Russian legislators have drafted a law to restrict various materials that are exported to the U.S. as a response to American federal government actions it found "unfriendly." The U.S. Congress passed legislation imposing various sanctions on Russia in response to allegations of election influencing and other behaviors. The recently drafted Russian material restrictions may be in retaliation for passing the Countering American Adversaries through Sanctions Act (CAATSA).

One of these materials Russia may restrict is uranium. The U.S. currently imports most of its uranium which is used for fuel in nuclear power plants to generate electricity. About 14% of uranium used in America comes from Russia currently. Another 25% or so comes from Kazakhstan, which was part of the former Soviet Union. Most of the remaining uranium comes from Canada and Australia.

Uranium fuel is an essential part of the American energy mix because nuclear power produces about 20% of US electricity.

Stock Catalyst Report uranium expert Mike Alkin explained, "[the U.S. imports] half of their uranium from Russian and Russia-friendly countries. They import 95 percent, but half of that is Russian, Russian friendly. At the tensions that are right now it takes one sanction against Russia for uranium not to come in, and I think it's a huge risk."

The announcements made about Russia's potential uranium export restriction to the U.S. didn't have much effect on the spot price of U3O8.

If Russia does restrict uranium exports to the United States, that could be bullish for the price of uranium as well as for uranium companies.

Shares of Energy Fuels Inc. (EFR:TSX; UUUU:NYSE.American), the largest producer of energy in the U.S., and Ur-Energy Inc. (URG:NYSE.MKT; URE:TSX), another U.S. uranium producer, have increased since the release of the news. Shares of Energy Fuels just reached a 52-week high.

Energy Fuels has the White Mesa Mill in Utah, the Nichols Ranch Processing Facility in Wyoming, and the Alta Mesa Project in Texas, providing both conventional and in-situ recovery uranium mining.

Ur-Energy operates the Lost Creek in-situ recovery uranium facility in Wyoming and owns the Shirley Basin and Lucky Mc mine sites, also in Wyoming.

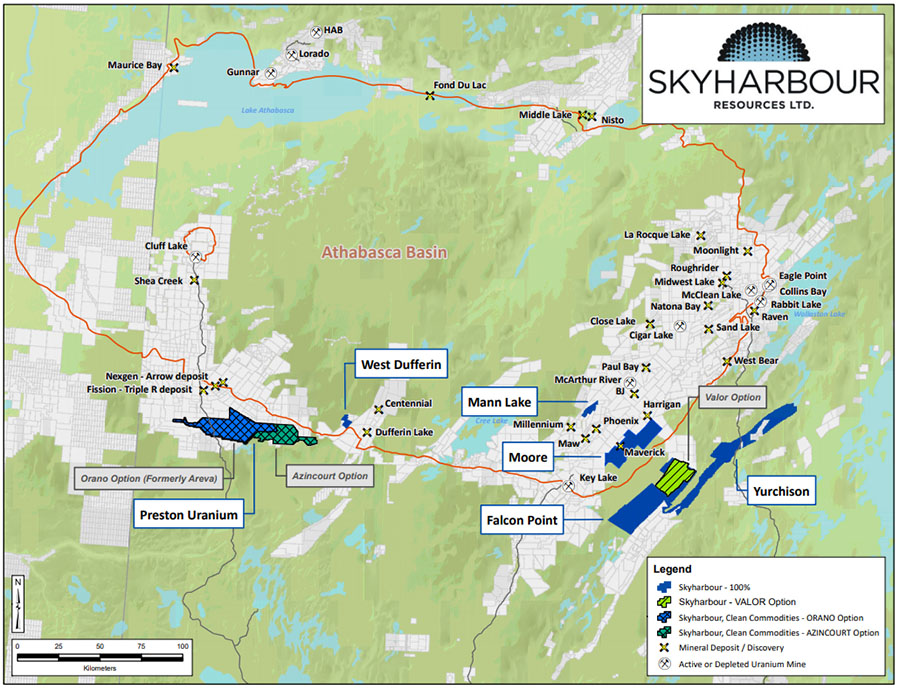

One active explorer is Skyharbour Resources Ltd. (SYH:TSX.V). The company has three on-going exploration programs and another junior explorer is optioning a fourth property in the Athabasca Basin in Canada.

In addition to potential Russian action, another catalyst for the price of uranium could be a limit on the amount of uranium imports to the United States. Energy Fuels and Ur-Energy have submitted a Section 232 petition to the Department of Commerce asking for relief from overseas uranium imports that threaten national security.

Former Assistant Secretary of Commerce for International Economic Policy Thomas Duesterberg wrote in support of the petition in Forbes on April 26, noting, "A viable U.S. uranium mining industry is needed to meet both defense requirements in the future and guard against becoming reliant on Russian and Russian-affiliated suppliers."

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Jake Richardson compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. He or members of his household own securities of the following companies mentioned in the article: None. He or members of his household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Energy Fuels Inc. Click here for important disclosures about sponsor fees.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.