Kootenay Arc; Jersey Emerald Project

1. Introduction

Every now and then certain junior mining companies succeed in consolidating a large group of claims or even multiple projects on very favorable terms, often creating very interesting continuous land packages with ongoing areas of exploration potential, greenfield and/or brownfield. This kind of transactions are usually out of the realm of larger, well-known parties, as prices shoot up the second their involvement becomes apparent.

One of these junior mining companies is Margaux Resources Ltd. (MRL:TSX.V), a relatively new player on the zinc front. The company consolidated a lot of land and historic mines in an area called the Kootenay Arc, and set out to look not only for zinc, but also for tungsten and gold. This year has already seen quite a bit of exploration activities on various projects, so it is time to discuss the current status of the company and its projects.

All presented tables are my own material, unless stated otherwise.

All pictures are company material, unless stated otherwise.

All currencies are in U.S. dollars, unless stated otherwise.

2. The Company

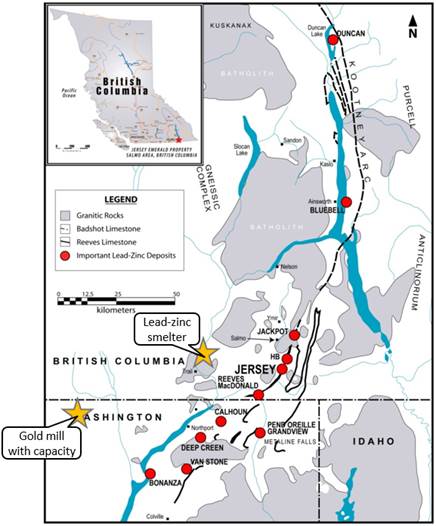

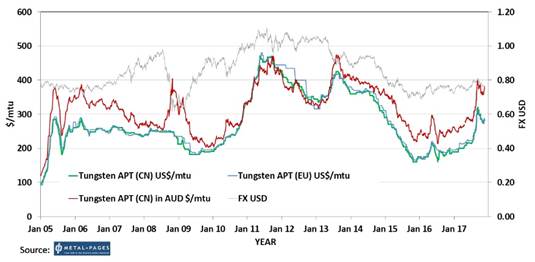

Margaux Resources is a mineral acquisition and exploration company focused on zinc, gold and tungsten resources in the richly mineralized Kootenay Arc region of southeastern British Columbia (B.C.), Canada. The company has quietly consolidated a portfolio of previously producing properties in the last three years with excellent exploration potential, five projects containing 24,635 hectares in total claims, that include the Jersey-Emerald mine, which at one point was the second largest historic zinc-lead mine in B.C. and the second largest tungsten mine in North America.

The projects are located in the richly mineralized zinc/lead/silver Kootenay Arc belt in the southern part of B.C. which extends over 300km, in hilly/moderately mountainous terrain. British Columbia is a very familiar mining jurisdiction, and has a solid ranking on the Policy Perception Index according to the last Fraser Survey of Mining Companies, coming in at #41 out of 104 jurisdictions worldwide.

Kootenay Arc; projects

The infrastructure is excellent as the area is a mining hotspot, with power dams nearby, and the company also identified a few nearby opportunities to eventually mill and process ore in the future. These are the Kettle River gold mill owned by Kinross in Washington, the Pend Oreille Mill belonging to Teck in the same state, and Teck's Trial smelter complex in B.C., one of the world’s largest fully integrated zinc and lead smelting and refining complexes.

Margaux Resources has laid out a clear strategy from the get-go: it wanted to identify high-yield, past-producing and long-time inactive mines; it wants to apply modern geoscience and technology in order to research current potential at low cost, and identify economic potential previously discarded due to old mining/processing technology. It seems that they acquired the right projects in the Kootenay Arc.

The flagship Jersey-Emerald project, which hosted once one of the largest zinc-lead-tungsten producers in British Columbia, has a 2010 NI-43-101-compliant resource on it, containing 1.9Mt @4.1% Zn, 1.96% Pb Indicated, and 4.98Mt @3.37% Zn, 1.95% Pb Inferred at an unofficial 3.5% "Zn+Pb" cut-off grade, at a time where zinc and lead were roughly priced the same (about US$1/lb). As zinc has appreciated more since 2010 (US$1.54/lb vs lead US$1.12/lb at the moment), the ZnEq cut-off grade will probably come closer to 3%. This assumes an underground mining scenario, similar to the historical operation. There is potential to extract the mineralization by open-pit mining. For an open-pit scenario, the 2010 NI-43-101-compliant resource is 5.3 Mt @ 2.6% Zn, 1% Pb Indicated and 17.0 Mt @ 2.2% Zn and 1% Pb Inferred, using a cut-off grade of 1.5% "Zn+Pb."

