Maurice Jackson: Welcome to Proven & Probable, where we focus on metals, mining and more.

Today we will discuss a company that is expanding and discovering heap-leach gold deposits in Nevada. I'm speaking of Northern Empire Resources Corp. (NM:TSX.V;, PSPGF:USOTC ).

Joining us today is Michael Allen, the president, CEO, and Director of Northern Empire.

Mr. Allen, for someone new to the story, who is Northern Empire, and what is the thesis that you're attempting to prove?

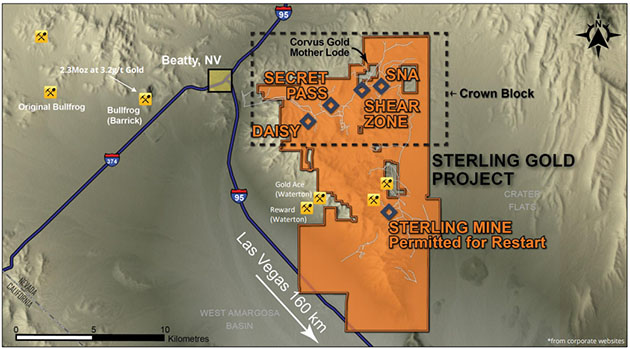

Michael Allen: Northern Empire is a relatively new company in the Nevada space. We are a team of what we call businessmen that do mining. The company is focused on the Sterling Gold Project. It's about two hours northwest of Las Vegas. The thesis that we're testing is essentially high-grade gold mineralization in the southern part of the U.S. and a heap-leach operation that we're trying to establish down there.

Maurice Jackson: Please provide us with a historical narrative on the Sterling Gold project, and why Northern Empire decided to make this your flagship project.

Michael Allen: The Sterling Gold Project is essentially two past-producing operations that have been combined under the banner of Northern Empire. There's the Sterling Gold Mine, which was operated by Imperial Metals, and the Daisy Mine, and was our Crown Project in the northern part of the project.

Grossly speaking, the projects are 160 kilometers northwest of Las Vegas, located in the Walker Lane of Nevada. We're in the mountain range called the Bare Mountains. B-A-R-E as in not a bug, blade of grass, or plant. It's an excellent place to develop mines, and these are past producers that have been successful in past with excellent metallurgy, and in a great location.

Maurice Jackson: The timing to acquire the Sterling Gold Project couldn't have been better for Northern Empire. Please share with us your optionality success, and are there any reversionary interest on the Sterling Gold project?

Michael Allen: We were able to purchase a fully permitted gold mine from Imperial Metals. We were able to get 100% interest in the property. There are a few NSRs on it, depending on which part of the ground that you're on. There's a 2.25% NSR over the sterling mine itself. And as part of the transaction with Imperial, we gave a 2% NSR for anything that wasn't previously burdened with an NSR to Imperial. But we own 100%, and we've staked a lot more ground that is not burdened with an NSR.

Maurice Jackson: Would you please share with us your management's philosophy?

Michael Allen: The best way to describe our management philosophy is to go back to the statement: This is businessmen that do mining. We're looking for a couple of things out of the company, and it's all about liquidity. There's an option with the backbone of the permitted asset that is Sterling, of growing this into a company that is a large U.S.-based gold producer with a starter asset, the Sterling Gold Mine. Or there is an option that there are other large U.S.-based gold producers that are going to look at the sterling asset, the Sterling Project, and say, "That's something that we want," and create that liquidity that way.

So, it's a movement of shareholders in and out, but we're dominantly driven as shareholders ourselves, and to shepherd the capital in an effective manner to increase shareholder value.

Maurice Jackson: Now that we have a historical context of the Sterling Gold Project, which contains four deposits, let's discuss Northern Empire's main deposit, the Sterling Mine. What can you share with us?

Michael Allen: There are a lot of very interesting things about the Sterling Gold Mine. It's been around in various forms since the 1970s. It started as a private mine operated by some guys out of Nevada. It was swallowed into E&B, which ultimately became Imperial.

