Ayawilca project; drilling location

1. Introduction

Tinka Resources Ltd. (TK:TSX.V; TLD:FSE; TKRFF:OTCPK) came a long way doing its financings without the Canadian brokerages, supported by Sentient and IFC, but finally it was time to let them in as the upcoming/ongoing drill programs, resource estimate and Preliminary Economic Assessment demanded a substantial treasury, preferably raised well before it will be needed. The raised amount of no less than C$16.2M is among the highest for base metal explorers for the last year or so, although I believe it had a substantial impact on the share price.

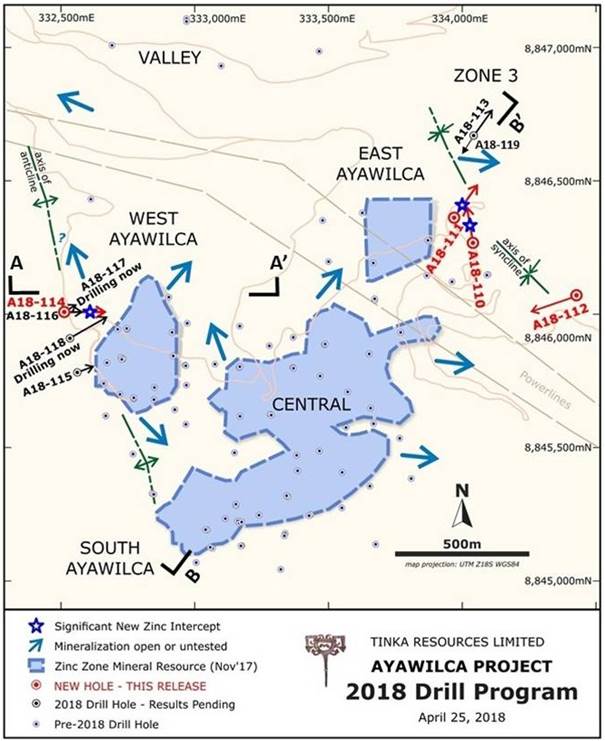

The company also released new drill results for West Ayawilca and Zone 3. For West, the stepout hole was pretty successful, the Zone 3 results didn't return much but this wasn't entirely unexpected, as mineralization was expected more in the vicinity of hole A18-113 (more to the north), of which the assays are coming up soon. What this all might implicate for investors can be read in this update.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in US Dollars, unless stated otherwise.

Please note: the views, opinions, estimates or forecasts regarding Tinka's performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka's management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

2. Financings

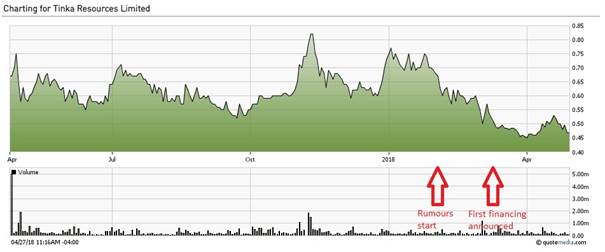

With the rainy season limiting drill result news flow, and a new cash injection to be foreseen in the not too distant future, most of the attention on Tinka Resources was focused on a new round of financing after the last results on Ayawilca came out in February, as discussed in my latest update. Rumors started swirling around in January about Canadian brokers wanting a piece of the Tinka pie, and coincidentally the share price started sliding soon after this, not in line with the neutral Venture/base metal sentiment:

Share price Tinka Resources 1 year timeframe; source tmxmoney.com

This might not have been that coincidentally, as careful observers of the markets often could notice likewise drop-offs after word gets out (for example, when the company is doing road shows for a financing) a company is going to raise fresh cash. Stock movers like interested parties (banks, brokers, big investors) have a clear incentive to get the lowest price possible on such a financing, and especially if they can get additional warrants they might, for example, even sell (part of) an eventual position and buy back with warrants attached, often getting the shares at a discount, as financings are usually done at a slight discount. In addition to this there was also heavy selling pressure from a sell recommendation of a U.S. newsletter right before PDAC.

