In a statement released July 2, CMS noted that the "proposed changes promote innovation to modernize home health by allowing the cost of remote patient monitoring to be reported by home health agencies as allowable costs on the Medicare cost report form. This is expected to help foster the adoption of emerging technologies by home health agencies and result in more effective care planning, as data is shared among patients, their caregivers, and their providers."

"Today's proposals would give doctors more time to spend with their patients, allow home health agencies to leverage innovation and drive better results for patients," said CMS Administrator Seema Verma. "The redesign of the home health payment system encourages value over volume and removes incentives to provide unnecessary care."

"Relliq is well positioned to grab share in this relatively untapped market." - David Kwan, PI Financial

Poised to benefit from this changes are companies with virtual medical care delivery and home monitoring technologies, among them Teladoc, Philips Healthcare and Reliq Health Technologies.

Teladoc Inc. (TDOC:NYSE) was among the first telehealth providers in the U.S. The company offers access to physicians within 10 minutes via the internet, phone or a mobile app. Teladoc has a network of over 3,100 physicians across the U.S. that the company pairs with a member in the member's state. The company has 10,000 total clients, which include health plans, health systems and hospitals, and more than 300 Fortune 1000 companies. It has more than 20 million members.

At the end of May, Teladoc acquired Advance Medical, a virtual care provider outside of the United States, which will extend the company's reach globally.

Philips Healthcare, a division of Royal Philips (PHG:NYSE), has a home telehealth program with a three-pronged approach focusing on complex care management, chronic disease management and readmission management. Philips' system uses a computer-based eCare Coordinator software platform provides a clinical dashboard, allowing health professionals to monitor vital signs and send patients short surveys about their health status.

The patient at home uses the eCareCompanion app that is accessed by a tablet. Patients enter their vital information, which is submitted to their care team. The system allows for two-way live video to connect medical professionals with patients, making it possible to assess patients more accurately.

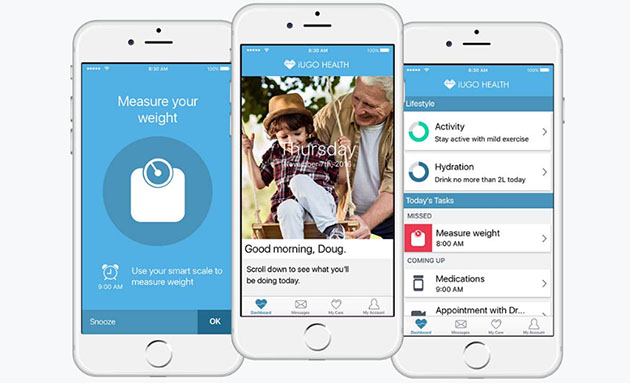

Reliq Health Technologies Inc. (RHT:TSX.V; RQHTF:OTCQB) is a Vancouver-based company that specializes in developing innovative software solutions for the community care market. It has developed the iUGO health technology platform that integrates "wearables, sensors, voice technology, and intuitive mobile apps and desktop user interfaces for patients, clinicians and health care administrators."

Reliq notes that allowing complex patients to receive high-quality care at home improves health outcomes, enhances quality of life for patients and families, and reduces the cost of care delivery.

The company's focus has primarily been on Texas, where is has agreements with a number of healthcare providers. Earlier this month, Reliq announced that it had signed contracts with two additional home health agencies in south and central Texas, which will add 1,200 chronic disease patients to its roster.

Patients can use various service providers on Reliq's iUGO platform, but ForaCare's D40g 2-in-1 blood glucose and blood pressure monitoring device has proven to be the preferred device. In order to secure availability of the device, Reliq has entered into a strategic partnership with ForaCare Inc.

Dr. Lisa Crossley, CEO of Reliq, noted, "Many of our clients in Texas who work in underserved communities where there are no internet service providers require monitoring devices that can collect and share patient data over a cellular network. ForaCare's D40g 2-in-1 blood glucose and blood pressure monitoring device is SIM card-enabled and ideally suited to these applications. This partnership will allow us to work closely with ForaCare on forecasts to ensure adequate device supply for our clients going forward."

