away with. It does not help me much to read conclusions of studies only without being able to independently determine whether these are reasonable and credible.

TCI: I also noticed your critical mindset. How did you develop this?

KD: My critical attitude is a basic trait, further groomed when working for GFSA in its Mineral Economics Division. The people working in this division were used by executive management to provide the information required for strategic decision making: optimizing operations and supporting acquisitions/disposals. The interaction with directors and general managers teaches one to look at information with a helicopter view and to dig deeper into aspects that are critical to the success of the project or company. One had to motivate in the reports to the executive the validity of the arguments and conclusions.

TCI: Which stages of a project do you feel you can analyze best (grassroots exploration, delineation, PEA, PFS, FS, permitting, financing, construction, production) and why?

KD: I feel I am best qualified to evaluate the prospects of a project that has advanced beyond the grassroot and delineation stages with studies that have resolved the quantity of resources available, the amenability to upgrading to a saleable product. As I indicated above, there is no real difference between the various economic analyses, just the level of detail provided and confidence one can attach to the inputs. There is essentially little difference between reviewing a PEA, PFS and BFS or actual production, only that one can rely more on the conclusions of studies supporting such business plans or reviewing actual production performance measures. Permitting is difficult to judge for foreign jurisdictions and requires direct interaction with parties on the other side of the table of the company. Similarly, construction is difficult to independently determine when relying only on company's progress reports and without visiting the site.

TCI: I agree about the limitations of desktop studies versus getting a complete picture including a site visit. Could you tell us a bit more about how you work as an analyst?

KD: Sure, I review the available documentation and follow the production process, starting with tenure, geological model, resource estimation, assumptions underlying conversion to reserves, production schedule, cost inputs. In parallel I start cash flow modelling, which often raise questions about the critical input variables and validity of assumptions. The review and modelling activities complement each other by pointing to issues to dig deeper into. At company level it is useful to review the actions of performance of management over the last +5 years to get a feel about how they deliver on promises, how they reward shareholders and themselves and whether this is not lob sided to themselves. I am a great believer of doing reality checks by means of benchmarking. Whereas every project and company has aspects unique to them, benchmarking gives an indication about whether the assumptions are credible, or not. The problem with cost estimates based on first principles (an estimation from bottom up based on estimation of employees, consumable, fuel, etc. and their cost) is that they only can quantify what is considered. By definition this means that these estimates are too low because items not considered are not quantified. This is probably one of the main reasons for economical studies almost always being too optimistic compared to actual performance. Benchmarked costs are preferably derived from actual operations, not suffering from underestimation or having overlooked certain activities, services and items in studies.

TCI: You talk about cash flow modelling which is something I think is very important when analyzing any project on economics, let's address this further in a moment. Another aspect of your research is company management. What is your experience regarding management in general?

KD: The most usual issue encountered for a share's underperformance with producers is the management priority of extending the life of mines and pursue company growth at all cost. Management's agendas are inclined to differ from shareholder's interest in that they wish to extend their tenure and optimize remuneration.

The consequence of this management's agenda is that it will use/force "independent" consultants to use unrealistically favorable inputs to pull the project over the line. The more marginal the project is, the more unrealistic the input parameters are inclined to be. This is another reason to favour high grade projects with high internal returns, not only are they inherently less economically risky, one can rely more on the inputs used as the consultants are allowed to use more conservative assumptions. Low-grade projects with returns bordering on being economic are often doctored beyond viability.

TCI: Interesting. Did you have to deal a lot with management that tried to force you to use unrealistic inputs, and when this was the case, how did you deal with this? How standard is this practice in the mining industry these days you think?

KD: This is still going on these days I'm afraid. As for myself, I have personally experienced that the chairman of a company developing a mine in southern DRC was livid with our conclusions about the risks associated with its project. He placed great pressure on us (Coffey Mining) to rate the project low to medium risk. As we had been appointed by a bank considering providing project financing, it was much easier to withstand the pressure than if we had been appointed by the company itself. Banks will incorporate covenants in the loan agreement to address identified risks.

Other examples are the independent technical review of two platinum group metal projects in South Africa for banks considering giving project finance. One project assumed the use of a so-called Efficient Cut, which limited dilution and gave a higher plant feed grade than what the normal mining width (based on a chromite layer that preferentially parted the rock) would give. We differed in opinion with management as we thought that in normal mining conditions—not the heavily supervised test mining conditions—this would not be achieved. This proved to be the case.

