Maurice Jackson: Today we will highlight the next mid-tier production company. I'm speaking of Nevada Copper Corp. (NCU:TSX; NEVDF:OTC.MKTS), North America's next copper producer. Joining us for a conversation is Matthew Gili, the president and CEO of Nevada Copper.

Matthew, who is Nevada Copper and what is the value proposition you present for investors?

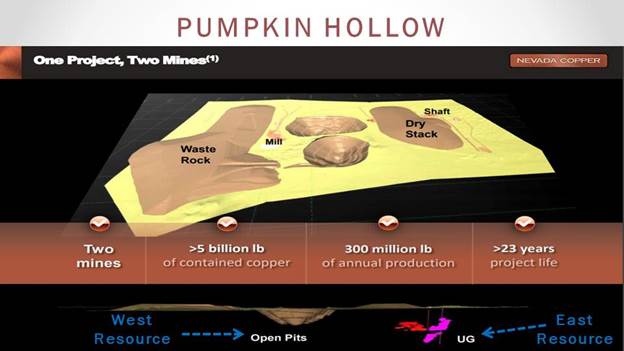

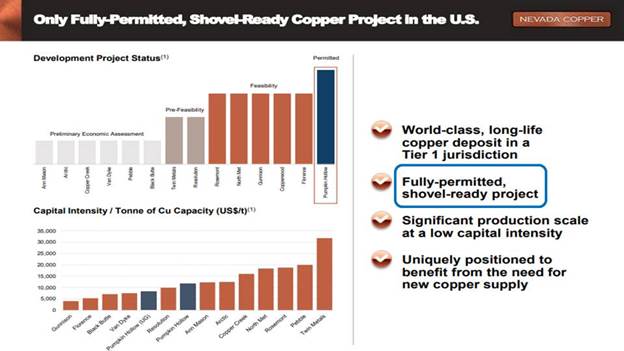

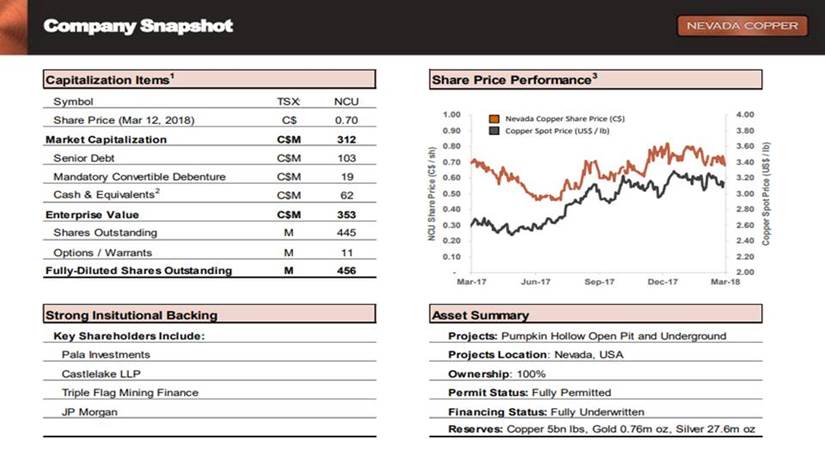

Matthew Gili: Nevada Copper is the owner of Pumpkin Hollow, a 5 billion pound resource of copper in Yerington, Nevada, about 80 miles outside of Reno. There are two projects there, an open pit and and an underground. We are the only major shovel-ready, fully permitted copper project in the U.S. We're in a tier one mining jurisdiction in a prolific copper district. Yerington historically has been a very large copper producer. We have a lot of blue sky in terms of drilling and potential M & A with the areas around us, and we've got strong financial partners to make this project fully financed.

Maurice Jackson: Please provide us with a brief narrative on the background of Nevada Copper.