The company is basically controlled by a family of miners, to be more specific, the Letwins. IAMGold President and CEO Steve Letwin and his family own about 10% of Margaux, he is an advisor and is involved in marketing; his brother James Letwin is chairman; and his brother-in-law Doug Foster is a director. Letwin provides mid-tier producer experience, but also access to capital, as Margaux raised over C$10.6 million in the last year and a half. Margaux is headed by President and CEO Tyler Rice, CPA, who is a successful and versatile young entrepreneur in many industries, including oil & gas, real estate, health care and mining. He already has a few rewarding exits to his name, invested over C$500,000 into Margaux equity, and relocated to Nelson especially for being in touch with the projects, and build relationships with local communities. The exploration team is headed by VP Exploration Linda Caron who has extensive experience in the region where Margaux's projects are located. Another familiar name can be found on the advisory board: Chris Stewart, president and CEO of Treasury Metals.

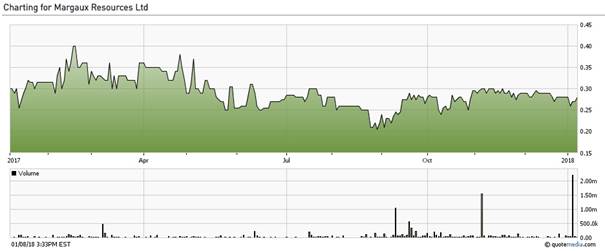

Some basic information on share structure and financials: Margaux Resources has a tight 59.984 million shares outstanding. The fully diluted share count stands at 84.4 million shares, as there are 4.8 million options and 19.3 million warrants (8.1 million are out of the money @C$0.40 expiring March & December 2019). In December the company closed a C$3.25 million financing, and the company has no debt. The current share price is C$0.28, resulting in a current tiny market cap of C$16.8 million. This is tiny, as almost every zinc junior that has something of a resource has a market cap of at least C$20–30 millin (see my peer comparison in my latest Tinka Resources article).

Share price 1-year timeframe; Source: tmxmoney.com

The stock has been relatively stable all year, on a low average volume of 81,249 traded daily, which has been skewed by a few large trades a few months ago, I would say trading comes closer to 40,000 daily now. This is caused partly by the stock being hold tightly as mentioned; insiders and management hold about 15%, which means a lot of skin in the game.

Let's have a look first at the main base metals Margaux is after, zinc and tungsten. I will not discuss precious metal gold as I view this as a metal without solid market fundamentals that can't be analyzed properly. There are countless people who try to work with sentiment drivers like negative real interest but results remain inconsistent as gold prices are determined by futures traders who play sentiment speculation to perfection, which has nothing to do with real supply/demand.

3. Zinc & Tungsten

Zinc

I discussed zinc recently in earlier articles, so if you are familiar with those than you can skip this, of course.

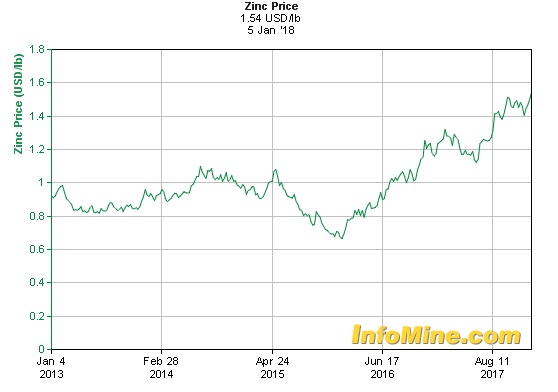

A chronic shortage of supply of zinc is well underway now. The coincidental closure of major zinc mines (Brunswick, Perseverance, Century, Lisheen, Skorpion) through depletion, taking 500kt per annum off the table, and this, coupled with a very limited number of new zinc mines in the near-term development pipeline set to come on-line, is expected to lead to a robust zinc price for the next few years. The price of zinc already ran up from US$0.67 to a recent US$1.54/lb, and is forecasted to go up even more:

The zinc market has been in deficit for a long time (since 2012), but only since the end of 2015 did the zinc price start to appreciate, probably due to covert stockpiles that finally seem to be depleted. So, despite the current modest correction, the long-term zinc case looks pretty convincing in my view, and playing into the hands of Margaux Resources.