It was operated in the past as an underground heap-leach operation, quite high grade, with exceptional recoveries. Historical grades mined from the underground were 7.4 grams per ton. Recoveries were about 88%.

What happened in the past was Imperial realized that there was an opportunity to transition from the underground operation to an open-pit operation. It began the permitting exercize and did the engineering internally for Imperial to actually say, "Okay, there's an opportunity here to go in open pit." It went through the permitting process, and it had a gap. The permits were delayed before it got them, and the company didn't make the transition to the open pit itself. When that gap in permitting being in hand came in, was when the Mount Polley spill happened. And so, Imperial was capital constrained. Nothing could happen down at Sterling, as all its capital went to fix Mount Polley, so that created the opportunity for Northern Empire to make this acquisition.

Maurice Jackson: The Sterling Mine is permitted for restart, is that correct?

Michael Allen: Yes. .

Maurice Jackson: When will it restart, and what is the strategy in delaying the restart?

Michael Allen: I couldn't give you a hard date as to when we're going to restart the Sterling. But the strategy for delaying the restart is to really understand what we've got both at the Sterling and at the Crown Series of deposits in the north.

At the Sterling, with it being a high-grade underground operation in the past, there were several opportunities that were left untested. Nothing less than a 3.5 gram per ton intercept was thought to be significant for the Sterling because of the underground nature of it at the time. So, there were several shallow intercepts that needed to be followed up on, things like 22 meters of 2 grams per ton that need to be followed up on. We're going to be investigating those and making sure that we understand and are able to optimize value of the sterling before we restart.

And then also right now we're focusing on the Crown part of the project. What we call the northern part, and seeing what we can get for value for shareholders up there.

Maurice Jackson: Being that the Sterling mine was a previous producer, what can you share with us regarding metallurgy, existing infrastructure, and capital expenditures?

Michael Allen: Historical capital expenditures are probably the most difficult to quantify because it's been around for a long time. The metallurgy is excellent, but the commercial leach cycle was 88% recovery in a 30-day leach cycle using run of mines. So, you're looking at a very coarse material going on to the leach cut. It's about 24-inch minus.

Existing infrastructure on the site. The process plant is there, which is called ADR or carbon columns. That is sized actually for the permitted open-pit operation. So really, in terms of going forward capital, it's actually a fairly simple operation to turn on. There are generators there. There are offices there. There's manpower there. The well is already drilled, and that process plant is there, and actually it is operational. We're actually pumping solutions through it right now and recovering about three-quarters of an ounce per day.

Maurice Jackson: Moving on to the Crown Series of deposits, which consist of the Daisy, Secret Pass and SNA. What can you share with us regarding the Daisy deposit?

Michael Allen: The Daisy deposit is an exceptional high-grade deposit. It has all the signatures of a Carlin deposit, which is generally what you see as the larger deposits in the state of Nevada. Daisy is about 2.1 grams per ton. It's hosted in carbonate rocks. It's also a past producer. There's a small pit there, where Glamis and Rayrock exploited a part of the deposit in the past. Metallurgy there was excellent. That deposit supposedly historically received a 75% recovery run of mine. So, it's a very interesting deposit, and it's open up-dip, and there's a lot of exploration potential around it.

Maurice Jackson: How about Secret Pass?

Michael Allen: Secret Pass is further to the east from the Daisy. We actually just released a hole out of Secret Pass a couple of days ago. It was 70 meters of 1.7 grams per ton. It's an oxide deposit. It's epithermal, so slightly different. There's a big structure that goes through the valley, that links up Daisy, Secret Pass and SNA. Secret Pass is in the hanging wall of the structure, so it's slightly different. It's an epithermal deposit in volcanics.

Maurice Jackson: What can you share with us about SNA?

Michael Allen: SNA is probably the least known, or the least understood, of the Crown Series of the deposits. It's about 1.6 grams per ton. It hasn't been exploited. Secret Pass and Daisy were mined in the past; SNA has not been. It was discovered actually, drilling a water well for another operation in the area called the Mother Lode.

