With all of the chatter about Bitcoin forks, few people remember that Litecoin was actually one of the first forks of Bitcoin. Unlike Segwit2x, it was not a hostile or contentious fork that sought to replace Bitcoin. It was an open-source fork launched during October of 2011, by Charlie Lee. Charlie views Litecoin as silver to Bitcoin as gold. Litecoin had some key differences when it launched including:

- 4x as many coins (84 million vs. 21 million for Bitcoin)

- 1/4 the block confirmation time (2.5 minutes vs 10 minutes for Bitcoin)

- Scrypt proof-of-work (simpler and less energy-intensive mining)

Charlie wanted it to be complementary to Bitcoin and believed it offered some key advantages. He also wanted Litecoin to be a fair distribution and thus there was no pre-mine of the currency as we have seen from several other competing cryptocurrencies. Charlie is still leading its development and very active in the cryptocurrency community. Charlie also worked for coinbase.com for a long time, before quitting in June of this year to focus on Litecoin full time.

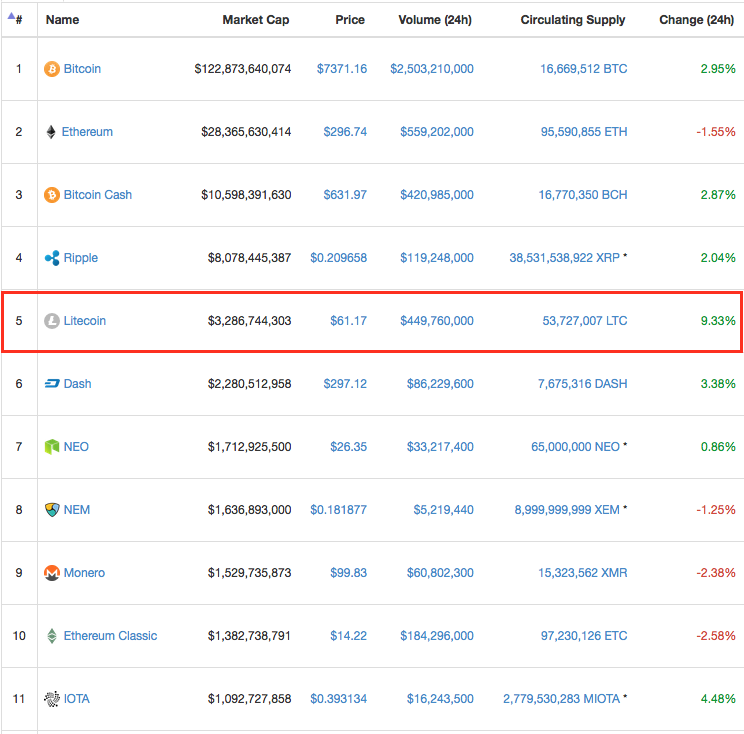

Litecoin is currently the #5 cryptocurrency with a market capitalization of $3.3 billion. This compares to Bitcoin with a market capitilization of $120 billion. Thus, Bitcoin is currently valued at roughly 40 times the value of Litecoin.

Yet, there are only four times more Litecoin in existence than Bitcoin. Given how long Litecoin has been along, the trust it has established and some clear technological advantages over Bitcoin, one would expect the gap in their valuations to be smaller.

Key Advantages of Litecoin vs. Bitcoin

Here are a few key advantages of Litecoin over Bitcoin:

- Faster transaction times

- Less expensive transactions

- First to successfully implement Lightning network for instant, zero-fee transactions

- First to complete a cross-chain atomic swap (with Decred)

- In the process of adding confidential transactions

- Faster to adopt new technology, without community infighting over upgrades

So, if Litecoin has better technology, has been around almost as long as Bitcoin, has established trust and a successful track record, trades on all major exchanges with high liquidity, has strong community support and a fixed supply of 4x as many coins at Bitcoin, why is the price of Bitcoin 116x higher and market cap 40x higher?

Certainly, part of the answer is that Bitcoin has better name recognition and was the first-mover in the cryptocurrency space. It has the best liquidity and is the most paired trades with other altcoins. Bitcoin is improving its network tech with Segwit and will likely implement the Lightning Network, atomic swaps and privacy features at some point in the months ahead.

But is this enough to justify at market capitalization that is 40x that of Litecoin?

Bitcoin-to-Litecoin Ratio and LTCís $1,800 Price Target

If we assume that Bitcoin's advantages in name recognition and Litecoinís advantages in technology/usability are a wash and simply focus on relative supply, we should see the Litecoin price at roughly one quarter (1/4) the Bitcoin price. With Bitcoin currently at $7,200, this gives us a Litecoin price target of around $1,800 ($7,200/4). This is 30x the current price of $60.