Here is a chart from Kitco.com, indicating long-term weakness in LME inventories, but only since the end of 2015 coinciding with factors like production going off line:

It seems like the stocks are heading for new lows, and recently broke through the 200,000t levels, and dropped below the 10-day supply threshold that is deemed critical. Following up on supply constraints, cutbacks like the ones executed by Glencore, as well as decreases expected for Kazakhstan and Peru, have tightened supply further and deepened the concentrate deficit. Interestingly, China had also shut down 26 mines in August 2016 due to safety and environmental concerns, which was a serious gesture. The latest development is Glencore bringing back online another 100,000t, but this is not believed to have much of an impact, and my guess is, looking at this very modest increase, that Glencore will do anything to maintain and support much higher pricing for a long time.

Analysts believe that the zinc price could appreciate further, to $2.00/lb levels or more, as a new critical deficit could be looming for 2018. Biggest risk factor in all this remains main producer and consumer China (like it is with almost every other metal).

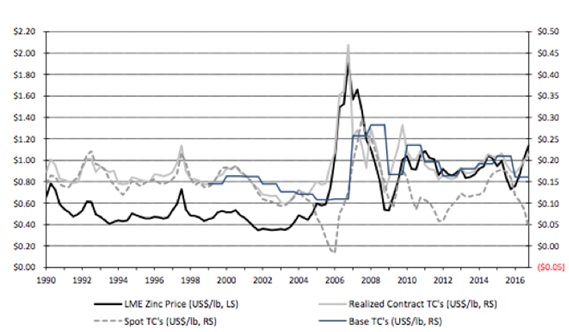

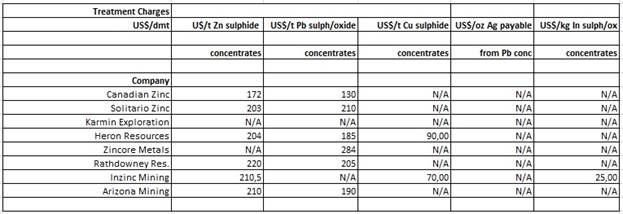

On a side note: an interesting phenomenon in zinc production are the treatment charges (TC). These are the charges paid by zinc miners to the smelters, for refining their zinc concentrates into zinc ingots. These TCs are often quite substantial, often to the amount of $200/t Zn for long term contracts. Besides LT contracts there are also spot TCs for smaller quantities, and those have gone down a lot lately, going from $100–120/t to $40/t, as smelters are having a hard time getting zinc concentrates to process. As this chart shows, the interesting part of this is that spot TCs go down first as an indicator, before zinc prices start rising:

Zinc prices and TCs; source RBC zinc report Jan 2017

The funny part is that the long-term contract TC prices don't go down first with shortages, but only go up when the zinc price really starts to take off. So apparently there are two different TC pricing mechanisms at work at the same time with smelters.

Smelters have a dominant position in the zinc business, as they can set the TC terms. These terms are so one-sided, that zinc concentrates usually need significant by-products, or miners need to have a lead concentrate as well in order to be profitable. This was an important reason for BHP and Rio Tinto to exit the zinc business. Usual by-products are lead, silver, gold, and copper, but sometimes iron ore, molybdenum and even indium are recovered and paid for.

When analyzing a few economic studies of zinc juniors, I came across several TCs, and I gathered them in this table, to get an impression:

Besides TCs, there are also penalties for deleterious elements or impurities, which, if present above certain limits, can have a negative impact for smelters regarding toxicity or obstructing the smelting process. Those limits can vary per smelter, as they buy different batches of concentrates, each with different impurities, resulting in different mixed smelter feeds. If there is too much of certain impurities, the entire concentrate can even become unsalable. As far as this wasn't already clear to investors, now it is.

Again, I created a table based on the penalty terms for Canadian Zinc and Zincore, which appeared to be a very global industry guideline as there was very limited data available in most studies:

The $12.6/t penalty for Arizona is a total as provided by management, and not a price per grade percentage. Etc., which can be found in the footnote of the table. As can be seen, for Zincore a 1.3% manganese content wouldn't even result in a penalty, as the term I used for this table was coming from the Zincore 2013 PFS study. It has to be noted that this term was quoted for the fume case (roasting), and for the refined zinc con scenario there wasn't even a manganese term mentioned. A distinction was made between Chinese and non-Chinese smelters so this could make a difference. The study was done by AMEC, which I hold in very high regard, so I don't expect sloppy work there. In general, a 1% Mn percentage is considered a threshold for a good zinc concentrate, although cost-wise a multiple of this wouldn't make much of an impact. However, smelters are able to dictate what they want, and are the reason several large mining companies divested their zinc assets.

