It has been a good year for the stock market; in 2017, the major U.S. stock indexes hit record highs. Many of the companies profiled in Streetwise Reports did very well also, most particularly in the cannabis, blockchain and healthcare sectors.

Several of the companies profiled on Streetwise Report that had IPOs and reverse takeovers saw substantial gains. On May 26, Streetwise published an article on Assure Holdings Inc. (IOM:TSX.V), an intraoperative neuromonitoring company founded by former NFL quarterback Preston Parsons; the company began trading on May 29, closing that day at CA$1.08. The company hit a high of CA$4.17 on Nov. 24, a rise of 286%, and is currently trading at CA$3.35.

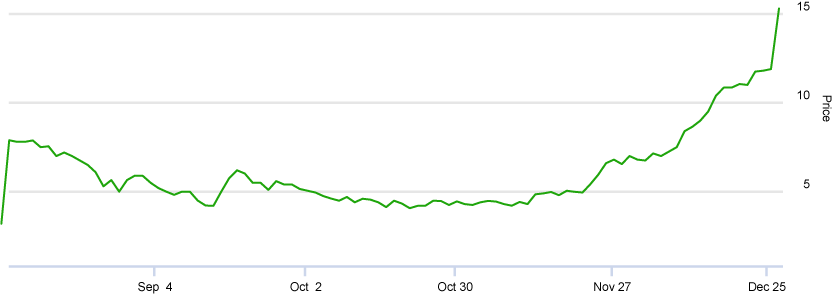

Scythian Biosciences Inc. (SCYB:TSX.V), a preclinical research and development company that is developing a proprietary cannabinoid-based combination drug therapy for the treatment of concussions and traumatic brain injury, completed a reverse takeover and began trading on Aug. 8. That day it closed at CA$7.89; on Dec. 28 it hit CA$15.98, a 102% rise in less than five months.

CannTrust Holdings Inc. (TRST:CSE) was the subject of a Streetwise article on Aug. 18; the company produces pharmaceutical-grade cannabis products. CannTrust IPO'd on the Canadian Securities Exchange on Aug. 21 and its shares closed that day at $2.50. The shares hit a high of CA$9.44 on Dec. 28, a gain of 277%.

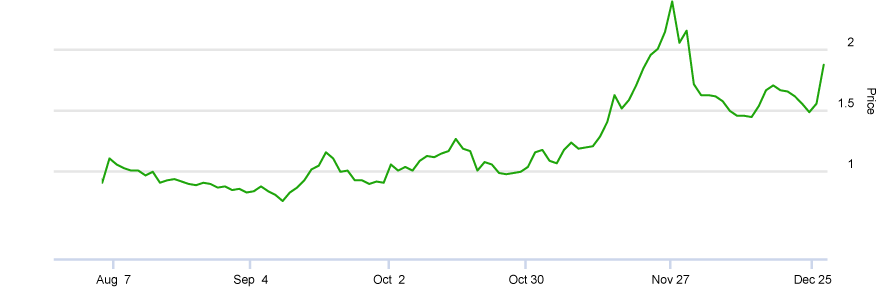

Streetwise published an article on July 25 on Liberty Health Sciences Inc. (LHS:CSE), a Canadian medical cannabis provider that is expanding into the U.S. The company completed a reverse RTO, and began trading on July 27, closing that day at CA$1.30. The stock then rose to CA$2.39 on Nov. 27, an 83% gain, and is at CA$1.92 on Dec. 29.

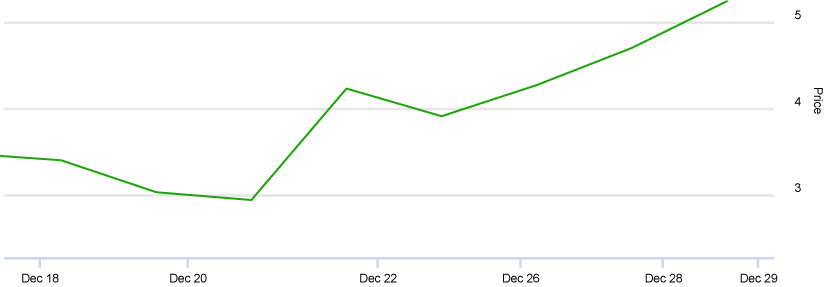

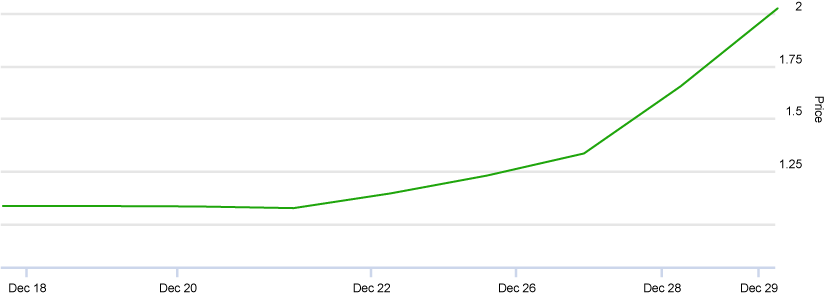

Other cannabis companies are also top performers. On Dec. 18, Streetwise published a contributed opinion by technical analyst Clive Maund, who discussed a pair of cannabis companies, General Cannabis Corp. (CANN:OTCQB) and United Cannabis Corp. (CNAB:OTCMKTS). Since the date of publication, General Cannabis has risen from $3.40 to $6.27 on Dec. 29, an increase of 84% in two weeks. During the same period, United Cannabis has gone from $1.08 to $2.09, a 93% gain in a fortnight.

