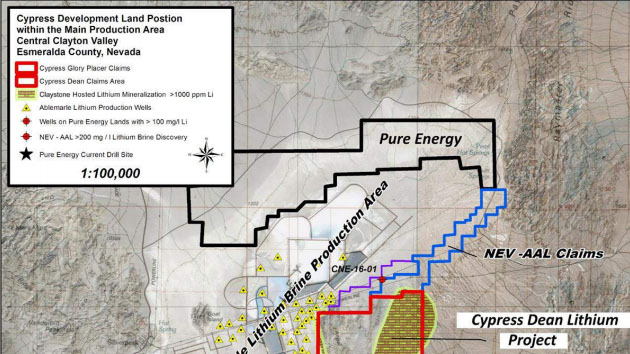

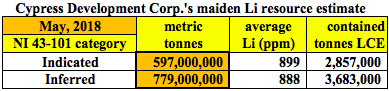

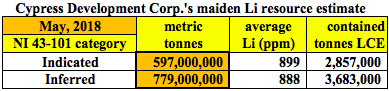

WOW! Cypress Development Corp. (CYP:TSX.V; CYDVF:OTCQB; C1Z1:Frankfurt) killed it with its maiden NI 43-101 compliant lithium resource estimate yesterday! The whisper number was 4 to 6 million Inferred tonnes of Lithium Carbonate Equiv. (LCE), (which would have been a tremendous result), but Global Resource Engineering Ltd. determined there's an estimated 6.54 million metric tonnes LCE.

Perhaps even more exciting than the size of the resource, (we knew it would be large), was something I never even considered, 44% (2.857 M tonnes) of the resource is in the "Indicated" category. I thought it would 100% Inferred. That just goes to show how strong the continuity of the lithium zones is in this giant, thick, tabular formation—where 21 of 23 drill holes ended in mineralization.

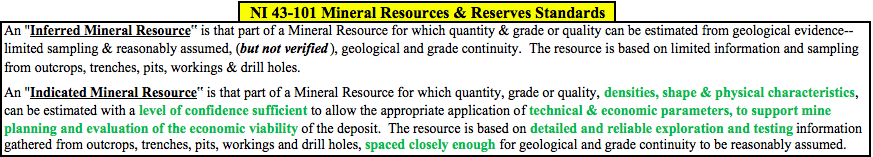

In the boxed paragraphs above, notice the added level of evidence or "confidence" (highlighted in green) needed to be designated an Indicated resource vs. Inferred. The sizable Indicated portion will make it easier and less costly to reach PEA stage (expected in Sept/Oct). Importantly, Cypress is funded through PEA, especially as a wave of options and warrants will likely be exercised on the back of this news.

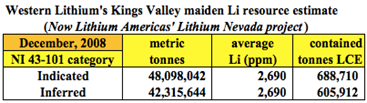

Putting this into perspective, consider that Lithium Americas Corp.'s (LAC:TSX; LAC:NYSE) (formerly Western Lithium) clay-hosted Li project (then called Kings Valley) also in Nevada, had the following maiden mineral resource estimate:

It had an impressive 53% of its total resource classified as Indicated, but the absolute size of the resource was 24% & 16%, respectively, the number of tonnes of LCE in Cypress Development's maiden Indicated & Inferred resource.

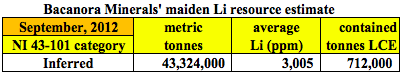

Bacanora Minerals Ltd.'s clay project in Sonora Mexico had the following maiden resource:

Bacanora Minerals' (London: BCN) maiden resource was 25% the size of Cypress Development's Inferred resource. However, Bacanora had no tonnage at all in the Indicated category.

Fast forward to today, Lithium Americas' project now hosts a combined Measured & Indicated resource just shy of 6 million tonnes LCE, plus an Inferred inventory of about 2.3 million tonnes. Recall that LAC has a clay-hosted lithium project, also in Nevada. An entirely new (will replace the prior) Preliminary Feasibility Study (PFS) on LAC's clay project is expected in June.

Likewise, Bacanora's net attributable resource has soared to 4.1 million tonnes LCE (Measured & Indicated), and 3.2 million tonnes (Inferred). Bacanora's BFS-stage clay project is in Sonora Mexico.