The first round of financing was finally announced at March 13, and involved a C$7.008M bought deal @C$0.48 plus a half warrant (@C$0.75 for 12 months). The Canadian syndicate was led by GMP Securities and consisted of Canaccord, Beacon, CIBC and Industrial Alliance, which received 6% commission in cash of gross proceeds. There was a C$1.051M over-allotment option, which was exercised in full, resulting in C$8.059M proceedings, and it was a short form prospectus, meaning that the shares can be sold directly after closing of the financing without the usual four-month hold period.

At the same time, the company was undertaking a non-brokered private placement, which consisted of two tranches, C$5.77M (closed April 9) and C$2.4M (closed at April 27), totaling C$8.17M, under the same terms (@C$0.48 with a half warrant @0.75 for 12 months) except these securities are subject to the usual four-month hold period. The largest shareholder, Sentient Global Resources Fund IV, was a big buyer of this placement, bringing its total holdings of Tinka at 24.7% of outstanding shares, and 23.8% fully diluted. The other big shareholder, International Finance Corporation (IFC), participated in the second tranche as well, exercising its contractual rights regarding the offering, bringing its holdings to 11.5% outstanding and 13.2% fully diluted. On a side note: assuming a finder's fee of 6%, there was a Peruvian broker taking up a participation of about C$653k, so Tinka managed to get some local interest in the end.

The company plans to use the net proceeds of C$16.2M to fund exploration expenditures at the company's Ayawilca project in Peru, an updated resource estimate and a PEA, as well as for other corporate purposes and general working capital. CEO Graham Carman had this to add according to the news release:

"The Company is now fully funded to carry out its planned exploration programs for the next 18 months. Drilling has already been stepped up to three rigs, and we look forward to disclosing the results of the drill programs, and other planned work such as metallurgical tests, as results come to hand."

It is good to see that Tinka doesn't have to go back to the markets for the first 1.5 years. Although there was quite a bit of (future) dilution added because of the relatively low price and the warrants of the last capital raise, which wasn't always appreciated among investors, management did well by pulling the trigger by lack of better offers. The golden rule in mining is always, if you can get the money, you have three priorities: 1. take it 2. take it 3. take it. Management told me they didn't get better offers earlier on, contrary to rumors in the industry, so there is only so much you can do as a junior it seems. The issued and outstanding share count stands at 271M at the moment, and the fully diluted number is about 301M shares.

The markets are digesting this financing now, and it seems to me that the current C$0.46-0.48 levels could be strong bottoms that could provide strong support chart-wise, as I do believe these levels were enforced by selling around the financings.

3. Exploration

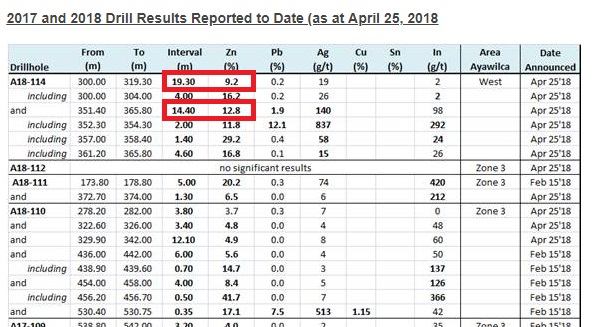

The rainy season has ended, and Tinka Resources is ramping up to three rigs again (the third rig is about to commence drilling, in addition to two operating rigs), and might be looking to add one more later on. A new set of drill results came in on April 25 with somewhat mixed results:

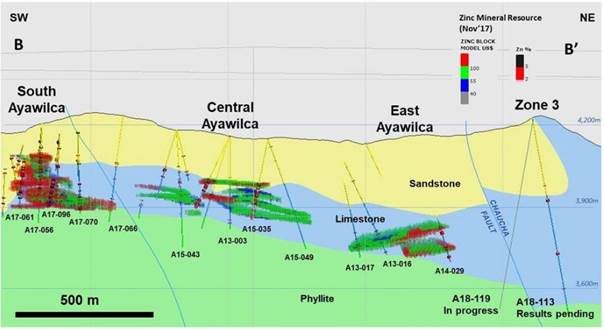

Hole A18-110 added a bit of mineralization (12.1m@4.9%Zn), but hardly economic, and hole A18-111 followed up with a 1.30m interval at depth, which isn't economic as well. Hole A18-112 didn't have any significant results, and I must say this was a distinct possibility as a contemplated concept of lateral displacement of mineralization regarding Central and Zone 3 along the large fault (east of Central, running SE-NW) to the north seems to become more and more realistic, notwithstanding the gossans that were discussed in the March update.

