The Gold Report: Thank you for joining us today. Southern Silver Exploration Corp. (SSV:TSX.V; SSVFF:OTCQB; SEG1:FSE) is nearing the end of its 2016-2017 core drill program at Cerro Las Minitas in Mexico. What has the drilling revealed?

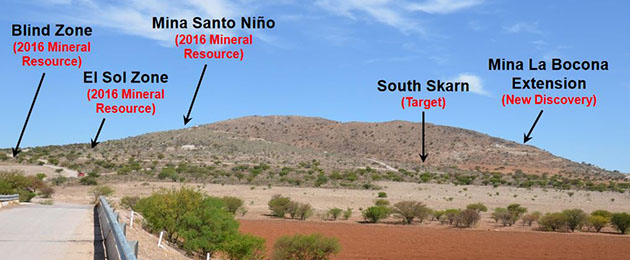

Robert Macdonald: We are currently drilling two holes and will probably drill one or two more before the end of the program. The total meterage will be over 12,000 meters (12,000m) for the entire program that started late last fall. The focus of the program has been to test deeper targets that occurred beneath the currently known deposits, the Blind and the El Sol zones.

The current program was successful in delineating a significant mineralized zone beneath those deposits. This target now has an approximate strike length of 650m and a width of up to 350m. This is a significant addition to what we identified previously and will contribute to increasing the mineral resource, which we anticipate updating in early fall 2017.

The other significant aspect to the results that we have had to date has been some very encouraging grades and thicknesses. We previously announced 14m thick intervals of 288 grams per tonne (288 g/t) silver, 2% copper and 2% combined lead-zinc. We have other significant results coming from there, including 9m 600 g/t silver and 25% combined lead-zinc.

So, not only are we seeing some good thicknesses, we're also seeing very extensive mineralized zones overall and some higher grades than what we had seen earlier in the program. It's all very encouraging.

TGR: When do you anticipate getting the last results from this program?

RM: We expect to finish the program around the end of July. About three weeks after that should be the publication of the final results. And then, in relatively short order after that, we'd like to have an updated resource calculation. We have been feeding the data to the resource modeler, the same person who did the maiden resource back in March 2016. We're trying to stay up to date on it, so hopefully it'll be a relatively quick turnaround when we get the final results.

TGR: You recently acquired additional strategic mineral claims adjacent to the Cerro Las Minitas claims package. Can you tell us about these claims and what drilling you have planned for them?

RM: These are the Biznagas and Los Lenchos claims, which are contiguous to the southern and western boundaries of the Cerro Las Minitas claim block. This was an area that we were directed to by two very prominent prospect generators, Bud Hillemeyer and Perry Durning of La Cuesta International Inc., who have had tremendous success in Mexico over the last two or three decades. These were the explorers who identified Hecla Mining Co.'s (HL:NYSE) San Sebastian mine, which is located on the eastern boundary of our claims. They also identified Argonaut Gold Inc.'s (AR:TSX) San Agustin deposit, located 25–30 kilometers (25–30 km) to the northwest of our property. They identified other major deposits throughout Mexico, including Silver Standard Resources Inc.'s (SSO:TSX; SSRI:NASDAQ) Pitarrilla deposit and the Camino Rojo deposit. These two individuals have been the premier mine finders in Mexico over the last several decades.

We were on a recent property tour with Bud and Perry in January. They relayed that they had previously collected some anomalous samples to the south of our property and asked if we would be interested in seeing the data and working out an agreement with them. So, we did that.

The data show some anomalous silver arsenic and antimony values, which are fairly classic pathfinders for epithermal deposits. We went in and did more due diligence sampling. We confirmed some of those early results and staked the ground, approximately 100 square kilometers (100 sq km). We've started sampling it more intensely, mainly float sampling and grab samples on surface. We've now collected over 700 samples.

We have results from around 400 samples so far and have about 300 sample results pending and have identified some fairly significant anomalies over a 5 km-long trend. We're seeing clusters of anomalous silver and gold mineralization, as well as the previously mentioned pathfinders of arsenic, antimony and mercury. These are important, as they are indicators of a vigorous epithermal-style mineralization active throughout this area. This might be similar to the aforementioned San Sebastian style of deposit, which is located to the east, or maybe more significantly, the Avino Silver & Gold Mines Ltd. (ASM:TSX.V; ASM:NYSE.MKT; GV6:FSE) gold-silver deposit, which is located around 15 km to the northwest of the Biznagas and Los Lenchos claims.

