The Canadian Constitution couldn't be clearer about who controls pipelines that cross provincial boundaries—as in Kinder Morgan's proposal to twin an existing pipeline that runs from Edmonton to Burnaby, BC. According to the 1867 Constitution, section 92(10)(a), the federal Parliament has jurisdiction over railways, canals and "other works and undertakings" (including pipelines) that extend across provincial boundaries. If the federal government approves a pipeline, as Justin Trudeau's Liberals did with the Kinder Morgan TMX Expansion project in 2016, no provincial government may, within the limits of our Constitution, override the decision. The "declaratory power" of section (c) strengthens federal jurisdiction even more if the project is considered to be in the national interest. The following is from Tom Flanagan, a professor of political science at the University of Calgary, who knows the Constitution inside-out:

This allows Parliament to declare a work, even though "wholly situate within the province," to be for the general advantage of Canada, or of two or more provinces, and therefore to come under federal jurisdiction. Parliament could invoke the declaratory power over all the local roads, bridges, storage facilities, hydro connections and any other physical installations necessary to construct and maintain a pipeline. - Tom Flanagan

So, all the federal government needs to do is pass a law stating that we WILL build a pipeline to allow Alberta oil to get to tidewater and enjoy international prices rather than the current $27 discount Canadian producers of Western Canadian Select must accept versus the North American West Texas Intermediate benchmark. Instead, we have the Minister of Finance, Bill Morneau, saying Wednesday that they have agreed to write Kinder Morgan a cheque to ensure that the pipeline gets built despite the steadfast opposition of the BC government. In other words, the federal government's solution to what has become a ridiculous dog and pony show of separate interests all fighting each other instead of working together in what could be a national infrastructure project of benefit to all Canadians, is for the costs of any delays to be picked up by you, the taxpayer. And so far Morneau has given no limit as to what he'd pay. It's a blank cheque. How did we get to this sad state of affairs, where our government has to pay off a company just to get a key piece of infrastructure built?

A brief history

It all goes back to the decision in 2016 by newly minted PM Justin Trudeau. The golden boy who could do no wrong, despite the Trudeau name being a curse word in Alberta for Trudeau Senior's hated National Energy Program, decided to reject Northern Gateway and approve Kinder Morgan's project, aka the Trans Mountain pipeline. Why did Trudeau do that? In a bit of twisted logic, Trudeau and his Environment Minister, Catherine McKenna, reasoned that in order for Canada to meet its international carbon emissions reduction obligations, it would impose a national carbon tax. Knowing that a carbon tax wouldn't go over big in Alberta, Trudeau rejected Northern Gateway, which faced impossibly high hurdles in First Nations and environmental opposition, and instead green-lighted Kinder Morgan.

The proposal would twin the Texas-based company's existing pipeline, allowing a tripling of crude oil from 300,000 barrels to 890,000 barrels a day, while also triggering a seven-fold increase in the number of oil tankers coming and going from Vancouver Harbour.

Since it was not a new pipeline but an extension of an existing one, Trudeau likely reasoned it would face less opposition than Northern Gateway (people forget that the National Energy Boardan independent regulatory agency recommended that the federal government approve it, with 157 conditions). He was obviously wrong about that, as the ongoing protests on Burnaby Mountain, just outside of Vancouver, demonstrate. Thus, the bargain struck in 2016 was a carbon tax in return for Alberta being granted a route for its bitumen from the oilsands, and a way out of the current dilemma of chock-full pipelines forcing producers to accept a discount on Canadian crude oil. The oil flowing through Kinder Morgan's new pipes would be exported, meaning it could fetch the higher Brent crude price. Win win, right? Wrong.

Remember Christy Clark? The former BC premier was instrumental in cutting a deal with Alberta Premier Rachel Notley that would satisfy BC's concerns that it was getting a fair shake over this Kinder Morgan pipeline proposal. Clark and Notley's predecessor, Alison Redford, got off on the wrong foot right away (their relationship was described as "frosty") when Clark demanded that she wouldn't agree to the pipeline unless five conditions were met:

- world-leading marine and land oil spill response

- protection and recovery measures for B.C.'s coast and land areas

- environmental reviews

- First Nations consultations

- participation and economic agreements that reflect the level and nature of the risk the province bears with a heavy oil project.

