I used to travel 2/3 of the time. Barbara hated it. I hated it. American Airlines loved me. I had so many air miles the Captain would invite me up to the cockpit to chat about the problems with the ILS 28 approach into Hong Kong and I had to fly every third leg.

Eventually I realized that I had seen most of the mining districts in the world. I was visiting projects for the second and third time. Barb would far prefer I stay home to focus on Honey-Do projects so I started cutting down the number of trips per month to three and then two and now I only go see really interesting countries or companies.

I haven't been to Anaconda Mining Inc.'s (ANX:TSX; ANXGF:OTCBB) Goldboro Saddle Reef gold deposit in Nova Scotia. But I have been to the Dufferin Saddle Reef gold deposit on the same structure twice when it was owned by a predecessor company to the company who owns it now. Once you understand what a saddle reef is, they are all more or less the same. So knowing Dufferin means you understand Goldboro.

Way back when, the earth in certain areas got stretched, then jammed together much like an accordion. From the side, it looks like a saddle. Where the fold is, at the top, you have a low pressure area where gold bearing fluids moved up but had nowhere to exit so they create small but very rich deposits.

Someone who had worked at Goldboro contacted me and wanted to put me into contact with management at Anaconda. At 321gold we handle potential customers in a way unlike any other of the gold sites work. We don't go to shows; I'm way too lazy.

If companies don't know me by now there is nothing I can say that would make any difference. The last few times I went to gold shows, I got bombarded with dozens of companies each telling me they had the most experienced management and best project in the world. I was pounded with so much information that I knew less when I left the show than when I arrived. So I just stopped going. People don't need to hear me preach, they can go to my site for free and if someone wants to advertise, they can just figure out how to reach me.

But I do have a place in my heart for saddle reef deposits and Nova Scotia. I think it's the most beautiful area in Canada. If I lived in Canada and wanted to raise kids, I'd be in Nova Scotia. And from a mining perspective, it's an easy area to get people to move to. Unlike the insanity of prices in Vancouver and Toronto you can still buy a house there at a reasonable price.

I began to look into Anaconda after my conversation with management. The more I looked at it, the more I liked it. What I like best is the potential. Anaconda is made up of a lot of little bits and I think that confuses people so they see the trees and miss the forest.

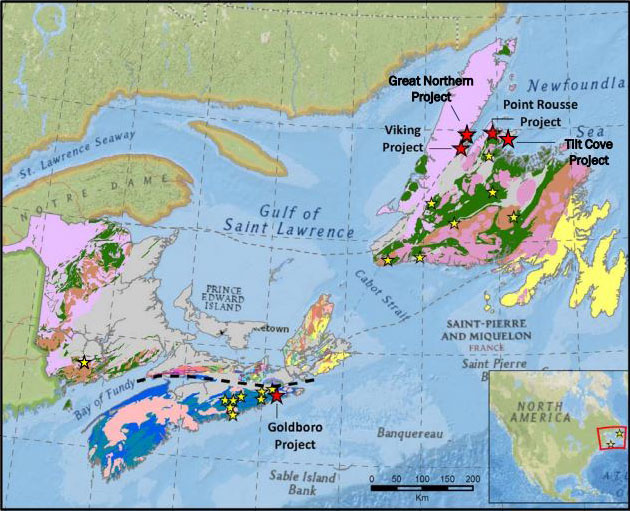

In Newfoundland Anaconda owns a mill capable of processing 1280 tons a day and several different open pit mines. The mill is at Pine Cove and has done about 16,000 ounces a year historically. Management plans on using grade control to deliver more of the higher grade gold from the Point Rousse project consisting an open pit at Stog'er Tight and Argyle and increasing production to above 20,000 ounces. Stog'er Tight has a 43-101 resource of about 50,000 ounces of gold; Argyle has a resource of just under 70,000 ounces of gold. In addition, Anaconda plans a 5000-meter drill program at Argyle to add ounces.

Within Newfoundland the company has an additional two exploration projects. One, named the Great Northern project has a historic resource of about 83,000 ounces. The other, the Tilt Cove project has gold in copper potential and an existing 30,000-ton stockpile of ore grade material.

All of that is interesting and would more than justify the $25 million market cap the company had a month ago. But my conversations brought up Nova Scotia and their saddle reef deposit there. Now I will say, the company wasn't nearly as interested in the fact they have a saddle reef deposit at Goldboro as I am.

When I went to see the Dufferin mine and mill ten years ago, the company that owned it then had some wonderful pictures of what a saddle reef looks like. And the key is that you have reef after reef after reef. All a company has to do is drill down through the fold and they will keep hitting reefs. I think Anaconda shows some 26 reefs they have identified and the company who now owns Dufferin has identified 30 such reefs. The grades in such deposits can get stupid. Prior drilling at Goldboro had one intercept of 485 g/t gold over 2.6 meters in hole BR-17-04. Grade control is vital as the gold is very nuggety and hard to measure.

Anaconda just released a PEA on Goldboro that was at least as interesting in what it didn't say as what it did say. The PEA called for production of about 41,000 ounces climbing to 62,000 ounces in year five. All in sustaining costs are $797 CAD and $89 million CAD would be necessary for capital. The average grade would be 5.13 g/t and they guess a recovery of 93.6%.

What they don't say in the PEA is that once you have a mill in place, you can add as many high-grade ounces as you want. All you have to do is drill or drift down to more reefs. The PEA assumes an 8-year mine life. Knowing what I know about saddle reefs, they have a lot more like 50-year mine life but can't say so.

I'm not a big fan of companies selling for peanuts with hundreds of millions of shares outstanding. It's just my feeling but I hate shares below $0.25. I was hoping the company would announce a roll back. The board approved it last spring. They just did announce a 4-1 roll back. I don't see any reason the shares will fall back; the pie is still the same size. Only the number of slices has changed.

Having been to Nova Scotia in the past and seeing the Dufferin and now knowing about Goldboro, I have fantasies about the two companies either merging or one buying the other out. With Goldboro going into production, Anaconda has 60,000 to 80,000 ounce a year gold potential when the mill is complete. But there is an existing mill at Dufferin. Anaconda could save probably $50 million in capital cost by buying Resource Capital Group (RCG-V) that only has a $13 million dollar total market cap today.

Resource Capital had a real dingbat as CEO who just either got fired or at least shoved out the door. He was the same guy that destroyed Palladon Ventures. That was one of the greatest projects I ever saw and it would take someone working 24/7 to have killed it. But kill it he did. I suppose he put in a lot of overtime. In any case, right now RCG needs management and ANX has it in spades. I'd love to see a deal between them on any terms.

Anaconda has a lot of valuable pieces. They have a producing mill in Newfoundland with lots of potential feed. Management is young and first class. Goldboro is an unsung opera just waiting to be heard. While total gold production isn't much now, I believe the 80,000 ounce potential is not far off. If ANX and RCG got together, it would be a company to be reckoned with. It's a case where the whole is greater than the sum of its parts.

I own shares I bought in the open market in Anaconda and participated in their last PP. They are advertisers and as such naturally I am biased. While RCG is not an advertiser, I am nibbling at shares in the open market in the hope they see what I see.

Anaconda Mining

ANX-T $0.115 (Jan. 19, 2017)

ANXGF-OTCBB 422.6 million shares

Anaconda Mining website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Anaconda Mining and Resource Capital Group. Anaconda Mining is an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.