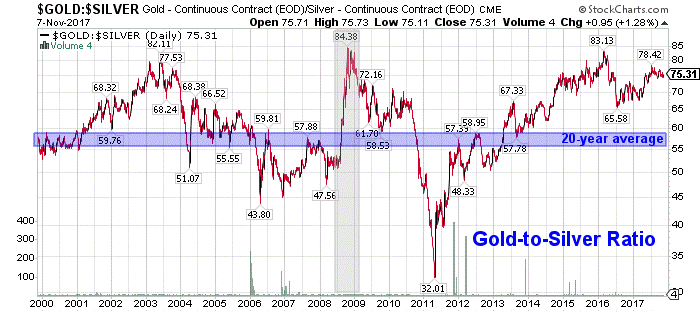

And if Litecoin is really silver to Bitcoin as gold, we should be seeing a much lower BTC-to-LTC ratio. The gold-to-silver ratio is currently around 75 and has averaged closer to 60 over the past few decades.

Yet the Bitcoin-to-Litecoin ratio is currently at 116. This is nearly double the 20-year avearge gold-to-silver ratio and near the all-time high. In other words, Litecoin has never been more undervalued relative to Bitcoin.

The chart below shows the Bitcoin-to-Litecoin ratio over the past several months. Notice this ratio has more than doubled since July, as the Bitcoin price has rocketed higher and outperformed Litecoin.

How to Profit from the Coming Rebound in Altcoins

This outperformance of Bitcoin vs. Litecoin has largely been driven by multiple hard forks on the Bitcoin network. When the hard forks occur, those holding Bitcoin receive an equal number of the new forked coin such as Bitcoin Cash, Bitcoin Gold or the upcoming fork into Bitcoin Segwit2x (B2X). This has caused investors to sell Litecoin and other altcoins in order to buy more Bitcoin and get more free forked coins. But once this Segwit2x fork has passed, I expect Bitcoin to sell off and altcoin prices to rise significantly.

The drop in the Bitcoin-to-Litecoin ratio over the past few days from 135 to 116 has been driven by positive news for Litecoin. Major South Korean exchange Coinone has added Litecoin to its platform as of early November 2017. The exchange has reportedly processed $3.2 million worth of Litecoin in the first 24 hours of trading.

This has caused the Litecoin price to rally 15%, while the Bitcoin price has corrected from the all-time high of $7,600 to $7,100. Yet, Litecoin at $62 is still trading significantly below its September high around $90. It has been seriously lagging behind Bitcoin, but I expect the Litecoin price to catch up in the weeks ahead.

image via cointelegraph.com

While most investors appear to be holding their Bitcoin or adding to their positions ahead of the November 16th B2X fork, there are signs that funds are starting to flow from Bitcoin into deeply oversold altcoins. Some of our favorite altcoins have bounced sharply off multi-month lows in the past few days. A number of cryptocurrency investors are clearly looking to get a jump on the herd, which is likely to wait until after November 16th to move back into altcoins.

This may be a good strategy to consider. The market is currently pricing Segwit2x at $1,300 via futures trading. This is a premium of 18% to the current Bitcoin price. Yet, many altcoins would need to double or triple to return to previous highs. And if the Bitcoin price crashes following the fork as expected, investors that donít sell out immediately are going to take a loss during the correction. If the Bitcoin price falls towards $5,400, this would essentially wipe out any gains from getting free B2X tokens.

Given the above analysis, we have started to buy oversold altcoins in anticipation of a major rally ahead. The returns expected from the altcoin bounce are significantly larger than the current value of Bitcion Segwit2x tokens. We still benefit from the fork, as it has caused our Bitcoin holdings to increase in value significantly. We can now use those BTC to buy significantly more altcoins that we could have just a few weeks ago. This creates an incredible opportunity for value investors as the buying opportunity is enhanced by both the recent Bitcoin rise and altcoin correction.

If you would like to view our top cryptocurrency picks for the upcoming altcoin rebound, please consider joining our premium membership for just $99.

You will get our model portfolio of cryptocurrencies and top stock picks, our monthly contrarian newsletter, weekly trade alerts, ICO tracker, Beginners' Guide to Investing in Cryptocurrency and much more. It is a tremendous value for the money and most of our subscribers say that the subscription pays for itself many times over. Our investment research is best viewed as an investment itself. If you arenít seeing a positive ROI from the information that we provide, simply cancel your membership and walk away. Click below to get started now!

Jason Hamlin is the founder of goldstockbull.com and publishes a highly rated investment newsletter focused on precious metals and cryptocurrencies. Hamlin has a background analyzing charts and trends for the world's largest market research company, is versed in fundamental and technical analysis and has consulted to Fortune 500 companies around the globe. Hamlin is a cycles investor, student of Austrian economics and speaks regularly at investment conferences. The Gold Stock Bull newsletter is focused on finding junior mining companies that are undervalued relative to their peers and early-stage cryptocurrencies and ICOs that can provide investors with high levels of returns.

Want to read more Streetwise Reports articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Statements and opinions expressed are the opinions of the author and not of Streetwise Reports or its officers. The author is wholly responsible for the validity of the statements. Streetwise Reports was not involved in any aspect of the article preparation. The author was not paid by Streetwise Reports LLC for this article. Streetwise Reports was not paid by the author to publish or syndicate this article.

2) This article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

Charts and images courtesy of the author.