By far the most successful hole was A18-114, drilled at West and to the west of the existing mineralization, generating two meaningful intercepts at depth of 19.3m@9.2%Zn and 14m@12.8%Zn. Drill collar locations can be seen here:

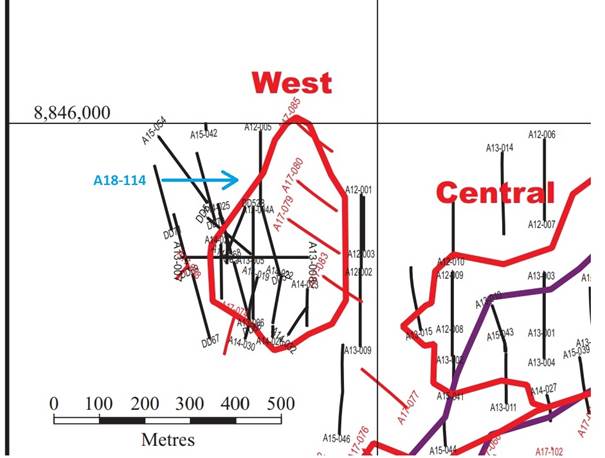

Hole A18-114 was drilled as management believed there could be mineralization at depth from the left of the existing West deposit (on a side note: the hole located about 400m north of West is hole A17-105, generating an intercept of 1m@2.8%Zn). So far only relatively narrow and more near surface veins in sandstone were intersected in 2015 in this area (see news release dated from January 20, 2016):

"Zinc Mineralization (veins):

- A15-54: 5.8 metres at 8.9% zinc and 26g/t silver from 95.9 metres depth, including:

- 1.6 metres at 28.1% zinc and 76g/t silver from 95.9 metres depth;"

To give an impression how close good hits at depth could be located towards areas without deep mineralization, here is the map with older drill collar locations at West, taken from the December 2017 NI43-101 resource estimate, also showing A15-042 which didn't return a significant intercept at all, and adding hole A18-114 in blue:

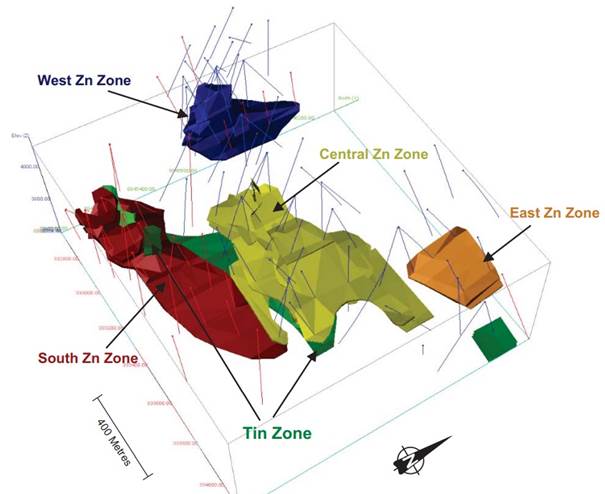

Let's see how much a potentially continuous mineralized area at A118-114 could add. The West Zone is a compact volume, as can be seen here in this 3D wireframe taken from the NI43-101 report:

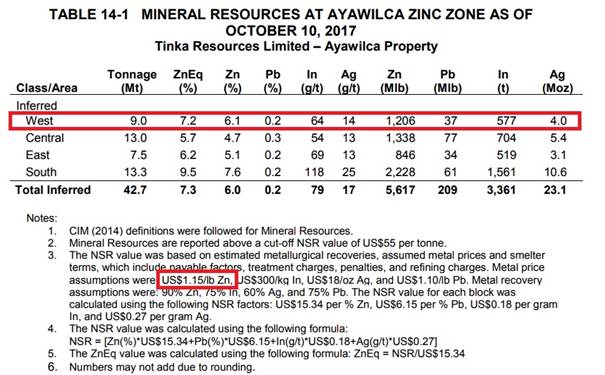

The total tonnage of the West Zone accounts for 9Mt at the moment, at a zinc price of US$1.15/lb Zn or an NSR value of US$55/t:

