In a Nov. 8, 2017, press release, Viveve Medical Inc. (VIVE:NASDAQ), a women's health and wellness company, announced record Q3/17 sales of $4.1 million," a 120% year-over-year (YOY) increase. "These results demonstrate continued strong demand for our innovative technology and the Geneveve treatment globally, particularly in North America, our largest commercial market," said Patricia Scheller, the corporation's CEO and director.

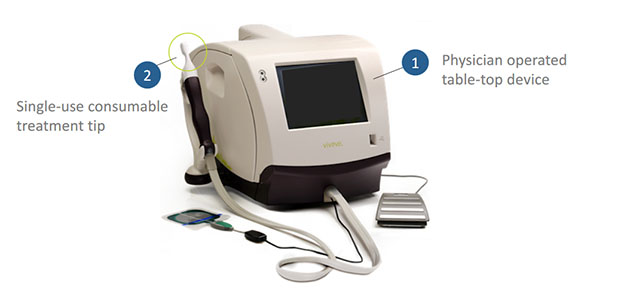

Revenue derived from the sale of 60 systems, 47 in North America, and 2,724 treatment tips. "The increasing demand we have seen since launching the Viveve System in Q3/15 reinforces the size of the worldwide opportunity and sets the stage for continuing global adoption through the remainder of the year and into 2018," Scheller concluded.

Viveve's Q3/17 global sales led to greater gross profit of $2 million, or 49% of revenue. This compares to that of Q3/16, which was $691,000, or 37% of revenue.

Q3/17 total operating expenses were $10.8 million, more than double those of $5.3 million in Q3/16. This primarily resulted from "increased costs to support United States commercialization and expansion into new international markets, research and development efforts, strategies to protect our intellectual property and other general corporate expenses," the press release noted.

At the quarter's end, Viveve had cash and cash equivalents of $19.2 million, which represents an $11.2 million increase since year-end 2016.

The press release also reported milestones the company achieved during Q3/17. It reached a total global installed base of 364 Viveve Systems. It received additional regulatory approvals and clearances, taking the total obtained this year to nine. It launched InControl Products by Viveve in the U.S.

In a Nov. 15, 2017, report, Zacks Small-Cap Research analyst Brian Marckx noted that Viveve "set several new records" in Q3/17, including number of consoles sold, total revenue and gross margin. Treatment tip sales, at 2,724, were "relatively strong" and "the second highest on record." Zacks expects growth to continue in all of these areas. It anticipates Q4/17 revenue of $5.2 million, "which implies YOY and sequential growth of 113% and 28%," respectively.

Greater sales in the U.S. are due to Viveve boosting its domestic sales force from 10 to 23 since May and the scope of clinical data supporting Geneveve's use, Marckx wrote. The latter has led to new adopters and has captured market share from competitors.

In contrast to strong U.S. sales, console placements outside of the U.S. (OUS) were weaker than expected in Q3/17, Marckx indicated. Whereas Zacks anticipated 18 would be sold, the number attained in Q2/17, only 13 were. Marckx attributed this to potential headwinds in China, including the China Food and Drug Administration possibly mandating regulatory approval of radiofrequency medical devices. He added that strong U.S. sales, however, have more than offset "softer" OUS sales.

In a Nov. 9, 2017, research report, Anthony Vendetti, an analyst with Maxim Group, described Viveve's Q3/17 numbers as "in line" and noted, "we would continue to be buyers" of the stock. The company's "strong performance in the U.S." and its plan to add 30 reps to its North American sales team by year-end are encouraging, "especially as its China business could potentially face new regulatory hurdles," he wrote.

Maxim sees potential for the greatest growth of the Viveve System in "an expanded FDA approval for the improvement of female sexual function," Vendetti explained. The start of the Viveve II study has been delayed one or two quarters, to possibly Q1/18, due to the U.S. Food and Drug Administration's (FDA's) request for more data. "Nonetheless, we are optimistic about the outcome of the study and believe it could further bolster adoption of the Geneveve system," he added.

Ladenburg Thalmann analyst Jeffrey Cohen called Viveve's Q3/17 financial results "robust." He noted that Viveve's Q3/17 revenue of $4.1 million came in above Ladenburg's estimate of $3.9 million. "Viveve's commercial and clinical activities continue to drive adoption and penetration in the marketplace, particularly in the U.S.," he said.

However, following Viveve's release of its Q3/17 results, Ladenburg lowered its price target to $15 from $18.50, "generally as a result of the overall three to four quarters of additional time estimated for expanded labeling in the U.S." for its Viveve System, Cohen explained. This delay is due to the FDA requiring additional information with respect to Viveve's investigational device exemption application. "The company remains optimistic that it can begin enrolling patients in the Viveve II study in Q1/18," he added.

Zacks and Maxim have an $11 per share target price on Viveve; Ladenburg has a $15 target price on it. The biotech's stock is currently trading at around $5.04. Maxim and Ladenburg have a Buy recommendation on Viveve; Zacks doesn't rate the company.

Read what other experts are saying about:

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following company mentioned in this article is a billboard sponsor of Streetwise Reports: Viveve Medical Inc. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Viveve Medical Inc., a company mentioned in this article.

Editor's note: an earlier version of this article did not state that Viveve Medical is a billboard sponsor of Streetwise Reports.

Additional disclosures about the sources cited in this article