On a shareholder call on May 31, Dr. Crossley assured shareholders that the company will hit its 2018 goal of 35,000 patients by year end.

Editor's note: On July 12, Reliq announced it had received the first shipment of backordered remote monitoring devices and is now able to resume onboarding new patients.

Reliq has caught the attention of industry analysts. PI Financial initiated coverage on June 26 on the company with a Buy recommendation and a CA$2.60 target price. Analyst David Kwan expressed the opinion that the strong growth in healthcare costs is unsustainable, noting, "healthcare costs are expected to rise +5% per year in the US and reach US$5.7T in 2026 or close to 20% of GDP. To help control the growth in costs, Medicare and Medicaid is shifting to a value-based model from a fee-for-service model, which has created an opportunity for RHT."

Kwan sees Reliq as an early mover in the sector, noting that it is targeting the approximately 37 million Medicare and Medicaid patients with at least two chronic conditions. "There is a burgeoning market to provide better care for these patients and RHT is well positioned to grab share in this relatively untapped market, especially given their iUGO Care solution is fully reimbursable by CMS (i.e., no cost to their customers)."

"Despite spending little on S&M to date, Kwan wrote, "RHT has over 60K patients under contract (+$45M in annual recurring revenue) with ~12K already on boarded and a near-term pipeline of +500K patients, as customers are proactively looking for a solution like iUGO Care."

Reliq has about 105 million shares outstanding, 142 million fully diluted; management and other insiders own 24%.

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following company mentioned in this article is a billboard sponsor of Streetwise Reports: None. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Reliq Health Technologies. Please click here for more information. An affiliate of Streetwise Reports is conducting a digital media marketing campaign for this article on behalf of Reliq Health Technologies. Please click here for more information.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Reliq Health Technologies Inc., a company mentioned in this article.

Disclosures from PI Financial, Reliq Health Technologies Inc., Initiating Coverage, June 26, 2018

I, David Kwan, hereby certify that all of the views expressed in this report accurately reflect my personal views about the subject securities or issuers. I also certify that no part of my compensation was, is, or will be, directly or indirectly related to the specific recommendations or views expressed in this report. I am the research analyst primarily responsible for preparing this report.

Research Disclosures:

1) PI Financial Corp. and its affiliatesí holdings in the subject companyís securities, in aggregate exceeds 1% of each companyís issued and outstanding securities. No

2) The analyst(s) responsible for the report or recommendation on the subject company, a member of the research analystís household, and associate of the research analyst, or any individual directly involved in the preparation of this report, have a financial interest in, or exercises investment discretion or control over, securities issued by the following companies. No

3) PI Financial Corp. and/or its affiliates have received compensation for investment banking services for the subject company over the preceding 12-month period. No

4) PI Financial Corp. and/or its affiliates expect to receive or intend to seek compensation for investment banking services from the subject company. Yes

5) PI Financial Corp. and/or its affiliates have managed or co-managed a public offering of securities for the subject company in the past 12 months. No

6) The following director(s), officer(s) or employee(s) of PI Financial Corp. is a director of the subject company in which PI provides research coverage. No

7) A member of the research analystís household serves as an officer, director or advisory board member of the subject company. No

8) PI Financial Corp. and/or its affiliates make a market in the securities of the subject company. No

9) Company has partially funded previous analyst visits to its projects. No

10) Additional disclosure: No

Analysts are compensated through a combined base salary and bonus payout system. The bonus payout is amongst other factors determined by revenue generated directly or indirectly from various departments including Investment Banking. Evaluation is largely on an activity-based system that includes some of the following criteria: reports generated, timeliness, performance of recommendations, knowledge of industry, quality of research and investment guidance, and client feedback. Analysts and all other Research staff are not directly compensated for specific Investment Banking transactions.