There are hundreds of junior resource companies in Vancouver and Toronto that have had the devil's own time trying to get traction since the high water mark for the metals in 2011. I believe we had a major bottom in December/January of 2016 but many companies have yet to secure financing to move forward. It will come one day because the majors are consuming their young and need new mines to replace what they are using up. There is zero exploration on the part of the majors and little on the part of the mid-tier and juniors. I recently came across a junior that decided to determine their own future.

The company is Plato Gold Corp. (PGC:TSX.V) and as their name suggests, they have several gold projects in the Timmins-Kirkland Lake region of the Abitibi Gold Belt. In addition they staked some prospective ground in the Santa Cruz province of Argentina. Surface samples show high levels of pathfinder minerals such as mercury, arsenic and antimony. Both areas are on the back burner as the company was near death after the high in gold and silver in 2011 with the shares dropping to as little as $0.005 from 2012 to 2017.

A year ago the company made the decision to move in another direction. One of Ontario's most experienced prospectors, Rudy Wahl, approached the company with an interesting niobium project in Ontario.

The option agreement is interesting because instead of being loaded for a lot of up front money to the prospector, there is a tiny amount of money up front, $108,600 with a lot of shares in Plato. Plato is committed to handing 9.1 million shares to Rudy and his partners. And even better, if the project is sold or optioned, they get 10%. Also there is a work commitment of $400,000 on the project and a 3% NSR.

The option agreement tells me Rudy Wahl is betting on both the quality of the project and the depth of management of Plato Gold. If the project is not economic, he will have 9 million shares pretty much only good for wallpaper but if the project is viable and Plato moves it forward, he does very well for himself.

I've seen dozens of option agreements that were front-end loaded to reward the guy giving up the project. He collects a bunch of money and immediately turns around and does everything in his power to queer the deal so he can peddle it to someone else.

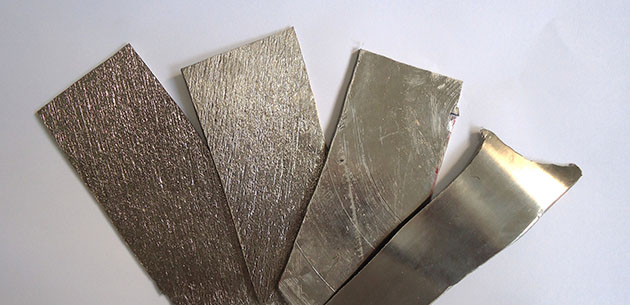

Let's talk about niobium because I have little doubt that my readers are as ignorant about the metal as I was before Plato contacted me. By far and away, Brazil is the biggest producer of niobium with about 90% of the world's production coming from two mines. Canada produces just under another 10%. Australia, Rwanda, Nigeria and Mozambique produce the last tiny bit among them.

Niobium added to steel or aluminum can make a metal 30% stronger. Toshiba Japan recently announced a niobium-based battery for production in 2019. These batteries might double or triple the electric car range to over 200 miles per six-minute charge. That could literally be an explosive growth market. To give you an idea of how large the market is, it is three times larger than the world's graphite market at about $3 billion and is predicted to increase by 25% over the next five years. Niobium sells for about $42 a kilogram.

Rudy Wahl's surface sampling program showed assays of as high as 15 kilos per ton. Plato is in the middle of a 5,000-meter drill program designed to find the feeder zones. At least four holes have been finished and assay results will be out shortly.

I have had a number of conversations with management over the last couple of months. They are pleased with the drill results and are in the midst of another private placement to do more holes. When you buy any junior exploration company you are buying a lottery ticket with an expiration date. I don't think I have ever talked to any management team in the midst of a drill program that wasn't optimistic but Plato sounds convincing enough that I put more money into the 2nd private placement. If the drill program is a bust, I expect the shares to revisit $0.005 and my investment in management will be my 2nd. That is both my first and my last.

Plato is a crapshoot but I like the odds. I am investor in two private placements and I have bought shares in the open market. They either tank or go up a lot and we will know soon. Plato is an advertiser and I am biased.

Plato Gold

PGC-V $.045 (Apr 27, 2017)

PTOZF-OTCBB 173.0 million shares

Plato Gold website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Plato Gold. Plato Gold is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.