In this increasingly difficult environment for investors, Greenbriar Capital Corp. (GRB:TSX.V; GEBRF:OTC) looks like a real standout, with its excellent fundamental prospects and still very cheap stock—which won't be cheap for much longer. Over the past 24 hours it has been announced that the company will receive key Congressional support for its giant 100 Megawatt Montalva Solar Project in Puerto Rico.

The management of Greenbriar are anything but amateurs and the CEO, Jeff Ciachurski, demonstrates his commitment by not having taken a salary during his nine years of running the company, but don't be concerned about his welfare—he doesn't have to sleep in his car and live on junk food, because he built up Western Wind Energy from scratch some years back and sold it for a cool $430 million. The other members of the management team are also experienced professionals.

In recent years solar power has become increasingly commercially viable as the capital costs involved have dropped through the thresholds that make it competitive with other less environmentally friendly methods of power generation. Greenbriar and its predecessor have had a presence on Puerto Rico for about 10 years—long before the devastation of Hurricane Maria and even the financial crisis on the island, and has owned a $1.9 billion solar electrical generation contract for six years. Greenbriar has already made a considerable investment in its Montalva solar project on the island, but due to the credit crisis and the policy of "getting by with what you've got" mentality has not been able to advance the project to completion—until now.

That all changed with the hurricane, which wrecked the decrepit infrastructure, necessitating a clean sweep and radical solutions, and with the electrical and communication grids such as they were having been trashed by the hurricane literally overnight, the appeal of big solar projects on the island is obvious, especially any whose planning is already relatively advanced as the Montalva project is, and the urgency of the situation means that the project will be expedited so that it is up and running as soon as possible. Before the hurricane the Montalva project was stymied because of the credit crisis on Puerto Rico, which resulted in the power purchase contract not being honored, which is why construction never started, and Greenbriar has been proceeding in the courts for breach of contract. Needless to say this has not done wonders for the share price, but the hurricane has changed everything and now the project is being given the go ahead.

So let's stop and think about this for a moment. Greenbriar has a current market cap of $17 million and throughout the 35-year power contract this Montalva project will generate $58 million in annual revenue to Greenbriar. A quick "back of a matchbox calculation" makes plain that Greenbriar's stock will soar if this project is given the go ahead—and it looks like it will be.

Reading thus far, you might think that this Montalva solar project in Puerto Rico is the only quiver in Greenbriar's bow, well, it isn't. In addition the company is in the forefront of the "Smart Glass" revolution. In a nutshell, this is glass that uses liquid crystal technology to instantly change light transmission qualities. As a simple example, an office could have a Smart Glass wall that enables the boss to see out, while the people outside cannot see in, or they can, at the flick of a switch (or it can be programmed), and this same wall can be instantaneously changed to serve as a projection screen, etc. An impediment to the widespread use of Smart Glass thus far has been longevity and transparency issues, but great strides have been made towards solving these problems by a company called Gauzy. There are several reasons that the Smart Glass market in the U.S. has barely been tapped—a big one is that what has been available up to now has been expensive customized installation or self-install kits, and distribution has been sparse. Greenbriar intends to change all that and open up this potentially huge market that is still in its infancy. It has developed its own Smart Glass using the Gauzy solutions and will make the glass widely available though partnerships with manufacturing, distribution and installation.

In addition, Greenbriar has launched a wholly owned independent subsidiary company called Realblock, a first of its kind functional real estate blockchain enterprise. As any of you who have had real estate dealings will know, the procedures are almost Dickensian—it can take weeks to do what could be done with modern technology like Blockchain in a matter of days or even hours. Blockchain promises to revolutionize the real estate industry by greatly reducing the time required to get things done and Greenbriar is at the forefront of this with Realblock.

Greenbriar also has profitable real estate interests. After the 2008 market crash, Jeff Ciachurski bought a block of land in Tehachapi, California, for $1 million, which is now worth five times that, but if developed into town homes, this property would yield the company $260 million over seven years.

Finally the company has a 50% (optionally 100%) interest in its 80 Megawatt Blue Mountain Utah Wind Energy project.