The other project failed to give attention to timely develop the underground infrastructure in order to fill the plant once the 18 months open pit material was depleted. We considered the open pit phase as unnecessary (apart from the scar to the landscape for precious little value), complicating the plant performance by feeding partially oxidized material, which would complicate stabilization of plant performance, and interfered with underground development. The two banks involved took our advice and avoided the loss that Macquarie Bank incurred when it took over the financing of the project.

TCI: Interesting, I can imagine working at the side of a project financier is much more independent regarding analysis. What puzzles me in this regard is that once in a while you read about failed projects, taken through FS stage so assuming at least decent engineering work has been done, where financiers with solid reputations apparently took on huge risks. In the end some of those projects appeared to have failed on pretty basic causes. Do you have any idea, assuming these financiers' capabilities of doing thorough due diligence, why they pursue to fund these projects nevertheless and lose huge amounts of money when projects go into bankruptcy or have to be refinanced at high costs for financiers?

KD: Management will try to pull projects over the line no matter what the real merits are, and sometimes they manage to convince financiers. Whereas financiers have a totally different agenda than management, equity investors should not rely on that. Project finance will be serviced before any dividends and it is almost always fully secured by the assets. Project finance is therefore of much lower risk. Financiers also often rely on technical advice given to them by outside consultants. I have seen enough consultants who are not critical enough and which lead institutions up the garden path.

TCI: There has been quite a bit of talk about the viability of a Preliminary Economic Assessment (PEA) in recent years, and some mining professionals even compared the usefulness of a PEA with toilet paper. I still think it is a good first indication, with a high margin of error, of economics, depending on the engineering firms doing it. What is your opinion about a PEA in general?

KC: A PEA has a role to play, when it is seen to establish a prima facie case for development, better still when it compares various options for development. Once this has been determined, more detailed studies have to prove up the input parameters at a higher confidence level.

A clear warning sign for investors is management giving the go-ahead to projects based on a PEA instead of a feasibility study (FS). PEAs are very often notoriously overoptimistic in parameters used and also, for example, include too much material in the life of mine by incorporating inferred resources with a low level of confidence.

TCI: Yes, we have seen that with Rubicon Minerals and its Phoenix project failing completely, building it from a PEA. When I noticed the company wanted to build it from a PEA I didn't even look at it again. What could cause financiers to fund the capex of such risky projects? These projects will always be severely discounted for valuation anyway because of the low level of confidence in resources and mine plan, besides the inherent execution risks. What could be their rationale behind such a risky strategy? As if mining wasn't risky already.

KD: This isn't always obvious. A reason could be that the perceived economics are so compelling that company management believes that any risk of disappointments are more than covered by the robustness of the project, and in turn they somehow managed to convince the financiers of this idea. I am of the opinion that this also happened to TMAC with its Hope Bay project, which was developed on the basis of a PFS, but with metallurgical studies that were very skimpy and should not have qualified as sufficiently detailed for a PFS. The initial financing of US$120 million must have looked modest to the financiers as the after-tax discounted value was calculated in the study at C$478 million (US$406) using a discount rate of 7.5%.

TCI: Have you seen typical characteristics of projects that got constructed just based on a resource or a PEA?

KD: I have seen management typically opt for project go-ahead based on PEAs on deep, steeply dipping and narrow deposits where the costs of carrying out a feasibility study are extra high. A feasibility study requires drilling the resources to a level of confidence that would allow it to be included in a mine design required for the feasibility study. The required density of drilling and narrow nature results in very high cost per tonne in resources. Naturally the temptation of a short cut is then very high.

TCI: That rings a bell or two, one very nice example of a narrow deposit that didn't even see a PEA before construction, not even a resource estimate, and broke down on extensive water issues (and had much less ounces than projected) was Serra Pelada by Colossus Minerals. Management was always very upbeat on the project and didn't want to hear anything negative. What is your general experience when communicating with management when analyzing their projects? I have found it to be difficult when you have a critical standpoint, but nevertheless with good and professional management I almost always have constructive discussions, and management can often elaborate on things that are not always obvious to a non-insider of a project like myself and everybody else outside the company or engineering firm.

KD: To be honest, with not publishing my work to a wide audience I normally do not bother to send the reports to management for comment. When I have been in contact with management on critical reports, they were without fail defensive and accused me of being wrong, threatening to sue me or did not respond at all. This is not really surprising; management's role is to promote their project and by definition will not support dissenting voices.

TCI: Could you name a few examples where practice showed that economic studies aren't always realistic?

