It's time. The trend is strong, and we've got confirmation that the bull market has commenced. We're first in the door—literally.

This is the Canada Marijuana Index, and since July, it has started a breakout. It's up 35% since then, and the sector is up over 20%, which officially puts us in bull territory.

What Wealth Research Group describes here could be the key to making incredible returns, effective immediately.

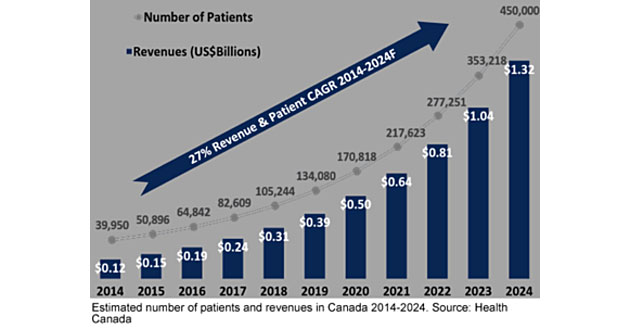

Canada's marijuana market could be worth as much as $9 billion once recreational use launches. That's 22 times the current size—a 2,200% increase, essentially overnight. If that's not enough, Canada will become the only developed nation in the world with the capacity to export cannabis, at a time when 29 other countries are going through the legalization process, including Germany (Europe's richest country), Australia and Argentina.

The strongest companies right out of the gate could become "tomorrow's Amazons" of the weed industry, and with worldwide acceptance growing exponentially by the minute due to amazing stories like that of Alexis Bortell, the 12-year-old epileptic girl who has been seizure-free for a couple of years after using oils, the validity of the medical benefits are attracting the best scientists in the world.

This is huge.

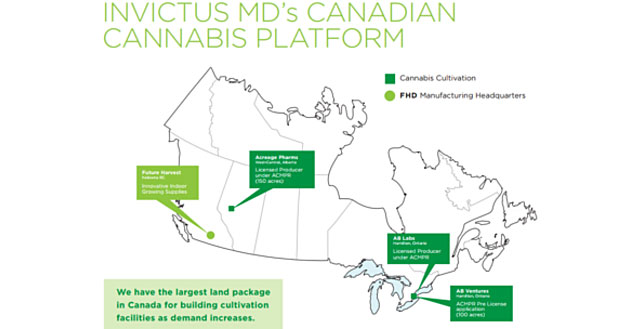

What we found after looking at 71 cannabis companies in Canada is one cash-rich, fully funded cultivator, with licenses already permitted, operations in Alberta and Ontario, a gifted management team, and a roadmap to a billion-dollar valuation in 3 years. Its current market cap is CAD$100M.

Invictus MD (IMH:TSX.V; IVIT:OTC) is our No. 1 cannabis company, bar none, and it could potentially soar from today's prices.

I spoke to founder and CEO Dan Kriznic. Along with Trevor Dixon and Brenda Dixon, management has a cumulative 28% ownership of this company. The shareholder base couldn't be healthier. Their sole objective is to unlock the value of their cultivation facilities and dominate Canadian cannabis for both medicinal and recreational uses.

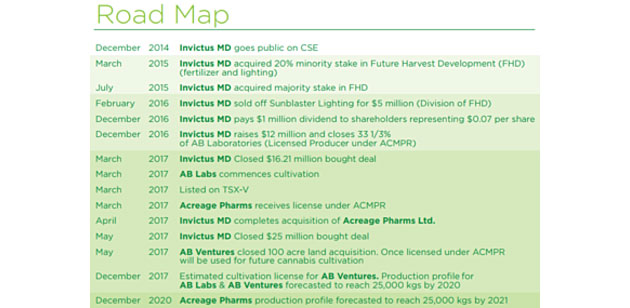

Our due diligence of Invictus MD began in March when they were initially listed on the TSX Venture exchange. That same month, they closed a CAD$16.1M financing and their Alberta facility, 100% owned, received its ACMPR license, one of only 62 in the nation.

The reason our timing is immaculate is because they are about to receive their sales approval and begin to start revving the cash-profits machine. The fact that management moved quickly ahead of many of the now-launching competitors has given Invictus MD a huge advantage.