It will be clear by now that zinc isn't as straightforward as for example copper, but has a lot of moving parts, and the outlook for even higher prices is bright.

Tungsten

Tungsten (symbol W) is an extremely hard, heavy, steel-gray metal that is one of the heaviest of all the elements, amazing for its strong physical properties and vast uses. It has the highest melting point of all the non-alloyed metals (3,410°C), the lowest vapor pressure and the highest tensile strength (19.3 gms/cc).

Tungsten does not occur naturally in its pure metallic state; rather, it is found in several ores, including wolframite and scheelite. Most of the world's reserves are located in China, which supplies more than 80% of the world's demand. Tungsten is also found in Australia, Bolivia, USA, Russia, Portugal and Korea. Tungsten is a metal with unique properties making it an essential component in many industrial applications. Critical properties include —very high melting point, very high density, hardness close to diamond, thermally and chemically stable, excellent conductor, and environmentally benign.

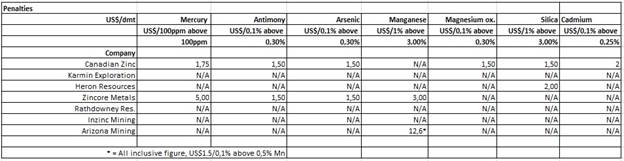

The most important use is as tungsten carbide in hard metals, used mainly for industrial drilling and cutting tools. Secondary uses are in electronics and specialist steels. China accounts for over 80% of world tungsten mine production as mentioned; Western world supply is very limited. The U.S., Europe and Japan consume ~55% of world tungsten, but produce only ~5%. Chinese domestic demand has increased, and China has moved from a net exporter to net importer of tungsten concentrates. This extensive control over production and world supply hasn't resulted in continuing higher pricing for the metal, but during the summer tungsten appreciated a lot in a very short period of time, without a clear cause for it, as can be seen in this chart of Metal Pages:

It seems tungsten has been playing catch up with lots of other metals, and the world economy in general. Concerns over security of supply of tungsten concentrates to western processors and industry end-users resulted in the EU categorizing tungsten as a "critical raw material." Tungsten demand is forecasted to grow by 5–8% annually. Growth markets for tungsten are still being identified, such as nickel-tungsten alloys that could replace chrome plating and nickel-tungsten alloys that could replace gold-nickel plating. Tungsten, with essential applications in industry, aerospace and military, is a strategic commodity. The U.S., Russia, China and Japan have indicated that they have or intend to build stockpiles.

So far for zinc and tungsten, let's continue with the projects of Margaux Resources.

4. Projects

The Kootenay Arc Project consists of five smaller projects, all located in the southern part of British Columbia.

The flagship Jersey-Emerald project is a past-producing lead-zinc, and tungsten mine. Some 50 years ago, Jersey-Emerald was the third largest zinc-lead producer in British Columbia, as well as the second largest tungsten producer in North America. As can be seen below, there are extensive underground workings present and accessible:

Jersey Mine; Jersey-Emerald Project; room & pillar mining

There is actually over 30km of underground workings in place, of which 14km is accessible, and 16km requires dewatering. The 2010 NI-43-101 resource estimate contains a small 1.9 MT at 4.1% Zn and 1.96% Pb Indicated, plus 4.98 Mt at 3.37% Zn and 1.95% Pb Inferred for zinc/lead, and a tungsten resource: 3.07 Mt at .34% WO3 M&I, and 5.48 Mt at .27% WO3 Inferred. However, the resource doesn't have to be of usual economic size, as it doesn't have to be a standalone project. The earlier discussed Pend Oreille mill is relatively close by, just like the Trial smelter complex, and mill feeder ore could be trucked, just like the concentrate to the smelter afterwards. This type of operation also limits the permitting process, as a mill, plant and tailings facilities are no longer necessary. The geometry of the Zn-Pb resource is such that it could, potentially, be mined as an open pit. As mentioned earlier, assuming a reasonable open-pit cut-off grade, the 2010 NI-43-101 resource estimate is 5.3 Mt @ 2.6% Zn, 1% Pb Indicated and 17.0 Mt @ 2.2% Zn and 1% Pb Inferred. This is an interesting scenario, as an open-pit operation like this could produce, annually, as much as five times the Zn concentrate that Teck currently produces from its Pend Oreille mine in Washington.