Near-term Catalysts to Keep Market on its Toes

Readers should know that there are important near-term catalysts leading up to a PEA as soon as August (I've been saying in September/October). First and foremost, ongoing metallurgy test results will be released. The full maiden mineral resource technical report will be filed on Sedar this month. And, assays from up to 30 new drill holes are coming this spring and summer. Management expects to be in talks with prospective strategic partners, but there's no rush because, as mentioned, Cypress is funded through PEA.

Cypress should be able to substantially upgrade its NI 43-101 compliant Indicated & Inferred resource to the Measured & Indicated categories, potentially ending up with a resource around the same size and level of confidence (albeit lower grade) as Lithium Americas' and Bacanora's. In fact, in today's press release management stated that it believes 30 additional drill holes would be sufficient to upgrade the Inferred portion to Indicated.

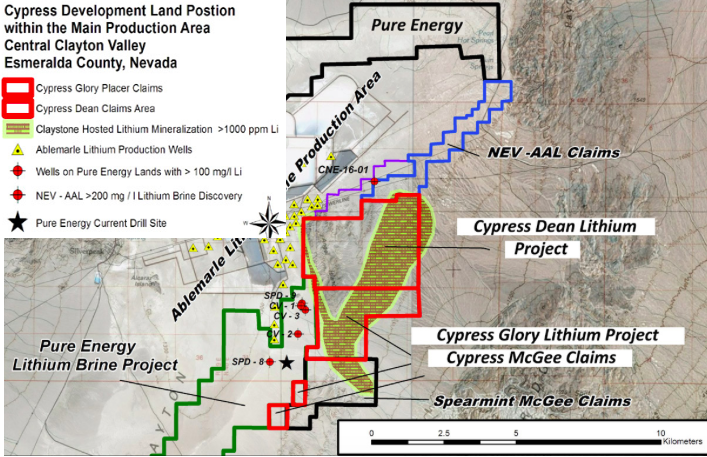

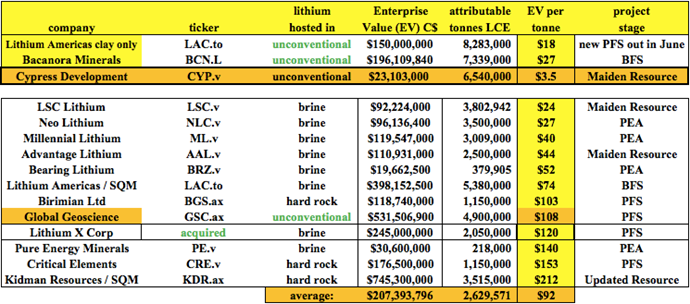

Cypress' Indicated-only portion at nearly 3 M tonnes LCE is larger than most hard rock, and many brine projects around the world. Cypress is trading at Enterprise Value (EV) to tonne LCE ratio of just C$3.5, (share price C$0.33 intra-day May 1) and that's on a fully diluted share count. Compare that to C$18/t for Lithium Americas (I assume 25% of LAC's EV is attributable to its Nevada clay project), C$27/t for Bacanora, and an average of C$92/t for several other global hard rock and brine projects (most peers in the chart below are more advanced than Cypress).

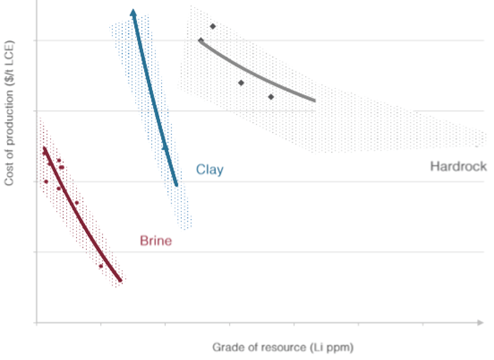

The graph below, from a recent Lithium Americas' corporate presentation, shows where clay-hosted lithium projects fit into the conventional world of hard rock (mostly in western Australia) and brine (mostly in Chile and Argentina). Generically speaking, clay is right in the middle on both operating costs and lithium grade. What the chart doesn't show is that the most significant clay projects (BCN's, LAC's and now CYP's) are quite sizable—much larger than the average conventional lithium project.

To recap, this is a major advancement for Cypress. It puts the company on the map, not just U.S. and North American maps, but global maps. A KEY TAKEAWAY is that the amount of TIME and CASH needed to drill out the entire resource for a Bank Feasibility Study (BFS) next year should be relatively low, especially compared to the time and capital deployed by Lithium Americas and Bacanora to get to PFS and BFS, respectively. Cypress is now (in my opinion only) in a position to deliver a BFS in mid-to-late 2019 at a total cost (including company overhead) of <C$10 million.

