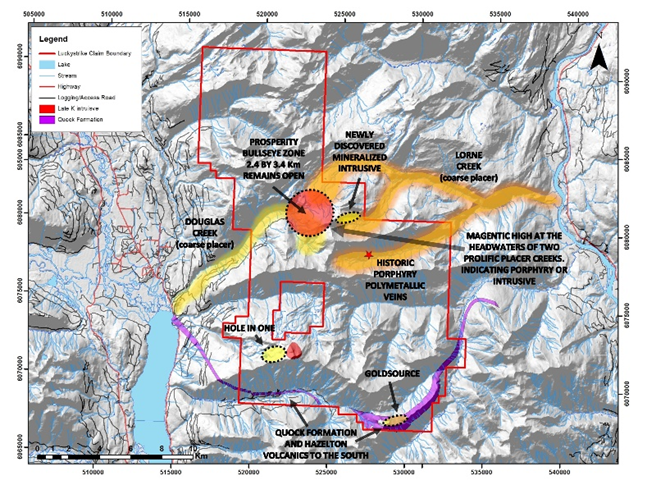

Goliath Resources Ltd. (GOT:TSX.V) is a precious metals project generator focused in the prolific Golden Triangle and surrounding area of northwestern British Columbia.

Why the Golden Triangle?

Much has been written about British Columbia's Golden Triangle, as it is one the richest reservoirs of metal in the world. The Golden "Triangle," "rectangle" or more aptly, a "Golden Corridor," as we like to call it, is one of the most richly mineralized areas in the world. This Golden "Corridor" is a small part of a much larger geological feature of the Pacific "Ring of Fire." It is associated with some of the largest and richest mineral deposits in the world, from Indonesia through Japan, Alaska, the Yukon, down through Nevada, to the metal-rich Mexico, Colombia, Peru, and the massive copper deposits of Chile.

The Golden Triangle is at a much earlier stage of exploration than other mineral-rich areas like Nevada and Chile. However, with the recent snowpack and glacial abatement in the area, new exciting targets are now being exposed at surface and being seen for the first time in +12,000 years. Also, the success of Pretium Resources Inc. (PVG:TSX; PVG:NYSE) that began production last year and Seabridge Gold Inc.'s (SEA:TSX; SA:NYSE.MKT) massive, ever-expanding KSM and Valley of the Kings deposits have encouraged new infrastructure buildout, such as new roads, rail and power lines. The Golden Triangle is coming of age, after more than 120 years of mining history, men's dreams built and broken, looking for the sweet spot by having to drill through hundreds of meters of ice.

The northern British Columbia deposits are large porphyry copper-gold deposits, but the area has a variety of other deposits. An example is Eskay Creek (Stikine SKZ.V) a Volcanogenic Massive Sulphide deposit that produced more than 3 million ounces of gold, 160 million ounces of silver with grades of 49 grams per ton and 2405 grams per ton of silver, respectively. But it was not an overnight success; first walked over and drilled in 1935, the project was revisited in the years that followed until Stikine, a junior explorer, drilled over 100 holes into the property during the 1990s. Finally the company hit and was later bought out by Barrick Gold Corp. (ABX:TSX; ABX:NYSE). Below is the chart of Stikine; it shows the move after it hit and the incredible wealth that can be made when you explore and discover a precious metal deposit. It also shows that shares are volatile; some investors bought at $0.50, someone sold at $0.30, and then it went to $60.00. Investors must ask themselves why they are in the story, Dimes or Dollars, there is no wrong answer; however, the management of Goliath believe they are on to something important. Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTCQB), also in the Golden Triangle, saw shareholders that sold last week and maybe forgot to ask themselves this important question.

Chart courtesy of StockCharts.com.

