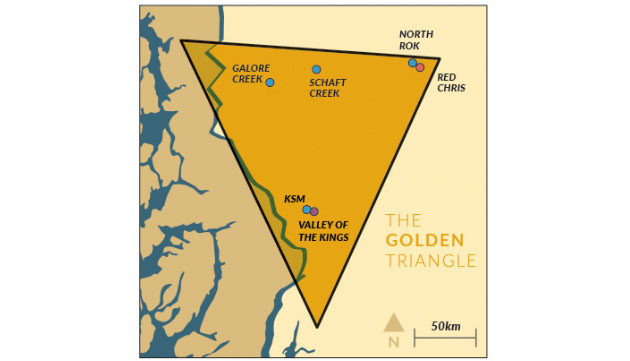

We have looked at three exploration stocks working in British Columbia's Golden Triangle in recent months. Two of them are at about the same price as when we bought them, while the third is up significantly, and all three are expected to advance in coming months as the drilling season unfolds. They should go up even if gold doesn't go up, although it is expected to.

In this update we are going to review the technicals of these three stocks, and three new ones have been added. You will observe that since we are talking about the Golden Triangle here, this article started with three stocks, and has just been expanded to six stocks, which are, of course, multiples of the number of sides of a triangle.

The well-known Lawrence Roulston has got the fundamentals of the Golden Triangle well covered in his just published interview, Highly Anticipated Summer of Exploration in BC's Golden Triangle, which it is worth reading carefully. I, therefore, do not need to discuss them, but would draw your attention to the key third paragraph in Roulston's article, which, for convenience, is pasted in below, and also to the additional point he makes that the infrastructural situation in the Golden Triangle (roads, electricity, etc.) is vastly improved. From Roulston's article:

"After decades of traveling around the world looking for big high-grade metal deposits, I found the best area was right here in my backyard—the northwest part of British Columbia (B.C.), an area called the Golden Triangle. It's one of the most richly endowed mineral regions on the planet. The gold resources that have already been outlined in that region exceed the Carlin Trend, which is generally seen to be the biggest depository of gold on this side of the planet. And in addition to the gold, there's an equivalent value of silver, copper and other base metals as well as exotic metals like scandium. So, this is a really exceptional depository of metals and there will be a lot more ounces and pounds found in that region over the next couple of years."

Now we will proceed to review the three Golden Triangle stocks that we bought earlier. Note that clicking on the stock name will take you back to the latest/last report on it.

Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTC.MKTS); CA$0.21, $0.165

We start with Aben Resources Ltd. (ABN:TSX.V; ABNAF:OTC.MKTS), which we bought at just the right time as its current uptrend started early in April, so even after the correction of recent days it is up 50%, as we can see on its latest 6-month chart below.

Despite the stock having become overbought some days back, we decided not to sell, but to ride out any minor correction, because it is still early in its drilling season speculative rally, which could see it attain its highs of last year by midsummer and possible exceed them, as we can see on its 3-year chart below.

Aben Resources website.

Auramex Resources Corp. (AUX:TSX.V); CA$0.065

On the 10-year chart for Auramex Resources Corp. (AUX:TSX.V) we can see that it is just started to emerge out of a giant saucer-base pattern, with its volume indicators positive.

On the 3-year chart we see that it is in a strong uptrend, and at a good entry point having just reacted back to support near to its rising 200-day moving average. Although it looks like it has risen a lot already on this chart, with the benefit of having looked at the 10-year, we know that it could rise much further yet and could well accelerate.

On the 6-month chart we see that we are at a good entry point right now.

Auramex Resource Corp website.

Golden Ridge Resources Ltd. (GLDN:TSX.V); CA$0.14

Next we look at Golden Ridge Resources Ltd. (GLDN:TSX.V), which is at about the same price as when we bought it back in the middle of March. As we can see on its latest 9-month chart it is still basing in a trading range, but as the drilling season gets underway it is likely to do what we expected of it, which is to break out of the trading range and advance, possibly steeply, again probably topping out in midsummer.

Golden Ridge Resources website.

Metallis Resources Inc. (MTS:TSX.V); CA$1.33, $1.03

Metallis Resources Inc. (MTS:TSX.V) staged a summer rally of almost mind-boggling proportions last year, as we see on its 1-year chart. This was followed by an inevitable fall reaction, which was actually rather modest and followed by the formation of a saucer-base pattern, that appears to be completing, as luck would have it, right at the start of a new drilling season. Could we see another big summer ramp? We could—why not? Although since it will begin from a much higher start point we won't and can't see the sort of percentage gains that occurred last year. Nevertheless they could be well worth going for, and after the dip of recent days it is rated a strong speculative buy here.

The 6-month chart shows recent action in more detail, and we can see more clearly the recent uptrend above the saucer boundary, with the bullishly aligned moving averages providing underlying support. Good entry point but a break below the saucer boundary would spoil the pattern. Dump it if it drops below CA$1.20. The stock should break out upside from the saucer imminently. Metallis trades in light but acceptable volumes on the U.S. OTC market.

Metallis Resources website.

Romios Gold Resources Inc. (RG:TSX.V; RMIOF:NASDAQ; D4R:FSE); CA$0.07, $0.058

On the 10-year chart for Romios Gold Resources Inc. (RG:TSX.V; RMIOF:NASDAQ; D4R:FSE) we can see that a fine large head-and-shoulders bottom is completing that corresponds to the one completing in gold itself, and this chart, with its positive volume indicators, adds weight to our contention that gold is building toward a major upside breakout. We should note, however, that Romios looks set to break out with or without gold's help, with the chances of its doing so being increased by the fact that it is active in the Golden Triangle. This pattern looks mature and complete, so an upside breakout is considered likely to occur soon.

The 3-year chart for Romios enables us to view the right shoulder of its giant head-and-shoulders bottom pattern in much more detail. With it hauling itself up from the right shoulder low, and still some way below the "neckline" or upper boundary of the giant base pattern, we are believed to be at a good entry point here.

On the 6-month chart we can see that the recent dip on the back of sector weakness has resulted in its being oversold near to its rising 200-day moving average, so the chances are good that it will turn up again here, thus this looks like a good entry point. Romios trades in generally light volumes on the U.S. OTC market.

Romios Gold Resources website.

Shamrock Enterprises Inc. (SRS:CSE); CA$0.05

Shamrock Enterprises Inc. (SRS:CSE) is an extremely cheap Golden Triangle play that we scooped up at just $0.03 or a little above back in December, since which time it has basically done nothing, although its average price has since been higher, as we can see on its 6-month chart below. The news here is that they have beefed up their management and they are understood to also have a summer drilling program in place. There was a rather amusing episode last week where a broker accidentally bought 800,000 shares, probably by hitting the wrong button or inputting the wrong code, and then had to sell them again, hence the flurry of activity that is obviously meaningless.

The long-term 6-year chart for Shamrock looks very promising indeed, with a large head-and-shoulders bottom completing. There is a clear band of resistance at the upper boundary of this pattern, and should the price break above it, it will likely spike, and with the summer drilling season at hand, that could happen soon. So we stay long and it is a speculative buy on minor dips ahead of the breakout.

Shamrock Enterprises website

Read what other experts are saying about:

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Aben Resources and Shamrock. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has consulting relationships with Aben Resources and Golden Ridge. Please click here for more information.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Aben, Golden Ridge, Shamrock and Auramex, companies mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.