KD: Sure, and a lot of these failed projects had to do with inappropriate resource estimates, like the one we mentioned earlier, the Phoenix project of Rubicon Minerals, and Hope Bay of TMAC. The Santa Rosa project of Red Eagle Mining Corp. (R:TSX; RDEMF:OTCQX; R:BVL) had geotechnical issues and used very optimistic grades and operating cost, and I consider the Black Fox project of Primero (since purchased by McEwen Mining) as having used far too optimistic inputs.

TCI: Resource estimates are often key, I also think that Pretium Resources Inc. (PVG:TSX; PVG:NYSE) isn't out of the woods yet as there was a lot of controversy about its resource estimate, and Strathcona still doesn't think all gold is there as projected by Snowden. What is your opinion on Pretium? And have you heard about the Aurizona mine of Equinox (former Luna Gold)? This one ran into cash flow problems when the milling and crushing circuits didn't operate well, and the operation was burdened by the heavy Sandstorm stream. It had to be completely refinanced; do you think this was the result of taking shortcuts during geotechnical drilling for example?

KD: Both consultancies involved with the Brucejack project of Pretium are very reputable and the difference of opinion essentially revolves around whether the very high grades that push up the average grade are representative and should be given the influence that Snowden awarded to them. Whereas I am by no means a resource geologist I had sympathy for the Snowden approach given the very dense drill spacing and numerous assays that constituted the database. This resulted in the histogram becoming very close to a population curve with the high grades properly represented. It will be interesting to see how this plays out after another 18 months production at Brucejack. The deposit is fairly unique and the lessons there learned will have a great impact on estimation of similar deposits, should these be found in future.

I haven't looked into the Aurizona mine so I cannot comment on this unfortunately.

TCI: On the contrary, let's talk about solid studies, if there are some in your view, can you mention some?

KD: Well, in my mind there are no really solid, good studies issued by junior companies. I have seen realistic studies in large mining companies developing projects using in-house resources not requiring outside capital. However, to stay with the subject, the better studies of junior companies are the Morelos Project of Torex Gold Resources Inc. (TXG:TSX) and the Yaramoko Project of Roxgold Inc. (ROXG:TSX).

For open pit mining at Morelos conservatively high mining losses (5%) and dilution (15%) were used and the unit operating cost for Morelos at US$2.11/t mined is comparatively higher for Mexico as is the processing cost of US$16.32/t.

For Yaramako internal dilution of 18% at 2.4 g/t was assumed with external dilution assuming 35 cm on either side of the stope design plus another 3% dilution from backfill. This combined with operating cost of US$144/t, that gives due cognizance of African conditions, gives comfort. When I reviewed the project, production was ramping up and initial capital sunk.

TCI: That is quite a statement to say about juniors, but everything is relative I suppose. Nevertheless, an analyst has to review those studies, too. When doing due diligence, to what subjects should investors pay attention in your view?

KD: That will not be a quick answer I'm afraid. I will try to list some criteria per stage:

- Exploration

- selective reporting of drill hole results with gaps in borehole numbering

- the true width of the intercepts and siting and direction of holes relative to targeted intersection (some companies purposefully intersect obliquely, i.e., Nighthawk, Marathon Gold)

- the reasonableness of interpolation provided

- the possibility of another geological model

- Resource Estimation

- The drill spacing on which the estimate is based. There are no hard and fast criteria for drill spacing as these differ for the type of the deposits and the dimensions of such a deposit and a high-grade deposit needs (much) smaller spacing than a low-grade bulk deposit. Statistically one would want a drill spacing that does not compare too wide to the dimensions of the blocks used for grade estimation. For example, Detour used a drill spacing of 40 m and a block dimension in that direction of 10 m.

- Whether grade capping was used. The average grade of a deposit can be overestimated when the influence of a few very high grades are not limited either by capping their value to a value that is considered more representative (determined for each deposit separately using certain statistical techniques) or by limiting the extent to which it influences the grade in blocks further away, or using both.

- How conventional and straightforward was the estimating technique used. Grade estimation is not straightforward and the experts will use their discretion in deriving a resource that they consider representative. The more convoluted the approach used, the more risk is associated with the result.

- The level of confidence awarded.

- Preliminary Economic Assessment (PEA)

- What proportion of the plant feed is from Inferred Resources? The higher the ratio of Inferred Resources the higher the risk.

- The reasonableness of input parameters with opex and capex provisions, benchmarked against those of actual, similar operations.

- Prefeasibililty Study (PFS) and Feasibility Study (FS)

- The reasonableness of input parameters with opex and capex provisions benchmarked against those of actual, similar operations.

- To what extent have non-technical issues such as environmental permitting and community relations been addressed? The degree of attention is highly determined by the jurisdiction, the sensitivity of communities towards mining, whether projects/operations in the near proximity have been applying for permits/ mining successfully without trouble.