Jersey-Emerald also contains the Canex tungsten tailings project, and Margaux is busy with lab scale sampling, testing grades and recoveries.

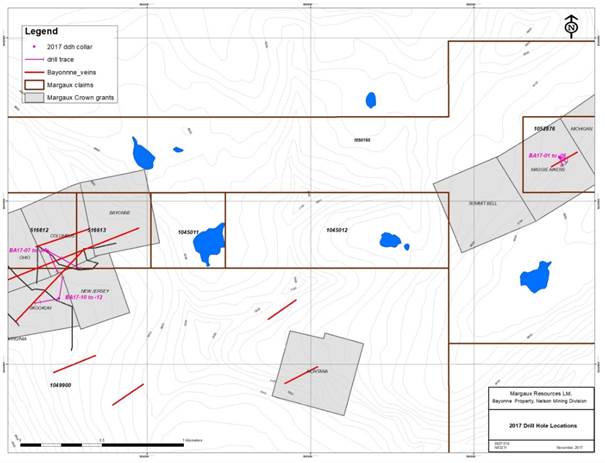

The Bayonne property historically produced a small amount of 42koz @16.0 g/t gold and 120.7koz @45.9 g/t silver from a single quartz vein. The property has a historic resource of 12.3koz @ 12.8 g/t gold M&I and 45.7koz @ 14.9 g/t gold Inferred.

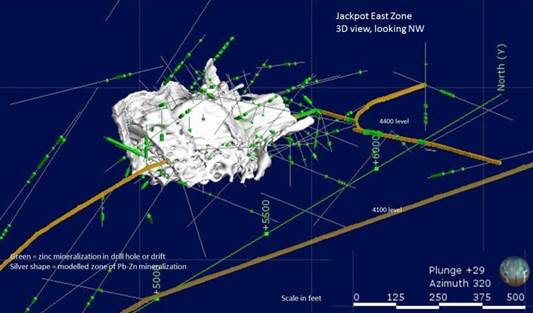

The Jackpot property is located approximately 2 kilometers north of Margaux's Jersey-Emerald property. The property consists of mineral claims and crown grants, covering 1,643 hectares, and is prospective for zinc, lead and silver. This project has seen a lot of drilling in the past, and the company has compiled all data into a 3D Model:

If this could in fact be a more or less continuous mineralized zone at good grades (4-5% ZnEq open pit [0-200m], 8-10%ZnEq underground), things could get interesting for Margaux, as at a gravity of 2.6-2.7 the size of this mineralized zone could get to an estimated 50–60Mt. The same concept for Jersey Emerald would work here again: existing underground workings, nearby mill and smelter would save on capex and permitting time. There is also the Big Zinc target, located 3km north of Jackpot East. Samples of very high-grade zinc oxide (up to 54%Zn) have been collected, and usually in these situations the oxide is at surface and the sulphides are located at depth (below 50-100m). The company is looking for the sulphides as the oxides are much harder to recover, although oxides grading over 20% Zn and near surface are economic anyway when the resource would be of economic size, of course.

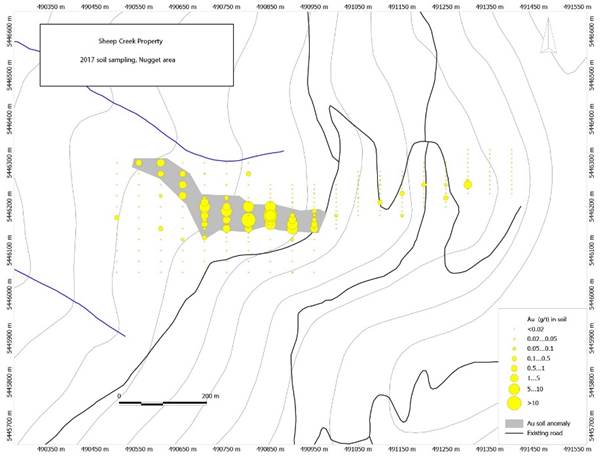

The Sheep Creek property consists of mineral and crown grants, covering 3,744 hectares, and is prospective for gold and silver. The property has a historic resource of more than 68,000 tonnes grading more than 15 g/t gold. Historic production from the Sheep Creek camp is 785,000 oz Au (plus Pb, Zn, Ag) at an average grade of 14.4 g/t Au. The majority of the gold production was during the periods 1899–1916 and 1928–1951, with historic mining from 34 separate high-grade gold-bearing quartz veins. Veins in the Sheep Creek camp are orogenic gold veins, which are considered analogous to the Barkerville District in age and style. The gold potential for this property is considered significant by management, and a soil anomaly program was completed, with an average of 2.95 g/t gold for 48 soil samples, which is pretty convincing.

