I wrote recently about Columbus Gold Corp. (CGT:TSX; CBGDF:OTCQX) in October. The company owns 45% of a gold project in French Guiana with 2.75 million ounces in proven and probable reserves, not resources, reserves. With a market cap today of about $97 million US that values their 1.23 million ounces at about $79 an ounce. That's really cheap for a project that shows a plan for producing 237,000 ounces of gold a year. Someone will take them out and this project is going to go into production.

Columbus Gold's partner in South America is Nordgold, a Russian company. Naturally the Russians don't want any part of U.S. assets so the 14 other projects owned by Columbus Gold are not only not giving any value, if anything they are a drag on the company. It's something I have talked to the company about for years, how to monetize their other very real assets.

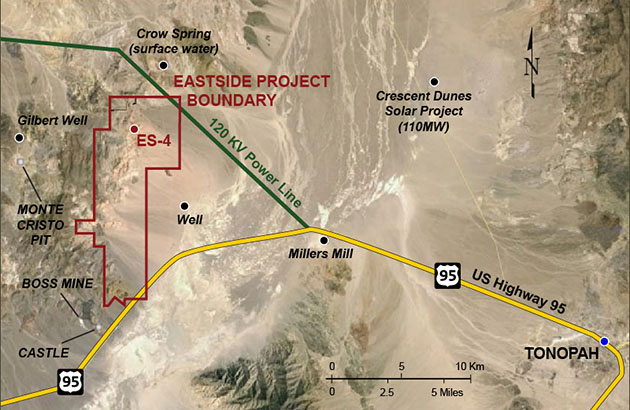

Their Eastside gold project in Nevada discovered by Andy Wallace already holds a 721,000-ounce gold resource in addition to a 272,000-ounce historic resource. Their 100% owned Bolo Gold project in Nevada had a 2800-meter drill program conducted in August of 2017. The company has just sent 1900 samples off for assay and expects results to be released early in January.

Columbus Gold shareholders voted overwhelmingly in November to approve a spinout of the 14 non-core assets into a new company that will be named Allegiant. Columbus received approval for the spinout from the Supreme Court of BC on the 4th of December.

Existing shareholders of Columbus Gold on December 11 will receive a 20% distribution of their current CGT-T shares. If you own 10,000 CGT-T shares on the 11th, you will automatically get 2000 shares in Allegiant.

This is a really easy call. Columbus Gold is currently getting nothing for the fourteen 100% owned non-core assets even though they are coming out of the chute with about 1 million ounces at Eastside with a current value of exactly zero. Doing the spinout is going to monetize those 14 assets. They have to be worth something. The only real issue I see is the question of what 2+2 equals. I know it's going to be more than four and should the assays from Bolo come up trumps, Allegiant shareholders could be treated to a post Xmas gift. Columbus Gold will still own 13% of Allegiant so they have a vested interest as well.

Columbus Gold is not an advertiser. Allegiant has indicated they will be an advertiser. I bought shares in the open market that I intend to hold through the record date and I am participating in the private placement for Allegiant. Do your own due diligence.

Columbus Gold

CGT-T $.82 (Dec 05, 2017)

CBGDF-OTCBB 153 million shares

Columbus Gold website

Bob and Barb Moriarty brought 321gold.com to the Internet almost 16 years ago. They later added 321energy.com to cover oil, natural gas, gasoline, coal, solar, wind and nuclear energy. Both sites feature articles, editorial opinions, pricing figures and updates on current events affecting both sectors. Previously, Moriarty was a Marine F-4B and O-1 pilot with more than 832 missions in Vietnam. He holds 14 international aviation records.

Read what other experts are saying about:

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Bob Moriarty: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: Columbus Gold and Allegiant. Allegiant has indicated that it intends to be an advertiser on 321 Gold. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned are billboard sponsors of Streetwise Reports: Columbus Gold. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.