The purpose of this update is to remind readers that Amazing Energy Oil & Gas Co. (AMAZ:OTCQX) remains very cheap here with the potential to make big percentage gains. When you read up on the fundamentals of the company and then look at the stock price, you wind up thinking that most investors can't see further than the end of their nose, for whilst the fundamental outlook for this company has been steadily improving for a long time now, the stock price has remained depressed.

The fundamental story may be read here, but the key points are as follows—the company has acquired a large block of land in the Permian Basin in Texas at an extremely cheap price, which is adjacent to the prolific Yates Oilfield, and therefore very likely to contain a lot of oil and / or gas, and is embarking on an aggressive drilling program at a time when the oil price is advancing after being depressed for some years, and more than 90% of its stock appears to be tightly held by insiders, so the float is very low. It is therefore logical to suppose that any speculation regarding positive drilling results could cause a significant run up in the stock price.

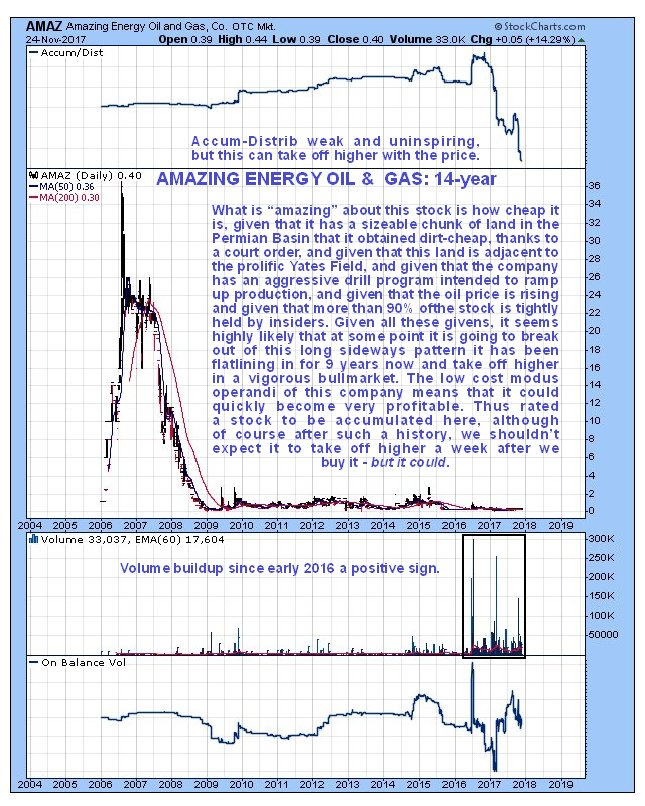

We will quickly look at three different charts for different time frames. The first 14-year chart shows us the big picture, which reveals that after collapsing back from a relatively high price between 2006 and late 2008, the stock price has essentially been flatlining, which was fair enough when the oil price plummeted during the period several years back when they were trying to destroy the Russian economy (and failed), but no longer makes sense now that the company, which has no financial problems to the writer's knowledge, is embarking on a drilling program at a time when the oil price is looking better than for years.

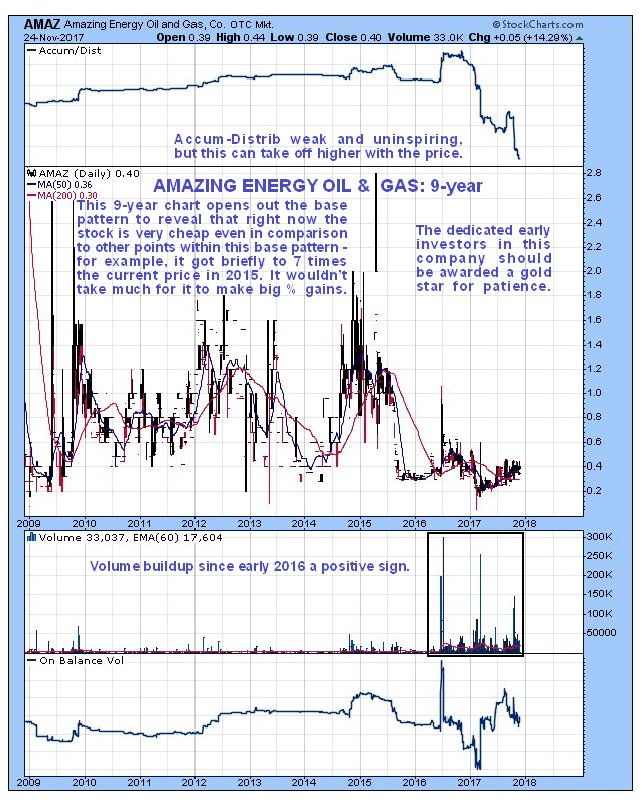

A 9-year chart, which deliberately excludes the earlier high stock price, shows us this low base in its entirety, and because it "opens it out," it enables us to see that right now the price is very cheap compared to most of the time during the formation of this base pattern—at several points during this base pattern it got to $2.00, or 5 times the current price, and at one point in 2015 it even got to 7 times the current price—so clearly it could make big percentage gains without even leaving the base pattern, but as we have seen it has increasing reason to do just that. True, the Accum-Distrib line looks very weak, but this can sometimes improve with the price, rather than ahead of it, and of course we will be on the lookout for an improvement in upside volume.

The year-to-date chart shows that a gentle uptrend has been in force since last February, with the trend of higher lows viewed as bullish, and the pattern that has formed is a suspected Cup & Handle base.

The conclusion is that Amazing Energy Oil & Gas is very cheap here and remains an attractive speculative play with big upside potential.

Amazing Energy Oil & Gas website.

Amazing Energy Oil & Gas Co, AMAZ on OTC, closed at $0.40 on 24th November 2017.

Clive Maund has been president of www.clivemaund.com, a successful resource sector website, since its inception in 2003. He has 30 years' experience in technical analysis and has worked for banks, commodity brokers and stockbrokers in the City of London. He holds a Diploma in Technical Analysis from the UK Society of Technical Analysts.

Want to read more Energy Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Clive Maund: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None. My company has a financial relationship with the following companies mentioned in this article: None. CliveMaund.com disclosures below. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. The author was not paid by Streetwise Reports for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

4) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Amazing Energy, a company mentioned in this article.

CliveMaund.com Disclosure:

The above represents the opinion and analysis of Mr Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. Mr. Maund is an independent analyst who receives no compensation of any kind from any groups, individuals or corporations mentioned in his reports. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stockmarket analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks can only be construed as a solicitation to buy and sell securities when they are subject to the prior approval and endorsement of a Registered Securities Advisor operating in accordance with the appropriate regulations in your area of jurisdiction.