We're pretty excited about that and are continuing to develop those targets through conducting high-density grab sampling to vector in to where we need to be. The plan is to do a drill program this fall. It would probably be a reverse circulation drill program that would do the initial testing on some of these targets.

TGR: Let's switch over to New Mexico and the Oro project. Southern Silver recently announced the start of airborne Z-TEM survey and surface work. Would you tell us about that?

RM: The Oro project is the second property within our portfolio; Cerro Las Minitas is the flagship and more advanced while Oro is at a much earlier stage. It appears to be a large, Laramide-aged porphyry copper-molybdenum system similar to some of the major deposit types that occur throughout New Mexico and Arizona.

What's striking about this particular property is a very large zone of quartz, sericite and pyrite alteration that can be traced on surface for about 6 sq km. This is a tremendously large alteration footprint and much larger than the footprints of some of the major mines in Arizona. So, it attracts a lot of attention.

On the margins of that, we also have a gold target that we like, which we call the Stock Pond gold target. This is potentially the classic zonation that one sees in these large, very robust porphyry systems. And the analogy that we look at is the Barneys Canyon and Melco gold deposits and their relation to the Bingham Canyon porphyry copper deposit in Utah: A big porphyry center and about 3–4 km outboard, bulk-tonnage, oxide gold deposits.

That's what we think we're seeing here on the Oro property, a big porphyry center that has yet to be fully tested and drilled out, and outboard from that, a shallow, oxide gold target that occurs on the outer fringes of the mineralizing system.

So we have two targets there. At the porphyry target, we've completed data compilation by a Ph.D. porphyry specialist out of the University of British Columbia. He has identified two main target areas from the surface geochemistry and the alteration on the property. We've started a 300-line km Z-TEM program over the property, which is in process and nearing completion. The idea is to generate another targeting criterion, deep-seeing geophysics, that can help resolve some porphyry targets on the larger property package. This we think would make it more amenable to getting a major involved to explore the property and put in the big bucks that are generally required to drill a porphyry target.

In the meantime, we think that we can add value to the company by doing relatively inexpensive exploration on the Stock Pond gold target. Here, in the fall of 2016, we completed a nine-hole program, which identified a 40m interval of 0.4 g/t gold in drilling on the eastern margin of our drill pattern. This included a 9m interval of 0.75 g/t gold. This hole is open to the east, north and south.

We are now in the final stages of permitting an additional nine holes targeting a 500m by 800m area to the east of that mineralized hole with the intent of testing for a good oxide gold, bulk-mineable target on the project. It's relatively low cost. We're looking at a $300,000 to $400,000 total budget for both the geophysics and the drilling on the Stock Pond target. We think that we can upgrade the targeting and the property and add value to the company with those efforts.

TGR: When do you expect to do this second drill part?

RM: We would anticipate the start of drilling in mid-September.

TGR: Could you tell us a little bit about your joint venture arrangement with Electrum Global Holdings L.P.?

RM: We started down the path with Electrum in the beginning of 2015. We are very pleased with how we've been able to advance the project together.

In early 2015, we announced a deal where Electrum would earn 60% interest in the Cerro Las Minitas project by spending $5 million over a four-year period. It has also come in and took an equity interest in Southern Silver as well. So, it's supporting us both with efforts on the property as well as corporately.

Electrum has been very aggressive in pursuing the property and very aggressive in deploying its investment into making the resource bigger. It had four years to spend $5 million and has done it in two and a half. When we started with Electrum, internally we felt we had maybe a 5–6-million-tonne (5–6 Mt) deposit drilled and ready to do a resource model. With Electrum's initial investment in the project, we ended up doubling our projection to 10.8 Mt. In this last round of drilling, we think we're going to significantly add to our existing resource with the latest results that we've released.

So we've been nothing but happy with how things have progressed with Electrum. It is an aggressive explorer and, like us, it wants to see how big this project can be before we start making any sort of development decisions or doing the predevelopment work that's necessary to bring things to a production decision.

We're the operator, too. So Electrum is very happy with the way that we're advancing the project. I think it's a win-win for everybody.

Electrum is seeing the value of its investment in the project go up. Since it came onboard, the company has gone from $0.05 up to as high as $0.60, $0.65. We're now sitting in the $0.35–0.40 range. Electrum is not only seeing that we are creating value in the property, but also seeing its investment in the company get more and more valuable as we continue to advance the project.

TGR: You're in the process of doing a brokered private placement. Would you tell us about that?