The density or gravity of the mineralized rock was estimated in the report at 3.6t/m3. Let's say the additional envelope as a result of A18-114 could be 0.5*150*150*35m = 393,750m3, in this case the additional tonnage could amount to 1.4Mt, bringing the hypothetical total to 44.1Mt. I definitely thought the west side of the West Zone had seen sufficient drilling already, but a few more of this kind of high-grade stepouts across Ayawilca resource areas could very well prove to be pretty useful, and bring tonnage to 50Mt without another big discovery, which could be a sufficient threshold for another update in my view, and a PEA. Of course, I expect more with the currently ongoing drill program of 15,000m and up to 30 holes (my personal target is 60Mt based on one more sizable discovery), but Ayawilca is already world class.

The big question mark for me is now hole A18-113, and the planned hole A18-119, because of the displacement concept mineralized potential, and possibly finding more indications of the skarn concept, as discussed in my last update:

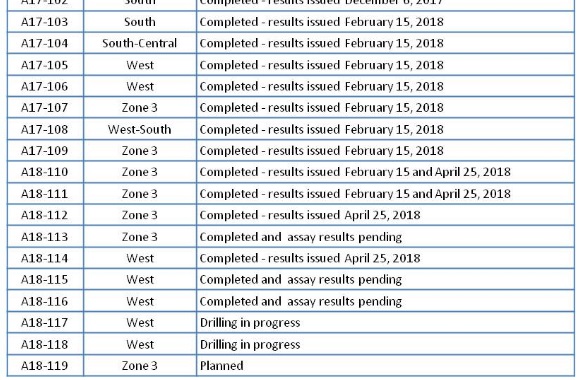

At the moment, I see the most potential here as the Zone 3 target is fairly large, is relatively untested and has a lot of indicators (pyrite, alterations everywhere). Here is an overview of the latest drill holes drilled and planned:

Zone 3 and West drilling is in full swing now, and other targets like stepping out at South and Central, and exploring Chaucha and Valley are coming up. The stepping out at South also contains drilling at depth later on as management is contemplating "false basement" rock below the current South deposit.

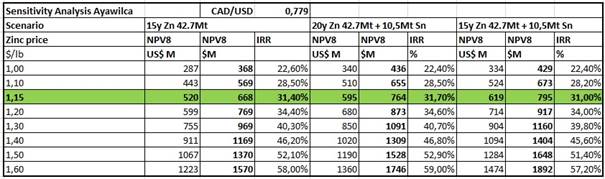

As a reminder which I can't stress enough, the considerable economic potential of Ayawilca remains intact, also at current zinc price levels ($1.41/lb Zn). Have a look again at the hypothetical sensitivity table I estimated when the updated resource came out, which is still valid as not much tonnage has been added in the meantime:

At a current market cap of C$127M, there is still plenty of upside to be expected, as opex in Peru is very low in general, providing lots of margin of error on my estimates. As it stands now, I believe with the summer drill program and met work ongoing, an updated resource estimate can be expected in Q3, 2018, and a decent PEA can be expected in Q4, 2018, which will finally reveal economics of this significant project.

5. Conclusion

By raising C$16.2M, Tinka secured at least 18 months of cash in the treasury, which is still pretty impressive in the current neutral environment despite the terms. As Sentient couldn't or wouldn't provide them with all cash at decent prices all the time, management had to turn to other options. Notwithstanding this, Tinka is now cashed up for a long time, has the support of Canadian brokers now, and has a few big catalysts looming in the second half of 2018. With the 2018 drill program at Ayawilca ongoing on lots of targets which might unearth an even bigger resource, potential economics of an upcoming PEA looking impressive and the chart potentially putting in a bottom, things seem to look bright for Tinka Resources.

Ayawilca project surroundings

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Tinka Resources is a sponsoring company. The views, opinions, estimates or forecasts regarding Tinka's performance are those of the author alone and do not represent opinions, forecasts or predictions of Tinka or Tinka's management. Tinka has not in any way endorsed the information, conclusions or recommendations provided by the author.

All facts are to be checked by the reader. For more information go to www.tinkaresources.com and read the company's profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.