It's a shallow oxide deposit. We think that it's also a Carlin.

Maurice Jackson: Is the lithology consistent within the Crown Series of deposits?

Michael Allen: No, they are different. As I said, the Daisy and SNA appear to be Carlin type deposits. They have slightly different hosts, but they're carbonate-hosted, and Secret Pass is an epithermal, so it is different. It's a volcanic-hosted rock.

Maurice Jackson: What can you share with us regarding Northern Empire's conducting an aggressive campaign in the Crown Series of deposits?

Michael Allen: We are with rigs right now. We've got two RC rigs going. As I mentioned, we did just release a hole out of Secret Pass, 70 meters and 1.7 grams per ton. A few weeks before that, we had released a hole out of the Daisy deposit, which was 124 meters of 1.4 grams per ton, very high grade for the state of Nevada in this day and age. And we're going to be releasing more results as we go forward, and the rigs move their way through the property in a systematic fashion.

Maurice Jackson: Is the goal for Northern Empire to build a mine and go into production, or arbitrage?

Michael Allen: As with the management philosophy, it's about shareholder capital and increasing shareholder value and liquidity. So, there is a scenario of us turning it on, or there is a scenario of somebody else coming in and making an acquisition.

I think that both scenarios are there, and we think that we have the team, and the management, that can build a mine and make this into a company that is a mine operator.

Maurice Jackson: Speaking of teams, I learned from Rick Rule and Doug Casey that the people running the business are equally, if not more important, than the latent material in the ground.

Please introduce us to your Board of Directors, and what unique skillsets do they bring to Northern Empire.

Michael Allen: We like to say that our management team is businessmen that do mining. Grossly speaking, there are three groups on the board. You've got Doug Hurst and Ray Threlkeld, who were part of the Newmarket Gold team. Doug was a founder of that company, and Ray was the Chairman of the Board when that company was sold to Kirkland Lake Gold for a billion dollars. These are really businessmen.

Ray is a mine builder by nature. He's an ex Barrick guy, and I believe that the number that he's built for Barrick is about 80 million ounces worth of production, so really strong guy.

Second group on the board is what we'll call the Kaminak team. We've got two of the founders and directors there, John Robins and Jim Peterson. They were successfully involved with Kaminak from its being founded as an exploreco in the Yukon, and transitioning, and being sold to Goldcorp in 2016 for $520 million.

And then the third group is what I'll call the Underworld team. They are the guys that founded and managed Underworld Resources. It was sold to Kinross back in the day. It was the White gold discovery up in the Yukon. That's Adrian Fleming, Jeff Sundar, and Darryl Cardey.

It's a really good, experienced board. Management, businessmen, founders and successful sellers of companies that I've got on the board.

Maurice Jackson: Tell us about Michael Allen, and what makes him qualified for the task at hand.

Michael Allen: The hardest thing of all is to talk about myself. I'm a geologist by trade. I've been in the mining business for about 20 years. I describe myself as an advanced project guy. I like the projects that are more towards resources and development. I've been all over the Northwest Territories, Yukon, and Europe, looking at, evaluating, and running projects.

The last 10 years, I've been dominantly focused on Nevada. If you look at another article that Rick Rule has talked about is, you get a management team that is familiar with the jurisdiction. So I've been in Nevada for about the last 10 years. I'm familiar with the regulatory regime. I know the permitting people. I know the service providers. And so that's really where for me my niche is, to get a Nevada project, and get it across the line, in the way that is most cost-effective, and ultimately being efficient with shareholder capital.

Maurice Jackson: What can you share with us about the technical team?

Michael Allen: It's really a great team that we've got down there. There's the mine team, which is the mine manager from Sterling, and all the staff crossed over with us. So, the Sterling mine, being on care and maintenance, there's a few people that are there: the metallurgist, the process manager and the mine manager. They're seasoned professionals who have been doing this for a long time, and they are delighted that somebody like Northern Empire came in, saw the opportunity that they've been seeing for 20 years and hadn't been able to act on, and make it a focus, so they're really excited.