On January 11, 2017, after five years of negotiations, Clark announced that the five conditions had been met and therefore gave the pipeline environmental approval, with 37 conditions. The deal included a revenue-sharing agreement worth up to $1 billion; the money from the fund was supposed to go into local environmental projects. Kinder Morgan promised that between $25 million and $50 million would flow to BC provincial coffers every year for the next 20 years. Four months later, an agreement was cemented with Kinder Morgan Canada, along with separate agreements with 33 BC First Nations and 19 cities in BC and Alberta. The 30-page document came with a poison pill, though. If the BC government resorted to undue regulatory hurdles, the company could declare it null and void. "The province will continue to endeavor to have a timely and efficient regulatory and decision-making process for all provincial regulatory matters related to the project," states the agreement quoted by the Calgary Herald.

But the next month, in May 2017, the BC Liberals lost the election to the NDP, who clung to power with a majority cobbled together with the BC Green Party, which won just three seats. Both NDP leader John Horgan and Green Party leader Andrew Weaver campaigned on a promise to kill the pipeline, with Horgan famously saying he planned to "use every tool in our tool box" to stop it, and Weaver, a climate scientist, saying the project represented a massive threat to the province's environment.

So far neither Kinder Morgan nor the provincial government have said they will pull out of the deal, despite obvious rancor between the company and the government since the NDP-Green coalition assumed power last summer.

Crucially, Clark in 2013 agreed that none of the royalties from Alberta's oil pipelines would go to BC, despite BC talking all of the risk of an oil spill in the waters of Vancouver Harbour and the shipping lanes that tankers would travel carrying Canadian heavy oil destined for Asian markets. Clark defended her decision based on the fact that BC gets royalties from its northern BC gas fields, and her Liberals were gung-ho to develop an LNG industry in BC, which has yet to happen and likely never will.

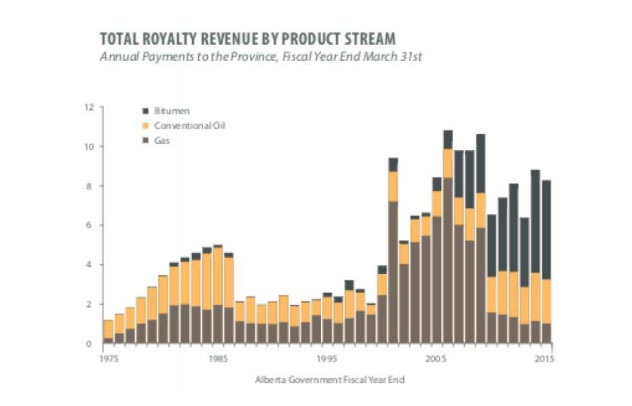

So while it sounded good to say all five conditions were met, all Clark really had were vague promises of taxes from Kinder Morgan and the Alberta government, a federal pledge for a $1.5-billion coastal protection plan, and no royalties. In 2015 the Alberta government earned about $8 billion in royalties, with the majority coming in the form of royalties from bitumen extracted from the oilsands.

From the horse's mouth

Officially, Kinder Morgan says the pipeline will mean $7.4 billion to the Canadian economy through project spending, generate 800,000 direct and indirect jobs—189,000 person-years for BC during construction and operations and 441,000 for Alberta. Houston-based KM says Canadian producers will see increased revenues of $73.5 billion over 20 years. $46.7 billion in additional taxes and royalties would go to federal and provincial governments from construction and two decades of operations. Out of that, BC would receive $5.7 billion, Alberta $19.4 billion, and the rest of Canada $21.6 billion. Municipal tax payments would total $992 billion for BC and $124 billion for Alberta.

The stalemate

The BC government though is having none of it. Since taking power Premier Horgan, a career politician born and raised in Victoria, has said that he will defend BC's environmental interests and is currently having his government draft a reference case to the B.C. Court of Appeal to decide whether British Columbia has the legal right to restrict the flow of bitumen by pipeline or rail through the province. The Alberta government tried to stop what it saw as BC meddling in Alberta's oil industry by slapping a boycott on BC wines. While that ban was lifted a few weeks later, the feud has escalated. On Wednesday Alberta passed Bill 12, a landmark piece of legislation giving it sweeping powers to intervene in oil and gas exports—including stopping the flow of hydrocarbons to British Columbia.