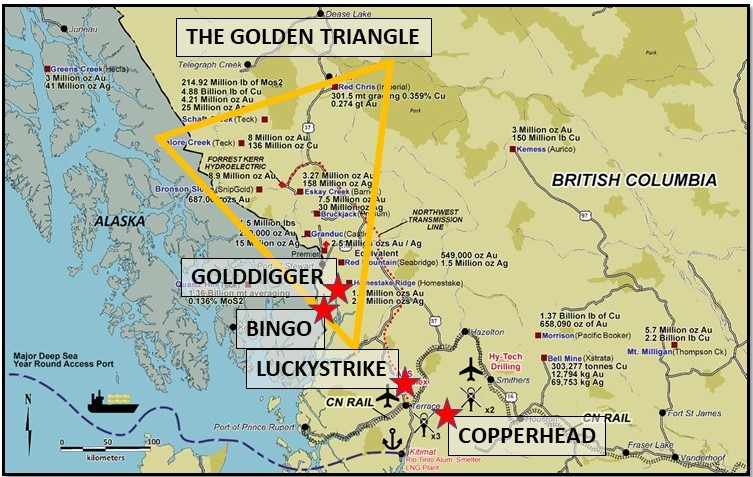

Goliath has options to acquire 100% of four highly prospective precious metals properties that include Bingo, Golddigger, Lucky Strike and Copperhead, covering 44,003 hectares.

Shares outstanding: 87,356,532 (believed that ~40,000,000 is in strong hands with family, friends, institutions, geologists and industry professionals).

Fully Diluted: 156,464,036 (average warrant strike price ~$0.18). This would raise abut ~$12,000,000. Therefore, no need to raise additional funds in the market.

Current Market Capitalization: ~ $12,000,000

Special Note: Private Placement shares issued April 12, 2018, become free trading this month.

Corporate Website and Corporate Presentation.

The founder, CEO and president of Goliath, Roger Rosmus, has extensive experience in the capital markets and resource sector. Goliath acquired its four property options from the J2 Syndicate, a private project generator focused on precious metals. The J2 Syndicate managing director and founder, Bill Chornobay, is a well-established project generator and dealmaker, and forms part of Goliath's senior technical advisors, corporate development and exploration management. This team includes members of the original group that generated, prospected and staked the Coffee Creek claims in 1998. They also discovered the gold in soil anomaly in 1999 and 2000 that now forms the nucleus of the Supremo zone. This discovery evolved into a 5-million-ounce gold resource that was recently bought by Goldcorp for $520 million. The team also includes some of the original members who staked and generated the Plateau Project in the Yukon for Goldstrike Resources Ltd. (GSR:TSX.V), which recently completed an unprecedented CA$53 million JV deal with Newmont Mining Corp. (NEM:NYSE).

Goliath Resources is a prospect generator with four excellent properties. Any one of these properties could be a company maker, as they all have the potential to have elephant-size deposits that would move the needle for senior mining companies looking to replace their depleting reserves in a safe political jurisdiction like Canada. The project generator model is an ideal corporate structure, because if any one of these properties has an economic deposit discovery, that project can be joint ventured, spun out and/or sold, and the company can separately carry on prospecting with the other properties.

All four of Goliath's properties have returned widespread mineralization of high-grade gold, silver and/or copper grades from exposed bedrock at surface. The new discoveries at Copperhead and Lucky Strike will be drilled shortly during the 2018 exploration program, and those properties will be highlighted today.

In 2017, Goliath purchased a 10% interest in the DSM Syndicate. This private company was formed by Bill Chornobay to pool geological knowledge and expertise relating to certain properties identified in an area of northwestern British Columbia south of Terrace. It staked a total of six properties and is marketing these properties with the intention to option or sell the interests. This would provide Goliath with 10% of all the economics of cash and/or shares when any deals are completed.

All these new discoveries are the result of the dramatic glacial recession and snowpack melting in geological settings where world-class deposits have been found within the Golden Triangle and surrounding area, thus making it easier for companies to find economic mineral deposits. (See picture below).

Responsible Mineral Development:

Goliath Resources notes that it is committed to "working shoulder to shoulder with its stakeholders to achieve responsible development of its projects, and to contribute to the sustainable development of the communities in which we work. Our work programs are all carefully planned to achieve high levels of environmental and social performance."