Then we've got the exploration team. We've got an experienced group of Nevada professionals that are running the exploration. These are guys who have worked with Barrick and various other companies throughout the United States, making discoveries, and putting mines into production, so I'm very proud of the team.

And then we also have a series of what I will call hungry, young kids. They're really interesting to watch because it's out-of-the-box thinking. They're out there mapping, sampling, enthusiastically working hard, and coming up with questions that need to be answered, and making new discoveries. It's a very exciting team to watch on the technical side.

Maurice Jackson: I'm hearing serially successful and Nevada centric when you're discussing your team.

Let's discuss some numbers here. How much cash or cash equivalents do you have?

Michael Allen: In Canadian terms, $16 million.

Maurice Jackson: Talk to us about your cash-flow distribution. What is the ratio between cash spent and tangible assets on the balance sheet?

Michael Allen: We spend most of our cash and put it into the ground. We're going to spend about $10 million in the Sterling asset this year. Then we also will be spending about $3 million in overhead, so we're going to exit the year with about $5 million in the till. We've already obviously spent some money, as we're in mid-March.

Maurice Jackson: How much debt do you have?

Michael Allen: We don't have any debt.

Maurice Jackson: Who are some of your institutional investors?

Michael Allen: Our single largest institutional investor, if you consider them, is Coeur Mining. It has 11.6% of the company. Following it is Donald Smith. Invesco is in there, McKenzie, RBC, a group called Zechner. That would probably round out the top five, top eight.

Maurice Jackson: What is the float?

Michael Allen: Retail shareholders is about 40% of the company. And in terms of institutional shareholders, actually management has a large chunk as well. We own about 8% of the company.

Maurice Jackson: What is your burn rate?

Michael Allen: This year, our total budget is about $13 million, and we started the year in January with just over $18 million, so we'll exit the year with about $5 million in the till.

Maurice Jackson: Are there any redundant assets, such as patented mining claims?

Michael Allen: Not particularly. We, as part of the transaction with Imperial, acquired all the assets of Sterling Gold Mining Corporation. That included some minor NSRs, and we've been gradually liquidating them as they've become of interest to people, but there's not a lot of redundant assets.

Maurice Jackson: Tell us about your share structure.

Michael Allen: It's a fairly tight share structure. Currently, we've got about 66.5 million out right now. Fully diluted with the options and warrants, we go to about 77 million.

Maurice Jackson: Are there any change of control fees, and if so, what are the terms?

Michael Allen: We have industry standard employment contracts for the senior management of the company. Myself, it's a three-year change of control clause. It's indexed off of the share price to motivate me to keep shareholder value up.

Maurice Jackson: What is the next unanswered question for Northern Empire? When should we expect results? And what will determine success?

Michael Allen: I think that the unanswered question is, What is the potential of the Crown Series of deposits in the northern part of the project? There's a lot of good geology that has yet to be tested. We're out there actively exploring right now.

In terms of results, as I said earlier, we've got two rigs up there, and they're moving their way through the project right now, so we're going to be releasing results, probably in a fairly steady stream between now and the end of summer.

And what will determine success? I think that ultimately success is an increase in shareholder value, and an interesting gold discovery in an underexplored part of Nevada.

Maurice Jackson: What keeps you up at night that we don't know about?

Michael Allen: That's an easy one. My seven-year-old son who's on spring break, and ready to do all sorts of fun things in his day off.

Maurice Jackson: Well, you have no mercy from me. I have seven-year-old twins and a nine-year-old, and grandchildren, but I digress.

Michael Allen: What keeps me up at night? Similar to what the Crown Series of deposits will be. We've got resources up there. We've got some interesting geology, but it is an early-stage exploration program, so you really have to temper expectations. We're putting out great results, but it is an early-stage exploration program. There are a lot of things that need to be thought of and discovered. But I like what we're doing. I like the team that we've got. I like the location. It's the best jurisdiction in the world for mining.

So, there's risk, obviously, because this is mining, but there is reward because we've done the best that we can in terms of picking an asset that gives a good shot for success.