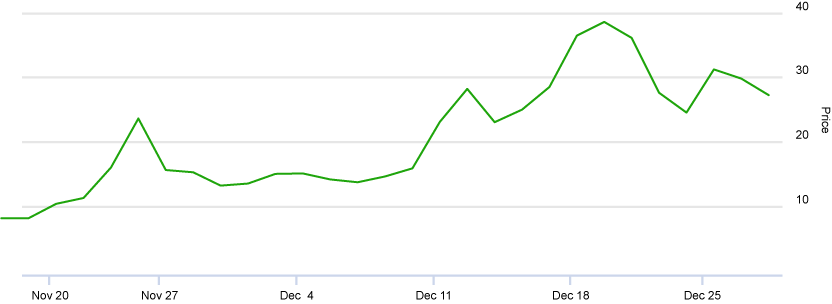

Blockchain, the technology that powers bitcoin, but which is now seen as an emerging technology for numerous applications, has ridden higher with the bitcoin boom. On Oct. 11, Streetwise published an article about Riot Blockchain Inc. (RIOT:NASDAQ), one of the few blockchain companies trading on NASDAQ. On that date, Riot's shares were trading at $9.24. They reached a high of $38.60 on Dec. 19, a gain of 317% in less than 10 weeks. The shares are currently trading at $28.55.

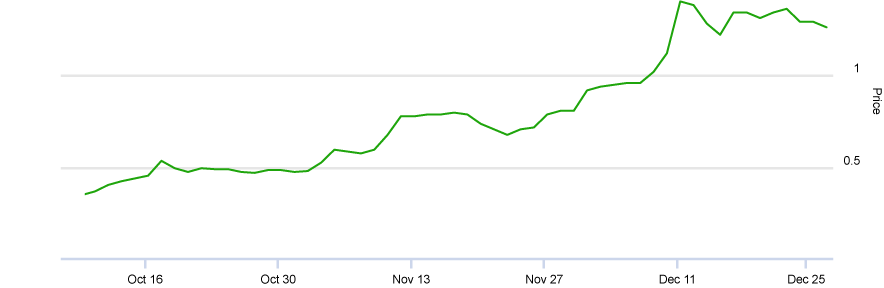

Some healthcare companies also saw large gains in 2017. Reliq Health Technologies Inc. (RHT:TSX.V; RQHTF:OTCQB), a Vancouver-based firm that has developed a telemedicine platform, was the subject of a Streetwise article on Oct. 5. On that date, the stock was trading at CA$0.35; the shares it a high of CA$1.40 on Dec. 11, a 300% rise in just over two months, before falling back to CA$1.30.

Last January, Streetwise introduced its 2017 Life Sciences Watchlist, a group of 19 companies selected by analysts Michael King of JMP Securities, George Zavoico of Jones Institutional Services and Ram Selvaraju of H.C. Wainwright & Co. A handful of those companies were standouts, including Pieris Pharmaceuticals Inc. (PIRS:NASDAQ), which has a proprietary biologics platform in the field of anticalins targeting anemia, asthma and immuno-oncology. Pieris' shares gained 422% from $1.46 on Jan. 3 to $7.63 on Dec. 29.

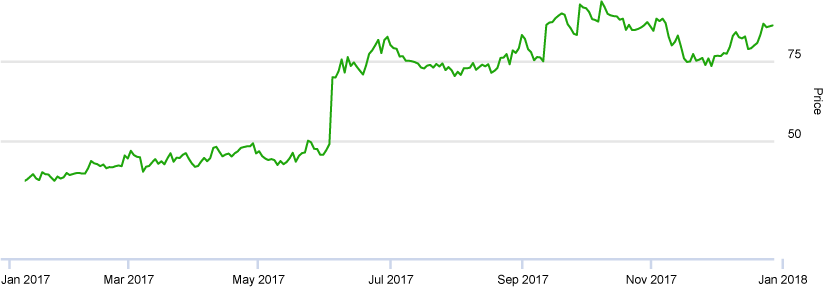

Also on the Watchlist is Blueprint Medicines Corp. (BPMC:NASDAQ), which rose from $28.95 on Jan. 3 to $88.32 on Dec. 11, a gain of 195%, before falling back to $76.28 on Dec. 29. Blueprint is in clinical trials, as well as discovery phase development, of kinase inhibitors targeting cancer including liver cancer and gastrointestinal stromal tumors.

Another Life Sciences Watchlist top performer was Abeona Therapeutics Inc. (ABEO:NASDAQ), which has three ongoing gene therapy clinical programs targeting life-threatening rare diseases with multiple orphan drug and rare pediatric disease designations. The stock rose from $5 on Jan. 3 to $19.95 on Oct, 10, a 299% gain, before retreating to $16.35.

Loxo Oncology Inc. (LOXO:NASDAQ) was also a standout on the Watchlist. The company is targeting the inhibition of genetic drivers in various cancers. Loxo shares traded at $31.05 on Jan. 3 and rose to $94.01 on Oct. 9, a gain of 202%. The stock is currently trading at $85.11.

Note: current stock prices were as of Dec. 29, 2017, unless otherwise noted.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an employee. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following companies mentioned in this article are billboard sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. As of the date of this article, an affiliate of Streetwise Reports has a consulting relationship with Assure Holdings, Liberty Health Sciences, Riot Blockchain and Reliq Health Technologies.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Assure Holdings, Liberty Health Sciences, CannTrust Holdings, United Cannabis, Riot Blockchain, Reliq Health Technologies and Blueprint Medicines, companies mentioned in this article.