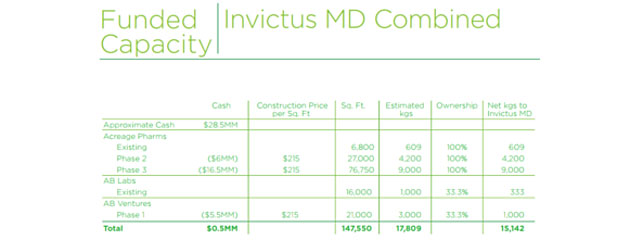

The company has CA$27 million in cash on hand, and the expansion phase is fully funded to 15,000 kilograms (kg). There will be zero dilution to shareholders in this coming growth period, while the company's cash flow and bottom line improve every quarter. With 15,000 kg and the industry standard at $19,000 per kilogram, the conservative valuation is CA$285 million (CA$285M), which is 300% higher than today's market cap.

Once they hit 15,000 kg, the expansion plan kicks into sixth gear, as Dan Kriznic, who has already built companies worth $750M in his career, puts in motion the strategy to reach 50,000 kg and a billion-dollar market cap, doubling the 2021 milestone.

As I see it, we are now getting the opportunity to become shareholders right before the announcement of sales license approval and the expansion phase going into next year's legalization date.

But the full story becomes apparent when you reduce the cash from the balance sheet and look at enterprise value. In other words, every institutional investor with deep pockets will notice right away that with the entire universe of cannabis stocks at their disposal, none of them have:

- Cultivation facilities fully funded for quadrupling current production capability in three years.

- Diversification between Alberta and Ontario.

- A management team with lots of skin in the game and the right incentives to follow the roadmap to the letter.

- Absolutely undervalued using every valuation metric out there.

In the U.S., there are already marijuana millionaires who have been alert to special situations and exceptional opportunities to back early-stage companies. The first marijuana ETFs launched recently, and this will add to the attention the media will bring. But for now, Canada's cannabis market isn't getting any attention. This is your moment. The mounting catalysts for Invictus MD to become one of Canada's leading companies and reach a 10-figure valuation are in place.

Kriznic, the founder, has been responsible for incubating companies in a variety of industries from nominal valuations to over a billion in enterprise value. He's a serial business-builder, and after meeting with him face-to-face and speaking with him over the phone for months, it is my opinion that he will be a hundred-millionaire from the legalization boom. Each decision he has made with regards to adding value to shareholders has been flawless.

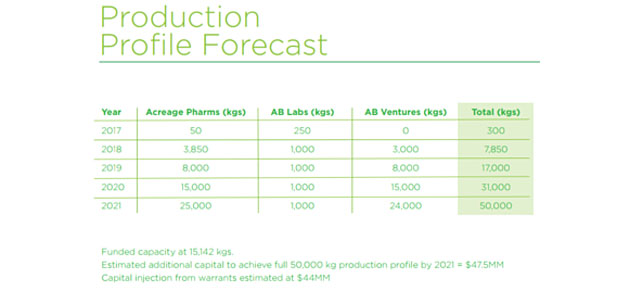

I also want to share with you what management has up its sleeve if operations continue to run like clockwork, as they have up until now. This is a production profile, which completely blew my mind.

Since the management team has championed how to raise funds brilliantly, it even has the potential to reach 50,000 kg in production without dilution, using only warrants for cash injection.

What I think is critical to wrap our minds around is the fact that Canada's medicinal market is only the tip of the iceberg, and in itself, it's set to exponentially boom. Once full legalization hits, Invictus MD will attack the recreational sector like no other company. With the caliber of the board and the tight relationships it has formed with government officials and peer businesses, the acquisitions model will disrupt the industry. The company has cash on hand and the willingness of institutions to come in at any moment.

Lior Gantz, the founder of Wealth Research Group, has built and runs numerous successful businesses and has traveled to over 30 countries in the past decade in pursuit of thrills and opportunities, gaining valuable knowledge and experience. He is an advocate of meticulous risk management, balanced asset allocation and proper position sizing. As a deep-value investor, Gantz loves researching businesses that are off the radar and completely unknown to most financial publications.

Want to read more Gold Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosures:

1) Lior Gantz: I, or members of my immediate household or family, own shares of the following companies mentioned in this article: None. I personally am, or members of my immediate household or family are, paid by the following companies mentioned in this article: None.

My company has a financial relationship with the following companies mentioned in this article: Invictus MD. I determined which companies would be included in this article based on my research and understanding of the sector.

2) The following companies mentioned in this article are sponsors of Streetwise Reports: None. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article. As of the date of this interview, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Invictus MD, a company mentioned in this article.

Charts and images courtesy of the author.