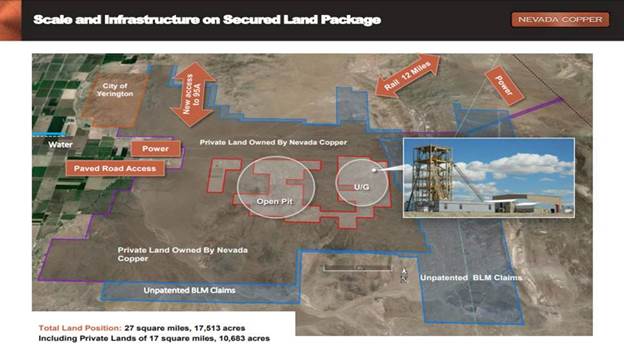

Matthew Gili: Nevada Copper has been around since about 1999 is when it first was incorporated. It really gained some traction in 2006 and it was focused developing Pumpkin Hollow. That was a time of rising copper prices. It was a time of a lot of excitement for copper and a time when mines were big and projects were big, and the team there did a fantastic job of permitting Pumpkin Hollow. They established a land package of private land. Pumpkin Hollow is entirely on private land, and that required cooperation with the federal government, and the state of Nevada, and the city of Yerington.

They secured that as private land and secured that land package, and were ready to develop this into a major asset. About that time, it got difficult in the copper industry, around 2012 to 2015, and, quite frankly, the team ran out of money. What we've done since then is refinance the project. You will see that on press releases, the $375 million refinancing package, and we're now ready and poised to finish the construction of the underground that was started by the previous team, and then bring on and complete the feasibility studies on the open pit to turn that into a real value making entity.

Maurice Jackson: You alluded to the copper sector here. Why should the market be excited about the copper sector and how does Nevada Copper's Pumpkin Hollow fit into the narrative?

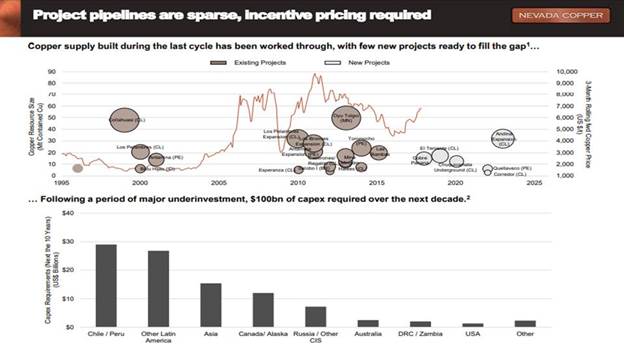

Matthew Gili: Where we see the real growth in copper is in the electrification of the world. Not just electric vehicles, but electricity is a much more efficient way to transfer energy, and you're seeing that across the world. So if you'll think about a vehicle, the electrification of a car takes the steel engine block, and transforms that into a copper electric motor, and the transmission of this energy now is not through a pipeline like petroleum, but through electrical conductors, some of which use copper. So that's really that value proposition we see for copper from the demand side. On the supply side, I just want to stress that there's been a limited, reduced amount of investment in expanding the copper supply. You're seeing a lot of permitting issues. You're seeing a lot of tough jurisdictions to get licenses to operate, and you're also seeing a lot of existing open pit producers as they wind down, converting over to underground resources that require more capitalization and have a higher operating cost. So, these are the things that we're seeing that are affecting the supply side of copper, and that's why we're so excited as Nevada Copper. We are the only fully permitted property. It takes a lot of time and energy and resources to get permits and to get that license to operate. Nevada Copper has secured that with the stakeholders involved and we are constructing right now.

Maurice Jackson: Walk us through you flagship project, the Pumpkin Hollow. Tell us about the location, metallurgy and scale.

Matthew Gili: Pumpkin Hollow is about 80 miles outside of Reno, Nevada, in a town called Yerington. Historically, Yerington has been a copper producer with a company called Anaconda in the 1950s to the 1970s. Pumpkin Hollow has two mines, an underground we call the East Resource, and an open pit, which we call the West Resource. They're about four kilometers from each other and so they seem like they're the same property, but they're not. They actually are two discrete mines that can be run independently, and we will run them independently. From the standpoint of production, of course, we'll share infrastructure and those sort of things.