The map below shows the location of the four properties:

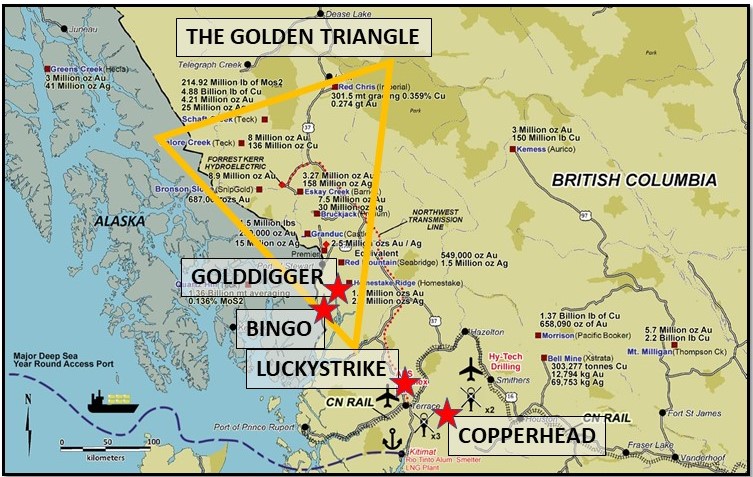

The Lucky Strike Property is a drill ready project and is located approximately about 30 km north of Terrace, BC, with logging road access and is only 3 km from a major highway, power and the infrastucture of a northern city, Terrace, with daily airline service.

The Prosperity Bulls Eye Zone is 2.4km x 3.4km on the Lucky Strike Property and is going to be drilled starting mid-August 2018. It has a classic textbook geophysical and geochemical porphyry signature with the central zone extending over 2500 x 1500 x 500 meters and remains open to depth. This massive porphery drill target also registered high gold, copper and molybdenum anomalies, and is believed to be the source of the placer gold and large nuggets found in the streams as well as placer creeks that surround this zone. You can view the 3D video model by clicking here.

Click here to read complete news release.

Initial prospecting on the Lucky Strike property in 2018, has already resulted in the discovery of several new significant zones of widespread mineralization at surface, and Goliath has expanded its drill program to test one of these new zones (Gold Source - 400 x 200 meters) that returned 3.1 ounces per tonne gold from a hydrothermal breccia grab sample.

You can view the most recent project update video (August 13, 2018) by clicking here.

Goliath's website is very detailed and has a lot of information. The history of the property goes into much more detail than we can discuss in this short article. The complete Lucky Strike project information can be viewed on the website.

The Copperhead property covers 4,354 hectares with logging road access, 6 kilometers to the nearest road and power line. It is located ~35 kilometers southwest of Smithers, BC, and situated south of the Golden Triangle area. It resides within the Skeena Arch, a belt-scale structural corridor associated with significant mineralization that will be drilled in August 2018.

The newly discovered and sampled Copper King Trend measures 2 kilometers long x 350 meters wide and remains open. It is defined by:

- Widespread massive and semi-massive sulphide volcanic breccias at surface in an area of sparse outcrop over a 450 meter area containing potassic alteration. Grab samples with mineralization up to 7.97% Cu and 45.41 g/t Ag were taken from this brecciated system that remains open in all directions;

- 11 meter chip sample from a volcanic breccia containing massive and semi-massive sulphides returned 0.17 g/t Au, 4.28 % Cu and 45.41 g/t Ag. The chip sample started and ended in mineralization that remains open;

- 8 meter chip sample returned 0.08 g/t Au, 1.57 % Cu and 12.45 g/t Ag. The chip sample started and ended in mineralization that remains open;

- SkyTEM aerial magnetics and electromagnetic data discovered an intense magnetic high and adjacent resistive zone, consistent with a hydrothermal alteration system. Extensive mineralized breccias extending over 450 meters, widespread potassic alteration and a corresponding magnetic high and adjacent resistive zone are consistent with a hydrothermal alteration system; and

- Geochemically, many of the samples taken display elevated As, Bi, Co, Mn, Mo, Pb, Sb and Zn signatures.