Also of major importance in today's press release:

- Preliminary test work conducted at SGS Canada Inc (Lakefield) and Continental Metallurgical Services, LLC has shown the material exhibits high lithium extractions with short leach times. Lithium extractions of greater than 80% can be achieved in 4 to 8 hours using conventional dilute sulfuric acid leaching. Currently, Hazen Research Inc is conducting additional leach tests and preliminary results confirm high lithium extractions for new mineral zones.

- The presence of acid leachable lithium presents a significant cost savings by avoiding calcine and regrind of material during processing. Preliminary results also show the consumption of sulfuric acid and other reagents are relatively low.

- The production of high-purity lithium carbonate was demonstrated in the laboratory using conventional recovery methods.

- The large tonnage of the deposit lends potential to target higher-grade lithium mineralization for the PEA {since the scale is so large, there's a chance the Company can capture higher-grade lithium values (in a subset of the overall resource) for the upcoming PEA}

Improvements in metallurgy to "greater than 80% extraction" (I'm assuming in the low 80%'s) was reported in the press release. The last news on that front had stated "up to 80%." Also noteworthy was that management produced a small amount of high-purity lithium carbonate using conventional recovery methods.

Bottom line, there's an increasing chance that due to favorable mineralogy, Cypress Development Corp. (TSX-v: CYP) / (OTCQB: CYDVF) / (Frankfurt: C1Z1) will be able to avoid certain significant steps in Bacanora's process flow sheet. That could mean NOT having to do a pilot plant, potentially saving ten(s) of millions in capex and one to two years of project development/construction time.

Cypress' resource is at or near surface, down to over 120 meters (and is mostly open at depth), the anticipated strip ratio is essentially zero (call it 0.1 to 1). By contrast, Bacanora's strip ratio is expected to be 3.9 to 1. That represents a huge difference in mining costs. As a reminder, the biggest advantage the company has over both Lithium Americas and Bacanora is that over 75% of its resource is hosted in non-refractory clay. That's why management believes it might not need to operate a pilot plant (avoiding calcine and regrind of material during processing would make the flow sheet a conventional leach process).

Management has delivered a blockbuster maiden resource, >6 million tonnes of LCE (combined Indicated & Inferred). Therefore, Cypress need never worry again about resource size; it already has huge scale and could potentially reach BFS-stage much faster and considerably cheaper than LAC and BCN did.

Peter Epstein is the founder of Epstein Research. His background is in company and financial analysis, and he is a Chartered Financial Analyst (CFA). He holds an MBA degree in financial analysis from New York University's Stern School of Business.

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures: The content of this article is for information only. Readers fully understand and agree that nothing contained herein, written by Peter Epstein of Epstein Research [ER], (together, [ER]) about Cypress Development Corp., including but not limited to, commentary, opinions, views, assumptions, reported facts, calculations, etc. is to be considered implicit or explicit investment advice. Nothing contained herein is a recommendation or solicitation to buy or sell any security. [ER] is not responsible under any circumstances for investment actions taken by the reader. [ER] has never been, and is not currently, a registered or licensed financial advisor or broker/dealer, investment advisor, stockbroker, trader, money manager, compliance or legal officer, and does not perform market making activities. [ER] is not directly employed by any company, group, organization, party or person. The shares of Cypress Development Corp. are highly speculative, not suitable for all investors. Readers understand and agree that investments in small cap stocks can result in a 100% loss of invested funds. It is assumed and agreed upon by readers that they will consult with their own licensed / registered financial advisors before making investment decisions.

At the time this interview was posted, Peter Epstein owned shares and/or stock options in Cypress Development Corp. and the Company was an advertiser on [ER]. Readers understand and agree that they must conduct their own due diligence above and beyond reading this article. While the author believes he's diligent in screening out companies that, for any reasons whatsoever, are unattractive investment opportunities, he cannot guarantee that his efforts will (or have been) successful. [ER] is not responsible for any perceived, or actual, errors including, but not limited to, commentary, opinions, views, assumptions, reported facts & financial calculations, or for the completeness of this article or future content. [ER] is not expected or required to subsequently follow or cover events & news, or write about any particular company or topic. [ER] is not an expert in any company, industry sector or investment topic.

Streetwise Reports Disclosure:

1) Peter Epstein's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: Cypress Development Corp. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and graphics provided by author.