The Ore Hill property is adjacent to Margaux's Jersey-Emerald and Sheep Creek properties. The property consists of mineral claims covering 338 hectares, and is prospective for gold, silver, zinc and lead.

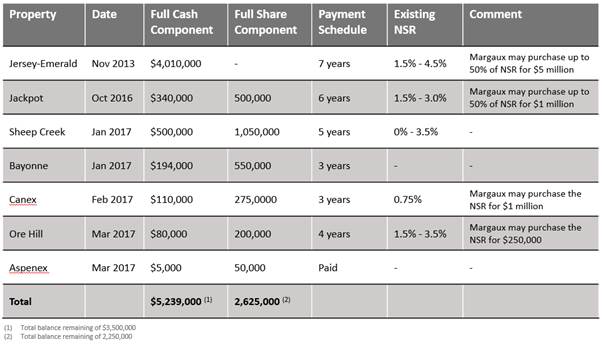

All projects are subject to option agreements towards a 100% ownership, with the most expensive project being flagship Jersey-Emerald:

As can be seen in the footnote, the remaining balance for cash obligations stands at C$3.5M at the moment, most of which has to be paid before 2021, which contributes to an estimated average annual obligation of C$600–700k, which isn't negligible but doable at its current estimated cash position of C$3M. The share components are small compared to the outstanding share count of 59.98 million at the moment.

5. The 2017 exploration program

The company has been busy this year, performing exploration on all projects. I will discuss all projects individually.

Jersey-Emerald:

Margaux Resources set out this year sampling and drilling for gold and zinc. In the recent past one significant high-grade intercept was encountered by coincidence (10.2m @24.98 g/t Au in 2014 at the King Alfred Gold Zone). Of the 23 stream sediment samples for gold, 14 had highly anomalous results and a few returned high-grade gold samples (ranging from 3.71 g/t to 18.1 g/t). The 2017 drill program was a six-hole program. Two holes were drilled at the King Alfred Gold Zone and didn't return very spectacular results. The remaining holes were exploration holes to the west and south of the historic mine, and the highlight was a 1.46m @ 2.70% Zn intercept, which was based on a 0.45m @7.17% Zn high grade part. No gold was reported except a "broad interval of elevated gold validating the mineralizing model and confirming the gold potential," although no intercept was mentioned, so the intercepted mineralization is likely not economic. So the drilling at Jersey-Emerald wasn't very successful so far, and the sampling returned promising results, although there is no direct correlation between sampling and actual underlying economic mineralization, it is an indication at best.

The 1.4Mt Canex tungsten tailings project is part of the Jersey-Emerald project, and has seen 3,500kg sampling by partner Cronimet Mining, of which Margaux is awaiting results soon. The company is preparing a 10,000t pilot project for summer-fall 2018.

Sheep Creek:

Extensive sampling returned high grade gold-silver-lead-zinc mineralization including 36.4 g/t Au, 1,021 g/t Ag, 33.68% Pb & 13.62% Zn and grab samples contained gold grades of 71.5 g/t & 17.75 g/t. An independent NI 43-101 report was filed which concluded that the property was "…an important orogenic gold vein system that has considerable merit" and as such warranted further exploration. Rock samples forming part of the report included 58.63 g/t Au & 21.80 g/t Au. A large, strong gold soil anomaly (450 x 100m) was identified from 48 samples, grading up to 13.5 g/t Au, and having an average grade of 2.95 g/t Au, which is impressive.

The company is wrapping up its fall 2017 drill program, and expects to report results in January 2018. Management is apparently pleased with what they see so far, and are expecting to do a lot more drilling, as they are already mapping out new drill targets for next year.