We're building a 5,000 ton a day underground with its own processing facility on site and the open pit. Right now, we're in the process of re-engineering. Historically, it had been established a 70,000 ton a day producer and processor of ore. We're going to re-engineer that and we're aiming for about half that production rate. But it's an increase in comparative copper production by increasing the grade. For metallurgy, it's a very straightforward float copper concentrate with some precious metal credits. It's exported to a smelter, and so that describes to you the size of Pumpkin Hollow. The underground, we would anticipate producing about 27,000 tons of copper per year in copper concentrate, and the open pit is a number around 100,000 tons per year of copper concentrate.

Maurice Jackson: What are the economics of Pumpkin Hollow?

Matthew Gili: So far $220 million of capital spend has been invested in Pumpkin Hollow by the previous teams that have managed it. We're looking at a number between $180 to $200 million of initial capital investment between now and the end of 2019 in order to get the Pumpkin Hollow underground up into its full production. Full production will be reached in mid-year 2020, so that's the capital investment required there.

When we're in full production, we'll be generating about $70 million a year of free cash flow from the operation and it's got about a 13-year mine life. The economics of the open pit are a little different. We're targeting an open pit of about half the size of the feasibility study originally published in 2015, so that would put it at about 35,000 tons a day with its own processing facility. It's got about a 16-year mine life, and again, that would produce about 100,000 tons a year of copper in concentrate.

Maurice Jackson: What can you share with us about the production profile and cash generation?

Matthew Gili: The production profile and cash generation of the underground deposit is well defined, and as we're constructing it now, the production profile will be about 27,000 tons per annum of copper in concentrate, generating a free cash flow of around $70 million a year at our consensus pricing. The open pit, we're still in the process of re-engineering. We're targeting an annual production of around 100,000 tons per year of copper in concentrate and still working through the feasibility study on just how does that translate into cash generation.

Maurice Jackson: How big of a concern should it be for speculators regarding infrastructure in capital expenditures?

Matthew Gili: From the standpoint of infrastructure, Nevada lends itself to good, efficient infrastructure. There's a rail spur just outside of the project. We're on good, high quality paved roads. We were within 10 kilometers of an existing high tension power line and we've got our water secured, so from the infrastructure standpoint, we're in good shape. From the capital standpoint, that's why our team is in place, a team of proven mine builders that understands how to manage projects and deliver projects on budget and on time, and that's really our focus of the management team at this point.

Maurice Jackson: Is drilling currently being conducted at Pumpkin Hollow, and if yes, how would you rate the results?

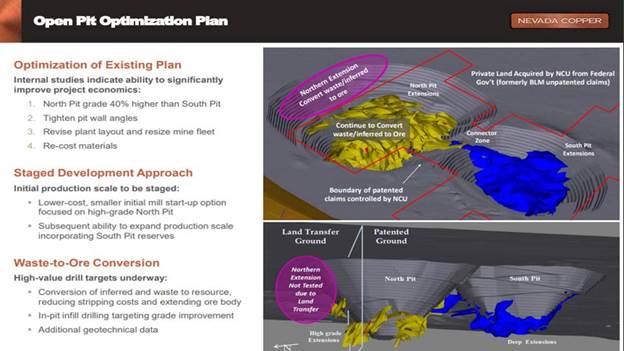

Matthew Gili: We're very proud of the drilling that's going on right now at Pumpkin Hollow. If you're paying attention to our press releases, you'll see we've started to release the results of the drilling on the north pit open pit area, what we call the west area, so we just started to drill that area out. What's exciting about that for us is that previously, before the land swap, before we tied up all this land as Pumpkin Hollow's land, that was government land, and so we purposely didn't drill. We'd always suspect it and our models always showed that there was mineralization of copper to the north of that and now that we own that land, and we're able to drill on that land, our drilling is showing that indeed there is good quality copper mineralization on the north edge of that pit. What that does is it just adds to the copper production profile for Pumpkin Hollow's open pit operations.

