Mackie Research Capital Corp. initiated coverage on ProMIS Neurosciences Inc. (PMN:TSX) on Sept. 19, with a Speculative Buy rating and a 12-month target price of $0.50 per share for a "high-risk, high-reward investment opportunity," wrote analyst André Uddin. "We value ProMIS using a two-stage, probability-adjusted discounted cash flow methodology."

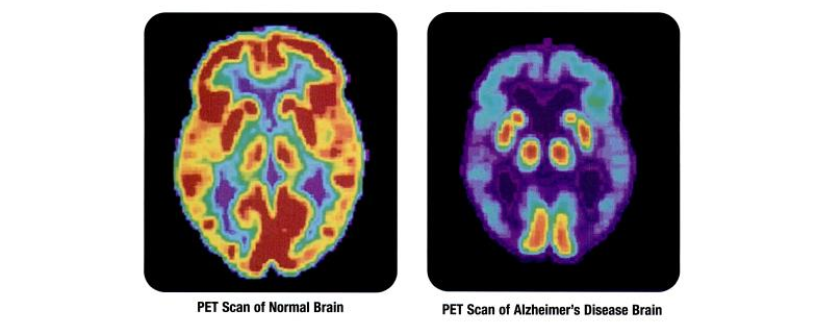

ProMIS' lead drug candidate PMN310 is "a preclinical-stage, novel monoclonal antibody being developed to modify Alzheimer's disease (AD)," noted Uddin. PMN310 is based on the new theory that AD "is primarily caused by toxic amyloid beta oligomers" versus amyloid beta plaques.

"This newer theory," Uddin explained, "is strongly backed by the Phase 1b success of Biogen Inc.'s (BIIB:NASDAQ) aducanumab, which targets toxic A_ oligomers (as well as plaque) and the failures of Eli Lilly and Co.'s (LLY:NYSE) solanezumab and Merck & Co. Inc.'s (MRK:NYSE) verubecestat, which target A_ monomers and their synthesis. The Phase 1b results of aducanumab demonstrated a slowing down of cognitive decline in prodromal or mild AD patients (before major memory loss) in a roughly dose dependent fashion. We believe this newer AD theory creates a path to develop a unique disease-modifying Alzheimer's treatment, PMN310, which has best-in-class potential."

PMN310 is designed to "selectively target toxic amyloid beta oligomers without binding to amyloid beta monomers or plaques," which is expected to "result in more effective targeting of oligomers and greater efficacy" and safety, the analyst added. "Plaque binding is often associated with brain side effects," such as cerebral edema, which limit safe drug dosing.

Also targeting Alzheimer's, ProMIS is developing PMN350 and PMN330, its second and third lead candidates, respectively, which are in the preclinical stage as well, noted Uddin. "Both products are designed to target the toxic prion-like forms of amyloid beta oligomers."

In ProMIS' pipeline, too, are two drug candidates targeting amyotrophic lateral sclerosis, which are in the discovery phase.

About the company and its therapeutics, Uddin wrote, "We believe [ProMIS'] rational design and approach for targeting the central nervous system should be disruptive to the industry."

Along with the prospective potential of PMN310, other favorable attributes of ProMIS are "zero debt on its balance sheet" and management's "extensive experience in drug development, deal making and capital raising," Uddin indicated.

The leadership team includes CEO Dr. Elliot Goldstein, former executive at SmithKline Beecham and Sandoz; executive chairman Gene Williams, former executive at Genzyme; and chief financial officer Daniel Geffken, who has "raised more than $1B in equity and debt securities for life science companies," detailed Uddin. Further, management owns more than "20% of the company, which indicates its strong commitment to building shareholder value."

ProMIS' stock is currently trading at $0.26 per share.

Read what other experts are saying about:

Want to read more Life Sciences Report articles like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Doresa Banning compiled this article for Streetwise Reports LLC and provides services to Streetwise reports as an independent contractor. She or members of her household own securities of the following companies mentioned in the article: None. She or members of her household are paid by the following companies mentioned in this article: None.

2) The following company mentioned in this article is a billboard sponsor of Streetwise Reports: ProMIS Neurosciences Inc. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclosures about sponsor fees. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Comments and opinions expressed are those of the specific experts and not of Streetwise Reports or its officers.

4) The article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

5) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.

Additional disclosures about the sources cited in this article