Bayonne:

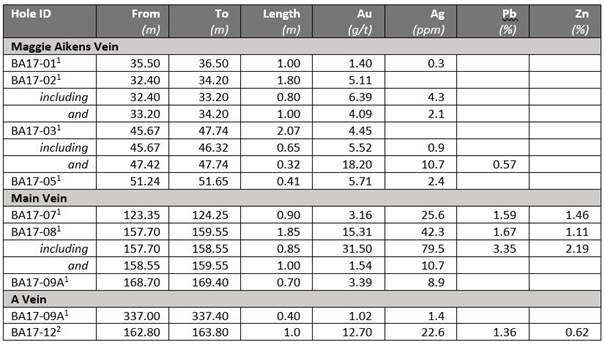

The company sampled along 900m of strike on the Main Vein, and even extended it slightly to a system strike length of 1,000m now. Grab sample results include 27.5, 23.3, 18.1, 15.0 and 10.6 g/t Au, which is high and in line with the historically mined average grade of 16g/t Au on this location. Chip samples were collected of 24.6 g/t Au over 1m & 43.6 g/t Au from a 0.5 to 0.75m wide vein. High gold values were confirmed from the narrow Bayonne West vein including 9.3 g/t Au. High-grade gold rock samples including 51.6 g/t Au & 46.6 g/t Au were found at the Maggie Aikens target. Overall the sampling at Bayonne can be considered successful, and warranted drilling. A 13 hole, 2,089m drill program was executed, an overview can be seen here:

The drill program delivered interesting first results on the explored high grade, steeply dipping orogenic quartz veins:

The mining of underground quartz veins requires a minimum width of 1m at an average grade of about 7-10 g/t Au as it is more labor-intensive, and a minimum width of 2m @5-6 g/t when using more efficient mining methods. This also implies continuous minimum width, whereas with narrow veins the width often varies to much smaller dimensions, resulting in additional dilution of mill feed grade, as more waste has to be mined as well. So the first results are promising, but not yet indicating economic mineralization.

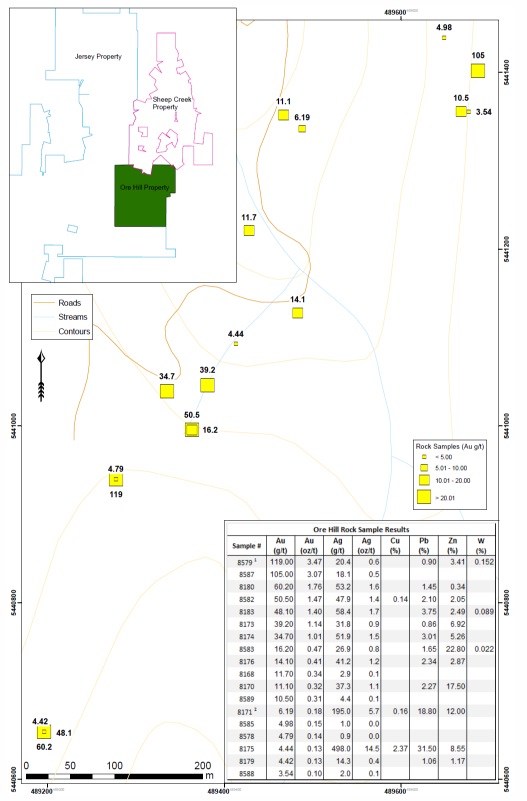

Ore Hill:

A sampling program returned numerous grab samples with high-grade gold values, including 119 g/t and 105 g/t Au, which are very high. High grades weren't confined to just gold, as high-grade silver grab samples up to 496 g/t & 195 g/t Ag and very high zinc grades of 22.8% & 17.5% Zn came in as well.

Collected over an area of 950m x 150m, indicated mineralization seems to be widespread. Of course, grab samples are selective and have no direct connection with eventual underlying mineralization as mentioned, but nevertheless these results indeed look very promising.

Jackpot:

The sampling program generated numerous high-grade zinc samples, up to even 54.3% Zn, at the Big Zinc target, although as mentioned these consist of zinc oxide (which is economic at roughly 10% ZnEq open pit and 20% ZnEq underground, about double the sulphide zinc grades needed). Detected elevated gold values of 0.36 g/t Au on average could provide for byproducts, which would be the equivalent of roughly 1% Zn. The exploration work outlined a broad continuous zone of limestone/dolomite host unit, 600m long, containing multiple zones of PbZn mineralization, of which the limestone could probably be recognized by readers of my newsletter as it is the source for the Ayawilca ZnPb mineralization of Tinka Resources as well. In the case of Jackpot, the mentioned gold seems to be present in a broad zone of stockwork quartz veinlets cutting the zinc-mineralized limestone. Gold has always been overlooked at the Margaux projects historically, and provides potential upside for economics.