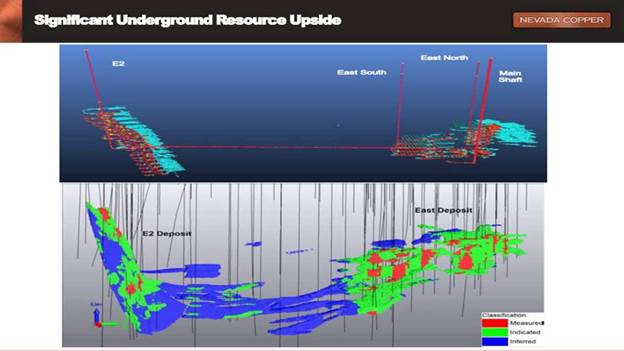

Maurice Jackson: Is there expansion potential on the Pumpkin Hollow?

Matthew Gili: There's absolutely expansion potential on Pumpkin Hollow, both in the underground and the open pit, and again, it is one of the things that has excited me the most about Pumpkin Hollow. We know that there are mineral occurrences underground. We know that there are some resources underground. It's really inefficient to drill them as deep as they are from the surface, so that's really going to be one of our first focuses as we finish out the underground, to establish the drill platforms so that we can expand that underground resource model, and convert some of that resource to reserves. So a lot of potential lies between the two sides of the underground, and from the open pit as we talked about previously. There's that north extension that we know is a high potential area, and our initial drill holes from there are showing that same potential. There's also some areas that are deeper in the open pit and in between the north and south open pit that also show that same potential, and we'll continue to pursue those as we go through our exploration program.

Maurice Jackson: Let's discuss the defined path to production.

Matthew Gili: Absolutely. So the defined path production for the underground is very clear. We've started pre-work construction now. We will be commissioning the underground hoisting system and plant facility in the fourth quarter of 2019 and we'll be up to a full ramp up at 5,000 tons a day of hoisting and processing about mid-year 2020.

Maurice Jackson: Before we leave Pumpkin Hollow, are there any reversionary interests?

Matthew Gili: Pumpkin Hollow is 100% owned by Nevada Copper. There's a small royalty holding, but other than that, Nevada Copper completely controls the Pumpkin Hollow deposit.

Maurice Jackson: Are there any redundant assets, such as patent mining claims?

Matthew Gili: No. The land package is completely private ownership and it's completely under Nevada Copper.

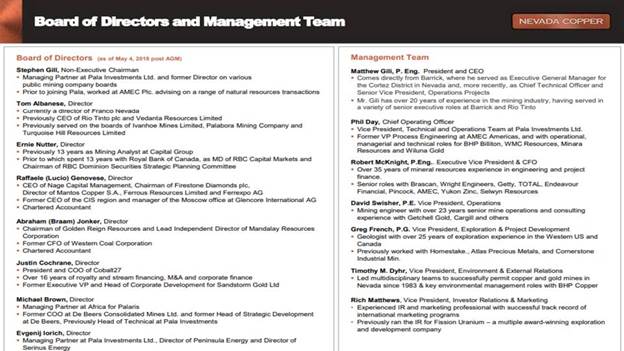

Maurice Jackson: We've covered the latent material in the ground. Let's discuss what I consider the most important aspect, which are the people. Who is on your board of directors, and what makes them qualified for the task at hand?

Matthew Gili: I'm really excited about the board of directors. This is a group of people who have been brought together that really understand how to construct and operate mines. The two newest board members are Tom Albanese and Ernie Nutter. Tom Albanese has had a long, distinguished career with Rio Tinto and certainly is somebody that I have had the privilege of working with for many years in my prior careers. Ernie Nutter brings this huge amount of experience with RBC, and then on the capital markets, is just an icon of the copper and mining industry in Canada. We are very fortunate to have these high quality people on the board of directors.

Maurice Jackson: Tell us about Matthew Gili; what unique skillset does he bring to the table?

Matthew Gili: Matt Gili is a miner and a mine builder. That is how I define myself. I'm a mining engineer and I've had the great fortune and opportunity to build and operate mines all across the world, all across North America and Alaska, South Africa, Mongolia and now in Nevada.