- Does the economic analysis incorporate all cash outflows such as investments in working capital (especially important for base metal projects), corporate overheads for a one-project company, tax on repatriation of profits, mixing positive with negative cash flows by having start of production halfway through a year (thereby understating peak financing requirement)?

- Has the economic analysis been on a full equity basis or introduces financial leveraging? This is not relevant for NI-43-101 studies, but can be for disposal/acquisition between two companies.

- Has the economic analysis discounted negative cash flows as well, thereby understating peak financing requirement?

- What upside is there for extensions of life of mine and what is the effect on the value per year added life?

- Going Operation

- How much of the reported costs have been pushed into "growth" capital expenditure thereby understating on-going cash cost of production? Many companies artificially reduce All Inclusive Sustaining Cost (AISC) by charging some of the stripping cost to growth capital, never to be brought back into the cost. Similarly underground mines can push some of the on-going capital expenditure to access new ore blocks to non-sustaining capital cost. These "growth" investments have usually nothing to do with production growth, but sustaining operations over the full life of mine. Reallocation of such expenses is an artefact to present a favorable picture in terms of implied profitability per tonne.

- Does the economic analysis incorporate all cash outflows such as investments in working capital, corporate overheads, etc.?

- What upside is there for extensions of life of mine and what is the effect on the value per year added life?

TCI: That was an interesting list of criteria, I also, like you, believe benchmarking of costs and key input metrics is the most important thing you can do as an investor, although keeping in mind that no two projects are the same. Now we have discussed analysis and a few companies, could you name a few cases which you did forecast correctly in your analyses and why?

KD: I take pride in forecasting in 2016 that the best was past for Centamin, in 2016 that Primero was overvalued, in 2016 that Sabina Gold & Silver Corp.'s (SBB:TSX; RXC:FSE; SGSVF:OTCPK) underrating based on permitting problems would be temporarily, in October 2016 that GoGold Resources Inc. (GGD:TSX) was overvalued, in February 2017 that Red Eagle should be shorted, in February 2017 that Roxgold was a case of irrational exuberance, in April 2017 that Seabridge Gold Inc. (SEA:TSX; SA:NYSE.MKT) sits on a massive project that probably only sees the light of day for our grandchildren, pointed out in October 2017 that Nighthawk Gold Corp. (NHK:TSX.V) severely overrepresented its drill results, in May 2018 that Nevsun Resources Ltd.'s (NSU:TSX; NSU:NYSE.MKT) management was correct in rejecting Lundin/Eurosun's bid.

TCI: On the other hand we as analysts (I very loosely categorize myself as one too here) also had to endure some failures. Two of my biggest misses were Red Eagle and Midway, as I didn't know back then how important drill grid spacing and clayish ore were among other things. Lessons learned in that regard for sure. Could you name some of your failures and why?

KD: Yes, I seem to underestimate the impacts of non-technical issues. My biggest failure in this regard has been Lydian International Ltd. (LYD:TSX) with its Almusar project in Armenia, which I highly rate on a technical/economical level, but which is now affected by a blockade of a certain section of the community, after the previous leader of Armenia, an autocrat, had to step down. Another is Continental Gold Inc. (CNL:TSX; CGOOF:OTCQX) with its Buriticá project, but which had its share price drop sharply after a number of exploration geologists at its Berlin prospect in Colombia were kidnapped and murdered. Another one was Torex Gold, which also experienced blockades in Mexico.

TCI: This seems connected with the level of trust you can have in management, as I frequently encounter management understating jurisdictional risks. Sometimes they are lucky and nothing happens, but other times stuff happens anyway. How important is management in your analysis?

KD: Management is all-important, not only in terms of competency, but especially if they have proven to be trustworthy (accepting some promotional hyperbole) and looking after the interest of its shareholders.

TCI: Talking about trust, are there people in the mining industry you could trust completely, as in that they always do as they say?

KD: I think you can only fully trust a person in the mining industry when you have worked on a number of projects together with this person, saw how he or she manages these projects, especially when things get tough, and saw/heard him or her talk about those projects to investors or financiers for example.

I can only give you one example of a person I trust in the mining industry and is somebody I heard making statements that I knew where honest based on my own intimate knowledge of the project/company: Mick McMullen. Not to say that he would voluntary open up on issues not asked about!

Except for Mick, all other people I worked for and know to be honest were in my mining house years, and who are now all retired. I knew Howard Stevenson from my Gold Fields days as an honest colleague, but that was many years ago. I have no idea how much he knew about the troubles with the community around the Almusar project of Lydian before the blockades started in May 2018.