Technically speaking, Goliath met its first share price target and corrected before rebounding sharply from its corrective low and then pulled back again to test the rising trend line. We did not expect such a deep retracement; however now it has corrected to just above the rising trend line. We believe we are in the postal code of a low and have an excellent opportunity to buy cheap shares in a company with multiple compelling drill targets that could deliver up significant new ore bodies.

Charts courtesy of StockCharts.com.

In summary, Goliath Resources appears to be an exciting, high probability ground floor opportunity in the high-risk, high-reward part of the early discovery mining cycle in mining. (See chart above). The company is committed to create shareholder value through systematically prospecting and exploring newly discovered ground that is highly prospective that has been uncovered by the very rapid glacier and snow-pack abatement in this area. This has revealed some spectacular drill targets at multiple projects that are near surface in both base metal and precious metals that experts say have been covered in ice for 12,000 years. And, finally, Goliath is in a safe political jurisdiction, in an area with good infrastructure, close to power, rail and roads. Last year I followed and charted Novo, Garibaldi, GT Gold and a few others with success, and Goliath appears to have a great chance of duplicating its spectacular 2017 runs.

John Newell is a portfolio manager at Fieldhouse Capital Management. He has 38 years of experience in the investment industry acting as an officer, director, portfolio manager and investment advisor with some of the largest investment firms in Canada including Scotia McLeod, CIBC Wood Gundy and Richardson Greenshields (RBC Capital Markets). Newell is a specialist in precious metal equities and related commodities, and follows a disciplined proprietary approach incorporating equity research, analytical frameworks and risk controls to evaluate and select long and short stocks primarily from the Canadian small and mid-cap coverage. Many large, midcap and junior precious metal companies use his technical charts. Newell is a registered portfolio manager in Canada (advising representative).

[NLINSERT]Disclosures:

1) John Newell: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: I do not have a personal position in Goliath Resources, but family and friends do. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. Funds controlled by Fieldhouse Capital currently do not hold Goliath Resources shares, but could initiate a position at any time. I determined which companies would be included in this article based on my research and understanding of the sector. Additional disclosures/disclaimer below.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: Pretium Resources, Aben Resources and Seabridge Gold. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Goliath Resources, Aben Resources and Pretium Resources, companies mentioned in this article.

Additional Disclosures and Disclaimer from John Newell, Fieldhouse Capital Management, August 13, 2018:

Disclosures and Disclaimer:

It should not be assumed that the methods, techniques, or indicators presented in these pages will be profitable or that they will not result in losses. Past results are not necessarily indicative of future results. Examples presented on these pages are for educational purposes only. These set-ups are not solicitations of any order to buy or sell. The authors, the publisher, and all affiliates assume no responsibility for your trading results. There is a high degree of risk in trading.

Hypothetical and historical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown. In fact, there are frequently sharp differences between hypothetical and historical performance results and the actual results subsequently achieved by any trading program. One of the limitations of hypothetical and historical performance results is

that they are generally presented with the benefit of hindsight. In addition, hypothetical and historical trading may not present the financial risks and returns for future trading. For example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect trading results. There are numerous other factors related to the markets in general or to the implementation of any specific trading program which

cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect actual trading results.

Disclaimer: This Publication is protected by Canadian and International Copyright laws. All rights reserved. No license is granted to the user except for the user's personal use. No part of this publication or its contents may be copied, downloaded, stored in a retrieval system, further transmitted, or otherwise reproduced, stored, disseminated, transferred, or used, in any form or by any means without prior written permission. This publication is proprietary.

Neither the information, nor any opinion expressed constitutes a solicitation for the purchase of an investment program. Any further disclosure or use, distribution, dissemination or copying of this message or any attachment is strictly prohibited; such information, whether derived from Fieldhouse Capital Management or from any oral or written communication by way of opinion, advice, or otherwise with a principal of the company is not warranted in any manner whatsoever, is for the use

of our customers only and may be obtained from internal and external research sources considered to be reliable.

Images provided by the author.