Maurice Jackson: Now, share with us, what attracted you to Nevada Copper?

Matthew Gili: Nevada Copper is the right mine in the right place at the right time. It is really a chance for Nevada Copper to show what it's capable of. It's fantastic to me to be part of that team that brings this asset on in a time when the industry wants more copper producers, where customers want more copper, and where what they really want is a mine that has been very well thought through, to be an efficient use of capital and a fantastic generation of cash flow and wealth, so it's a very exciting time for me. I really welcome the chance to be able to shape the very beginning of Pumpkin Hollow.

Maurice Jackson: Should something happen in your absence, who would lead the company?

Matthew Gili: What we do have is a fantastic group of directors who are experienced, as we discussed, and we have a very strong management team from diverse backgrounds, all of whom could step in in my absence. That's really one of our focuses as we're bringing together this new team and we're developing Pumpkin Hollow, and Nevada Copper is to put together those strong succession plans so we are confident in our ability to execute it.

Maurice Jackson: We haven't addressed the technical team. What can you share with us?

Matthew Gili: Our technical team is led by Phil Day, who's our chief operating officer, and just a fantastic asset at all kinds of experience across the world in building mines and really brings that whole team together. What he has done is really gelled the rest of the technical team into a very cohesive unit. We're very pleased with the addition of David Swisher, somebody who has built a lot of mines, but that doesn't take away from the strong background of people who have been experienced with Nevada Copper for a long time, like Greg French, who is our vice president of exploration and Tim Dyer, who's our vice president of environmental and external relations. So we're really fortunate to have a mix of people who have been with the property for a long time and have that institutional knowledge and great experience, and a few new people who bring the new approach, and a new energy into the property.

Maurice Jackson: Let's get into some numbers here. How much cash and cash equivalence do you have?

Matthew Gili: If you go through the press releases, you'll hear and see a lot about the refinancing. We completed it right at the beginning of this year. That has really set us up for going forward with the construction of Pumpkin Hollow's underground. Today, our cash and cash equivalence in the bank, on the balance sheet is about $45 million.

Maurice Jackson: Talk to us about cash flow distribution. Where is this cash being spent?

Matthew Gili: Right now, all of our cash is focused on the construction of the Pumpkin Hollow underground with minor amounts going into the drilling we talked about of the open pit, as well as completing the feasibility study of the open pit. So my mandate is first, construct the underground, but equally importantly commence and bring forward the feasibility study for the open pit.

Maurice Jackson: How much debt do you have?

Matthew Gili: There's $80 million of debt on the balance sheet today.

Maurice Jackson: What is your burn rate?

Matthew Gili: At full construction, we'll burn about $12 million per month. If you look at it another way, we have about another $180 to $200 million of project capital to spend between now and the end of 2019 to bring the underground into full production.

Maurice Jackson: Tell us about your share structure.

Matthew Gili: Right now we have 450 million shares outstanding. About 70% of those shares are held by our two major institutional investors.

Maurice Jackson: How did Nevada Copper get into this position?

Matthew Gili: We had the original IPO, and this has really been part of the whole refinancing that occurred at the end of last year. There was the conversion of a lot of debt into additional shares, and so this is really the formation of the new Nevada Copper.

Maurice Jackson: What is the float again?

Matthew Gili: It'd be 30% of our shares are the float if 70% are controlled by institutional investors.

Maurice Jackson: Speaking of your institutional investors, who are they and what is their level of commitment?

Matthew Gili: The largest institutional investor is Pala Investments out of Zug. Our non-executive chairman, Stephen Gill, is a managing partner of Pala Investments, and they take quite an active role right now in managing this asset. Many of our key management team people are from the Pala organization. I have been working with them now for about a month and am extremely pleased and fortunate to be working with such a high caliber group of people. The 20% of the rest of the institutional investment is done through a group called Castle Lake. They're treating this much differently, more as an investment, less direct impact, less direct involvement, but still very supportive of the project, as you would expect from somebody that owns so many shares.

Maurice Jackson: What are the change of control fees?