TCI: I don't know Mick McMullen personally, but I do know that Stillwater was run very well. Stevenson was a bit of a strange case, his resignation was buried in a news release handling a quarterly update on operations, without as much as an acknowledgement of his services. Enough about people, what kind of projects or companies do you rate highly and why, could you name a few companies?

KD: There are a few companies I like a lot:

Trilogy Metals Inc. (TMQ:NYSE.MKT; TMQ:TSX), advancing the very high grade Arctic deposit with strong economics plus having a much larger, lower grade but bulk mineable deposit nearby. It has been very restraint in approaching shareholders for funding .

Another is Midas Gold Corp. (MAX:TSX), which seems to handle the environmental sensitivities in Idaho well, has a reasonably attractive project, which recently enticed Barrick to take a strategic interest.

Bluestone Resources Inc. (BSR:TSX.V), which acquired the Cerro Blanco deposit in Guatemala cheaply. The share is cheaply priced because of concerns about the community, similar to what Tahoe is experiencing. It is Guatemala, but the community is, however, reputedly supportive and does not include indigenous groups, and in Guatemala communities and NGOs represent by far the biggest part of jurisdictional risk.

Gold Resource Corp. (GORO:NYSE.MKT) is a producer I like; it did repay its shareholders in the first year of production, it has since consistently paid dividends, and owns a good gold project in Nevada for growth.

TCI: I am usually more into juniors with more upside, but I regard Trilogy as a solid copper play, although it is not really clear to me why it would need to go to an open pit operation in such a Nordic location; I might ask management soon. On the other hand, are there projects or companies you don't like as an investment and why?

KD: On the companies I don't like as an investment, this is actually the vast majority but I will name a few individual companies:

Nighthawk has been issuing press releases that, in my opinion, do not reflect the true nature of the drill intercepts in terms of true width and overall size.

Harte Gold Corp. (HRT:TSX) is developing a relatively low-grade, underground mine focused on narrow structures with short strike length for a very high development cost per tonne plant feed. It has no chance for success, in my opinion.

Argonaut Gold Inc. (AR:TSX) has a track record of continuously tapping shareholders for funding, always holding it out to be for company growth, whereas it is essentially ensuring steady state production. In the Magino project, in my opinion, it has a sub-economic project that will likely destroy value should it be given the go-ahead without a much higher gold price than currently prevailing.

TCI: We have come to the end of our interview, Kees. It was a pleasure. As a closing statement, could you tell us what your take is on metals like gold, copper and zinc (or other metals which you have a strong view on, like uranium, diamonds, iron ore, lithium?), and on mining sentiment in general?

KD: From my time as Group Economist of GFSA I have learned not to forecast prices. Nobody can sensibly forecast these. What is, however, possible is to see turns in the supply/demand situation. There are many indications that we are close to peak gold, and mined supply should start dropping in the medium to long term. I similarly am of the opinion that the uranium price will recover in the next few years as production curtailment will make itself felt. Copper will benefit from the move to electrical cars and further economic growth. Zinc will benefit from the lack of new large projects. I am no fan of diamonds and believe that long-term synthetic diamonds constitute a major threat.

TCI: I am a believer in copper and uranium myself, major issue for me is when exactly the ongoing developments (closure of mines, Cameco buying on the spot market, new funds buying on the spot market, Japan recovering, etc.) result in higher long-term contract prices, as nobody knows the agenda and stockpiles of utilities who do this long term buying.

Thanks, Kees, for this extensive interview, it provided me and hopefully also the readers with useful insights on analyzing mining stocks.

KD: The pleasure was all mine, and hopefully this interview shows how interesting and multi-faceted analyzing mining stocks can be.

TCI: As promised in the introduction, several examples of Kees' analyst reports will be published shortly. The first one will be about a well-known ramping up producer, and I choose to have two rounds of feedback with the company and Kees, which increases the length of the analysis but also provides the company with a platform to defend its case, and gives insights in the way this company engages with critical analysts, and adds additional insights.

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter on my website www.criticalinvestor.eu, in order to get an email notice of my new articles soon after they are published.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Disclaimer:

The author is not a registered investment advisor, and currently has no position in any of the named companies. Kees Dekker is also not a registered investment advisor, and currently has a long position in Lydian International, Trilogy Metals and Cameco. All facts are to be checked by the reader. For more information go to the websites of the mentioned companies and read the available company information and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

[NLINSERT]Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Pretium Resources, Seabridge Gold and Red Eagle Mining. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Pretium Resources, a company mentioned in this article.

Images provided by the author.