Jay Oness: Rob and I had arranged for a number of meetings prior to the Prospectors & Developers Association of Canada's annual meeting this year with the intent of introducing the company to the institutional side of the equation. We recognize, with us being in the joint venture situation with Electrum, that as we go forward, we're now going to be required to put up our share of the funding, which would be 40%. We then began to look for a strategic partner or partners to support us as we go down that path. We had excellent meetings. We had a number of institutions give us positive feedback with the result that there were a couple that were interested in discussing acting as a lead agent for a $5 million financing.

That resulted in us entering into an agency agreement with Gravitas Financial. Since we began undertaking this financing, we've been able to close 50% of it through our president's list and through the participation of Electrum maintaining its percentage of ownership corporately. We're now in the process of introducing the company through Gravitas and the syndication. It is a $5 million unit offering, at $0.40 per unit with a full warrant for three years at $0.55. There's no acceleration or any onerous clauses to the warrant side of the equation.

We look at this as being an excellent opportunity. The company's last financing back in March/April of 2016 was done at $0.10. Obviously, all of our shareholders and investors in that offering have been very pleased. We've had a number of them come back into our market. A number of them exercised in warrants. We've been able to demonstrate that through our efforts on the ground and the kind of results that we continue to show and through an aggressive investor relations program, which entails exposure globally actually, we're able to maintain a retail element to the market. Even during the doldrums of summer right now, we're able to still maintain our offering price of $0.40.

I think that this financing will put us in a position with an institution or institutions that at some point may take a larger interest in us. But at the same time, it's going to be a necessity as we anticipate our share price will hopefully climb—and I believe it will with continued exploration success—to have these institutions continue to support us with what we anticipate to be a pretty aggressive exploration program leading into potential development studies and maybe a production decision sometime over the next two or three years.

TGR: Thanks for your insights.

Robert W.J. Macdonald is the vice president of exploration for Southern Silver Exploration. He is also the vice president of geological services for the Manex Resource Group of Companies, and in such capacity has been the Exploration Manager for several publicly listed companies including Homestake Resource Corporation (formerly Bravo Gold Corp.), Valterra Resource Corporation, Duncastle Gold Corp. and Fortune River Resource Corp. Macdonald has overseen the exploration of many projects throughout North America including the discovery and delineation of the high-grade 1.2 million ounce Homestake Ridge Au-Ag deposit in northern British Columbia and is currently advancing Southern Silver's 10 million tonne Cerro Las Minitas Ag-Pb-Zn project, Durango State, Mexico. Macdonald graduated with a B.Sc. (Hons) from Memorial University of Newfoundland in 1990 and earned a MSc. from the University of British Columbia in 1999.

Read what other experts are saying about:

Want to read more Gold Report interviews like this? Sign up for our free e-newsletter, and you'll learn when new articles have been published. To see a list of recent articles and interviews with industry analysts and commentators, visit our Streetwise Interviews page.

Disclosure:

1) Patrice Fusillo conducted this interview for Streetwise Reports LLC and provides services to Streetwise Reports as an employee. She owns, or her family owns, securities of the following companies mentioned in this interview: None. She is, or members of her immediate household or family are, paid by the following companies mentioned in this article: None.

2) Southern Silver Exploration Corp. is a sponsor of Streetwise Reports. Streetwise Reports does not accept stock in exchange for its services. Click here for important disclaimers. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security.

3) Southern Silver Exploration Corp. had final approval of the content and is wholly responsible for the validity of the statements. Opinions expressed are the opinions of Robert MacDonald and Jay Oness and not of Streetwise Reports or its officers.

4) Robert MacDonald and Jay Oness: We were not paid by Streetwise Reports to participate in this interview. We had the opportunity to review the interview for accuracy as of the date of the interview and are responsible for the content of the interview. We own shares of the following companies mentioned in this interview: Southern Silver Exploration Corp.

5) Interviews are edited for clarity. Streetwise Reports does not make editorial comments or change experts' statements without their consent.

6) This interview does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. This article is not a solicitation for investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company mentioned on Streetwise Reports.

7) From time to time, Streetwise Reports LLC and its directors, officers, employees or members of their families, as well as persons interviewed for articles and interviews on the site, may have a long or short position in securities mentioned. Directors, officers, employees or members of their immediate families are prohibited from making purchases and/or sales of those securities in the open market or otherwise from the time of the interview or the decision to write an article, until one week after the publication of the interview or article.