Maurice Jackson: And finally, what did I forget to ask?

Michael Allen: People on the more technical side will ask questions about how confident we are in the metallurgy, particularly at the Sterling. That's a common question. I've been asked several times, how many columns, and how many bottle rolls, and are you sure that the sample is representative? The answer that I give to that is, "Well, it's been mined before." And these deposits have been mined before so that the metallurgy has largely been done on, not columns or bottle rolls; it's mine scale.

I think that the de-risking part has been done for a lot of these assets, deposits.

Maurice Jackson: For readers who want to get more information on Northern Empire, please share the contact details.

Michael Allen: The best thing for more information about the company is to have a look at our website, which is www.NorthernEMP.com. The TSX-V is NM, and on the OTC it's PSPGF.

Maurice Jackson: And for direct inquiries, please contact Dylan Berg. His phone number is 604-646-4522, and you may email him at Info@NorthernEMP.com.

And last but not least, please visit our website www.ProvenAndProbable.com, where we interview the most respected names in the natural resource space. You may reach us at Contact@ProvenAndProbable.com.

Michael Allen of Northern Empire, thank you for joining us today on Proven & Probable.

Michael Allen: Thank you.

Maurice Jackson: As a reminder for our readers, Northern Empire is a sponsor of Proven & Probable.

Michael Allen is the president, CEO and director of Northern Empire Resources. He is a professional geologist with 20 years of experience in the mining industry. He has extensive experience in project evaluation, recently reviewing in excess of 400 gold projects worldwide. This effort led Allen to identify and negotiate the purchase of the Sterling Gold Project. Allen has a strong technical background having explored for gold in Nevada, the Arctic, British Columbia and Ontario. He has worked in both open-pit and underground mines, as well as managing the construction of new mines and exploration crews. For the last several years Allen has spent his time in Nevada where he was part of a team that advanced a gold project through permitting and a positive pre-feasibility study. Allen holds a Bachelor of Science degree in geology from the University of Alberta.

Maurice Jackson is the founder of Proven & Probable, a site that aims to enrich its subscribers through education in precious metals and junior mining companies that will enrich the world.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Michael Allen: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Northern Empire Resources. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: Northern Empire Resources. I determined which companies would be included in this article based on my research and understanding of the sector.

2) Maurice Jackson: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Northern Empire. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: Northern Empire is a sponsor of Proven & Probable. Proven & Probable disclosures are listed below.

3) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Click here for important disclosures about sponsor fees.

4) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

5) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

6) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Proven and Probable LLC receives financial compensation from its sponsors. The compensation is used is to fund both sponsor-specific activities and general report activities, website, and general and administrative costs. Sponsor-specific activities may include aggregating content and publishing that content on the Proven and Probable website, creating and maintaining company landing pages, interviewing key management, posting a banner/billboard, and/or issuing press releases. The fees also cover the costs for Proven and Probable to publish sector-specific information on our site, and also to create content by interviewing experts in the sector. Monthly sponsorship fees range from $1,000 to $4,000 per month. Proven and Probable LLC does accept stock for payment of sponsorship fees. Sponsor pages may be considered advertising for the purposes of 18 U.S.C. 1734.

The Information presented in Proven and Probable is provided for educational and informational purposes only, without any express or implied warranty of any kind, including warranties of accuracy, completeness, or fitness for any particular purpose. The Information contained in or provided from or through this forum is not intended to be and does not constitute financial advice, investment advice, trading advice or any other advice. The Information on this forum and provided from or through this forum is general in nature and is not specific to you the User or anyone else. YOU SHOULD NOT MAKE ANY DECISION, FINANCIAL, INVESTMENTS, TRADING OR OTHERWISE, BASED ON ANY OF THE INFORMATION PRESENTED ON THIS FORUM WITHOUT UNDERTAKING INDEPENDENT DUE DILIGENCE AND CONSULTATION WITH A PROFESSIONAL BROKER OR COMPETENT FINANCIAL ADVISOR. You understand that you are using any and all Information available on or through this forum AT YOUR OWN RISK.