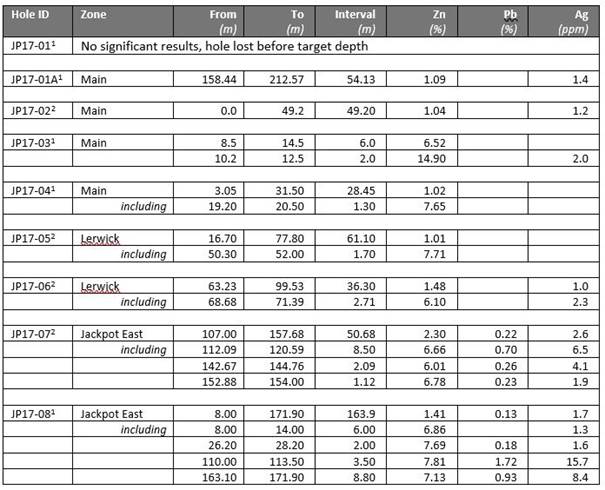

The initial nine-hole 1,400m drill program generated encouraging results as almost all holes hit zinc mineralization, although the current intercepts do not represent very economic grades yet (as a reminder 4-5% ZnEq open pit (0-200m), 8-10% ZnEq underground):

It looks like the first two holes into the Jackpot East target (see 3D model in chapter 4), JP17-07 and JP17-08, did confirm mineralization, but when interpreting these first holes, the large implied envelope seems to consist of several stacked, thin mineralized layers, of which just a few are amendable for mining (at least about 5m thickness laterally). So the zinc is there, but a lot of drilling has to take place before an economic deposit can be proven up in my opinion.

This goes for all projects, of course, as Margaux Resources is in the early stages of exploration and drilling. So far, mineralization seems to be present at all projects, with mostly (very) high-grade sampling results and consistent but not very economic drill results yet. However, for a first round of drilling, the successful sampling and considering the size of the area that is still unexplored, the company seems to have scratched the surface in a good way. It is up to management now to define economic mineralization in 2018, and for now I am particularly interested in the pending outcomes of the Ore Hill and Sheep Creek drill programs.

6. Conclusion

Margaux Resources finished exploration for 2017, has generated varying but also promising results, and defined lots of interesting drill targets for 2018. There seems to be mineralization everywhere the company looks, and chances of hitting economic mineralization could still be very much alive going into the second phase of exploration, in my view. The upcoming assays for Ore Hill and Sheep Creek could surprise, and the sampling results for the Canex tungsten tailings project should provide more insight in the feasibility of bringing it into production. Margaux only has to hit at one project to have lots of upside at a current market cap of just C$16.7 million; I like the odds so far.

Jackpot/Oxide Project

I hope you will find this article interesting and useful, and will have further interest in my upcoming articles on mining. To never miss a thing, please subscribe to my free newsletter at http://www.criticalinvestor.eu/, in order to get an email notice of my new articles soon after they are published.

Disclaimer:

The author is not a registered investment advisor, and has a long position in this stock. Margaux Resources is a sponsoring company. All facts are to be checked by the reader. For more information go to www.margauxresources.com and read the company’s profile and official documents on www.sedar.com, also for important risk disclosures. This article is provided for information purposes only, and is not intended to be investment advice of any kind, and all readers are encouraged to do their own due diligence, and talk to their own licensed investment advisors prior to making any investment decisions.

The Critical Investor is a newsletter and comprehensive junior mining platform, providing analysis, blog and newsfeed and all sorts of information about junior mining. The editor is an avid and critical junior mining stock investor from The Netherlands, with an MSc background in construction/project management. Number cruncher at project economics, looking for high quality companies, mostly growth/turnaround/catalyst-driven to avoid too much dependence/influence of long-term commodity pricing/market sentiments, and often looking for long-term deep value. Getting burned in the past himself at junior mining investments by following overly positive sources that more often than not avoided to mention (hidden) risks or critical flaws, The Critical Investor learned his lesson well, and goes a few steps further ever since, providing a fresh, more in-depth, and critical vision on things, hence the name.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Streetwise Reports Disclosure:

1) The Critical Investor's disclosures are listed above.

2) The following companies mentioned in the article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Charts and graphics provided by the author.