It should be clear after reading all this that any of these interests of the company could be spun off into separate companies.

On March 2nd last the company closed a financing at C$1.03 a share that has provided ample operating cash for all of 2018, and with the current price well below that it is clearly good value here.

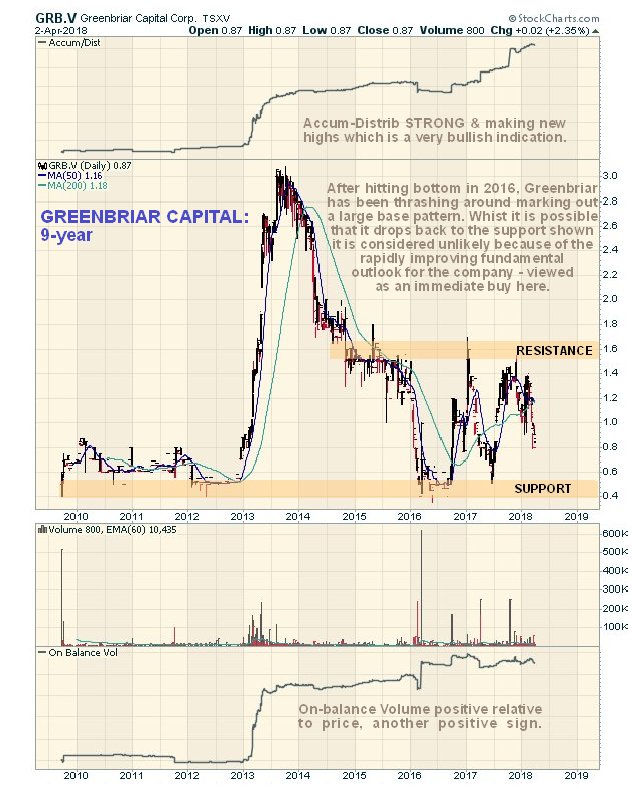

Turning now to the technicals for the stock, we see on the 9-year chart that after a severe bear market from 2013 through early 2016, which saw the price drop from over C$3.00 to about C$0.40, it has been thrashing around marking out a large base pattern bounded by support in the C$0.40 area and resistance in the C$1.50–C$1.70 zone. The strongly rising Accum-Distrib line and robust On-balance Volume line as this base pattern has developed are a clear indication that a new bull market is incubating in this stock, which is hardly surprising considering the positive fundamental outlook. This being so the stock looks like a buy here after the dip of recent months, especially as the positive indications make is less likely that it will drop back further to the support in the C$0.40 area.

The 6-month chart shows recent action in much more detail, and there are several important points to note on this chart. The first is that it is at a much better price after its reaction of recent months, and even though we have seen a moving average cross, the 200-day moving average is still rising, so the price could easily break back above both moving averages. Another factor suggesting that it is at a good entry point here is that it is quite deeply oversold on its MACD indicator, which is supportive of a rally, especially as the MACD histogram (bars) is contracting back towards the zero line. It is suspected that a small Double Bottom is forming here above limited support at about the C$0.80 level.

To conclude, this stock is regarded as fundamentally one of the best investments we have come across. Just on the basis of the Montalva solar energy project getting the go ahead, and with the just announced Congressional support it should do, the stock is probably worth C$10.00, and that doesn't factor in its other pioneering projects, and right now it is exceptionally cheap after drifting lower for months. Thus the stock is RATED AN IMMEDIATE BUY. Don't be surprised to see it gap up at the open this morning after last night's positive news. It is viewed as worth buying immediately up to C$1.40. Greenbriar trades in light sporadic volumes on the US OTC market, and there are only 17 million shares in issue.

Greenbriar Capital website.

Greenbriar Capital Corp, GRB.V, GEBRF on OTC, closed at C$0.87, $0.56 on 2nd April 18.

Click here to read Ron Struthers' analysis of Greenbriar Energy.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Read what other experts are saying about:

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: Greenbriar Capital. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Greenbriar Capital.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Greenbriar Capital, a company mentioned in this article.

Charts provided by the author.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.