Matthew Gili: There are no change of control fees. There's small change of control fees associated with some of the key staff, but other than that, there's no change of control fees.

Maurice Jackson: What is the next unanswered question for Nevada Copper? When should we expect results and what determines success?

Matthew Gili: On the underground, it's not an unanswered question. We know the direction. We know the path and it's clear, and it's public. The real next unanswered question at Nevada Copper is going to be the results of the re-engineering of the feasibility study for the open pit. Though we have a fantastic resource there, we know that the previous approach was well thought out for the context of the time, but those times are changed and the industry is looking for more capital efficient ways of producing copper. So we're going through that study right now. I could tell you that the initial results are very exciting. Through the course of this year, we're going to be able to produce and publish that feasibility study and then by the end of this year be able to update the reserve statement to reflect that, so that's really the next exciting unanswered question for Nevada Copper. What does that open pit look like and how does it add shareholder value?

Maurice Jackson: Now, if plan A doesn't work, what is plan B?

Matthew Gili: So plan A is that we develop the underground and then we transition into the open pit starting probably around the end of 2020. If that doesn't work, what we'll do is we can always put the open pit on hold. As I said before, the two mines are mutually exclusive and we purposely have done that so we are able to either bring the open pit forward if the economics were to indicate that it would be advantageous to bring that forward, or we could also delay that if necessary in order to best meet the needs of the shareholders.

Maurice Jackson: In closing, what keeps you up at night that we don't know about?

Matthew Gili: Okay, so the one thing that keeps me up at night more than anything is the cost escalation that we're concerned about in the mining industry. You're seeing a rejuvenation of mining. You're seeing a rejuvenation of people excited about mining projects, so I get a little worried about cost escalation. The team is managing that very well but I always worry about that. I always say what keeps you up at night is the safety and well-being of the employees of Nevada Copper. Just always knowing that it is our responsibility to ensure everyone goes home safe and healthy every night.

Maurice Jackson: Last question. What did I forget to ask?

Matthew Gili: I would want to stress the regional capacity of Nevada Copper, that Yerington district. So that would be something I would really want to focus on. Yerington historically had been a major copper producer. Where's the source of that porphyry? Where is the source of all this copper? Can Nevada Copper find that and can Nevada Copper capitalize on that? What really excites me is finding and unlocking the riddle of Yerington and finding that big copper play that really transforms that United States copper industry.

Maurice Jackson: For readers who want to get more information about Nevada Copper, please share the contact details.

Matthew Gili: Please come to our website, nevadacopper.com. It'll be able to take you through there and show you what we're doing, introduce you to the management team, the board of directors, and the history of Nevada Copper.

Maurice Jackson: Nevada Copper trades on the TSX symbol NCU, and the OTC symbol, NEVDF. For additional inquiries, contact Richard Matthews. His phone number is 604-683-8992, or you may email rmatthews@nevadacopper.com.

And last but not least, please visit our website www.provenandprobable.com where we interview the most respected names in the natural resource space. You may reach us at contact@provenandprobable.com.

Matthew Gili of Nevada Copper, thank you for joining us today on Proven and Probable.

Thank you for joining us today on Proven and Probable. Remember to like and subscribe for more conversations with the most respected names in the natural resource space. Check out our website at www.provenandprobable.com. The information presented on Proven and Probable is provided for educational and information purposes only, without any expressed or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The information is not intended to be and does not constitute financial, investment, or trading advice, or any other advice. You should not make any financial, investment, or trading decision based on any of the information presented without first undertaking independent due diligence and consultation with a professional broker, or competent financial advisor.

Maurice Jackson is the founder of Proven and Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Matthew Gili: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Nevada Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Nevada Copper.

2) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Nevada Copper. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Nevada Copper is a sponsor of Proven and Probable. Proven and Probable disclosures are listed below.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images provided by the author.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. You should not make any decision, financial, investments, trading or otherwise, based on any of the information presented on this forum without undertaking independent due diligence and consultation with a professional broker or competent financial advisor. You understand that you are using any and all Information available on or through this forum at your own risk.