"Albertans, British Columbians and all Canadians should understand that if the path forward for the pipeline through B.C. is not settled soon, I'm ready and prepared to turn off the taps," said Notley in a story written by Global News.

Meanwhile Kinder Morgan has dug in its heels, stating that it won't be spending any more money on the project until conflicts between levels of government stop impeding construction progress. It has given Trudeau's government until May 31 to show there is a way to complete it.

Benefits questioned

Pipeline proponents quote Kinder Morgan's numbers when arguing that the benefits clearly outweigh the costs. Oil tankers have plied the waters off BC's coast for years with no incidents. But in fact, a study done in 2014 shows that KM is overstating the project's benefits while, unsurprisingly, downplaying its risks. The study by Simon Fraser University's Centre for Public Policy Research combined with The Goodman Group, a U.S. consulting firm, said the 36,000 person-years of employment for BC quoted by KM is more like 12,000. Spinoff jobs once the pipeline is operational are pegged by the study at around 800 versus Kinder Morgan's estimate of 2,000.

As far as taxes from the pipeline, the report's authors say the take by BC municipalities along the route would average less than 1% of their total revenues. Overall, it's estimated that Kinder Morgan will derive two-thirds of the fiscal benefits of the pipeline, with Alberta getting most of the rest, 32%, and BC receiving just 2% of benefits, according to Doug McArthur, director of Simon Fraser University's graduate school of public policy.

On the costs of a spill, the report says the clean-up would be in the billions, from $2 billion to $5 billion, compared to the company's worst-case scenario of $100 million to $300 million. "What they did not do is look at a major or catastrophic event in a major urban area. This pipeline comes right into the heart of Burnaby and Vancouver," McArthur told CBC.

So to summarize: We have a pipeline project in the works that would undoubtedly raise the revenues of Canadian oilsands producers as it would allow them to command a higher price for their product. But most of the benefits of the pipeline—despite what Kinder Morgan says—will go to the company and the Alberta government, not BC. Looking at it this way, why should British Columbians support it? What has the Alberta government given BC taxpayers in return for shouldering all the risk? Nothing. No royalties, no funds for spill response, no promise of compensation for losses in the event of a major spill. Most oppose Trans Mountain on environmental grounds, but there is just as much reason to reject the pipeline on economic grounds as well.

Killing the economy

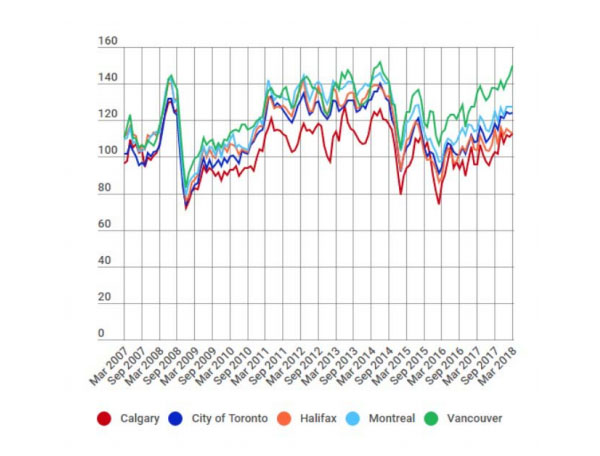

But it gets worse. Much worse. Now we have a law in place that allows Alberta to cut oil and gas supplies to BC at a moment's notice. Imagine what would happen if Notley and her crew decided to use the legislation to actually turn off the taps. Gas and diesel prices would shoot up, not just in Vancouver, which already has the most expensive gas in the country, but across the province—in places where diesel is a key input in running equipment for fishing, mining and forestry—the lifeblood of the provincial economy despite the gleaming new downtown Vancouver offices of Microsoft and Amazon.

If the spat between BC and Alberta resulted in a slowing or even stoppage of that flow, gas prices would definitely be hit very hard. Dan McTeague, an analyst with GasBuddy.com, told Global News that turning off the tap to the pipeline would mean a drop of at least 50% of fuel supplies, including diesel, gasoline and oil that is stored at the Parkland refinery in Burnaby. He estimated that 50 to 60% of BC's fuel needs would be affected. Gas is already at around $1.60 a liter across Vancouver; a stoppage by Alberta could easily put prices up to $2.00, to start, says McTeague. Plus, there would be shortages, gas and diesel prices could top $3L. Remember the 1973 oil embargo? Motorists might have to tag another hour or two onto their commute for lining up to fill up the tank.

On the other hand, approving the Kinder Morgan expansion would flow more fuel to the tight Lower Mainland gas market and push prices back down. Even Justin Trudeau, who is no economist, has tried to argue that, in defending the pipeline.

"With the extra capacity there, it would allow wholesale prices in Vancouver to basically go down to the same level as across the rest of Canada," Michael Ervin, senior vice-president at Kent Group Ltd., an Ontario-based analytics firm focused on the petroleum industry, told Global.

Nobody likes high gas prices, but they have ripple effects far beyond those behind the wheel—higher fuel prices affect people's discretionary spending. That includes everything from dining out, to taking vacations, to putting more away for retirement. Less consumer spending causes businesses to re-evaluate hiring plans, and even lay workers off. The prices of many goods go up, since bricks and mortar retailers have to pass on the higher costs of shipping them, to buyers. More expensive commutes have been shown to mark down the value of homes in suburban areas compared to ones closer to city centers.

Higher gas prices also have a disproportionately negative effect on the poor. While for some families, having to pay more for gas might mean buying a smaller car, for low-income families the choice is usually between cutting spending somewhere else, within their limited budget, or borrowing money to make up for the shortfall.

First Nations have most to lose

Many, though not all, First Nations lining the pipeline route are first to join the pipeline protests—being stewards of the land—but the irony is that this demographic has the most to gain from the pipeline and the most to lose from scrapping it. Why? Let's look at mining as an example. Mines built on or near native lands not yet settled by treaties almost always have a First Nations hiring component built in as part of the company's corporate social responsibility. The diamond mines in the Northwest Territories employ a significant number of native people; Ekati and Diavik have Impact Benefit Agreements (IBAs) and Participation Agreements with nine First Nations groups.

In 2013 the then-Liberal BC government announced two new revenue-sharing agreements that enable two Williams Lake-area First Nations to benefit from the expansion of the Mt. Polley mine, bringing the total number of Economic Development Agreements to seven. The New Afton mine near Kamloops started with a resource-sharing MOU with the Tk'emlups te Secwepemc and Skeetchestn Indian bands in 2007, which evolved into an IBA in 2008. The copper-gold mine started production in 2012.

While First Nations in BC often oppose new mines due to infringement on their traditional hunting, fishing and sometimes burial grounds—New Prosperity and Ajax being two examples recently rejected by government—the untold story is that mines are being built with the support of First Nations. The Red Chris and Brucejack mines were both approved and built with the blessing of local native groups. In fact, according to the federal Department of Natural Resources, mining is the largest employer of First Nations in Canada, right now employing 11,000 indigenous people. BIV quoted Kim Rudd, parliamentary secretary to the minister of Natural Resources Canada, saying at this year's Roundup event in Vancouver that there are 400 agreements between mining companies and First Nations across Canada.

So isn't it ironic that the environmentalist-First Nations coalition opposing the Kinder Morgan pipeline contains a group that will lose out big time in construction and operational jobs should this pipeline get the Deep Six. Think of what $3L gas and diesel does to resource plays bottom lines.

Meddling mayors

We can understand the environmental opposition to this pipeline, since there are substantial risks to the picturesque BC coastline with a seven-fold increase in tanker traffic, but what is more difficult to fathom is the interference by local government politicians trying to stop it. Vancouver Mayor Gregor Robertson and Burnaby Mayor Derek Corrigan are the most vocal opponents, despite having absolutely no jurisdiction over whether the pipeline gets built. All Burnaby can do is delay or reject permits needed for land clearing and the like, which the city has done in an effort to slow construction as long as possible. It's the equivalent of hooking a fish and dragging it so long it eventually drowns on the line. Radio station CKNW uncovered that Robertson and his Vision Party spent $323,000 of taxpayer money to fight the pipeline, not including staff time and contributions to environmental charities, which as we have written about, are mostly all funded by big U.S. philanthropic organizations like Tides Canada.

Derek Corrigan is a longtime NDP supporter whose wife Kathy Corrigan served two terms as an NDP MLA in a Burnaby riding. Corrigan frequently rails against the pipeline—clearly his pet project—despite the city receiving $6.5 million in property taxes annually from Kinder Morgan. That's about 2.4% of total revenues of $268.3 million in 2016, the latest financial statements available to the public. Not exactly chump change. And KM says if the pipeline expansion goes ahead its tax contribution will double to $12 million.

Conclusion: How do we fix this?

Well, we could start by having a BC government that has the guts to stand up to the Alberta premier. The two are on the same ideological side for God's sake, both espousing socialist ideals, though you would never know it from the words coming from Notley, who has to appease the oil industry to survive the next election. Anyway, instead of fiddling around with court challenges, which it will most certainly lose, the province would be far better off getting behind the pipeline—possibly tossing some goodies to the Greens for their support—and demanding royalties from Alberta along with money that will defend British Columbians against a catastrophic oil spill.

And as for the federal Liberals, instead of promising to indemnify the pipeline against delays it has lost control over, how about passing a law stating that this pipeline will be built in the national interest, over and above the objections of BC? Could that cause a constitutional crisis? Maybe. But arguably we already have one, with the makings of a tit for tat trade war brewing between BC and Alberta, like a smaller-scale version of the one Donald Trump has initiated south of the border. Not to mention legal wrangling over who is allowed to do what constitutionally which could drag this out for years—killing the pipeline in the process.

What would that do? Hike gas prices, more oil and gas would need to be moved by rail and truck—way more dangerous than pipelines, just ask the people of Lac Megantic, Quebec. The Canadian oil and gas industry is already on its knees, with investment fleeing the sector in droves to the U.S. where companies can actually make money. Not building the pipeline will keep Canadian oil cheap, resulting in billions in lost tax revenue that could be used to build schools and hospitals. In other words, without this pipeline, everybody suffers. But the politicians don't seem to get it. We've become like tribal chiefdoms, all fighting amongst ourselves, with no over-riding leadership. I blame Trudeau for that. He thought his pipeline for carbon tax bargain would pay off. In fact, it's been a dismal failure—underestimating the anger on the one hand of BC residents who say he reneged on a campaign promise to reduce greenhouse gases, and another segment who are tired of the pipeline fight and just want it built—likely scared of higher gas prices. A poll taken in April showed most, 69%, think their government should allow the pipeline to be built if the courts rule it doesn't have the authority to block it.

Once again, who's serving whom? The BC NDP needs to oppose the pipeline to preserve its extremely tenuous coalition with the Greens who have promised to topple it should it acquiesce on Kinder Morgan. As the dithering continues, we all suffer. Time to man up, Horgan and Trudeau, and take some leadership. Cut a deal with Alberta and build this pipeline.

Legal Notice / Disclaimer This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment.

Richard (Rick) Mills, aheadoftheherd.comJust read, or participate in if you wish, our free Investors forums.

Ahead of the Herd is now on Twitter.

Richard (Rick) Mills, AheadoftheHerd.com, lives on a 160-acre farm in northern British Columbia. Richard's articles have been published on over 400 websites, including: WallStreetJournal, USAToday, NationalPost, Lewrockwell, MontrealGazette, VancouverSun, CBSnews, HuffingtonPost, Beforeitsnews, Londonthenews, Wealthwire, CalgaryHerald, Forbes, Dallasnews, SGTreport, Vantagewire, Indiatimes, Ninemsn, Ibtimes, Businessweek, HongKongHerald, Moneytalks, SeekingAlpha, BusinessInsider, Investing.com, MSN.com and the Association of Mining Analysts.

Want to read more Streetwise articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Rick Mills: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company currently has a financial relationship with the following companies mentioned in this article: None. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Images provided by the author